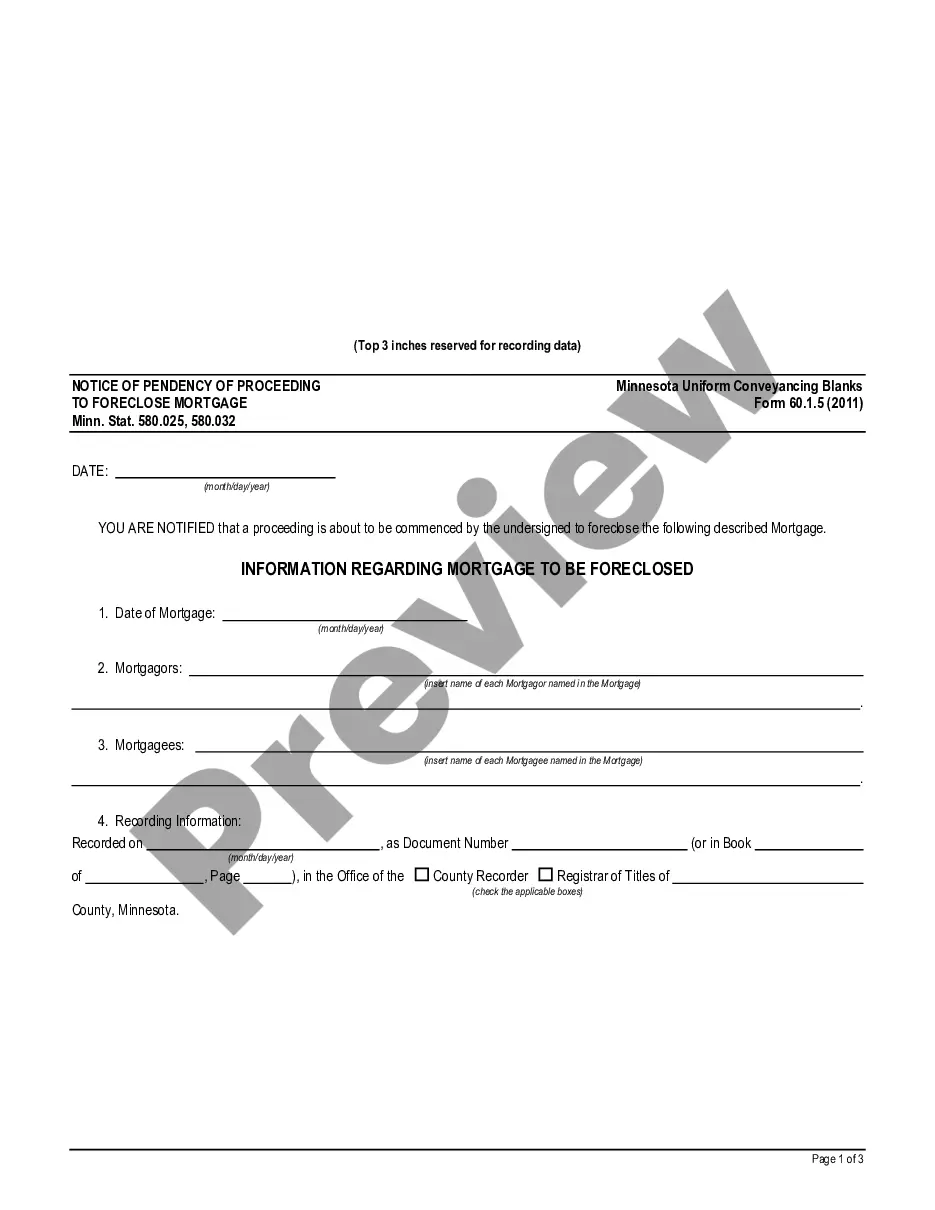

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Minneapolis Minnesota Notice of Pendency of Proceeding to Foreclosure Mortgage is an important legal document that serves as a formal notification to interested parties regarding an impending foreclosure on a property in Minneapolis, Minnesota. This notice is typically filed by the mortgage holder or lender, and it is a crucial step in the foreclosure process. Keywords: Minneapolis, Minnesota, Notice of Pendency, Proceeding, Foreclosure Mortgage, legal document, notification, foreclosure process, mortgage holder, lender. In Minneapolis, there are primarily two types of Notice of Pendency of Proceeding to Foreclosure Mortgage: 1. Judicial Foreclosure: In this type of foreclosure process, the lender files a Notice of Pendency of Proceeding to Foreclosure Mortgage with the court. This notice initiates legal proceedings to foreclose on the property and recoup the outstanding mortgage debt. Interested parties, including the property owner, are formally notified of the pending foreclosure through this document. Keywords: Minneapolis, Minnesota, Notice of Pendency, Judicial Foreclosure, legal proceedings, property owner, foreclosure process. 2. Non-Judicial Foreclosure: Unlike judicial foreclosure, non-judicial foreclosure does not involve court proceedings. Instead, the lender follows a specific procedure outlined by Minnesota law to foreclose on the property. In this case, the Notice of Pendency of Proceeding to Foreclosure Mortgage is typically recorded in the county where the property is located, ensuring interested parties are informed about the impending foreclosure. Keywords: Minneapolis, Minnesota, Notice of Pendency, Non-Judicial Foreclosure, Minnesota law, county, property, foreclosure. It is crucial for property owners, as well as other interested parties, to understand the implications of receiving a Notice of Pendency of Proceeding to Foreclosure Mortgage. This notice signifies that the mortgage is in default or arrears, and legal action is being pursued to recoup the outstanding debt. It is essential to consult legal counsel promptly to explore options and possibly avoid the foreclosure process. Keywords: Minneapolis, Minnesota, Notice of Pendency, foreclosure process, mortgage default, legal action, property owner, legal counsel. Receiving a Notice of Pendency of Proceeding to Foreclosure Mortgage can be stressful and overwhelming for property owners. It is essential to stay informed about the foreclosure laws in Minneapolis, Minnesota, and seek professional guidance to navigate this complex process. Understanding the implications and taking appropriate action may help mitigate the adverse effects of foreclosure on both the property owner and the lender. Keywords: Minneapolis, Minnesota, Notice of Pendency, foreclosure laws, property owner, professional guidance, foreclosure process, adverse effects, lender.