Minneapolis Minnesota Waiver of Homestead Exemption by Client to secure Attorney's Fees

Description

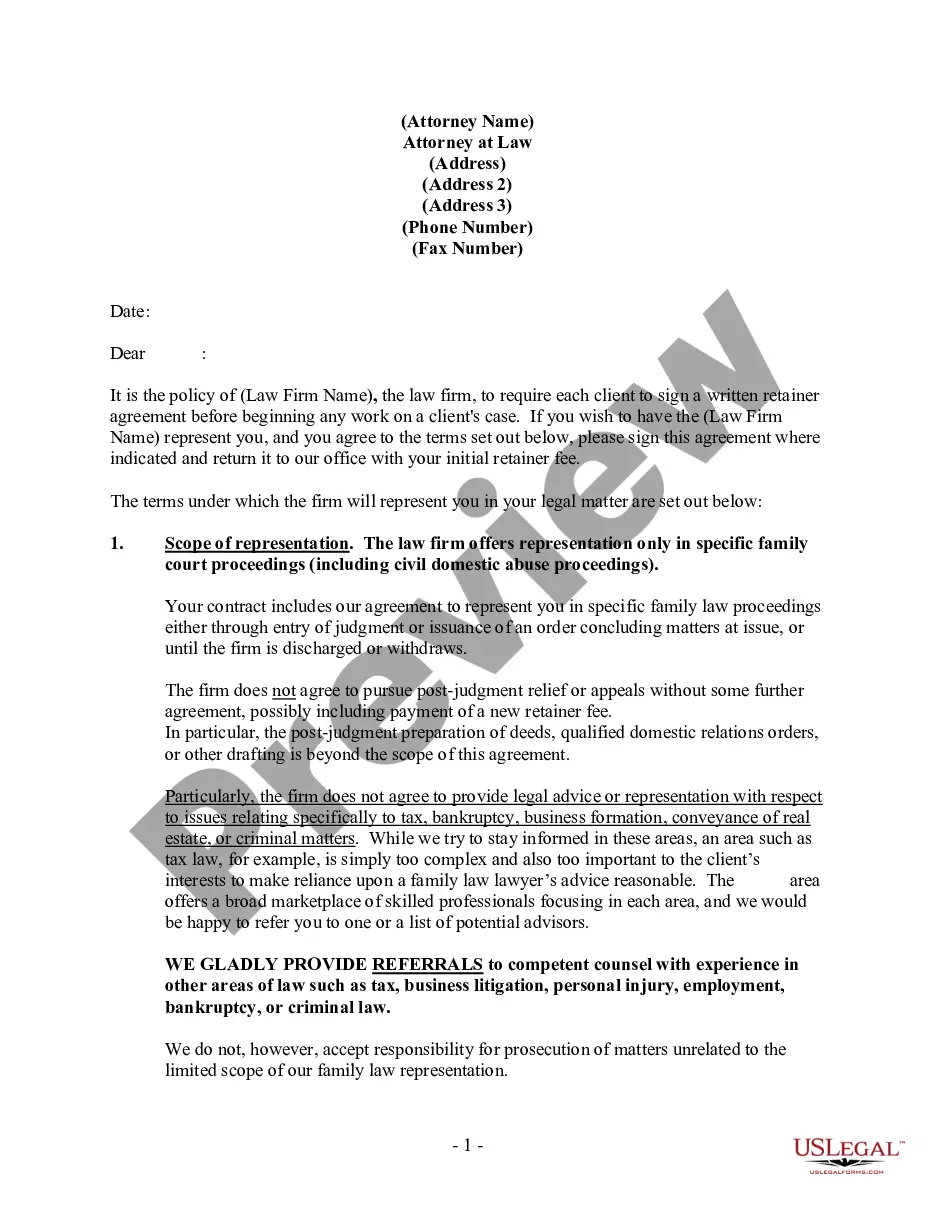

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Regardless of social or professional standing, filling out law-related documents is a regrettable requirement in the contemporary landscape.

Frequently, it’s almost unattainable for an individual without a legal background to compose such documents from scratch, primarily because of the complex language and legal subtleties they entail.

This is where US Legal Forms can be a lifesaver.

Make sure the form you selected is appropriate for your location since the laws of one state or area may not be applicable to another.

Review the form and examine a brief summary (if available) of the situations for which the document can be utilized.

- Our platform offers an extensive library with over 85,000 ready-to-use state-specific forms applicable for nearly every legal situation.

- US Legal Forms is also an excellent tool for associates or legal advisors who aim to enhance their efficiency with our DIY forms.

- Whether you need the Minneapolis Minnesota Waiver of Homestead Exemption by Client for Attorney's Fees or any other documentation that will be recognized in your region, US Legal Forms has everything available.

- Here’s how to swiftly acquire the Minneapolis Minnesota Waiver of Homestead Exemption by Client for Attorney's Fees through our trustworthy platform.

- If you are already a registered user, please proceed to Log In to your account to download the necessary form.

- If you are new to our platform, ensure you follow these steps before obtaining the Minneapolis Minnesota Waiver of Homestead Exemption by Client for Attorney's Fees.

