Minneapolis Minnesota Satisfaction of Lien on Real Property

Description

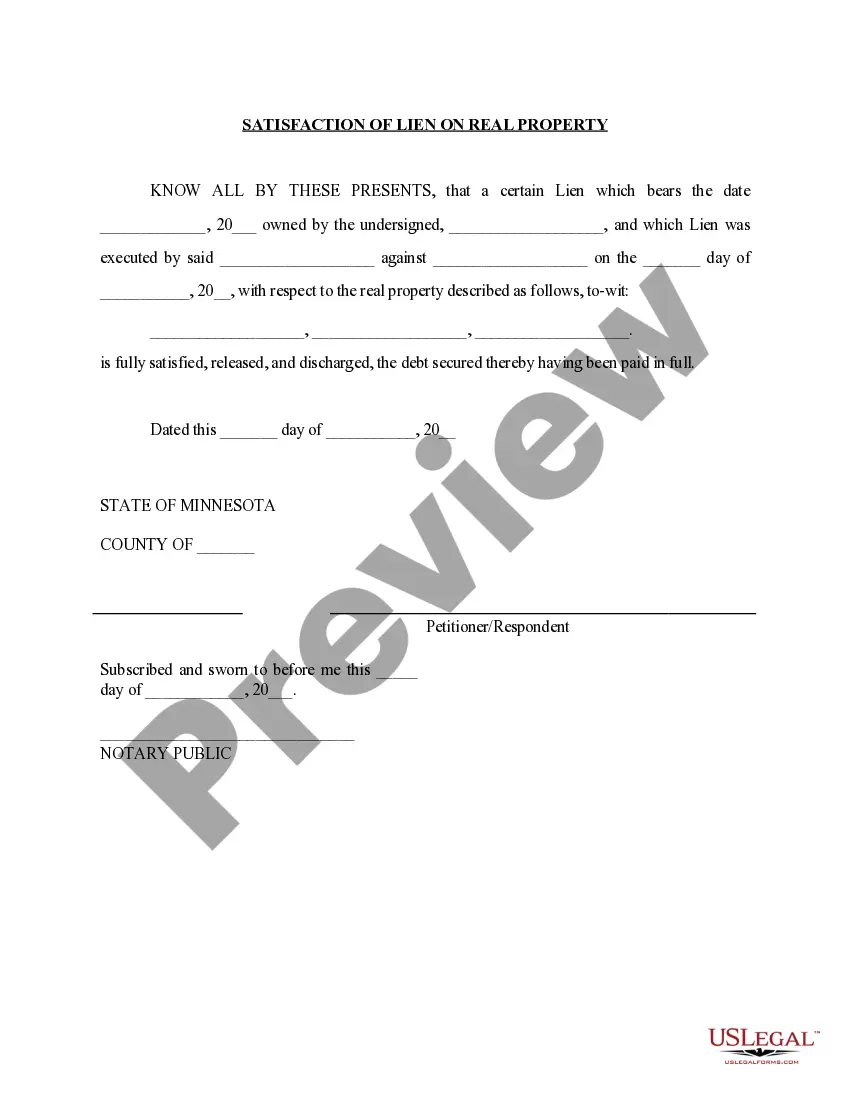

How to fill out Minnesota Satisfaction Of Lien On Real Property?

If you're in search of a suitable form, it’s challenging to find a more convenient solution than the US Legal Forms website – one of the largest libraries available online.

With this collection, you can access a vast number of document samples for business and personal use by categories and states, or keywords.

With our premium search feature, obtaining the latest Minneapolis Minnesota Satisfaction of Lien on Real Property is as simple as 1-2-3.

Obtain the template. Select the file format and download it to your device.

Edit. Complete, revise, print, and sign the downloaded Minneapolis Minnesota Satisfaction of Lien on Real Property.

- If you're already familiar with our system and possess an account, all you need to do to access the Minneapolis Minnesota Satisfaction of Lien on Real Property is to Log In to your profile and click the Download button.

- If you’re using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have selected the form you need. Review its description and utilize the Preview feature to view its content. If it doesn’t suit your needs, employ the Search function at the top of the page to find the suitable document.

- Confirm your selection. Hit the Buy now button. Then, choose your preferred subscription plan and provide the necessary information to create an account.

- Complete the transaction. Use your credit card or PayPal to finalize the registration process.

Form popularity

FAQ

Satisfaction of lien means full payment of a debt or release of a debtor from a lien by the lienholder.

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

State Tax Lien The state has a statute of limitations. According to the Minnesota Department of Revenue website, the lien must be filed within 5 years of the date of occurrence. After that, they have 10 years to collect. A renewal of the lien may be filed, but it must be done before the 10-year date.

If you don't pay your delinquent property taxes, the state of Minnesota can eventually claim your home and then sell it to a new owner. People who own real property have to pay property taxes.

File Number Search is a free search by the filing number of the document, and does not require an account. Copies of specified lien records can be ordered through the Minnesota Business and Lien System (MBLS) online for a fee; ordering copies requires an account.

State Tax Lien The state has a statute of limitations. According to the Minnesota Department of Revenue website, the lien must be filed within 5 years of the date of occurrence. After that, they have 10 years to collect. A renewal of the lien may be filed, but it must be done before the 10-year date.

You can search by name for state and federal tax liens recorded by a government agency for failure of payment of personal, business or real property taxes. The Recorder's Office staff will do a tax lien search for a per name fee or you can come to the office to view the records yourself at no cost.

How long does a judgment lien last in Minnesota? A judgment lien in Minnesota will remain attached to the debtor's property (even if the property changes hands) for ten years.

Satisfaction of lien means full payment of a debt or release of a debtor from a lien by the lienholder.