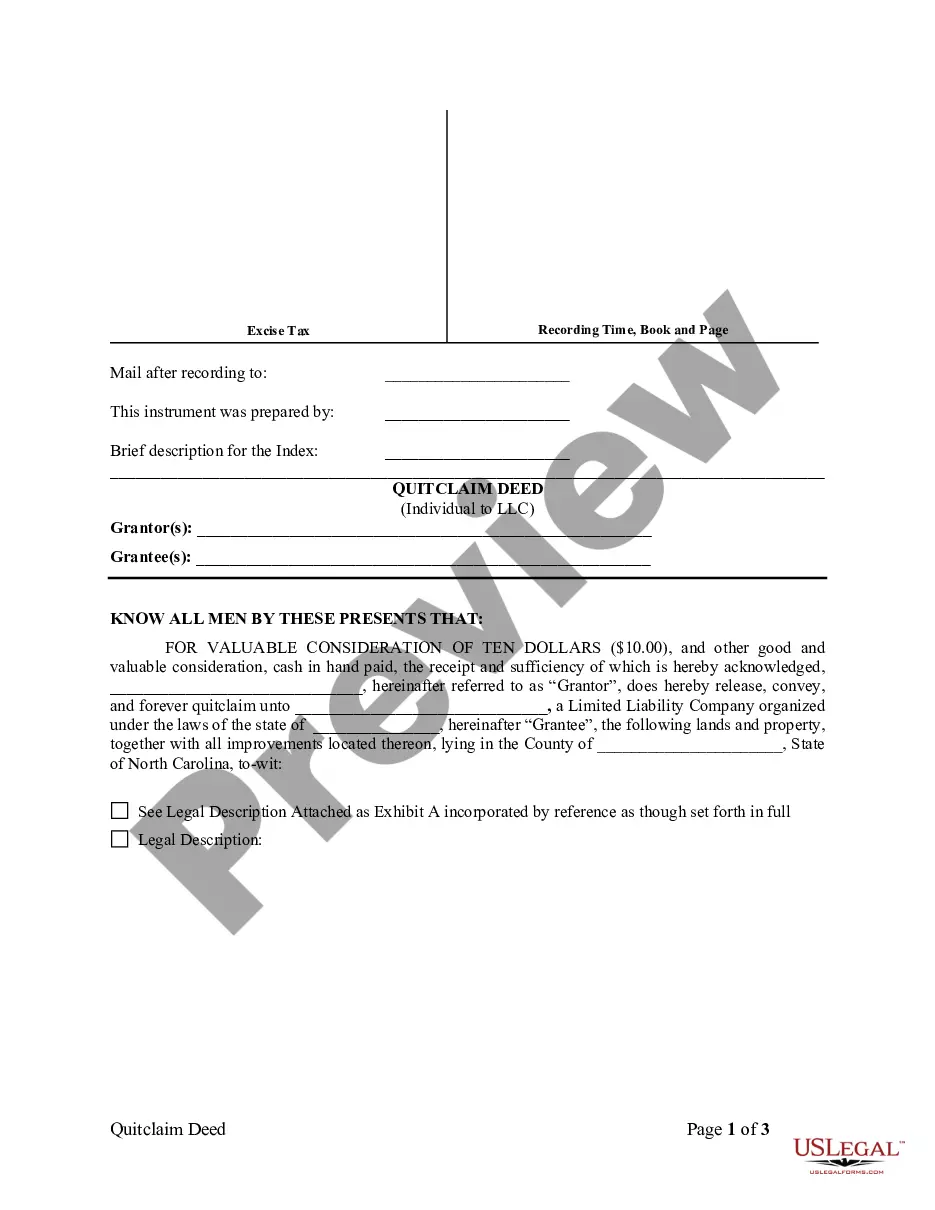

High Point North Carolina Quitclaim Deed from Individual to LLC

Description

How to fill out North Carolina Quitclaim Deed From Individual To LLC?

We consistently aim to minimize or avert legal repercussions when addressing intricate legal or financial issues.

To achieve this, we engage legal consultant services that are typically quite costly.

However, not every legal situation is equally complicated.

Many can be managed independently.

Utilize US Legal Forms whenever you need to locate and acquire the High Point North Carolina Quitclaim Deed from Individual to LLC or any other document quickly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it from within the My documents tab.

- US Legal Forms is a web-based library of current DIY legal templates ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection empowers you to handle your affairs without the requirement of legal representation.

- We provide access to legal form samples that are not always accessible to the public.

- Our templates are specific to states and regions, greatly streamlining the search process.

Form popularity

FAQ

When you consider the High Point North Carolina Quitclaim Deed from Individual to LLC, there are various advantages and disadvantages. On the positive side, an LLC can offer liability protection, which safeguards your personal assets against any legal issues related to the property. It also allows for easier transfer of ownership, facilitating the process when handling estate planning or sales. However, there may be additional costs involved, such as forming the LLC and maintaining compliance with state regulations, which can be a drawback for some.

To put personal assets in an LLC, use a High Point North Carolina Quitclaim Deed from Individual to LLC to formally transfer ownership. Ensure that you carefully document each asset's details and obtain the necessary signatures. This process not only protects your assets but also enhances your LLC's credibility and financial structure.