Form popularity

FAQ

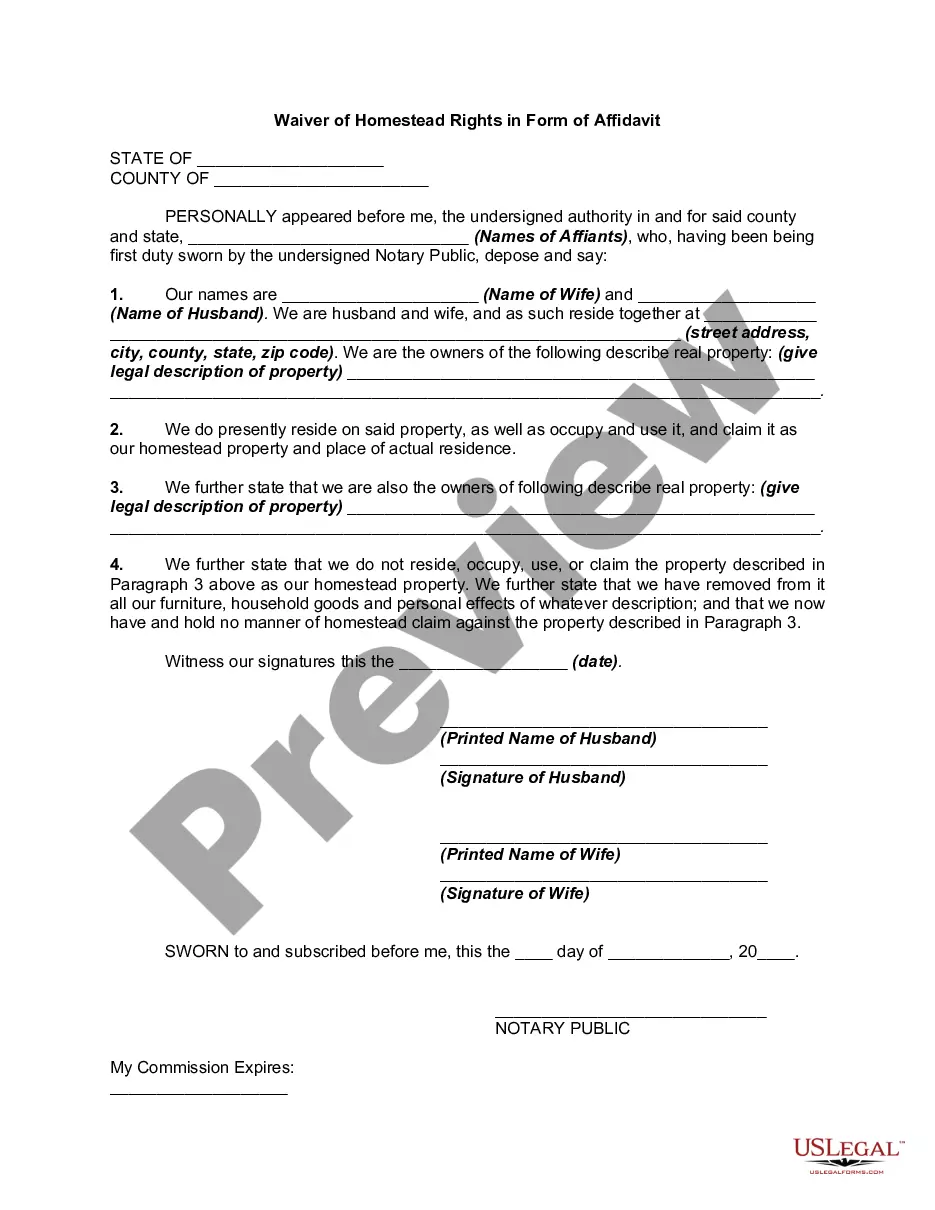

The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes. To qualify, you must: Have a valid Social Security Number. Own and occupy a home.

The Market Value Exclusion reduces the taxable market value for property classified as homestead if it is valued below $413,800. By decreasing the taxable market value, net property taxes are also decreased. How the Exclusion Works + The exclusion reduces the taxable market value of qualifying homestead properties.

You may only have one homestead per married couple in the state of Minnesota. Homesteads are administered by counties. To qualify for a homestead, you must: Own a property.

If you own real estate property and you or a qualifying relative occupies the property by December 31, you may apply for homestead status by December 31. You can only homestead one residential parcel in the State of MN.

If the occupant is a relative of the owner, the owner does not have to be a Minnesota resident. You must file a Certificate of Real Estate Value for homestead status to be granted. You can receive homestead status for more than one property, if a relative uses a second home owned by you as their primary residence.

A homestead classification qualifies your property for a classification rate of 1.00% on up to $500,000 in taxable market value. Homesteads are also eligible for a market value exclusion, which may reduce the property's taxable market value.

You may only have one homestead per married couple in the state of Minnesota. Homesteads are administered by counties. To qualify for a homestead, you must: Own a property.

(a) Residential real estate that is occupied and used for the purposes of a homestead by its owner, who must be a Minnesota resident, is a residential homestead.

You may only have one homestead per married couple in the state of Minnesota. Homesteads are administered by counties. To qualify for a homestead, you must: Own a property.

To qualify for homestead: You must own the property, or be a relative or in-law of the owner (son, daughter, parent, grandchild, grandparent, brother, sister, aunt, uncle, niece or nephew). You or your relative must occupy the property as the primary place of residence. You must be a Minnesota resident.