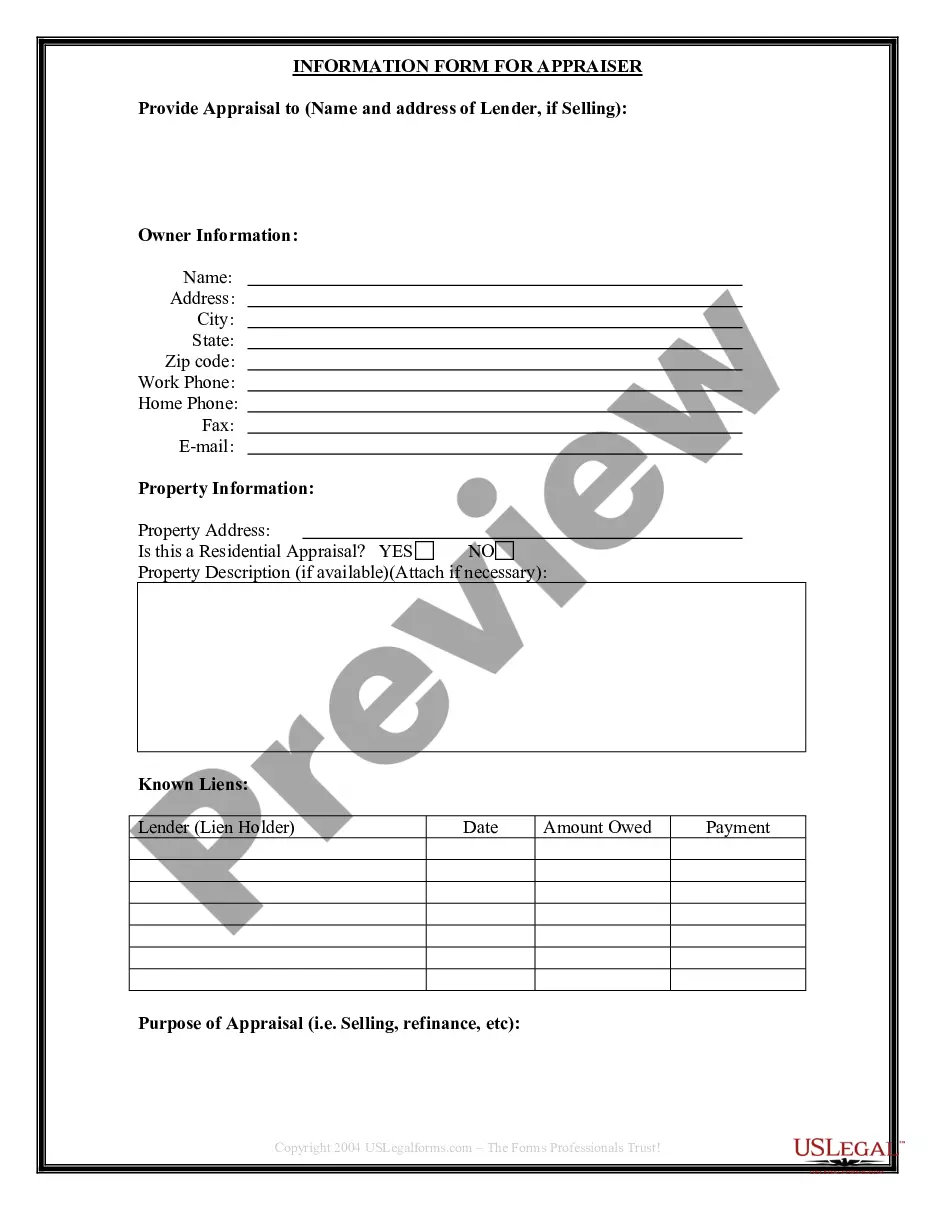

Raleigh North Carolina Seller's Information for Appraiser provided to Buyer

Description

How to fill out North Carolina Seller's Information For Appraiser Provided To Buyer?

Acquiring authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents for both personal and professional requirements and various real-world situations.

All the files are effectively categorized by area of application and jurisdictional regions, making it swift and effortless to find the Raleigh North Carolina Seller's Information for Appraiser provided to Buyer.

Pay for the service using your credit card information or your PayPal account, then download the Raleigh North Carolina Seller's Information for Appraiser provided to Buyer. Store the template on your device to fill it out and access it again in the My documents section of your profile whenever required.

- Review the Preview mode and document details.

- Ensure you’ve selected the appropriate one that fulfills your needs and entirely aligns with your local jurisdiction standards.

- Search for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the correct one. If it meets your needs, proceed to the following step.

- Purchase the document.

Form popularity

FAQ

?In general, it's nice to have somebody there as long as they don't interfere with the process,? said Graham. ?Be there to answer questions and provide necessary access, but just know when to keep your distance and let the appraiser do their work.?

