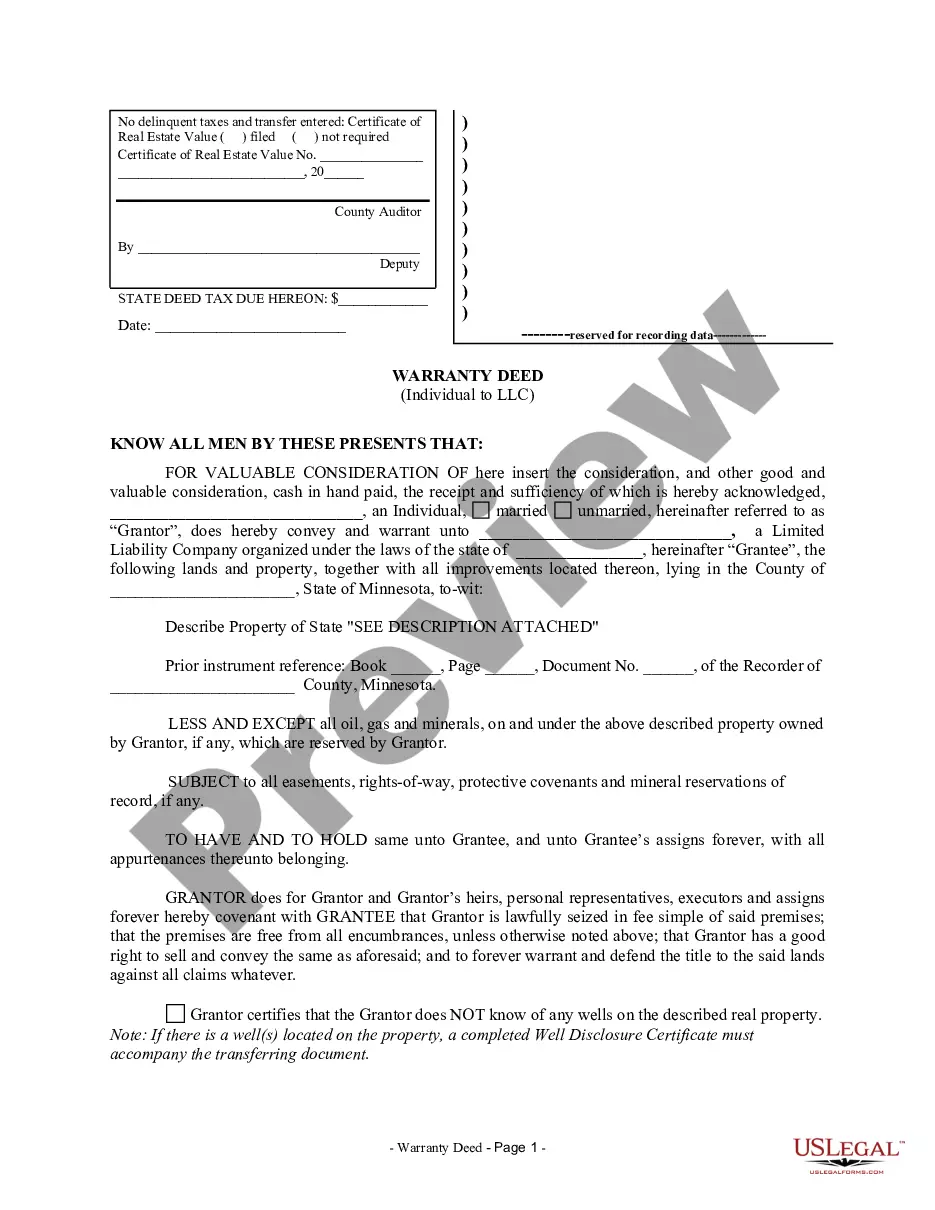

Minneapolis Minnesota Warranty Deed from Individual to LLC

Description

How to fill out Minnesota Warranty Deed From Individual To LLC?

Utilize the US Legal Forms and gain immediate access to any form sample you desire.

Our helpful website, filled with numerous templates, streamlines the process of locating and acquiring almost any document sample you require.

You can save, complete, and validate the Minneapolis Minnesota Warranty Deed from Individual to LLC in just a few minutes instead of spending hours searching online for a suitable template.

Using our catalog enhances the security of your form submissions.

- Our knowledgeable attorneys routinely review all documents to guarantee that the forms are suitable for a specific state and conform to current laws and regulations.

- How can you obtain the Minneapolis Minnesota Warranty Deed from Individual to LLC.

- If you already hold a subscription, simply Log In to your account.

Form popularity

FAQ

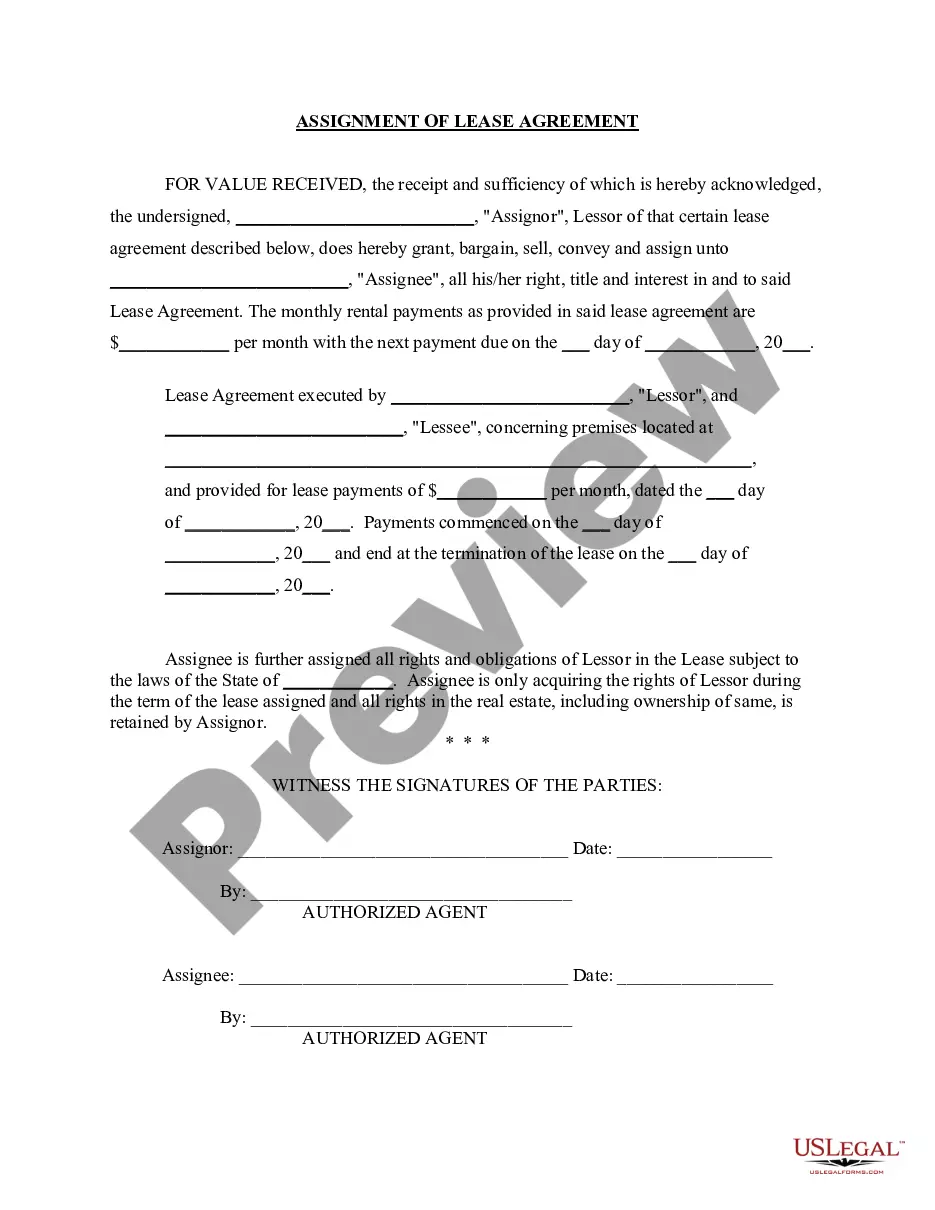

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.

