Raleigh North Carolina Small Estate Affidavit For Collection Of Personal Property Of Decedent Intestate - Testate

Description

How to fill out North Carolina Small Estate Affidavit For Collection Of Personal Property Of Decedent Intestate - Testate?

Irrespective of social or occupational standing, finalizing law-related documents is a regrettable requirement in the current professional landscape.

Often, it’s almost unfeasible for an individual without any legal knowledge to produce this type of documentation from the ground up, primarily because of the intricate terminology and legal nuances they involve.

This is where US Legal Forms comes to the aid.

Verify that the form you have selected is appropriate for your area since the laws of one state or county may not apply to another.

Review the form and check a brief description (if available) of situations the document can be utilized for. If the one you selected does not satisfy your requirements, you can begin anew and search for the appropriate document.

- Our service offers a vast collection of over 85,000 ready-to-use state-specific documents that are applicable for nearly any legal situation.

- US Legal Forms also serves as a valuable resource for associates or legal advisors who wish to enhance their efficiency time-wise with our DYI papers.

- Whether you need the Raleigh North Carolina Small Estate Affidavit For Collection Of Personal Property Of Decedent Intestate - Testate or any other forms that will be recognized in your jurisdiction, with US Legal Forms, everything is accessible.

- Here’s how you can effortlessly obtain the Raleigh North Carolina Small Estate Affidavit For Collection Of Personal Property Of Decedent Intestate - Testate using our dependable service.

- If you are already a member, you can simply Log In to your account to download the required form.

- However, if you are new to our library, make sure to follow these steps prior to downloading the Raleigh North Carolina Small Estate Affidavit For Collection Of Personal Property Of Decedent Intestate - Testate.

Form popularity

FAQ

North Carolina considers ?small estates? to be any estate valued at less than $20,000.00 (or $30,000.00 if the only beneficiary is a surviving spouse). You do not have to count real property or certain retirement accounts and life insurance policies if they already include a named beneficiary.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

If both parents are deceased, then your siblings (or the descendants of your deceased siblings) will inherit your property. If you are single, have no surviving descendants, and no surviving parents, surviving siblings, or nieces or nephews, then your property will be split into two halves.

In North Carolina, creditors have at most 3 years from the date of death to file claims against the estate.

Collection by Affidavit: The Process Once the court has approved the application, it will authorize the affiant to collect and administer the estate. The affiant must pay debts, and distributions must occur according to the will (or the intestate succession law, if the decedent dies without a will).

Bottom Line. North Carolina doesn't collect inheritance or estate taxes. However, state residents should keep federal estate taxes in mind if their estate or the estate they are inheriting is worth more than $12.06 million in 2022.

In North Carolina, when you die without a will, it is known as having a dying ?intestate?, meaning that a local probate court will appoint an administrator to distribute your assets according to the requirements of North Carolina probate law.

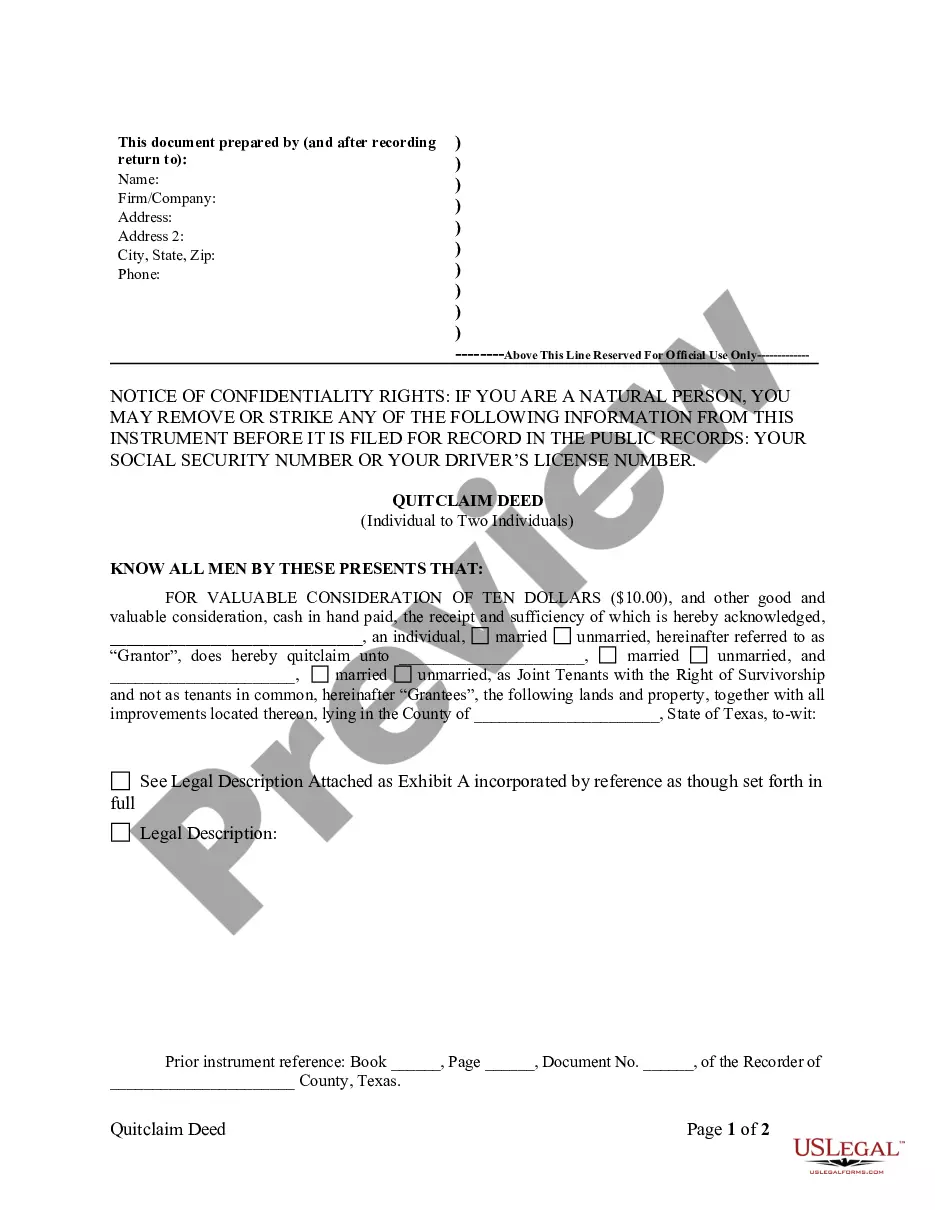

A North Carolina small estate affidavit is a document that allows an individual to petition for all or a portion of a deceased person's estate.... Step 1 ? Wait Thirty (30) Days.Step 2 ? No Personal Representative.Step 3 ? Complete Documentation.Step 4 ? File with the Superior Court.