Transferring personal assets to an LLC can be done through a High Point North Carolina Quitclaim Deed from Individual to LLC. Start by gathering documentation for each asset you want to transfer. Then, complete the deed form, execute it in front of a notary, and file it with the appropriate local authorities to establish clear ownership.

Filling out a quitclaim deed form involves providing specific information about the property and the parties involved. Include the name of the individual transferring the property, the name of the LLC, and a detailed property description. It is crucial to ensure accuracy to avoid complications later, particularly when executing a High Point North Carolina Quitclaim Deed from Individual to LLC.

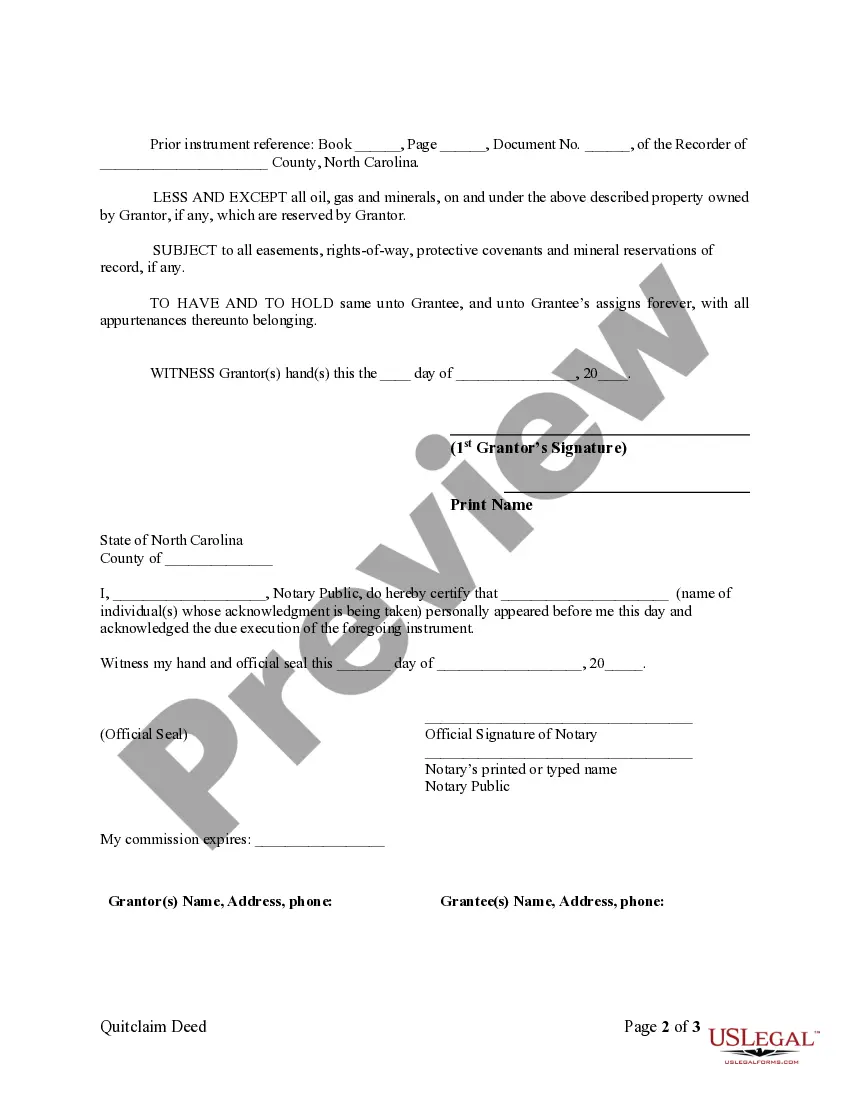

To transfer a deed from an individual to an LLC, you will typically need to use a High Point North Carolina Quitclaim Deed from Individual to LLC. First, complete the necessary form with relevant details, including the property description and parties involved. After signing, you must record the deed with your local county clerk's office to finalize the transfer.

Yes, you can transfer personal funds to your LLC, which can help with business expenses. However, it's crucial to keep these transactions well-documented to avoid any potential tax complications. Using a High Point North Carolina Quitclaim Deed from Individual to LLC for asset transfers can further clarify this financial arrangement.

While it is not mandatory to have a lawyer for a quit claim deed in North Carolina, consulting one can be beneficial. A legal expert can ensure that you complete the High Point North Carolina Quitclaim Deed from Individual to LLC correctly, reducing the risk of mistakes. This is especially helpful for ensuring compliance with local laws and regulations.

Yes, you can transfer personal assets to your LLC using a High Point North Carolina Quitclaim Deed from Individual to LLC. This process allows you to officially change the ownership of the assets, which can provide liability protection for your personal belongings. It's important to document these transfers properly to maintain clarity in ownership and financial arrangements.

One significant disadvantage of a quitclaim deed is that it offers no guarantees about the property's title. This means you may inherit existing liens or claims against the property. Furthermore, a High Point North Carolina Quitclaim Deed from Individual to LLC does not provide legal protection; if issues arise, you may face challenges during ownership. Consider reviewing these risks and possibly consulting US Legal Forms for support in the filing process.

While you do not need an attorney to file a quitclaim deed in North Carolina, consulting with one can be beneficial. An attorney can help you understand the legal implications of your transfer, especially when involving a High Point North Carolina Quitclaim Deed from Individual to LLC. They can ensure that your deed complies with state laws and protects your interests.