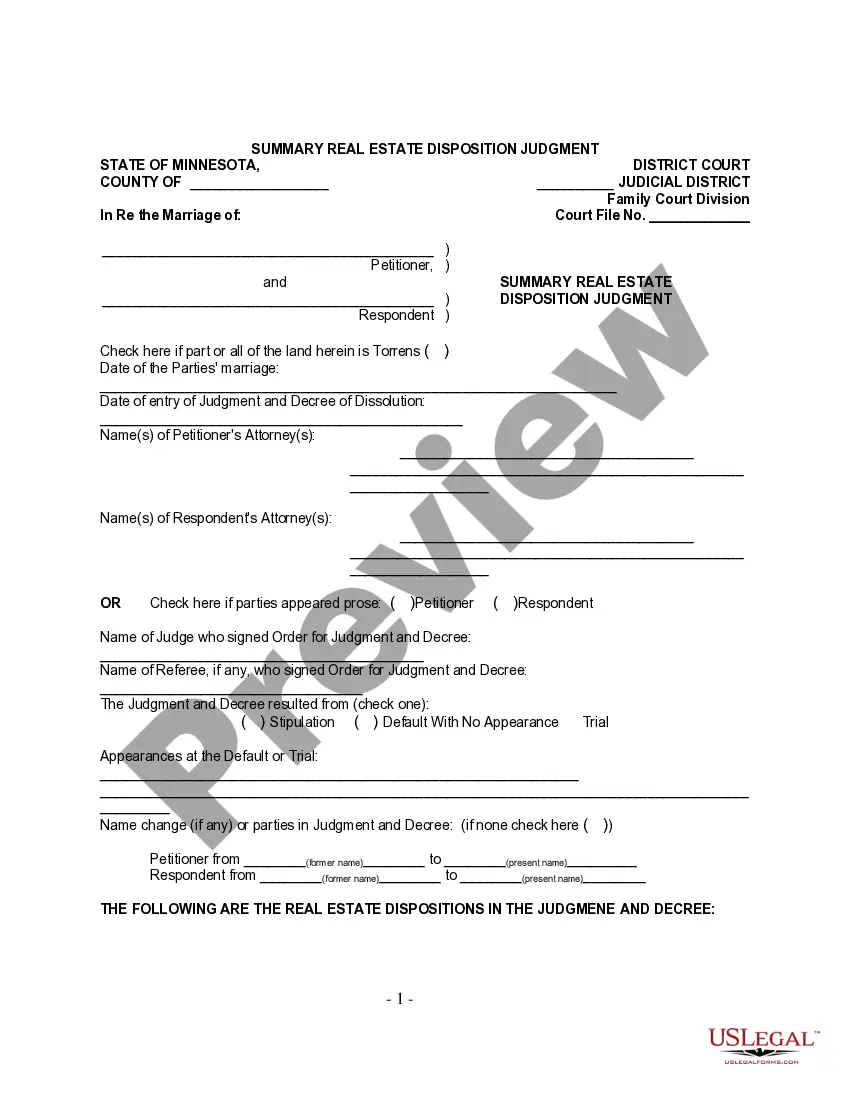

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce.The form is available here in PDF format.

Minneapolis Minnesota Release of Land From Judgment Lien - UCBC Form 40.3.3

Description

How to fill out Minnesota Release Of Land From Judgment Lien - UCBC Form 40.3.3?

If you are in search of an authentic template form, it’s unattainable to discover a superior platform than the US Legal Forms website – likely the largest collections available online.

Here you can obtain countless document examples for business and personal needs sorted by categories and regions, or via keywords.

Utilizing our top-notch search capabilities, finding the latest Minneapolis Minnesota Release of Land From Judgment Lien - UCBC Form 40.3.3 is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and download it to your device.

- Additionally, the pertinence of each document is validated by a group of knowledgeable attorneys who routinely assess the templates on our site and refresh them in line with the most recent state and county standards.

- If you are already familiar with our system and have an account, all you need to access the Minneapolis Minnesota Release of Land From Judgment Lien - UCBC Form 40.3.3 is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, just follow the instructions outlined below.

- Ensure you have located the sample you require. Review its description and utilize the Preview feature to examine its content. If it doesn’t meet your requirements, use the Search bar at the top of the page to find the appropriate file.

- Verify your selection. Click on the Buy now option. Then, choose your desired subscription plan and provide details to create an account.

Form popularity

FAQ

The easy definition is that a judgment is an official decision rendered by the court with regard to a civil matter. A judgment lien, sometimes referred to as an ?abstract of judgment,? is an involuntary lien that is filed to give constructive notice and is to attach to the Judgment Debtor's property and/or assets.

A state tax lien is the government's legal claim against your property when you don't pay your tax debt in full. Your property includes real estate, personal property and other financial assets.

A judgment for money in Minnesota does not survive indefinitely. Instead, a judgment only survives for ten years after its entry and any action to collect after that ten-year time frame is disallowed.

A notice must either be given in person or sent by certified mail. Deliver a mechanic's lien statement to the property owner no later than 120 days after the last day of work was completed or materials were supplied for the job.

State Tax Lien The state has a statute of limitations. According to the Minnesota Department of Revenue website, the lien must be filed within 5 years of the date of occurrence. After that, they have 10 years to collect. A renewal of the lien may be filed, but it must be done before the 10-year date.

A judgment for money in Minnesota does not survive indefinitely. Instead, a judgment only survives for ten years after its entry and any action to collect after that ten-year time frame is disallowed.

Once a judgment is docketed, a judgment lien in Minnesota generally lasts for 10 years.

The Recorder's Office staff will do a tax lien search for a per name fee or you can come to the office to view the records yourself at no cost. In most cases tax liens are not indexed against a parcel of land. They are indexed by taxpayer name.

State Tax Lien The state has a statute of limitations. According to the Minnesota Department of Revenue website, the lien must be filed within 5 years of the date of occurrence. After that, they have 10 years to collect. A renewal of the lien may be filed, but it must be done before the 10-year date.

You can search by name for state and federal tax liens recorded by a government agency for failure of payment of personal, business or real property taxes. The Recorder's Office staff will do a tax lien search for a per name fee or you can come to the office to view the records yourself at no cost.