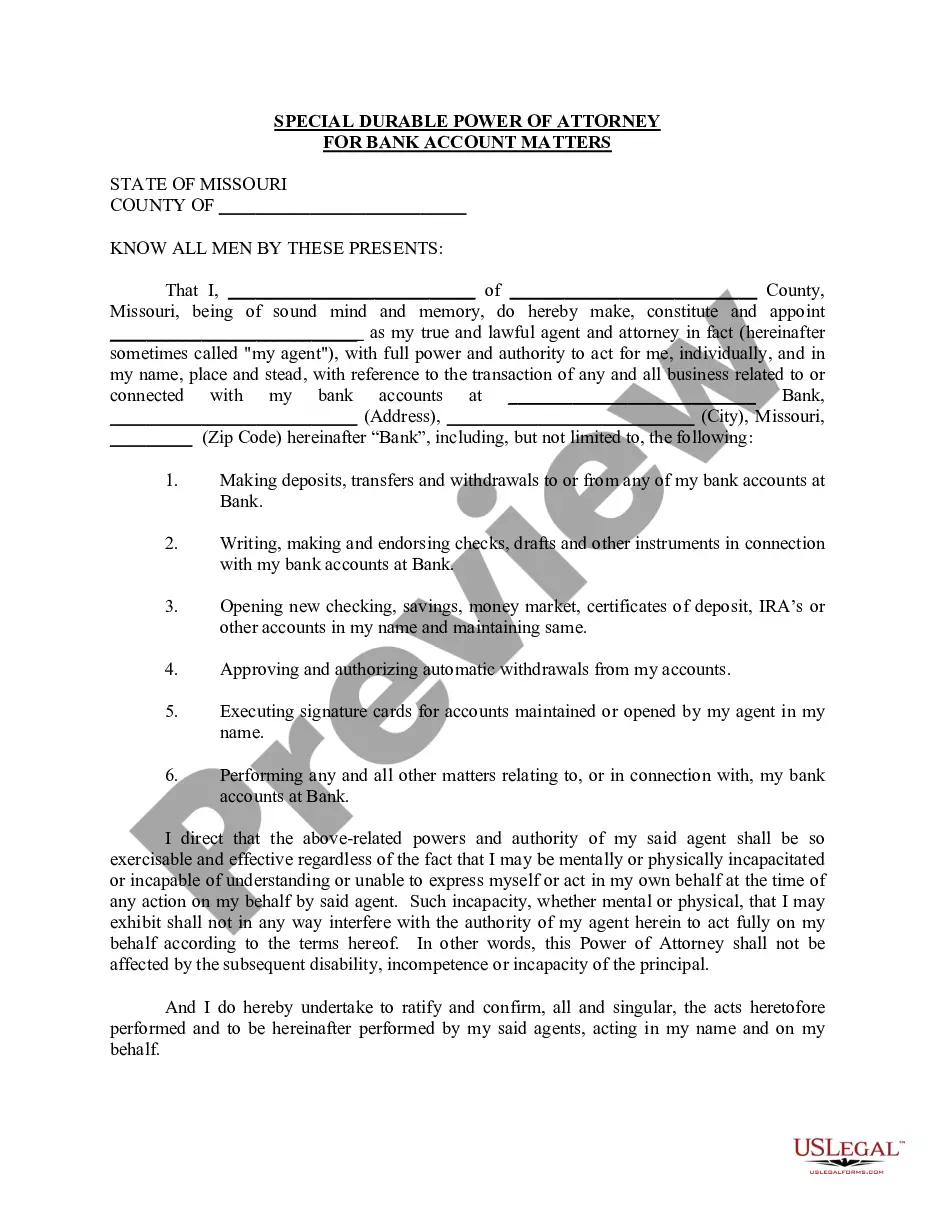

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Kansas City Missouri Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Missouri Special Durable Power Of Attorney For Bank Account Matters?

If you are looking for a legitimate form template, it’s challenging to find a more suitable service than the US Legal Forms website – one of the most extensive collections online.

With this collection, you can access a vast array of document examples for both organizational and personal uses categorized by type and state, or by keywords.

With the sophisticated search feature, obtaining the latest Kansas City Missouri Special Durable Power of Attorney for Bank Account Matters is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the document. Choose the format and save it to your device.

- Moreover, the accuracy of every document is confirmed by a team of legal experts who regularly assess the templates on our site and update them to comply with the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to procure the Kansas City Missouri Special Durable Power of Attorney for Bank Account Matters is to Log In to your user account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have located the template you desire. Review its description and utilize the Preview feature (if available) to inspect its content. If it does not satisfy your needs, employ the Search bar at the top of the page to discover the suitable document.

- Verify your choice. Click the Buy now button. Afterward, select the preferred pricing option and supply the necessary information to create an account.

Form popularity

FAQ

The Bank is entitled to rely upon any instructions/directions given by the Attorney in relation to the said Account, including any payment/withdrawal instructions, and is requested to act on the said instructions received from the Attorney.

Common Reasons Why Banks Won't Accept a Power of Attorney A financial institution might raise objections such as these: Your POA isn't durable. If the person who made the POA is now incapacitated, the agent can't use the POA unless it's durable?that is, made to last even during incapacitation.

A durable power of attorney does not have to be recorded to be valid and binding between the principal and attorney in fact or between the principal and third persons, except to the extent that recording may be required for transactions affecting real estate under sections 442.360 and 442.370.

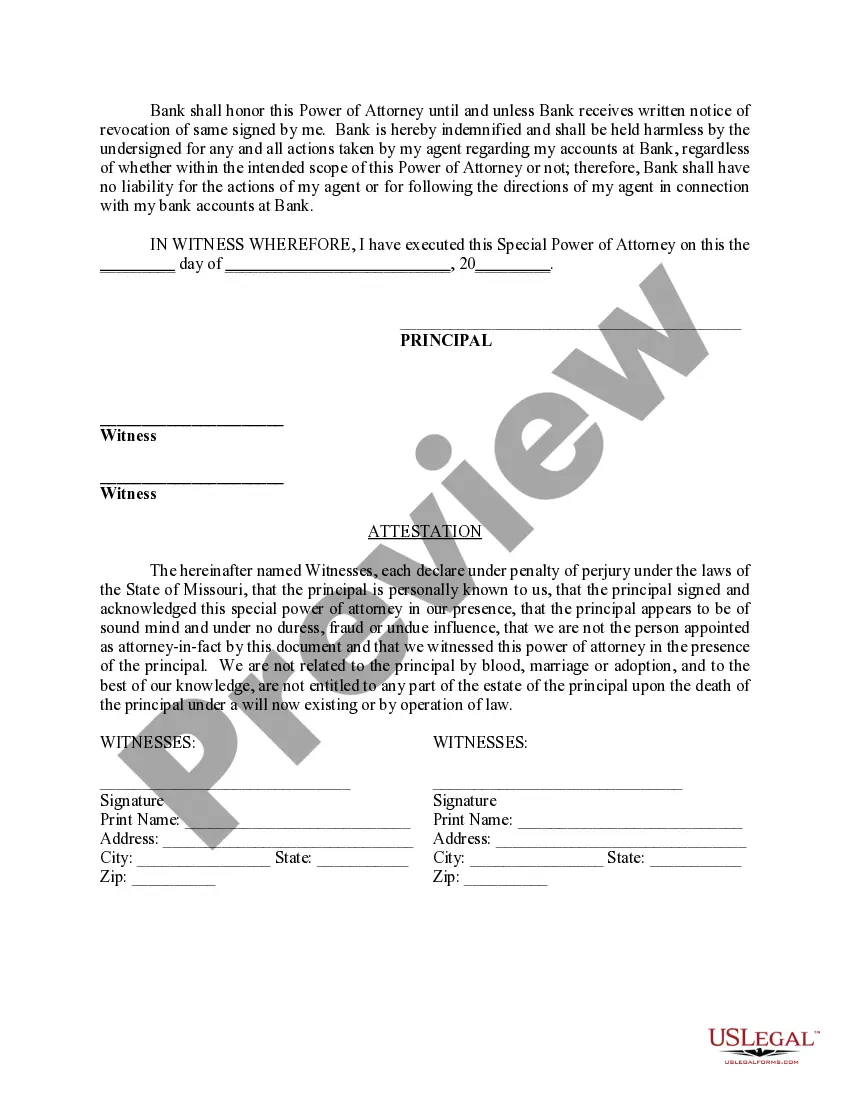

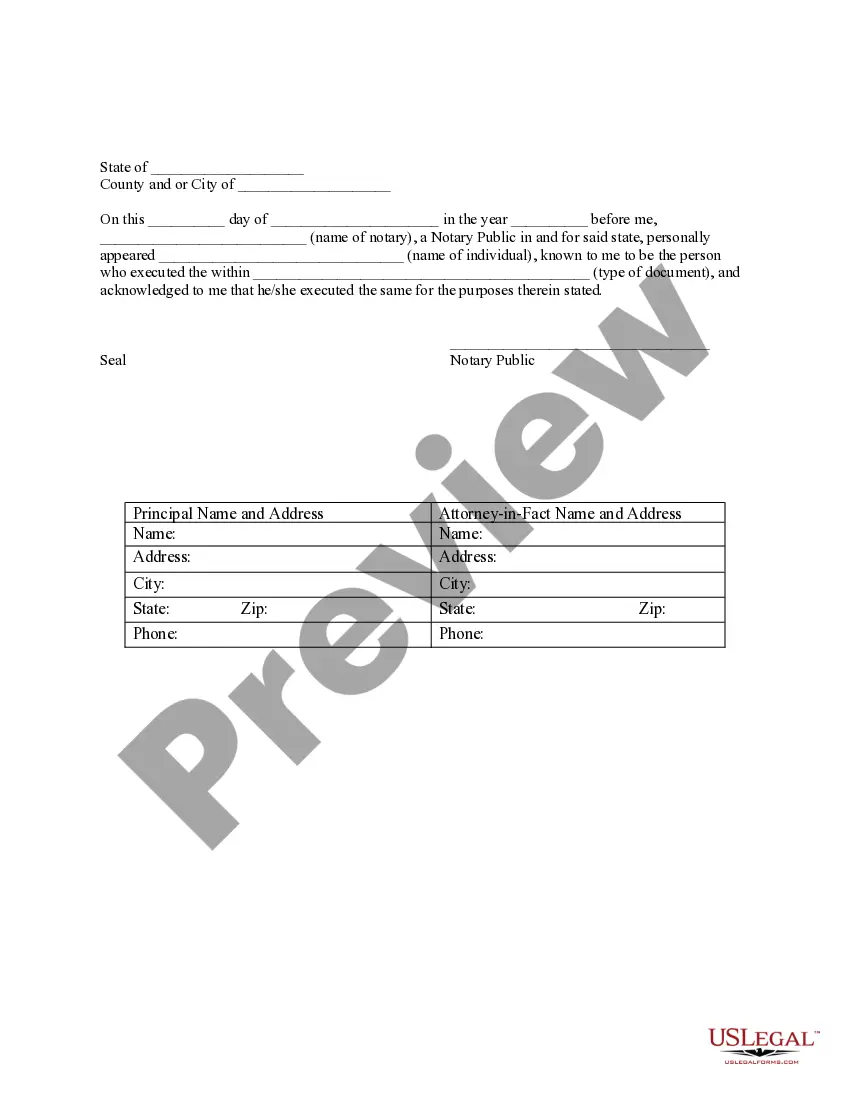

