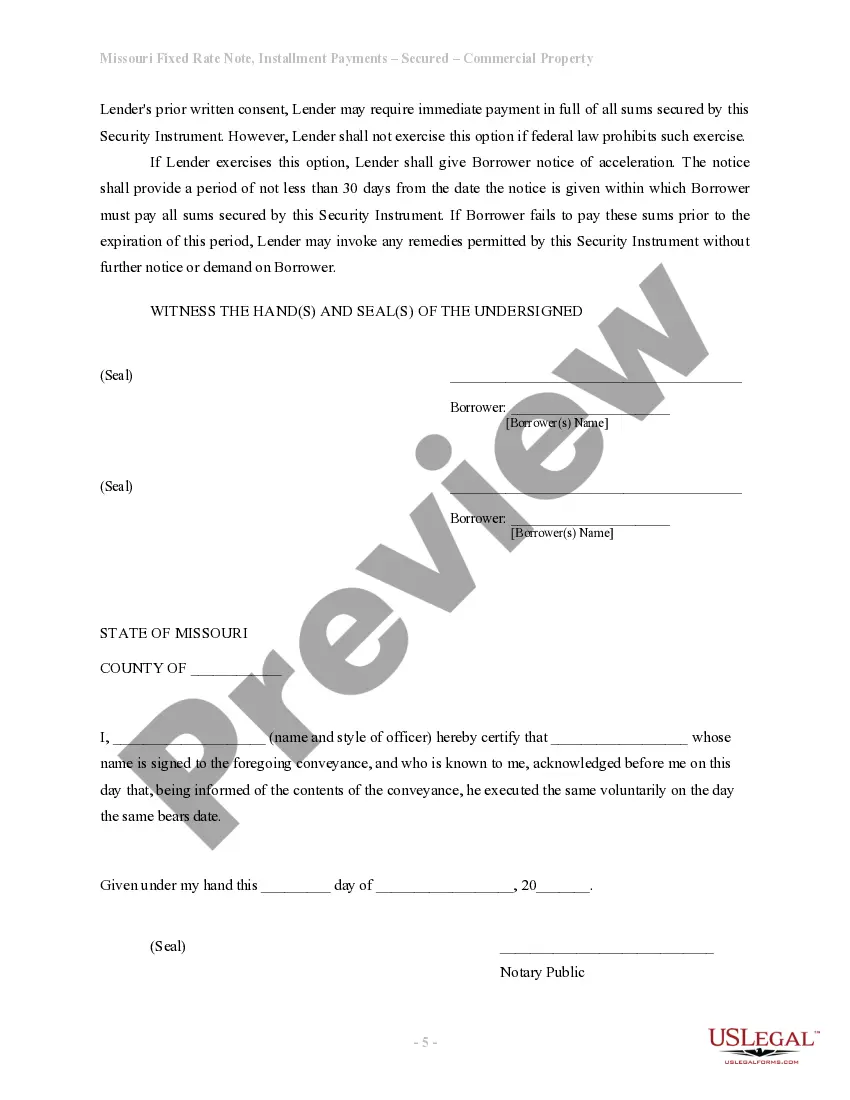

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Kansas City Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Missouri Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you are looking for a legitimate document, it’s challenging to select a superior service compared to the US Legal Forms website – arguably the most comprehensive collections available online.

With this collection, you can discover numerous form examples for both business and personal needs categorized by types and states, or keywords.

Utilizing our enhanced search feature, obtaining the latest Kansas City Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is as straightforward as 1-2-3.

Receive the document. Choose the file format and download it to your computer.

Edit as needed. Complete, modify, print, and sign the acquired Kansas City Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

- If you are familiar with our site and possess a registered account, all you need to do to obtain the Kansas City Missouri Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is to sign in to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have accessed the sample you desire. Review its details and utilize the Preview feature to inspect its content. If it does not suit your requirements, utilize the Search field at the top of the page to find the appropriate document.

- Confirm your selection. Click the Buy now option. Next, choose your desired pricing plan and enter your information to sign up for an account.

- Complete the purchase. Use your credit card or PayPal to finalize the registration process.

Form popularity

FAQ

There is no legal requirement to have a Missouri promissory note notarized. The promissory note needs to be signed and dated by the borrower and any co-signer.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances ? if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt ? then, the contract becomes null and void.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark ?paid in full? on the promissory note.Place a signature beside the ?paid in full? notation.Mail the original promissory note to the borrower.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

Yes, a promissory note is a legal, binding agreement, even if it's a handwritten note signed by both parties on a cocktail napkin. ?However, it would be foolish to sign a handwritten promissory note as it is easier to add language to a handwritten note after the fact as opposed to a typewritten one,? said Vincent J.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.