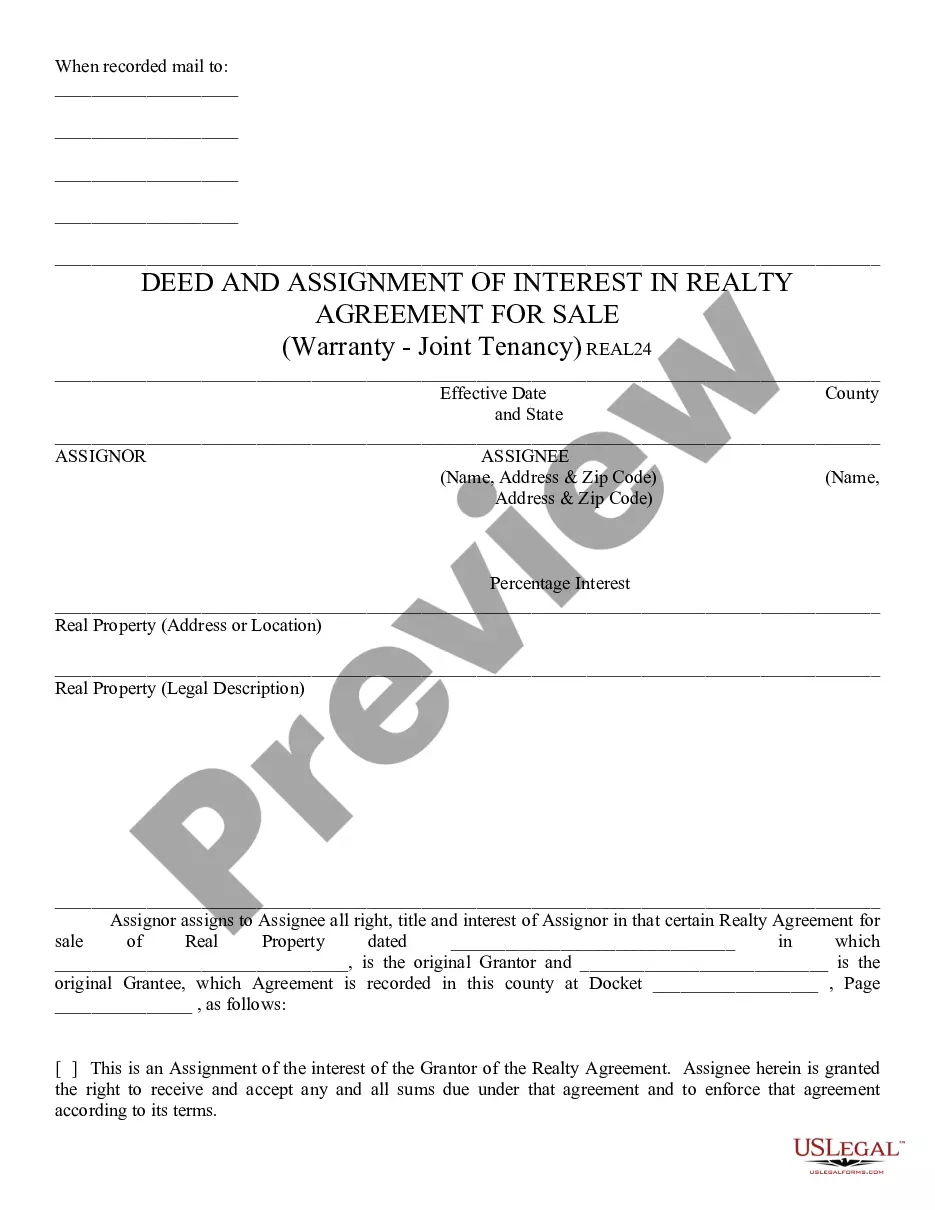

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minneapolis Minnesota Consent of Spouse to Deed of Sale - Personal Representative - UCBC Form 70.1.1

Description

How to fill out Minnesota Consent Of Spouse To Deed Of Sale - Personal Representative - UCBC Form 70.1.1?

If you're searching for a pertinent form template, it’s incredibly challenging to select a superior location than the US Legal Forms website – likely the most extensive online collections.

With this repository, you can access a vast array of form samples for organizational and personal needs by categories and states, or keywords.

With the sophisticated search feature, retrieving the most recent Minneapolis Minnesota Consent of Spouse to Deed of Sale - Personal Representative - UCBC Form 70.1.1 is as simple as 1-2-3.

Validate your choice. Click the Buy now button. Following that, choose your desired pricing plan and provide the necessary information to create an account.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the pertinence of each document is validated by a team of qualified attorneys who regularly evaluate the templates on our site and refresh them in line with the latest state and county regulations.

- If you're already familiar with our system and possess an account, all you have to do to obtain the Minneapolis Minnesota Consent of Spouse to Deed of Sale - Personal Representative - UCBC Form 70.1.1 is to Log In to your account and click the Download button.

- If you're using US Legal Forms for the first time, just follow the guidelines below.

- Ensure you have selected the template you need. Review its details and utilize the Preview feature to examine its content.

- If it doesn’t meet your requirements, use the Search field at the top of the page to find the desired file.

Form popularity

FAQ

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.

There is a $50.00 fee for filing the WDC with the county recorder. A WDC is not required if the property has no wells or if a disclosure was previously recorded for the property and the number and status of wells has not changed.

Property Transfer in Minnesota The grantor must sign the deed and have their signature notarized in order to accomplish a transfer of property. The Minnesota deed is then recorded in the county where the property is located.

Yes. A beneficiary who inherits property under a Minnesota TOD deed takes the property subject to any mortgage or deed of trust on it. As long as the beneficiary is related to the owner, the TOD deed should not affect the existing mortgage.

State deed tax (SDT) SDT is paid when recording an instrument conveying Minnesota real property. The rate is 0.0033 of the purchase price. SDT for deeds with consideration of $3,000 or less is $1.70. Hennepin County adds an additional .

The personal representative's (PR) deed of sale is a fiduciary instrument used in probate proceedings to convey real property from an estate to a purchaser. A personal representative, who may also be referred to as either an executor or administrator, is the fiduciary appointed to manage the decedent's estate.

How to Add a Person to a Deed on a Property in Minnesota Fill out and print the quit claim deed form (see Resources).Take the printed form to a bank or other institution with a notary for signing.Submit the form through your attorney, title insurance company or real estate office.

A Minnesota quitclaim deed?also called a deed of quitclaim and release?is a deed that transfers Minnesota real estate with no warranty of title. The person who signs a quitclaim deed transfers whatever interest he or she has in the property but makes no promises about the status of the property's title.

Average Title transfer service fee is ?20,000 for properties within Metro Manila and ?30,000 for properties outside of Metro Manila.

Subd. 8. Recording requirements and authorization. A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective.