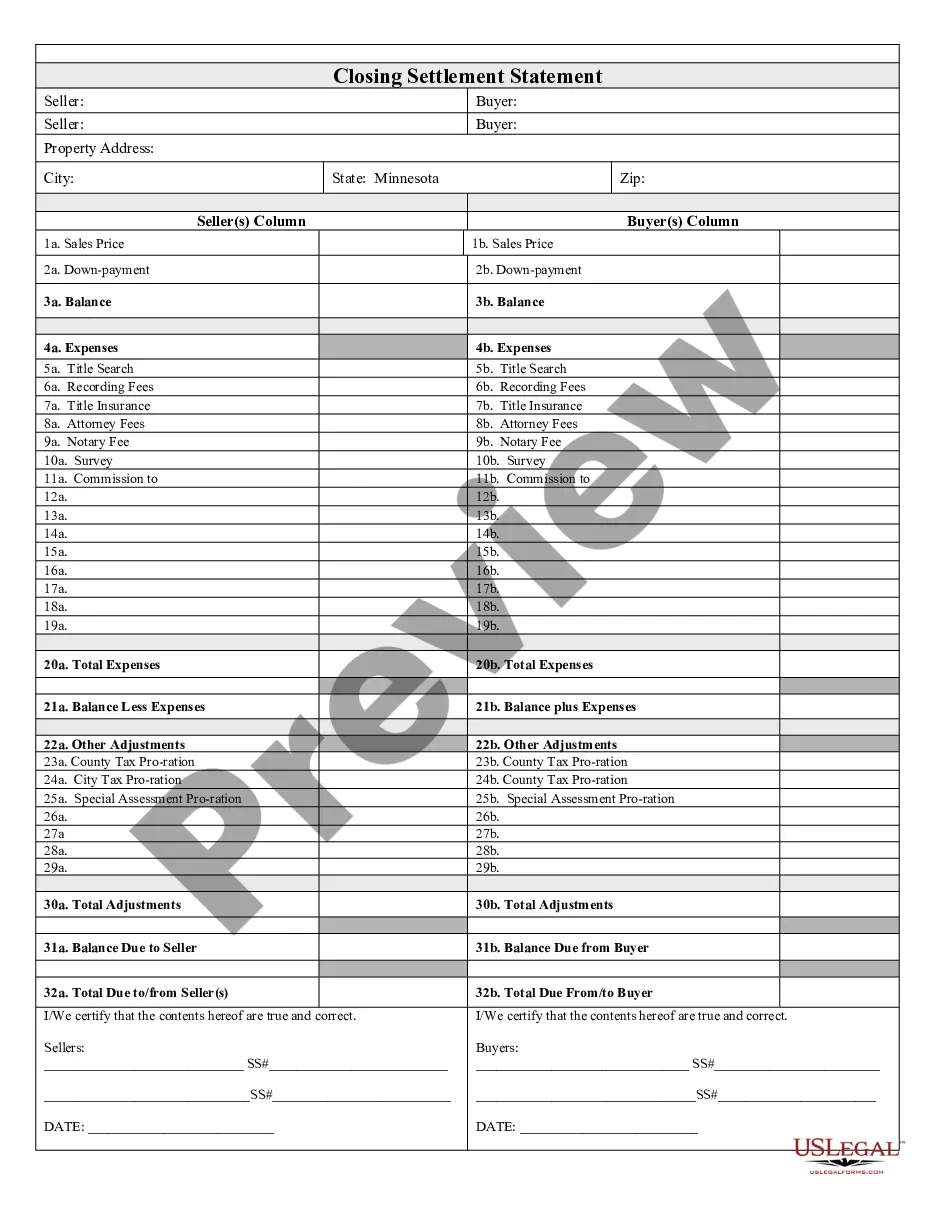

Minneapolis Minnesota Closing Statement

Description

How to fill out Minnesota Closing Statement?

Are you in need of a trustworthy and cost-effective legal forms provider to purchase the Minneapolis Minnesota Closing Statement? US Legal Forms is your top selection.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of paperwork to facilitate your divorce in court, we have everything you require. Our site offers more than 85,000 current legal document templates for individual and business purposes.

All templates that we offer are not generic and are tailored to meet the specifications of different states and localities.

To obtain the document, you must sign in to your account, search for the desired template, and click the Download button adjacent to it. Please keep in mind that you can access your previously acquired document templates at any time from the My documents section.

Now you can register your account. Then, choose the subscription preference and move forward to payment. Once your payment is finalized, download the Minneapolis Minnesota Closing Statement in any available file format.

You can revisit the website at any time and redownload the document without any additional expense.

- If you are unfamiliar with our site, there's no need to worry.

- You can establish an account within minutes; however, ensure you do the following first.

- Check if the Minneapolis Minnesota Closing Statement aligns with the laws of your state and locality.

- Review the form's particulars (if available) to understand who the document serves and its purpose.

- If the template doesn’t fit your unique circumstances, restart your search.

Form popularity

FAQ

A petition can be filed any time after 120 hours (five days) from the time of a decedent's death.

Form ST3 Expiration Exemption certificates do not expire unless the information on the certificate changes. But we recommend updating exemption certificates every three to four years. Below is a list of most nontaxable items. An exemption certificate or other documentation may be required.

A Personal Representative in a Minnesota probate proceeding which is not being supervised by the Probate Court may close the estate by filing a Minnesota Unsupervised Probate Closing Statement with the Court pursuant to M.S., Section 524.3-1003, declaring that the Personal Representative had completed the

In Minnesota, you must first file a Statement of Dissolution stating that you are in the process of winding up your business. Then, once you wind up your LLC, you must file the Statement of Termination. Minnesota requires business owners to submit their Statement of Termination by mail, online, or in-person.

File your business document online by visiting our website at . This form is intended merely as a guide for filing and is not intended to cover all situations.

In Minnesota, you must first file a Statement of Dissolution stating that you are in the process of winding up your business. Then, once you wind up your LLC, you must file the Statement of Termination. Minnesota requires business owners to submit their Statement of Termination by mail, online, or in-person.

To close a tax account through e-Services, you must be an e-Services Master for the business. You can also email business.registration@state.mn.us, or call 651-282-5225 or 1-800-657-3605 (toll-free). Note: You should close tax accounts at the end of your filing cycles (annually, quarterly, or monthly).

Contact the office that issued your seller's permit. You must cancel your seller's permit with the government agency that originally issued it, typically by filling out a form.

How do I close a business? To close your business and all of your tax accounts through e-Services, you must be an e-Services Master for the business. You can also email business.registration@state.mn.us, or call 651-282-5225 or 1-800-657-3605 (toll-free). Note: If your business closed more than a year ago, contact us.

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.