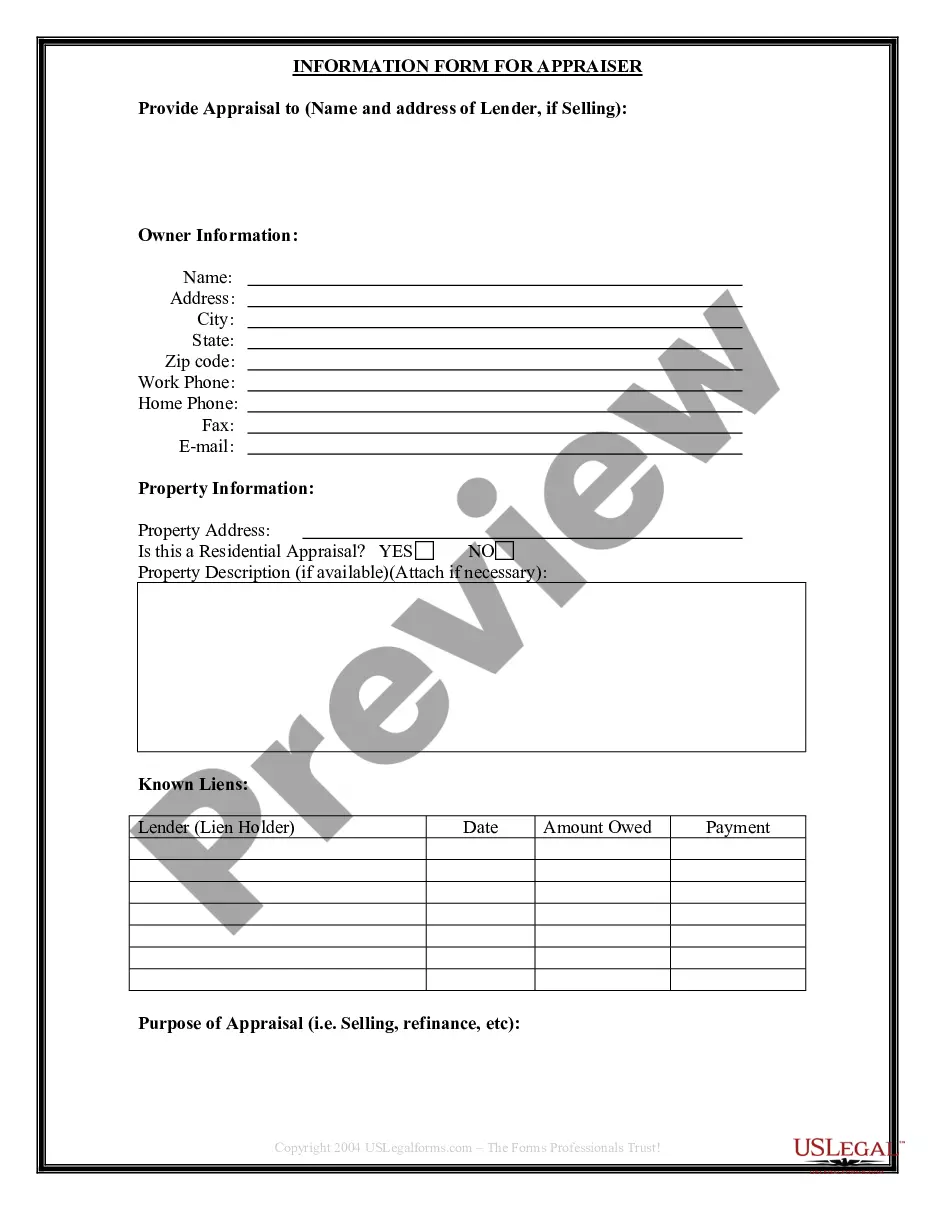

This Seller's Information for Appraiser provided to Buyer form is used by the Buyer in Missouri to provide information required by an appraiser in order to conduct an appraisal of the property prior to purchase. The Seller provides this completed form to the Buyer, who furnishes it to the appraiser. This form is designed to make the transaction flow more efficiently.

Kansas City Missouri Seller's Information for Appraiser provided to Buyer

Description

How to fill out Missouri Seller's Information For Appraiser Provided To Buyer?

If you are seeking a legitimate form template, it’s challenging to find a superior service than the US Legal Forms website – one of the largest collections on the web.

Here you can access a vast array of templates for both business and personal uses, categorized by types and states, or keywords.

With our advanced search option, locating the latest Kansas City Missouri Seller's Information for Appraiser given to Buyer is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Choose the format and save it to your device.

- Furthermore, the accuracy of each document is confirmed by a team of experienced lawyers who regularly review and update the templates on our platform based on the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Kansas City Missouri Seller's Information for Appraiser provided to Buyer is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure that you have opened the sample you require. Review its description and utilize the Preview feature to examine its content. If it doesn’t meet your requirements, use the Search box at the top of the page to find the suitable document.

- Confirm your choice. Click the Buy now option. Afterward, select your desired subscription plan and provide information to create an account.

Form popularity

FAQ

If you and your agent think the appraisal is too low, you may request a second opinion. You can ask for another appraisal; however, understand that you may be out of luck if the second appraisal comes in even lower than the first.

Just keep your communication to the appraiser about the facts of the home and neighborhood, how you priced the house, and any other relevant information you think the appraiser should know. And remember, don't discuss value. Don't pressure the appraiser to 'hit the value' and you'll be fine.

A purchase appraisal can also affect both the selling cost and mortgage amount. Read on to learn exactly how an appraisal helps both the buyer and seller.

The CRES Risk Management legal advice team noted that an appraisal is material to a transaction and like a property inspection report for a purchase, it needs to be provided to the seller, whether or not the sale closes.

Can the seller back out if the appraised value is too high? The conditions of the offer contract will determine when the buyer and seller can back out of the purchase. However, the seller may simply want to renegotiate if the appraised value comes back significantly higher than the selling price.

The sales contract is just one more piece of data to be used in the appraisal process. Therefore, the appraiser will most likely know the selling price of a home but this is not always the case.

How often do home appraisals come in low? Low home appraisals do not occur often. According to Fannie Mae, appraisals come in low less than 8 percent of the time, and many of these low appraisals are renegotiated higher after an appeal, Graham says.

If you have a previous appraisal, I might suggest you use my Appraiser Info Sheet to share information appraisers tend to ask about, and then say nothing more than, ?I have a previous appraisal if you want to see it.? If the appraiser doesn't want it, that's fine. If the appraiser does, that's fine too.

Many contracts may contain a contingency based on a home's appraised value. If so, you can probably renegotiate the asking price, or you may be able to walk away if you so choose. If the purchase agreement is silent regarding an appraisal, all hope is not necessarily lost.

Therefore, if the house appraises higher you still must base your down payment on the actual purchase price. VA: At the time of purchase the value is based on the lesser of the appraised value or purchase price. Therefore, if the house appraises higher you still must base your down payment on the actual purchase price.