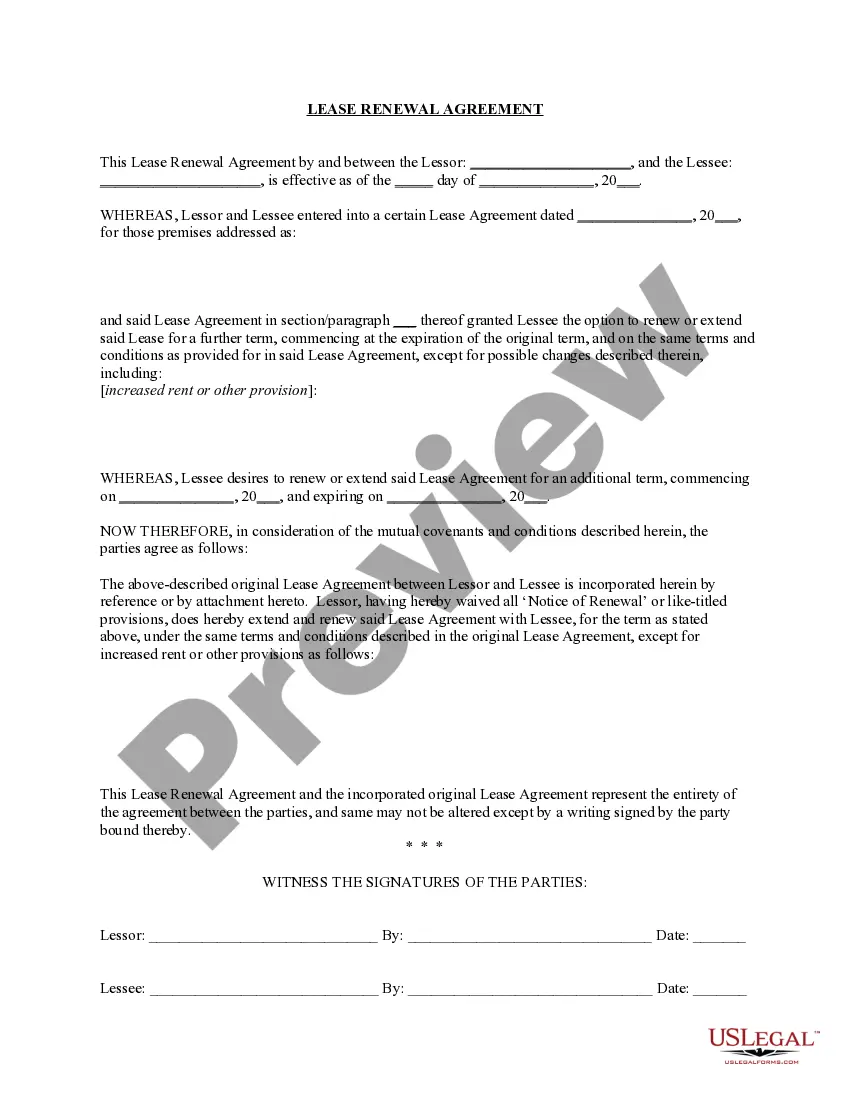

A limited warranty deed transfers legal title to real property. However, this type of deed does not promise clear title; it only guarantees the title for the period during which the grantor owned it. Despite this, it is useful in some situations. by Brette Sember, J.D. updated · 3min read.

State deed tax (SDT) SDT is paid when recording an instrument conveying Minnesota real property. The rate is 0.0033 of the purchase price. SDT for deeds with consideration of $3,000 or less is $1.70. Hennepin County adds an additional .

A Minnesota quitclaim deed?also called a deed of quitclaim and release?is a deed that transfers Minnesota real estate with no warranty of title. The person who signs a quitclaim deed transfers whatever interest he or she has in the property but makes no promises about the status of the property's title.

A special warranty deed guarantees two things: The grantor owns, and can sell, the property; and the property incurred no encumbrances during his ownership. A special warranty deed is more limited than the more common general warranty deed, which covers the entire history of the property.

There is a $50.00 fee for filing the WDC with the county recorder. A WDC is not required if the property has no wells or if a disclosure was previously recorded for the property and the number and status of wells has not changed.

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

Limited Warranty Deeds Conveys all right, title, and interest of the grantor in the real estate. Warrants that the grantor has not created or allowed any liens, encumbrances, or defects to attach to the real property, except as disclosed to the grantee. May or may not convey after-acquired property.

Property Transfer in Minnesota The grantor must sign the deed and have their signature notarized in order to accomplish a transfer of property. The Minnesota deed is then recorded in the county where the property is located.

Minnesota charges a flat fee of $46.00 to record a deed. A deed that cross-references more than four other recorded documents requires an additional $10.00 fee for each document referenced over four.