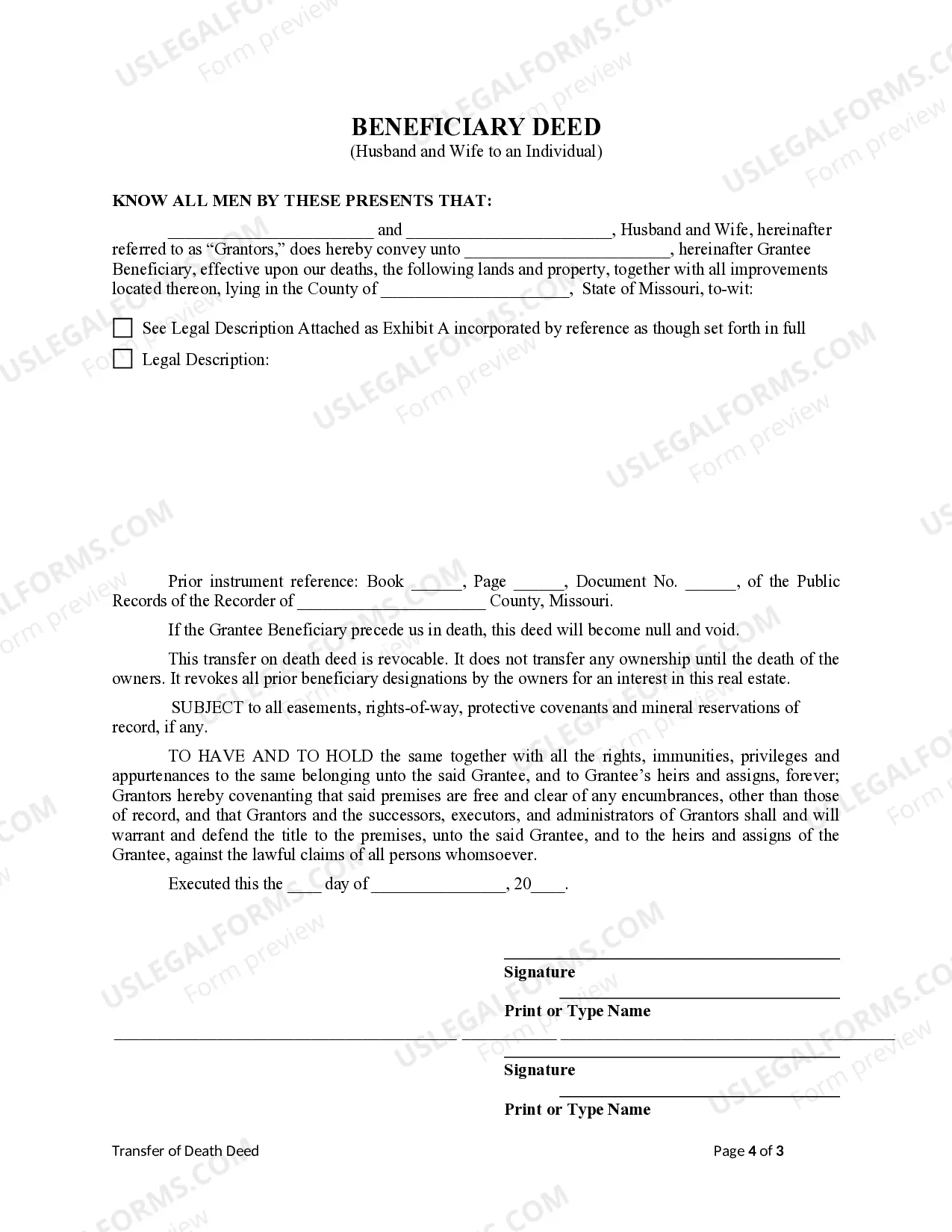

This form is a Transfer on Death Deed where the Grantor Owners are husband and wife and the Grantee Beneficiary is an individual. This transfer is revocable by Grantors until death and effective only upon the death of the surviving Grantor.

Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual

Description

How to fill out Missouri Transfer On Death Deed Or TOD - Beneficiary Deed - Husband And Wife To An Individual?

We consistently endeavor to minimize or avert legal harm when managing intricate legal or financial matters.

To achieve this, we seek attorney services that are typically quite costly.

However, not all legal challenges are of the same complexity. Many can be addressed by ourselves.

US Legal Forms is an online repository of current DIY legal documents that cover everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it from the My documents section. The procedure is just as simple if you are not familiar with the site! You can set up your account in just a few minutes. Ensure that the Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual complies with your state's laws and regulations. Additionally, it is essential to review the form's description (if available), and if you identify any inconsistencies with your initial requirements, search for another template. After confirming that the Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual meets your needs, you can select a subscription plan and process the payment. Then you can download the document in any preferred file format. For over 24 years, we have supported millions of individuals by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Our service empowers you to manage your affairs independently without requiring legal counsel.

- We provide access to legal document templates that are not always publicly available.

- Our templates are specific to states and regions, which greatly helps in the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual or any other document swiftly and securely.

Form popularity

FAQ

The choice between a Springfield Missouri Transfer on Death Deed or TOD and a beneficiary deed depends on your individual circumstances. A TOD allows you to transfer property directly to a designated beneficiary upon your death, avoiding probate. Meanwhile, a beneficiary deed gives ownership to someone while you are still alive but provides them rights after your passing. Evaluating these options can ensure you make the best choice for your estate planning needs.

