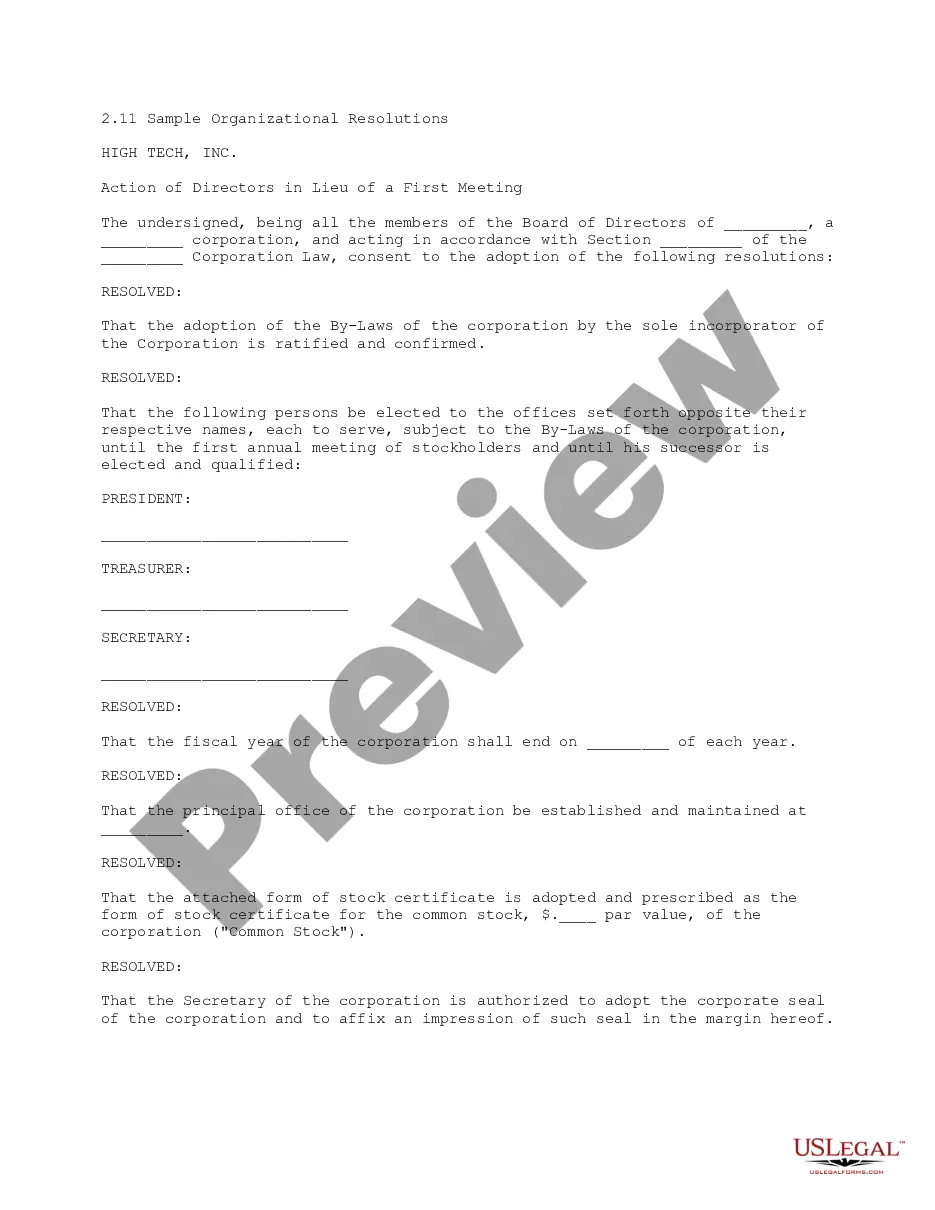

This is an official Minnesota court form for use in a bankruptcy case, an Application for Discharge of Judgments. USLF amends and updates these forms as is required by Minnesota Statutes and Law.

Minneapolis Minnesota Application for Discharge of Judgments

Description

How to fill out Minnesota Application For Discharge Of Judgments?

Utilize the US Legal Forms to gain immediate access to any form template you need.

Our practical platform, which features a wide array of templates, allows you to easily locate and obtain nearly any document template you require.

You can save, complete, and authenticate the Minneapolis Minnesota Application for Discharge of Judgments in merely a few moments rather than spending hours on the web searching for the appropriate template.

Employing our collection is an excellent method to enhance the security of your record submissions. Our expert attorneys routinely examine all documents to ensure that the forms are applicable to specific regions and adhere to current laws and regulations.

If you haven't created a profile yet, follow the steps below.

Access the page with the template you need. Ensure that it is the template you were looking for: check its title and description, and use the Preview feature when it is accessible. If not, use the Search bar to find the appropriate one.

- How can you acquire the Minneapolis Minnesota Application for Discharge of Judgments.

- If you already have a subscription, simply Log In to your account. The Download option will be available on all documents you view.

- Moreover, you can access all previously saved records in the My documents section.

Form popularity

FAQ

A judgment in Minnesota is valid for 10 years. To renew a judgment in Minnesota for another ten year period, a creditor must start a new lawsuit against the debtor before the expiration of the initial ten year period.

