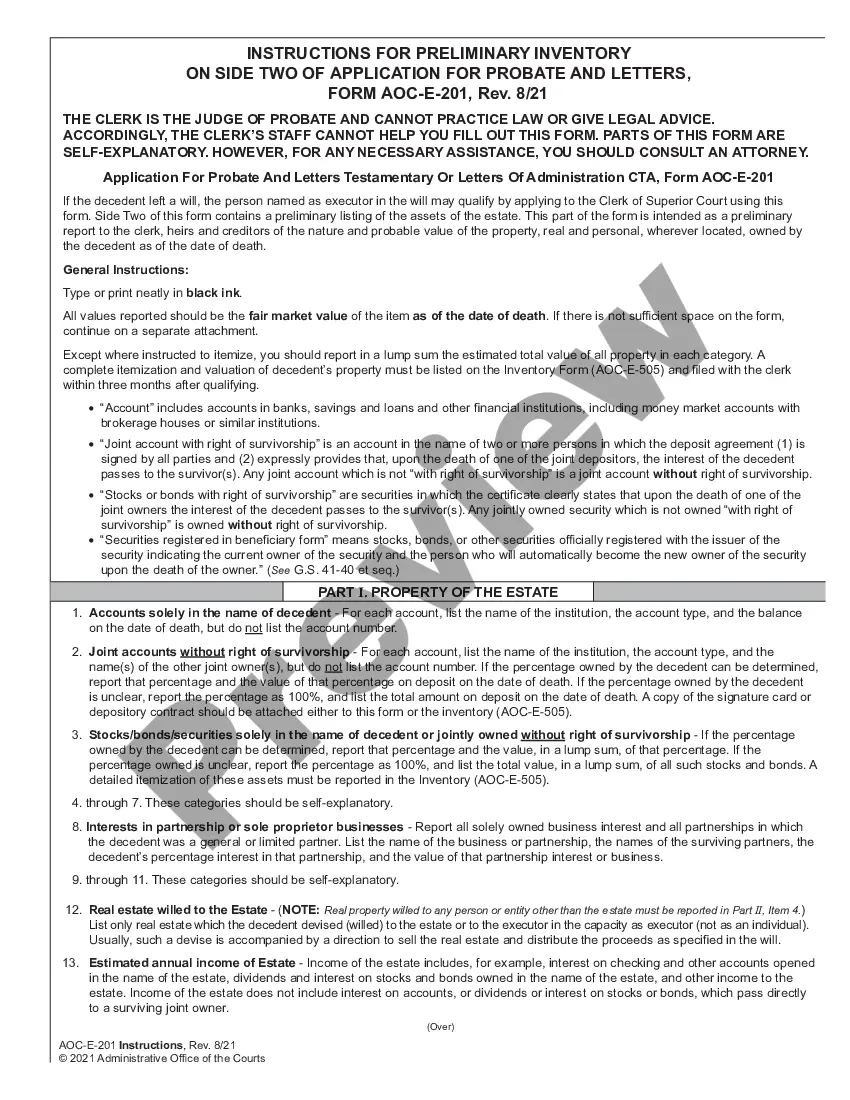

Instructions for Preliminary Inventory for Collection of Personal Property of Decendent: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent

Description

How to fill out North Carolina Instructions For Preliminary Inventory For Collection Of Personal Property Of Decedent?

Locating verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for both personal and professional requirements, as well as various real-world scenarios.

All the files are systematically categorized by area of use and jurisdiction, making it easy and quick to find the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent.

Maintaining paperwork organized and adhering to legal requirements is crucial. Leverage the US Legal Forms library to always have vital document templates for any needs right at your fingertips!

- Examine the Preview mode and document description.

- Ensure you’ve chosen the correct one that fulfills your needs and aligns with your local jurisdiction stipulations.

- Search for another template, if necessary.

- If you detect any discrepancies, use the Search tab above to find the accurate one.

- If it meets your criteria, proceed to the next stage.