Does a Power of Attorney Need to Be Notarized in Missouri? Yes. In Missouri, you are required to sign the medical power of attorney document in the presence of a notary public. Notaries are state-specific and you can only use a notary in your state of residence, in this case, Missouri.

Under Missouri law, and the law of many other states, a power of attorney with proper wording may be made ?durable.? This means that the power of the agent to act on the principal's behalf continues despite the principal's incapacity, whether or not a court decrees the principal to be incapacitated.

To make a durable power of attorney in Missouri (the most common type of POA in estate plans), you must sign your POA in the presence of a notary public. In addition, many financial institutions will not want to rely on a POA unless it has been notarized?a process that helps to authenticate the document.

To make a durable power of attorney in Missouri (the most common type of POA in estate plans), you must sign your POA in the presence of a notary public. In addition, many financial institutions will not want to rely on a POA unless it has been notarized?a process that helps to authenticate the document.

Once a power of attorney document is executed and accepted by the bank and the agent is added to the account, the agent is authorized to act on behalf of the principal during the principal's lifetime, according to the powers that the principal has included in their power of attorney document (unless the principal

You cannot generally use a Power of Attorney after a person is deceased. The only exception would be with regard to certain limited clauses contained in the document which specifically state that they are to be effective after death, such as the clause related to the disposition of the remains.

In some cases, bank employees can't even access all of your information. On a day-to-day basis, the only people who typically have access to your different types of bank accounts are you and the bank.