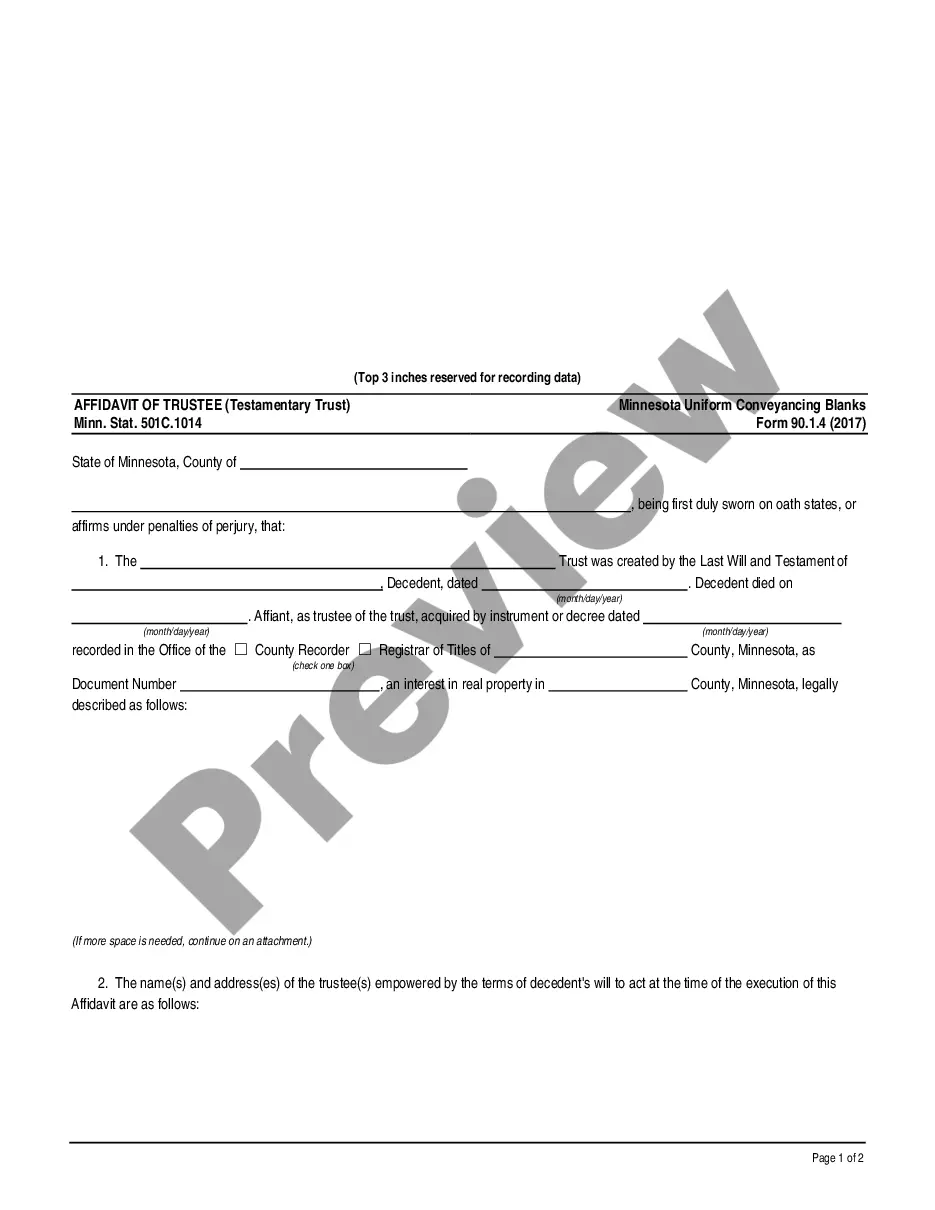

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Saint Paul Minnesota Affidavit of Trustee Regarding Certificate of Trust or Trust Instrument for Business Entity is a legal document governed by Minn. Stat. 501B.57. This affidavit is commonly used in the state of Minnesota to provide proof of the existence and terms of a trust for a business entity. It serves as a declaration by the trustee, confirming the trust's creation, provisions, and any amendments made to it. This affidavit plays a crucial role in various business transactions, such as real estate purchases, loan applications, and asset transfers. It allows the trustee to provide evidence of their authority to act on behalf of the trust and ensures compliance with legal requirements. Some common variations or types of the Saint Paul Minnesota Affidavit of Trustee Regarding Certificate of Trust or Trust Instrument for Business Entity may include: 1. Revocable Trust Affidavit: This affidavit is used when the trust is revocable, meaning it can be modified or terminated by the granter (person who created the trust) during their lifetime. 2. Irrevocable Trust Affidavit: If the trust is irrevocable, meaning it cannot be modified or terminated without the consent of all beneficiaries, this type of affidavit is used. 3. Testamentary Trust Affidavit: This affidavit is specific to testamentary trusts, which are created through a will and only come into effect upon the death of the granter. 4. Living Trust Affidavit: This type of affidavit applies to trusts that are established during the granter's lifetime and become effective immediately. When drafting a Saint Paul Minnesota Affidavit of Trustee Regarding Certificate of Trust or Trust Instrument for Business Entity, it is important to include essential details. These may include the trust's legal name, date of creation, the name and contact information of the trustee(s), the trust's purpose, and any amendment information. Additionally, the affidavit should confirm that the trust has not been revoked, modified, or terminated and that it is validly existing under the laws of the state of Minnesota. By using the relevant keywords such as Saint Paul, Minnesota, Affidavit of Trustee, Certificate of Trust, Trust Instrument, Business Entity, Minn. Stat. 501B.57, and its variations, you can generate an accurate and detailed description of this legal document and its different types.