Form popularity

FAQ

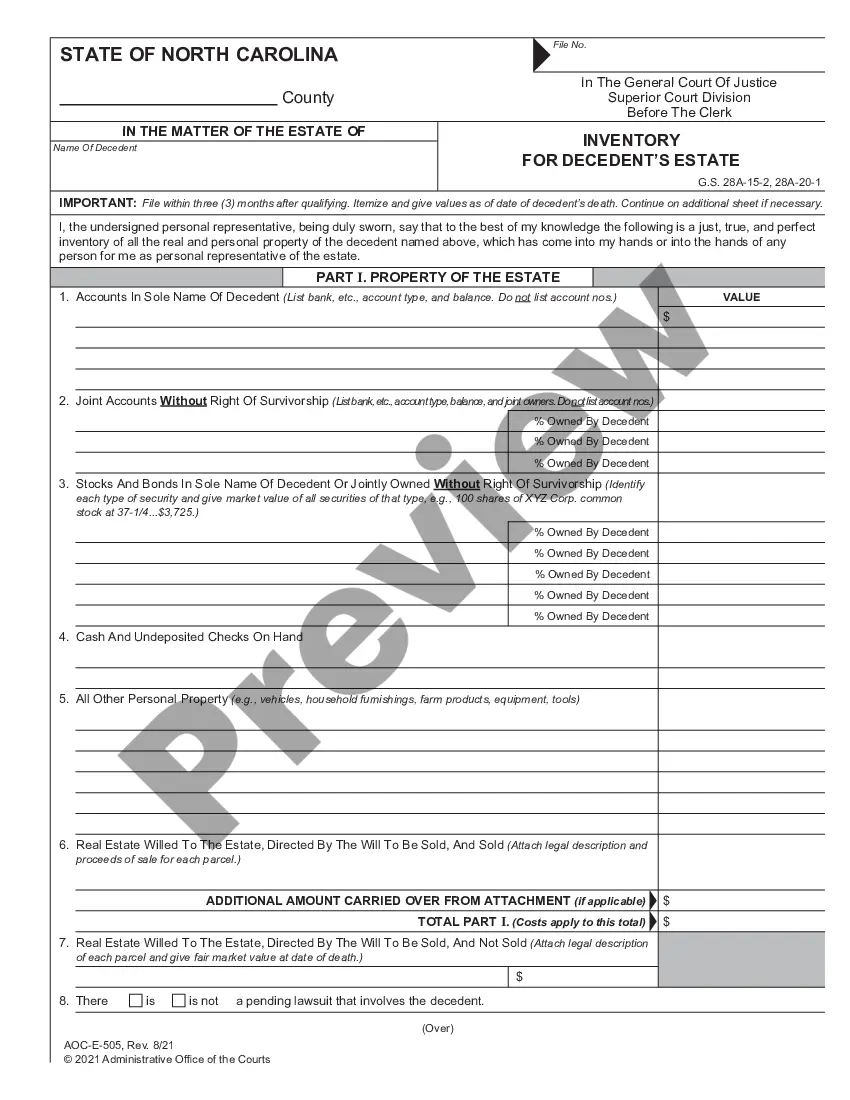

Filling out the inventory for a decedent's estate in North Carolina involves a systematic approach. First, collect all relevant data about the decedent's assets, including real estate and personal items. By utilizing the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent, you can ensure accuracy and compliance throughout this process.

The preliminary inventory of the decedent's property is a comprehensive list of the assets and belongings owned by the decedent at the time of their passing. This inventory is crucial for the probate process and helps determine the estate's value. Following the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent can simplify creating this inventory.

To fill out the inventory for a decedent's estate in North Carolina, follow the guidelines laid out in the state's legal framework. Begin by itemizing all assets, such as bank accounts, real property, and personal belongings. Refer to the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent to help you capture all required information.

Filling out the inventory for a decedent's estate requires careful organization and attention to detail. Start by documenting each asset, along with its fair market value. Leverage the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent for guidance throughout this task.

An example of an inventory of estate includes listing items such as real estate, bank accounts, stocks, personal possessions, and vehicles. Each item should have its estimated value documented. Utilizing the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent helps ensure you list everything accurately and completely.

In North Carolina, an executor typically has up to six months to settle an estate. However, this may vary based on the complexity of the estate and any disputes among heirs. It is essential to follow the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent to navigate this process smoothly.

To fill out the probate inventory effectively, gather all necessary documents related to the decedent's assets. Start by listing all properties, personal belongings, and financial accounts. Use the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent to ensure you capture every detail accurately.

To inventory an estate sale, start by evaluating all items available for sale, noting their condition and estimated values. Create a detailed list that includes descriptions and prices, ensuring buyers have clear information. Following the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent can help maintain organization and clarity during the sale process.

To fill out inventory for a decedent’s estate, you need to list all relevant assets along with their fair market values. Be sure to include real estate, financial accounts, personal belongings, and any outstanding debts. Keep the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent close by to ensure that all information is captured accurately and in compliance with local laws.

An affidavit of collection of personal property in North Carolina serves as a legal document that allows a person to collect and manage the personal property of a decedent without formal probate proceedings. This affidavit helps streamline the process for smaller estates or property collections. For accurate guidelines on the completion of this affidavit, refer to the High Point North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent.