This form is a Quitclaim Deed where the grantors are Two Individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Charlotte North Carolina Quitclaim Deed From Two Individuals to One Individual

Description

How to fill out North Carolina Quitclaim Deed From Two Individuals To One Individual?

We consistently aim to reduce or avert legal harm when navigating intricate legal or financial situations.

To achieve this, we enlist costly legal options as a general practice. Nevertheless, not every legal concern is equally complicated.

Many of these issues can be addressed independently.

US Legal Forms is a digital repository of current DIY legal templates encompassing various forms, from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform empowers you to manage your concerns independently of an attorney's assistance. We grant access to legal document templates that are not always readily available.

The process is just as simple if you're new to the platform! You can create your account in just a few minutes. Ensure that the Charlotte North Carolina Quitclaim Deed From Two Individuals to One Individual adheres to the legislation and regulations of your state and area. Furthermore, it’s crucial to review the form’s outline (if available), and if you detect any inconsistencies with your initial requirements, look for another template. Once you’ve confirmed that the Charlotte North Carolina Quitclaim Deed From Two Individuals to One Individual is suitable for your situation, you can select the subscription option and proceed with payment. Then you can download the document in any preferred format. For over 24 years, we’ve helped millions by providing customizable and up-to-date legal forms. Make the most of US Legal Forms now to conserve time and resources!

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you need to locate and download the Charlotte North Carolina Quitclaim Deed From Two Individuals to One Individual or any other form swiftly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you happen to misplace the form, you can always retrieve it again in the My documents section.

Form popularity

FAQ

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

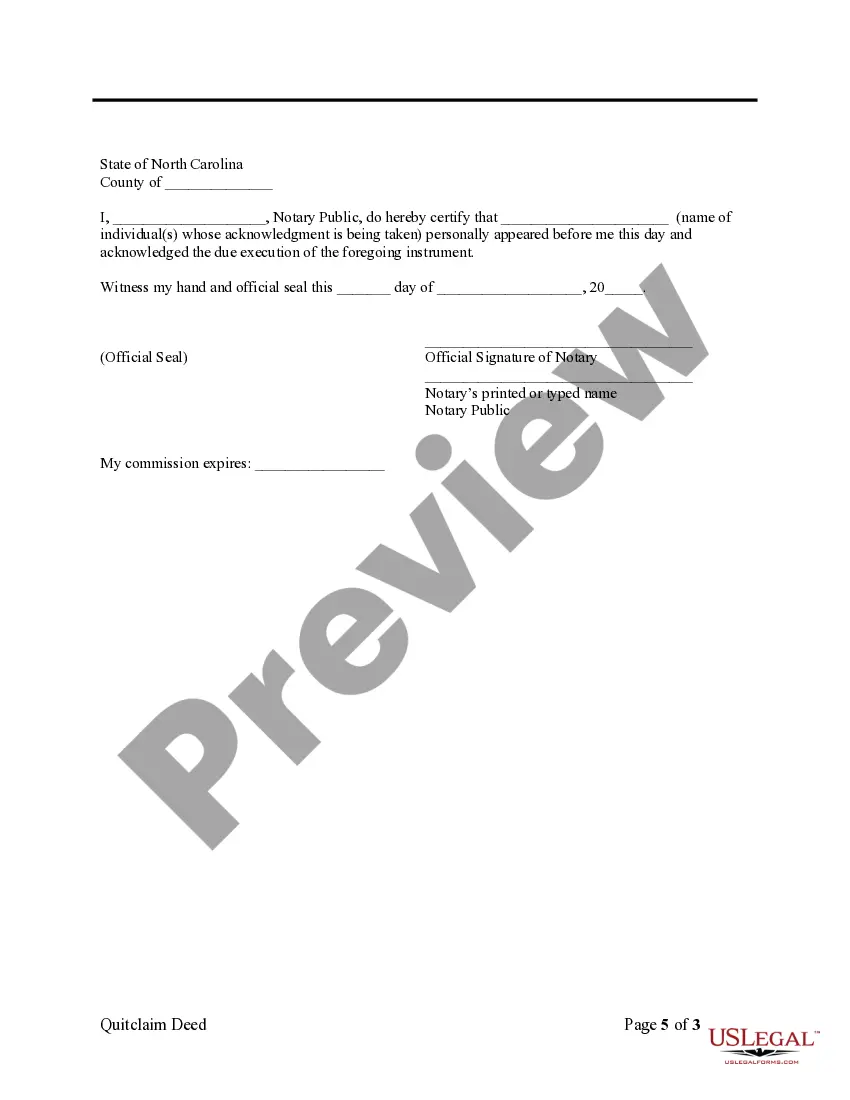

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

If you need to remove a name from a title deed for a property with a mortgage on it, you will need written consent to do so from the lender. Generally, it is easier to obtain this if the person(s) left on the title deed is (are) sufficiently financially secure.

A North Carolina quit claim deed is a legal form used to convey real estate in North Carolina from one person to another. A quitclaim, unlike a warranty deed, does not come with a guarantee from the seller, or grantor, as to whether the grantor has clear title to the property or has the authority to sell the property.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

The lender will need to be satisfied that you will be able to afford the mortgage as the sole mortgagor. The mortgage lender will then need to give you written consent in order to remove the other party from the deeds to your house. The lender will require the change in ownership to be carried out by a solicitor.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.