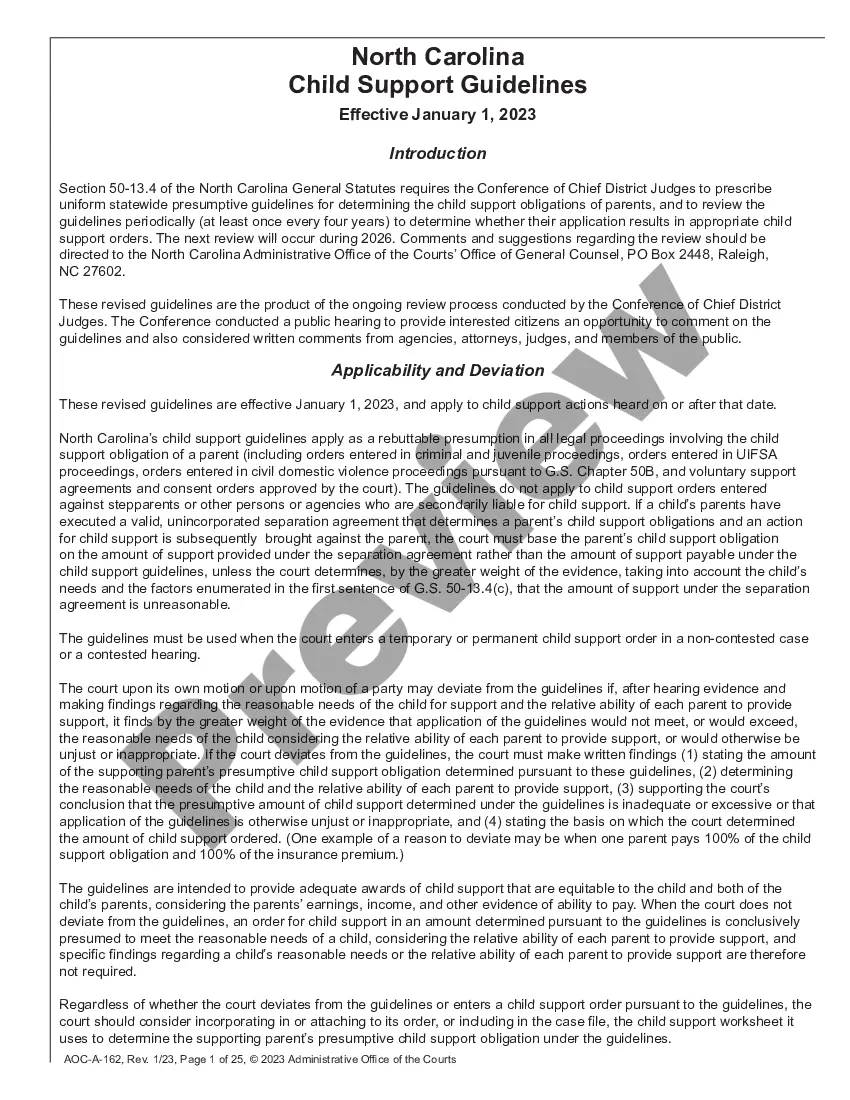

Charlotte North Carolina Child Support Guidelines

Description

How to fill out North Carolina Child Support Guidelines?

We consistently endeavor to lessen or avert legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we apply for legal assistance that is often exorbitantly priced.

However, not every legal issue is equally intricate. Many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Just Log In to your account and click the Get button adjacent to it. If you happen to misplace the document, you can always re-download it from the My documents section.

- Our platform empowers you to manage your affairs autonomously without resorting to legal representation.

- We provide access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you require to locate and download the Charlotte North Carolina Child Support Guidelines or any other document swiftly and safely.

Form popularity

FAQ

There is a common misconception that one does not have to pay child support if they have joint custody of their children. However, this is simply not true.

Is there a limit to the amount of money that can be taken from my paycheck for child support? 50 percent of disposable income if an obligated parent has a second family. 60 percent if there is no second family.

When parents are voluntarily unemployed or underemployed, judges will impute income to the paying parent. This means that the child support order will say that the paying parent earned a certain amount of money, regardless of what was actually earned.

Yes. Under North Carolina law, garnishment of a paycheck for child support may be ordered for up to forty percent (40%) of the net available pay.

The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent.

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

Child support is calculated based on the number of overnights the child or children spend with each parent. Worksheet A recognizes a situation in which one parent has primary custody (more than 243 days per year). Worksheet B is applicable to parents who share custody jointly.

North Carolina has strict instructions on how to determine child support for families that make less than $300,000 per year. All of the parents' incomes are included in the calculations, including: Salaries.

Child support is calculated based on the number of overnights the child or children spend with each parent. Worksheet A recognizes a situation in which one parent has primary custody (more than 243 days per year). Worksheet B is applicable to parents who share custody jointly.