High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out North Carolina Financial Statements Only In Connection With Prenuptial Premarital Agreement?

We consistently endeavor to minimize or evade legal complications when handling intricate legal or financial matters.

To achieve this, we enroll in attorney services that are typically quite expensive.

However, not all legal problems are equally intricate.

Most can be resolved independently.

Utilize US Legal Forms whenever you require locating and downloading the High Point North Carolina Financial Statements exclusively related to the Prenuptial Premarital Agreement or any other document promptly and securely.

- US Legal Forms is a digital repository of current DIY legal templates covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs autonomously without needing legal representation.

- We provide access to legal document samples that may not always be publicly available.

- Our templates cater to specific states and regions, significantly easing the searching process.

Form popularity

FAQ

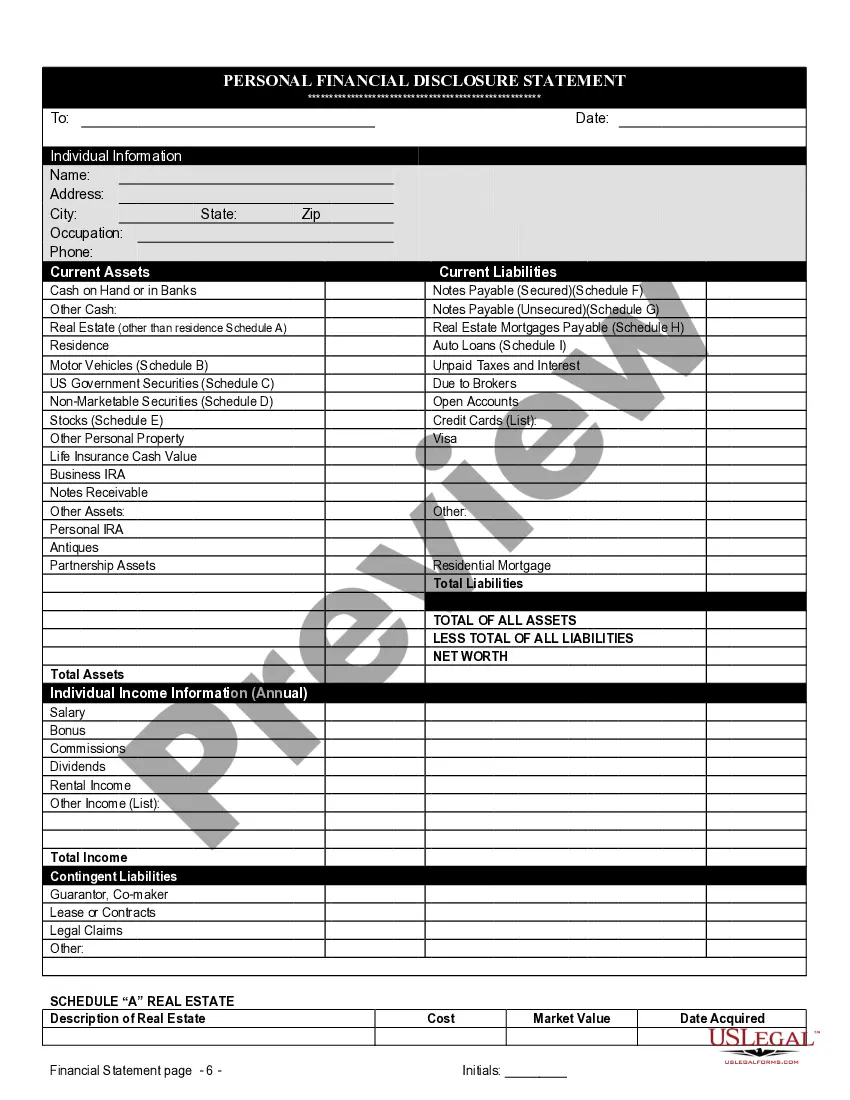

Yes, a prenup can completely separate finances between spouses. By defining the property and income of each individual, the agreement clarifies ownership and prevents potential disputes. High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement are essential in creating this clear separation, as they document each party's financial status. For assistance in drafting your prenup, UsLegalForms offers user-friendly templates and resources to ensure your financial interests are protected.

To protect future earnings in a prenuptial agreement, it's essential to include specific clauses that outline how income will be handled during the marriage. High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement play a vital role in detailing individual earnings and expenses. By being transparent about your financial situation, you can prevent any misunderstandings in the future. Utilizing tools like UsLegalForms can help you create a comprehensive agreement tailored to your needs.

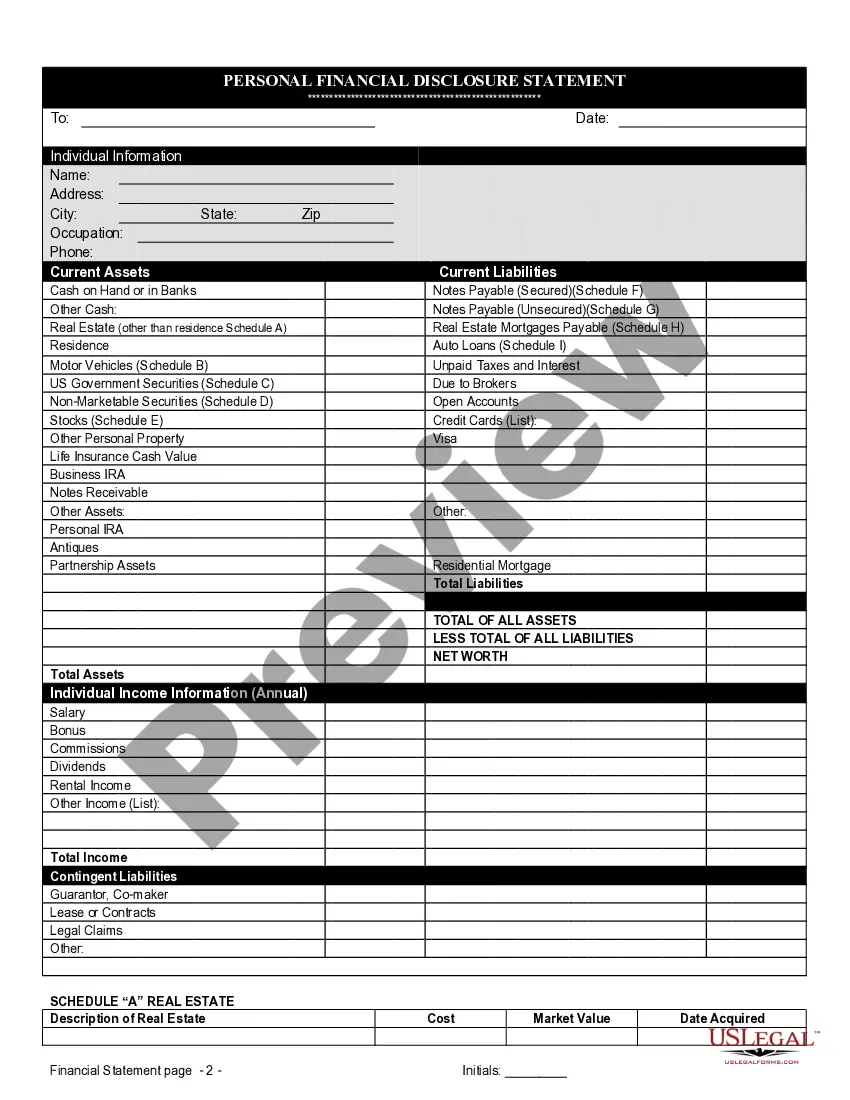

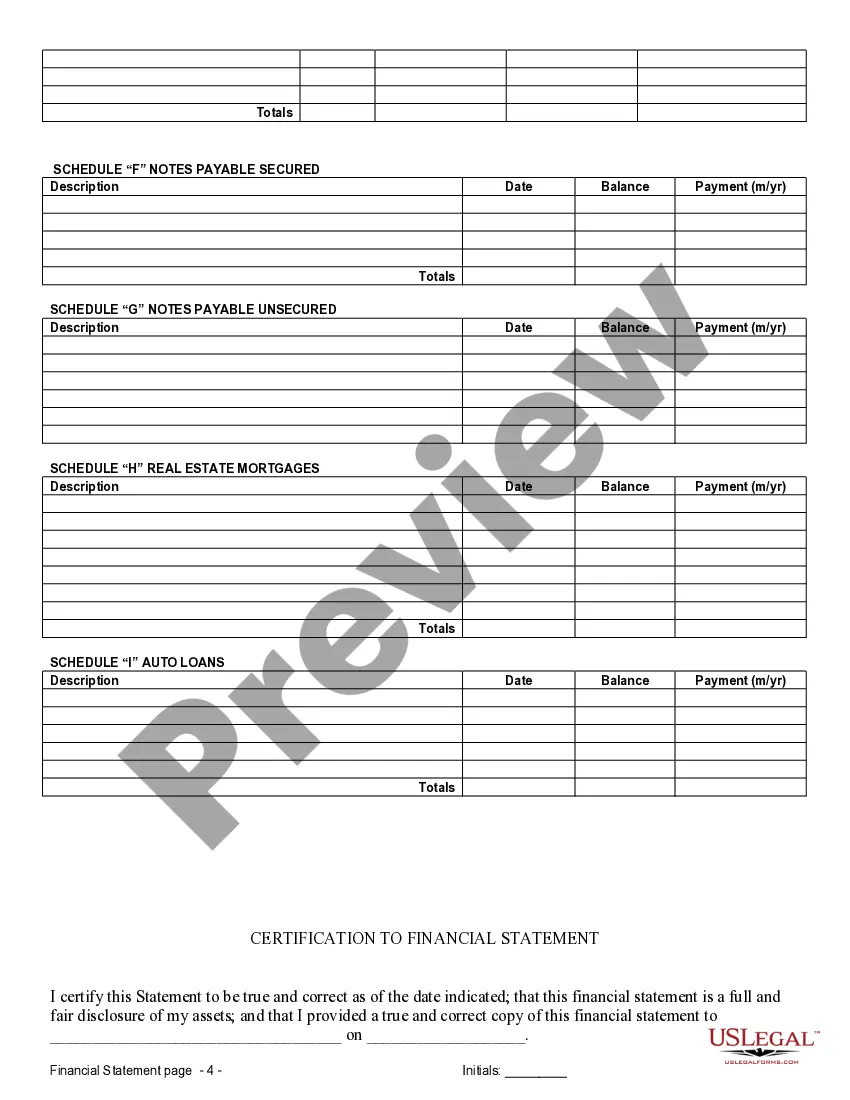

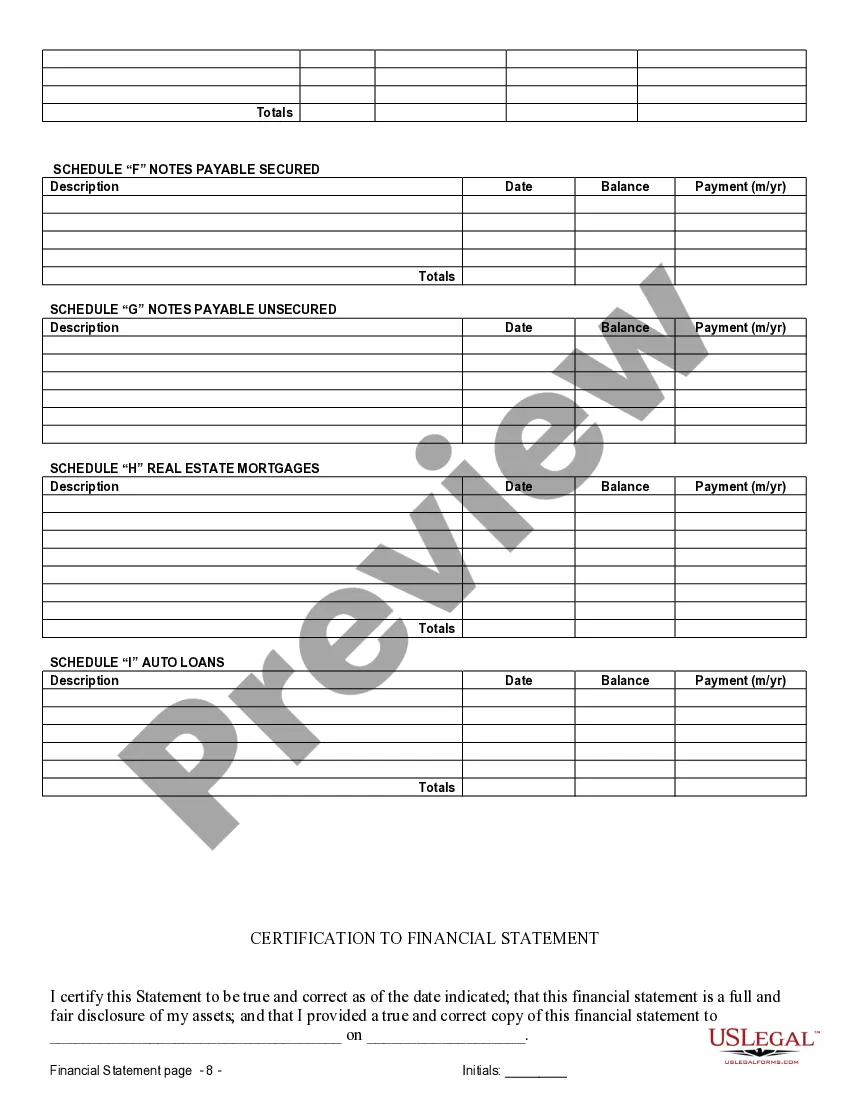

Yes, financial disclosure is a critical component of creating a valid prenuptial agreement. Each partner must fully disclose their financial situation to ensure fairness and transparency. In the context of High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement, clear financial disclosure helps establish trust and ensures that both parties understand their rights and obligations. Using a platform like USLegalForms can streamline this process, making it easier to compile and share necessary financial information.

The value of a prenuptial agreement lies in its ability to protect individual assets and clarify financial responsibilities within a marriage. It can reduce conflict and provide peace of mind by establishing clear expectations. By considering High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement, couples can tailor the agreement to meet their specific circumstances, ultimately strengthening their relationship.