A home appraiser's job is to assess the condition of your home and to provide an expert opinion on its estimated market value. They examine factors such as a home's condition, comparable recent sales, and any special features that could impact the property's value.

The Appraiser must verify transactional data via public records and the parties to the transaction: agents, buyers, sellers, Mortgagees, or other parties with relevant information.

An appraisal can come in low because the appraiser isn't selecting truly comparable sales for his or her analysis. This can happen if the appraiser doesn't know the local market well.

If you have a previous appraisal, I might suggest you use my Appraiser Info Sheet to share information appraisers tend to ask about, and then say nothing more than, ?I have a previous appraisal if you want to see it.? If the appraiser doesn't want it, that's fine. If the appraiser does, that's fine too.

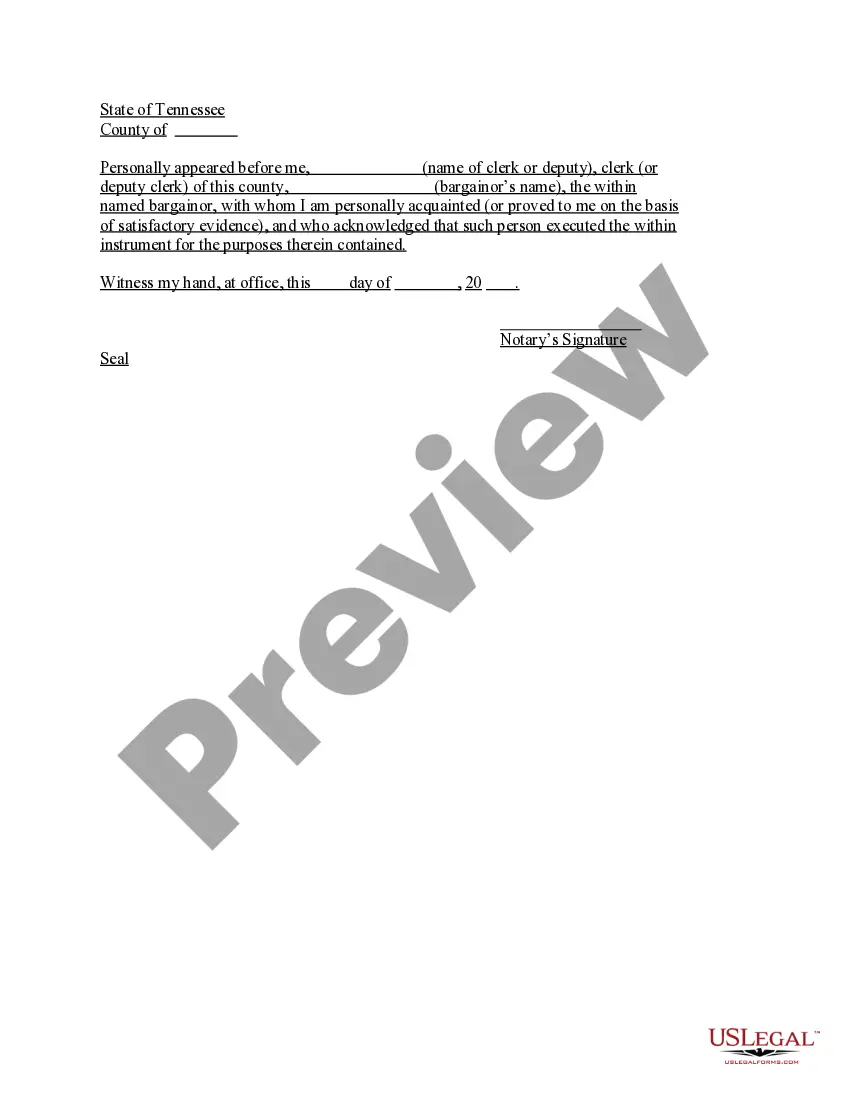

Unless the purchase contract requires the buyer to share the appraisal, it may not be mandatory. You need to consult a local attorney to review your agreement and render an opinion on the appraisal sharing requirement if there is one. Also, ask the attorney about the ramifications were you to break the contract.

Will the homebuyer receive a copy of the appraisal? A. Yes! Regulations allow real estate agents, or other persons with an interest in the real estate transaction, to communicate with the appraiser and provide additional property information, including a copy of the sales contract.

What is an appraisal contingency addendum? An addendum is a separate form that, once signed by the buyer and seller, becomes part of the sales contract. Appraisal contingency addendums are state-specific and allow buyers to move forward with their purchase under certain agreed-upon conditions.

Just keep your communication to the appraiser about the facts of the home and neighborhood, how you priced the house, and any other relevant information you think the appraiser should know. And remember, don't discuss value. Don't pressure the appraiser to 'hit the value' and you'll be fine.