Minneapolis Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement

Category:

State:

Minnesota

City:

Minneapolis

Control #:

MN-8569D

Format:

Word;

Rich Text

Instant download

Description

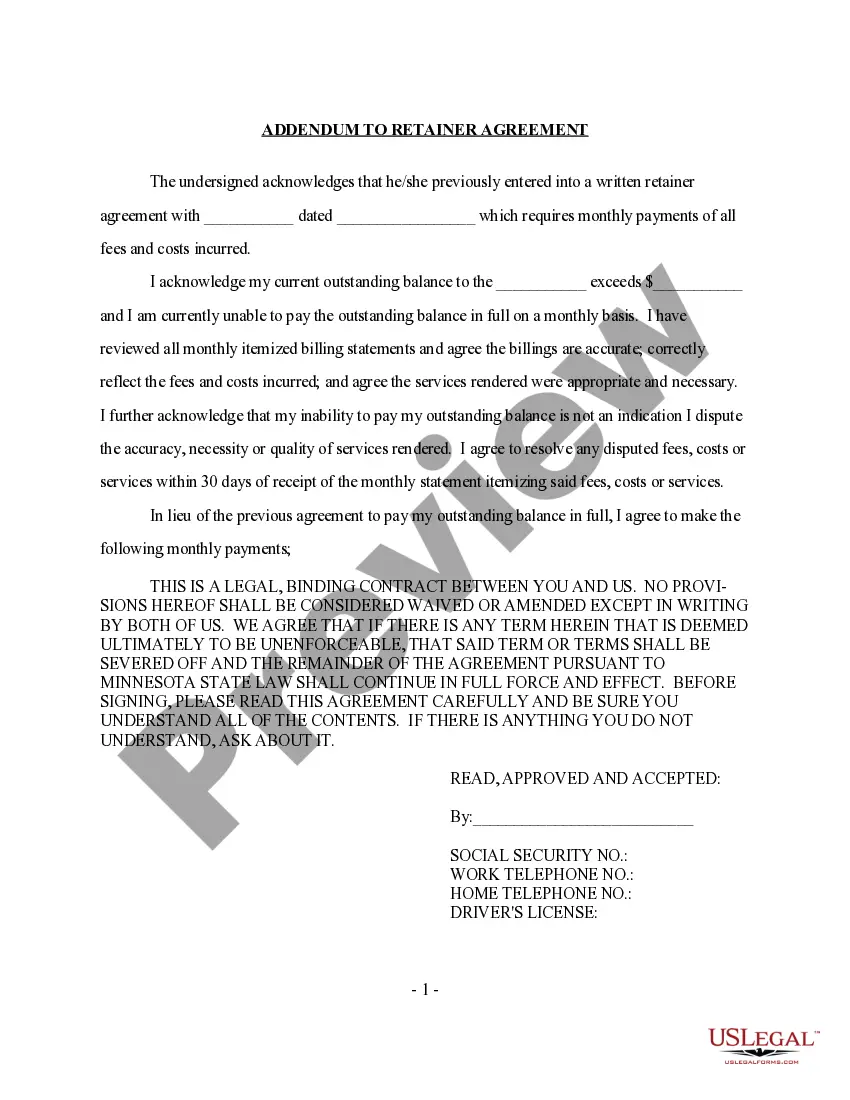

An addendum for client to sign: client is unable to pay full monthly balance of attorney's fees, but acknowledges accuracy of said fees and promises to pay by designated monthly payments.

How to fill out Minneapolis Minnesota Restructuring Of Monthly Payments For Past-Due Retainer Agreement?

If you’ve previously utilized our service, Log In to your account and save the Minneapolis Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your file.

You have indefinite access to every document you have purchased: you can locate it in your profile within the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to swiftly discover and save any template for your personal or business requirements!

- Verify you’ve found an appropriate document. Review the description and use the Preview feature, if offered, to ensure it fulfills your needs. If it’s not suitable, employ the Search tab above to locate the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Receive your Minneapolis Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement. Select the file format for your document and save it onto your device.

- Complete your sample. Print it or take advantage of professional online editors to fill it out and sign it electronically.

Form popularity

More info

In Minnesota the process to divorce is called a dissolution of marriage. Separate agreement, will be considered Rent under the terms of this Housing Agreement.In the event any payment is past due,. A repayment plan allows you to pay your regular monthly payment plus additional funds applied to past-due amounts. Past due rent payments accrue. 2. Prehire agreements in the construction industry . This program is a formal, temporary, written agreement with your mortgage lender designed to temporarily stop foreclosure proceedings. The payment due date is September 30th. The tax type for the fee is 7200D and the tax period month is "08" . 2. 3.1. Low-Income Objectives in a Restructured.