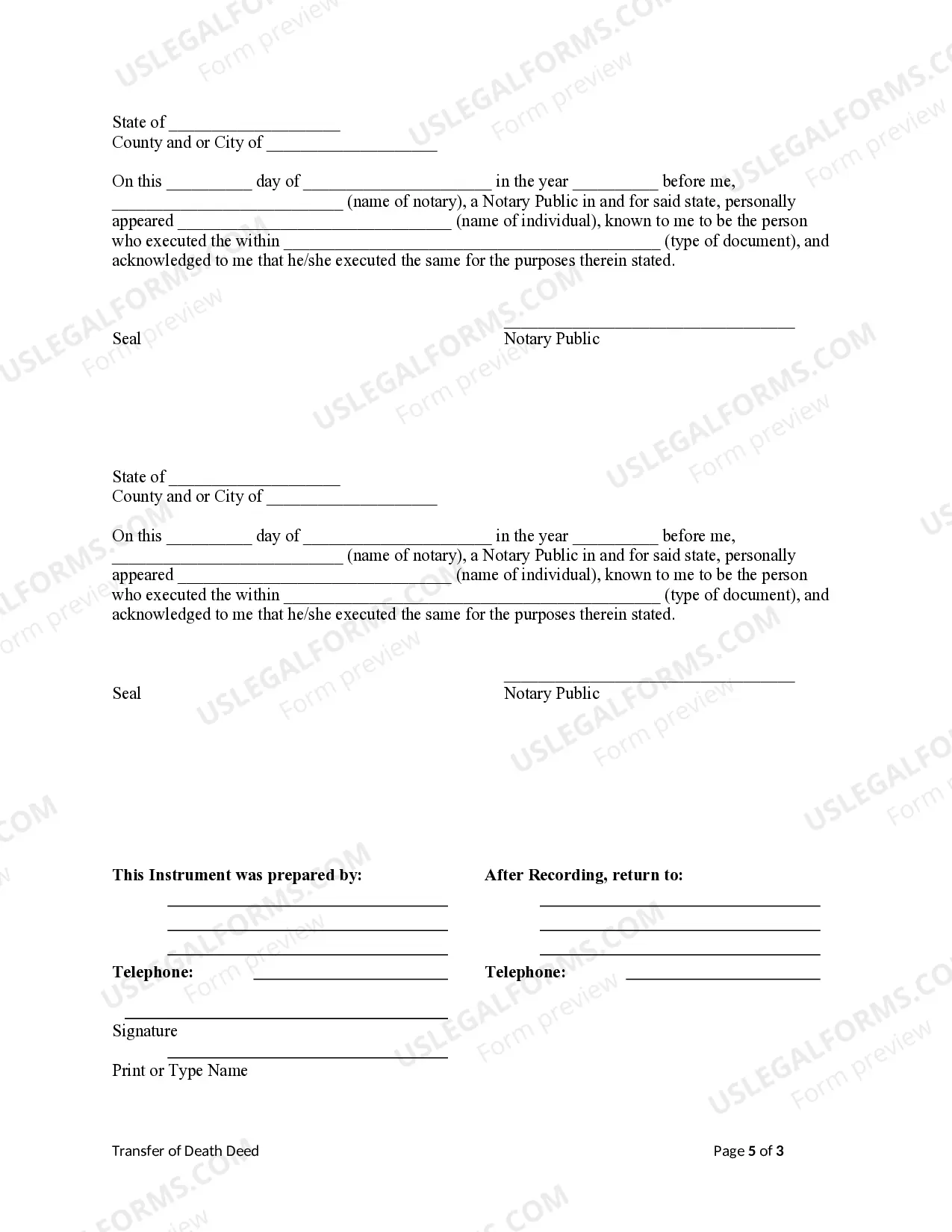

A valid transfer-on-death deed in Missouri requires certain criteria to be met. First, the deed must be in writing and signed by the property owner. Additionally, it must clearly identify the beneficiaries and be recorded with the county recorder's office. For assistance in ensuring these requirements are met, consider using the resources available on US Legal Forms, which specialize in Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual.

To fill out a transfer-on-death designation affidavit, begin by obtaining the correct form, which you can find on legal resource sites like US Legal Forms. You will need to provide information regarding the property and the designated beneficiaries. Make sure that all details are complete and accurate to ensure a smooth process for your Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual.

You are not required to have an attorney for a Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual, but consulting one can be beneficial. An attorney can ensure that all legal requirements are met and help avoid potential mistakes. If you prefer a more guided approach, US Legal Forms provides resources that simplify the process.

Filling out a Missouri beneficiary deed requires careful attention to detail. First, you need to gather the necessary information, such as the legal description of your property and the full names of the beneficiaries. You can find templates and guidance on platforms like US Legal Forms, which can help you accurately fill out the Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual.

While a Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual offers several benefits, it also has disadvantages. One significant downside is that if the property owner has outstanding debts, creditors may still reach the property even after the transfer is completed. Moreover, the transfer does not shield the property from estate taxes, which can impact the beneficiaries.

To create a Springfield Missouri Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to an Individual, you generally need a few key documents. First, you should have the legal description of the property for which you want to establish the deed. Additionally, you will require the names and details of the beneficiaries who will receive the property upon your death.

The primary difference between a Transfer on Death Deed and a beneficiary deed lies in how ownership is transferred. A TOD deed transfers property directly to the beneficiary upon your death without going through probate. In contrast, a beneficiary deed is a type of legal instrument that may offer additional flexibility regarding property management while you are alive. Understanding these differences in Springfield Missouri can help you make informed decisions.

A significant disadvantage of a Transfer on Death Deed is that it does not account for situations where beneficiaries become unavailable or unqualified to inherit. If the named beneficiary dies before you, the deed may need modification to ensure your wishes are followed. Furthermore, a TOD deed does not protect against creditors, which means your estate remains vulnerable. Consider these potential issues in your estate planning.

While a Transfer on Death Deed provides several benefits, it also comes with drawbacks. For instance, you retain full control of the property during your lifetime, which means you cannot transfer ownership without revoking the TOD. Additionally, if the named beneficiary passes before you, the property could become part of your estate, complicating transfer. Understanding these factors is crucial for effective estate planning.