To vacate a judgment in Minnesota, you'll need to prove the following four things: A defense to the collection lawsuit.A good reason for not answering the complaint.That the judgment was entered less than a year ago.That the debt collector will not suffer any prejudice if the judgment is vacated.

The statute of limitations for most debts in Minnesota is six years, including open accounts and written contracts. Creditors and debt collectors can file a lawsuit for breach of contract under Minnesota law within this period to hold you legally responsible for an unpaid debt.

Renew the judgment Money judgments automatically expire (run out) after 10 years. To prevent this from happening, the creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

There are four main ways to not pay a judgment: (1) use statutory exemptions, (2) use protected assets, (3) negotiate with the creditor, or (4) file bankruptcy.

The most common ways you may find out that there are outstanding judgements against you are: Letter in the mail or phone call from the collection attorneys; Garnishee notice from your payroll department; Freeze on your bank account; or. Routine check of your credit report.

Once a judgment is docketed, a judgment lien in Minnesota generally lasts for 10 years.

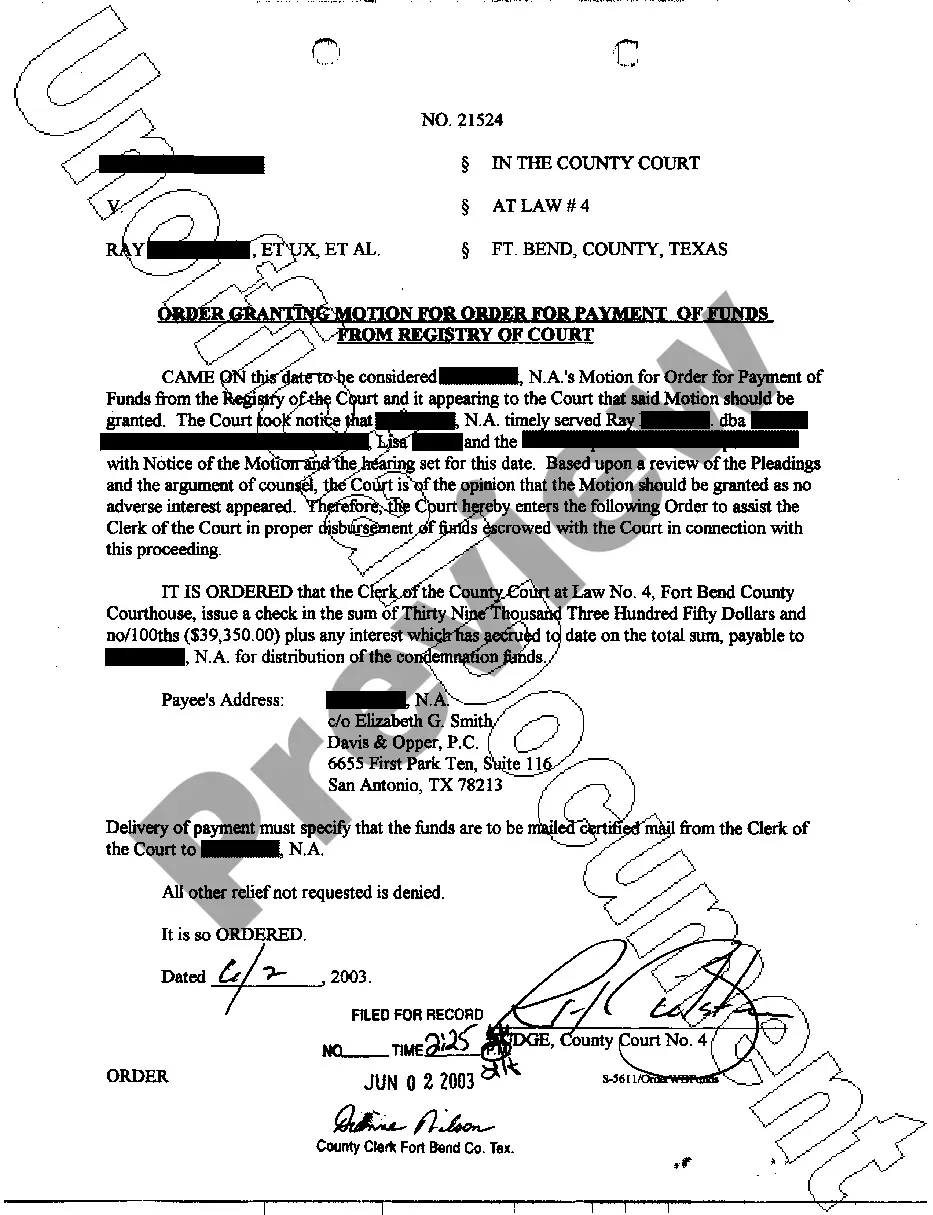

Total Discharge. The creditor, sheriff or creditor's designate can totally remove/discharge the judgment from the Judgment Registry and any associated titles or interests once the debt has been satisfied.

Sometimes, a judgment sits there for many years. The creditor can take action to keep it active. A judgment can be renewed for another 10 years by starting a new action within a ten-year period.

A judgment for money in Minnesota does not survive indefinitely. Instead, a judgment only survives for ten years after its entry and any action to collect after that ten-year time frame is disallowed.