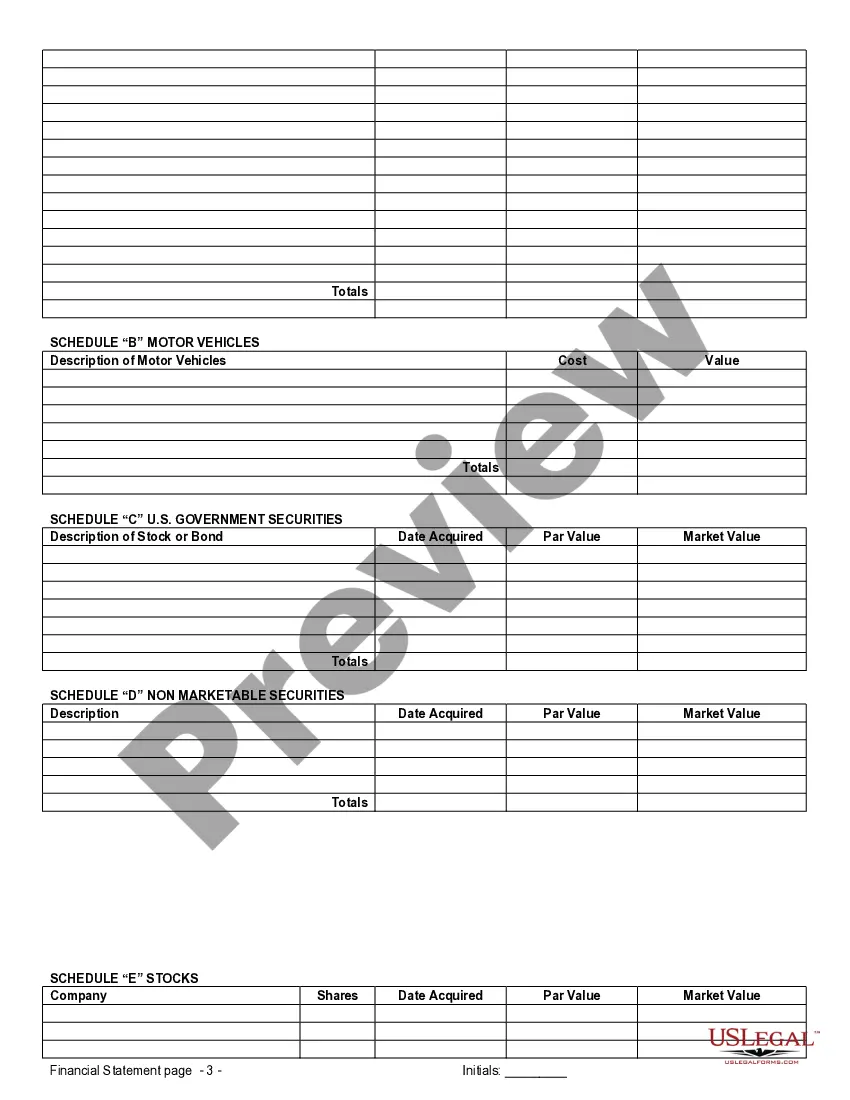

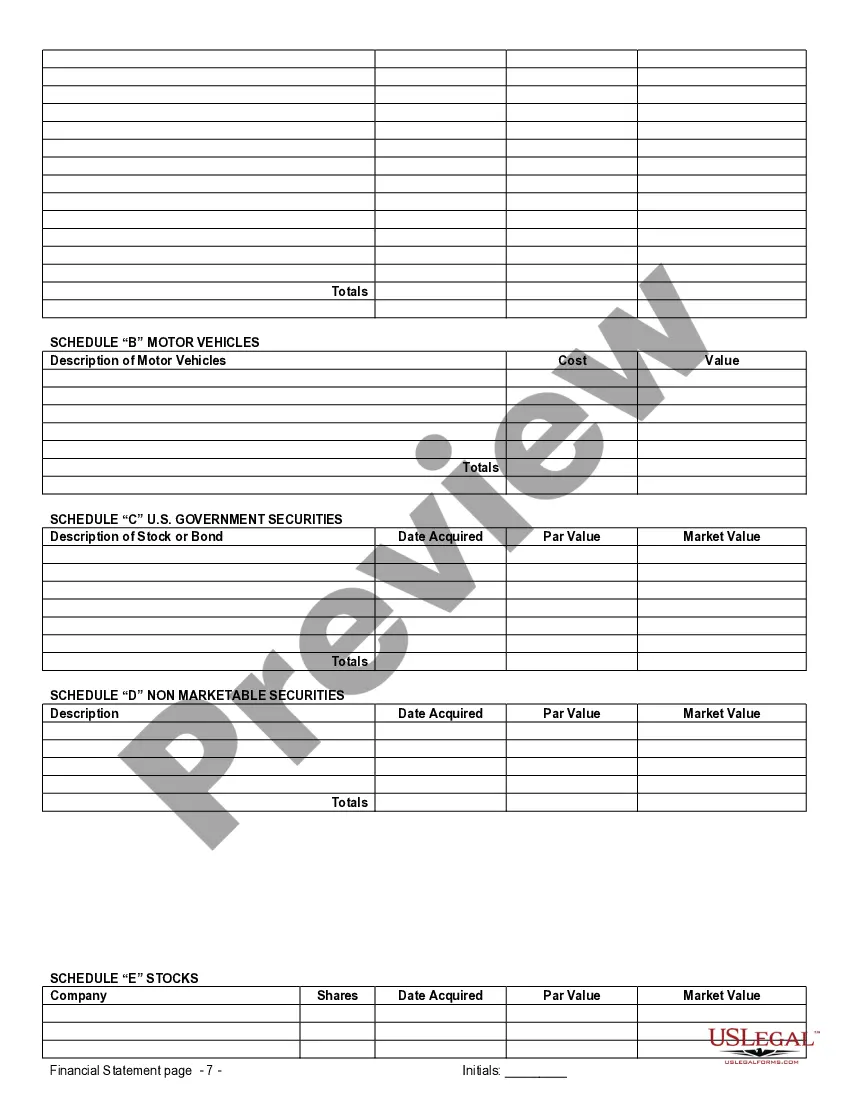

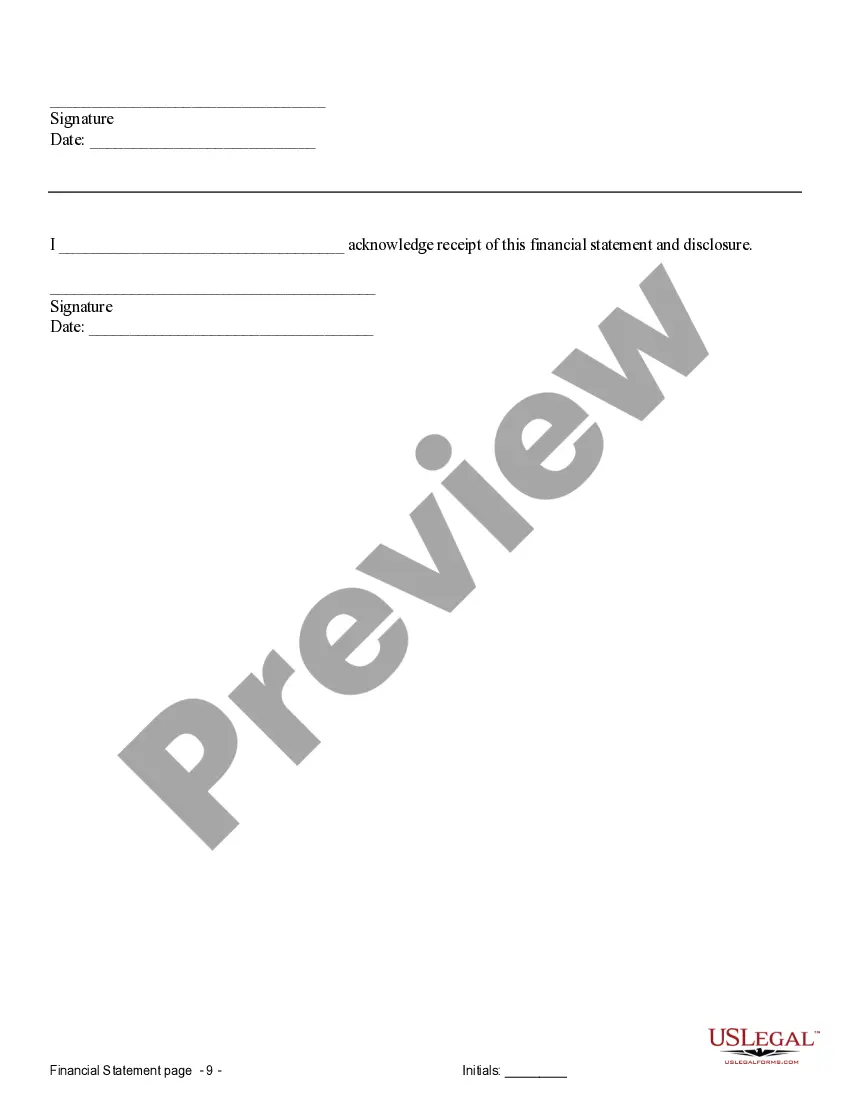

A financial statement for a prenuptial agreement details the assets, debts, and income of each party prior to marriage. This document plays a crucial role in ensuring transparency and fairness. By preparing accurate financial statements, couples can make informed decisions about their future, reflecting the principles of High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement. This transparency fosters trust and understanding between partners.

A prenup is primarily designed to outline the division of premarital assets. However, it can also address future assets acquired during the marriage. This flexibility means that a prenuptial agreement can provide a comprehensive financial plan for your relationship, aligning with the High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement. Thus, whether you have significant assets or wish to protect future earnings, a prenup can serve your needs.

Common loopholes in prenuptial agreements can arise from unclear language, lack of disclosure, or undue influence during signing. Courts may also scrutinize clauses that seem too one-sided or exploitative. For individuals in High Point, consulting with experts can help identify and close these loopholes to create a more watertight agreement.

While it's not legally required to list every single asset in a prenup, including detailed information is highly advisable for clarity. Listing significant assets helps create a more comprehensive agreement, reducing misunderstandings. In High Point, proactively detailing your assets in legal statements can strengthen the integrity of your prenuptial agreement.

Yes, North Carolina recognizes prenuptial agreements under specific legal standards. These agreements must be in writing and signed by both parties to be enforceable. Residents of High Point can feel secure knowing that a well-drafted prenup will hold up in court, especially when supported by proper financial statements only in connection with prenuptial premarital agreements.

A prenuptial agreement can be voided if it is found to be signed under duress, includes fraudulent information, or is grossly unfair to one party. Additionally, if one party fails to disclose significant assets, it can lead to unenforceability. Understanding the legal criteria can help those in High Point maintain a valid prenuptial agreement.