Minneapolis Minnesota UCC1 Financing Statement

Description

How to fill out Minnesota UCC1 Financing Statement?

Acquiring authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms collection.

It’s a digital repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the forms are appropriately categorized by usage area and jurisdiction, making the search for the Minneapolis Minnesota UCC1 Financing Statement as effortless as one two three.

Maintaining documentation organized and in line with legal requirements holds significant importance. Take advantage of the US Legal Forms collection to always have crucial document templates readily available for any requirements!

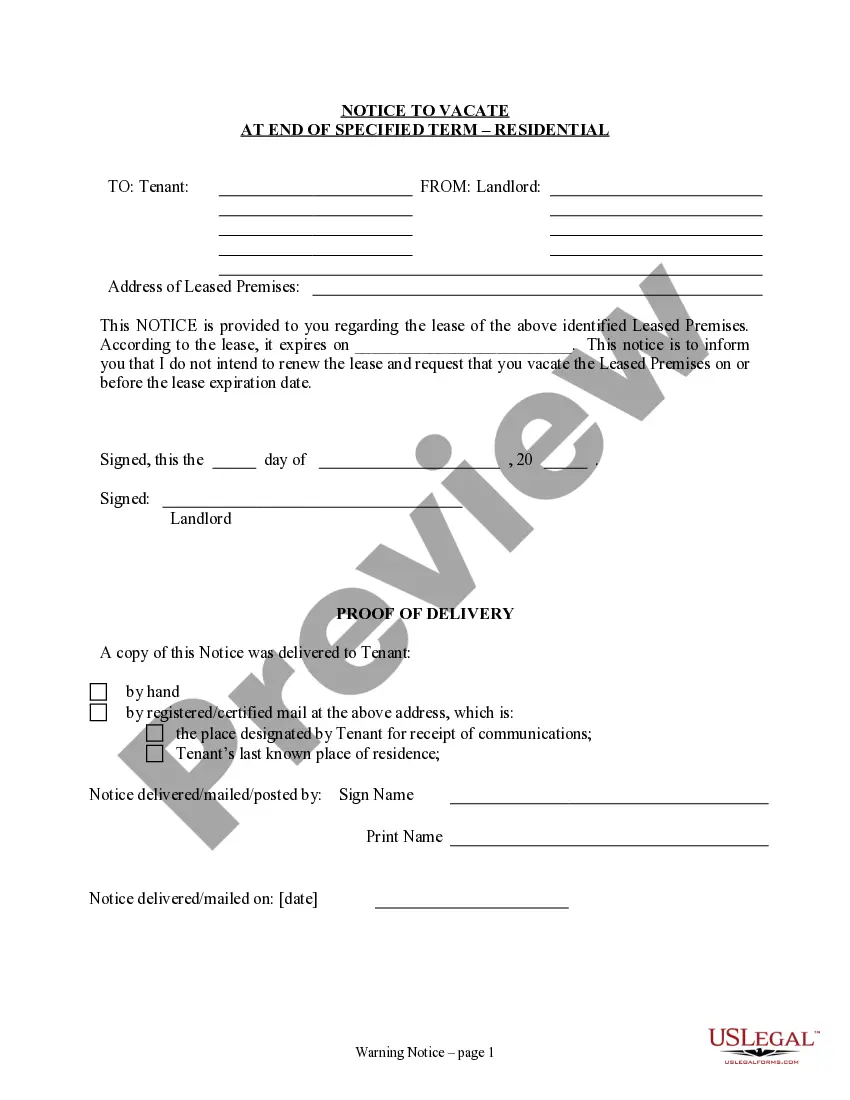

- Review the Preview mode and document description.

- Ensure you’ve chosen the correct one that aligns with your needs and fully complies with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- Once you detect any discrepancy, use the Search tab above to locate the appropriate one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

You should file a UCC-1 Financing Statement with the secretary of state's office in the state where the debtor is incorporated or located. If the collateral is real property, then you should also file a UCC-1 with the county recorder's office in the county where the debtor's real property is located.

How Does a UCC Filing Affect My Credit? A UCC filing won't impact your business credit scores directly because it doesn't indicate anything about your ability to repay your debts. However, it can affect your ability to get credit again in the future.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

Visit your secretary of state's office. To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

Additionally, a UCC filing does not natively impact your credit score. But a UCC filing does appear on your credit report, and it could affect whether you will qualify for other financing forms later down the road. For example, say that you receive funding from one lender who filed a UCC lien on some of your assets.

1 filing is good for five years. After five years, it is considered lapsed and no longer valid. Should your debtor remain in debt to you and encounter financial difficulty or file for bankruptcy, you have no secured interest if your UCC1 filing has lapsed.

You should file a UCC-1 Financing Statement with the secretary of state's office in the state where the debtor is incorporated or located. If the collateral is real property, then you should also file a UCC-1 with the county recorder's office in the county where the debtor's real property is located.

In theory, anyone can file a UCC-1 against anyone else. To protect both secured creditors and debtors, Article 9 has strict requirements that must be met for a filed UCC-1 to be effective. One of those requirements is that the financing statement must be authorized by the debtor.