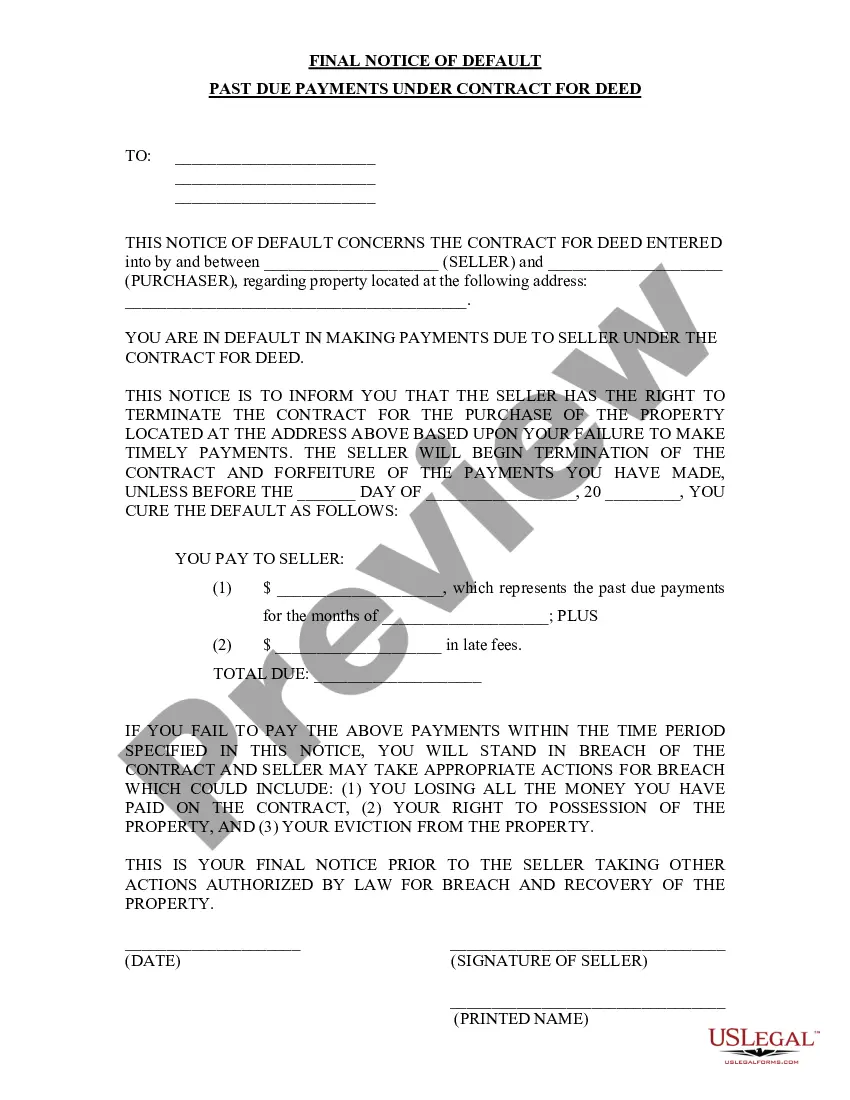

Title: Understanding Cary North Carolina Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Cary, North Carolina, individuals who enter into a Contract for Deed to purchase a property must adhere to specific payments and timelines stipulated in the agreement. However, in certain cases, when a buyer falls behind on their payments, the seller has the right to send a Final Notice of Default. This notice serves as a warning indicating that the buyer's failure to bring their payments up to date may result in serious consequences, including potential foreclosure. This article aims to provide a comprehensive understanding of the Final Notice of Default for Past Due Payments in connection with the Contract for Deed in Cary, North Carolina. 1. What is a Final Notice of Default? A Final Notice of Default is a formal document issued by the seller to the buyer who has fallen behind on payments in a Contract for Deed agreement. It acts as a final warning, notifying the buyer that they have a specific period to rectify the outstanding payments and bring their account up to date. Failure to do so may result in severe consequences, such as foreclosure. 2. Situations prompting a Final Notice of Default: a. Late or missed payments: When a buyer fails to make payments on time, consistently or according to the agreed-upon terms of the Contract for Deed, the seller may send a Final Notice of Default. b. Non-payment of property taxes: If the buyer neglects to pay property taxes associated with the purchased property, the seller may issue a Final Notice of Default to address this issue. c. Breach of additional obligations: In some Contract for Deed agreements, buyers may have additional obligations, such as maintaining homeowner's insurance, repairing damages, or up keeping the property. Failure to comply with these obligations may also lead to a Final Notice of Default. 3. Contents of a Cary North Carolina Final Notice of Default: a. Identification: The notice will typically contain the buyer's and seller's legal names, contact information, and any relevant identification numbers (if applicable). b. Property information: The notice will specify the property address associated with the Contract for Deed. c. Outstanding payment details: The notice will clearly state the exact amount owed, the due date, and any penalties or late fees incurred as a result of non-payment. d. Cure period: The notice will indicate a specific period, usually 30 days, during which the buyer must remedy the default by making the necessary payments or rectifying the issue. e. Consequences of non-compliance: The notice will underscore the potential consequences of failing to remedy the default, such as foreclosure proceedings and legal actions that may be taken by the seller. 4. Different types of Cary North Carolina Final Notice of Default: Though the Final Notice of Default generally serves the same purpose for all types of non-payment or non-compliance with the Contract for Deed, it may vary in specific language or format based on the circumstances of the default. Examples of potential types include Late Payment Notice, Property Tax Default Notice, or Breach of Obligations Notice. Conclusion: A Final Notice of Default is a significant document that aims to alert buyers who have fallen behind on payments or obligations in their Contract for Deed in Cary, North Carolina. It serves as the last opportunity for the buyer to rectify the default and avoid potential foreclosure. Understanding the contents, consequences, and different types of Final Notices is crucial for both buyers and sellers involved in Contract for Deed agreements in Cary, North Carolina.

Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Cary North Carolina Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize the US Legal Forms and gain instant access to any template you require.

Our advantageous site with numerous document templates enables you to locate and acquire nearly any document sample you desire.

You can download, fill out, and validate the Cary North Carolina Final Notice of Default for Past Due Payments related to Contract for Deed in just minutes instead of spending hours online searching for the correct template.

Using our repository is an excellent method to enhance the security of your record submissions.

If you lack an account, follow the instructions below.

Access the page with the template you require. Ensure it is the template you were looking for: review its title and description, and use the Preview feature when available. Otherwise, utilize the Search bar to find the suitable one.

- Our seasoned attorneys routinely examine all documents to confirm that the forms are applicable for a specific state and comply with current laws and regulations.

- How can you obtain the Cary North Carolina Final Notice of Default for Past Due Payments related to Contract for Deed.

- If you already possess a subscription, simply Log In to your account.

- The Download button will be activated on all documents you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

The risks of a contract for deed include potential loss of the property due to default and limited legal recourse compared to traditional mortgages. Buyers may face challenges if payments are not made, leading to a Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed. Understanding these risks can help you make informed decisions and work towards successful property management.

Defaulting on a contract can lead to serious consequences, including the loss of property and financial investment. The seller might issue a Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed, giving the buyer a chance to rectify the situation. It is crucial to address defaults quickly to avoid escalated legal actions.

In North Carolina, the time frame to back out of a contract depends on the specific terms outlined in the agreement. Generally, you may have a short period to cancel after signing, but it is crucial to consult legal advice for detailed guidance. If you are facing issues with payments, obtaining a Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed can clarify your obligations.

When you default on a contract for deed, the seller has the right to take action to reclaim the property. This action often includes sending a Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed. Failure to resolve the default may result in the loss of the property and any investment made towards it.

Yes, you can foreclose on a contract for deed in Cary, North Carolina. If the buyer defaults on payments, the seller can initiate the foreclosure process. This typically involves providing a Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed, which outlines the amount owed and the period of time the buyer has to remedy the situation.

When you receive a default notice, it informs you that your account is in default due to missed payments. This serves as a critical signal to take immediate action to avoid potential legal proceedings. The Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed is a situation to take seriously. It is essential to communicate with your lender and explore available options, which uslegalforms can help facilitate.

Receiving a notice of default indicates that you have fallen behind on your payments, particularly in relation to your contract. This official document serves as a warning that further action, such as foreclosure, may follow if payments are not made. If you encounter a Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed, consider addressing the issue promptly. Resources like uslegalforms can help you navigate this situation effectively.

In North Carolina, a default judgment occurs when a party fails to respond to a lawsuit, resulting in a ruling in favor of the other party. This means the court issues a decision without hearing from the non-responsive party. Understanding default judgments is important, especially when dealing with the Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed. If you receive a default judgment, it can complicate your financial situation, so seeking assistance is crucial.

A request for notice of default is a formal appeal made by a borrower or interested party, seeking to be informed if a default occurs. This can help in timely intervention and prevent escalation into foreclosure. Being on top of these notifications, especially regarding a Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed, allows you to take appropriate action when necessary. Consider using reliable platforms like uslegalforms to understand these processes better.

A notice of default in North Carolina is a legal document that indicates a borrower has not made required payments as agreed upon in their contract. This notice is a crucial step in the foreclosure process and lays the groundwork for potential property loss. Understanding your rights and responsibilities is essential after receiving a Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed. Clear communication with your lender or legal counsel is advisable.