Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

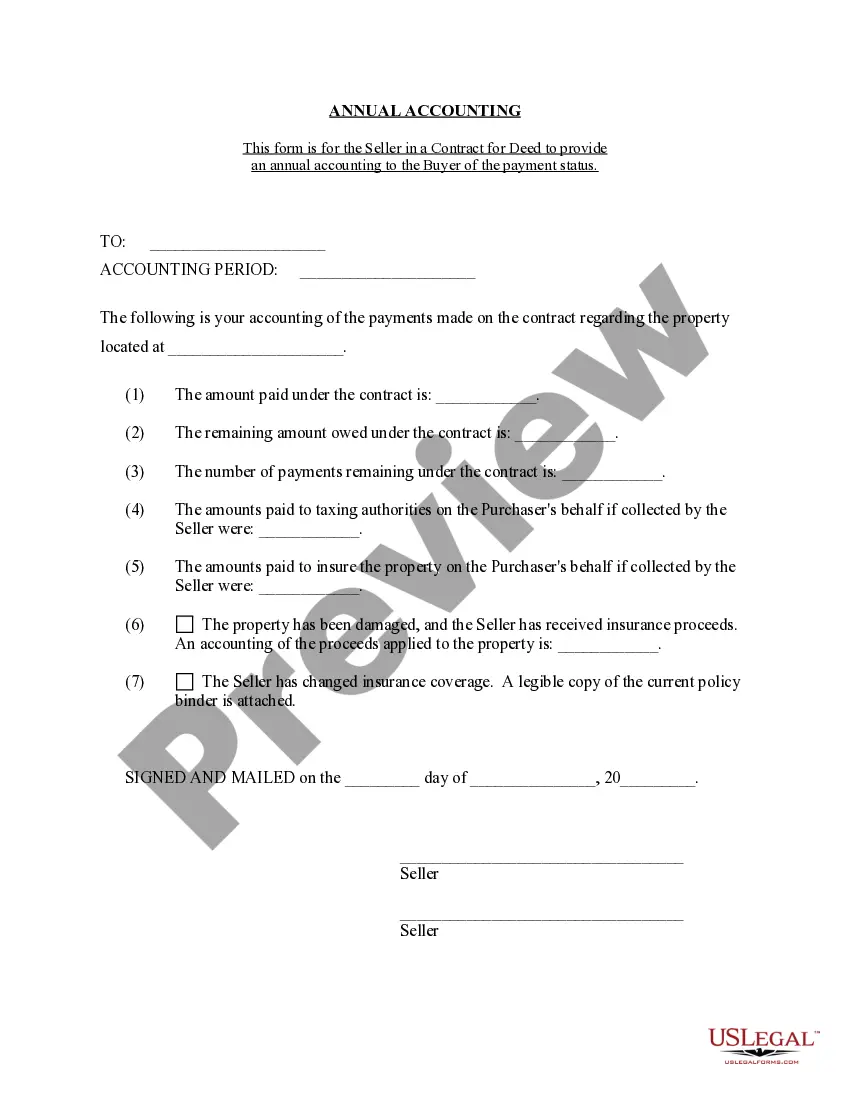

How to fill out North Carolina Contract For Deed Seller's Annual Accounting Statement?

If you are looking for a suitable form template, it’s hard to find a more efficient service than the US Legal Forms website – one of the largest repositories on the web.

Here you can access a vast array of form samples for both organizational and personal use, categorized by types and states, or keywords.

With our enhanced search functionality, obtaining the latest Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Specify the format and download it to your device. Make modifications. Complete, adjust, print, and sign the downloaded Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement.

- Furthermore, the accuracy of every document is verified by a team of qualified lawyers who consistently review the templates on our site and update them in accordance with the latest state and county requirements.

- If you are already familiar with our platform and have an established account, all you need to do to obtain the Wilmington North Carolina Contract for Deed Seller's Annual Accounting Statement is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the guidelines provided below.

- Ensure you have accessed the sample you need. Review its details and utilize the Preview option to view its contents. If it doesn’t match your needs, use the Search feature at the top of the screen to locate the suitable document.

- Verify your choice. Click the Buy now button. Then, choose the desired subscription plan and enter your information to create an account.

Form popularity

FAQ

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

An agreement for deed is often referred to as ?land contract.? This arrangement is where a seller provides owner financing to a buyer. In turn, this allows a buyer to make monthly payments to the seller (instead of a bank). The seller will transfer the property title once receiving a certain amount of money.

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A deed is a legal document that grants ownership to a piece of real estate or other property asset. A deed transfers the title of an asset to a new owner, and it is usually recorded in the local county clerk's office.

A contract for deed is a contract where the seller remains the legal owner of the property and the buyer makes monthly payments to the seller to buy the house. The seller remains the legal owner of the property until the contract is paid.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.