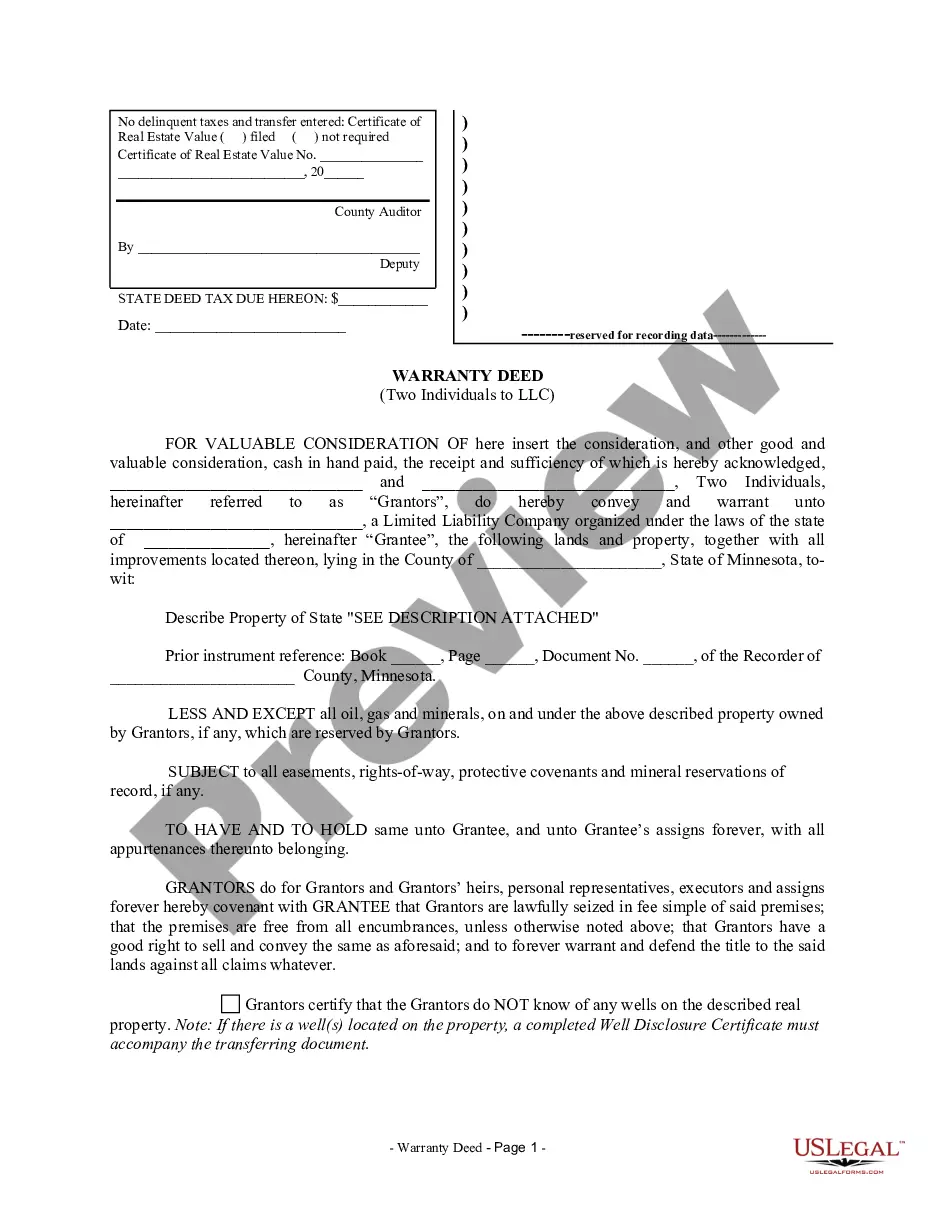

Minneapolis Minnesota Warranty Deed from two Individuals to LLC

Description

How to fill out Minnesota Warranty Deed From Two Individuals To LLC?

Irrespective of social or professional standing, completing law-related documents is an unfortunate necessity in today’s corporate landscape.

Too frequently, it’s nearly impossible for someone without any legal knowledge to create such documents from the ground up, primarily because of the intricate jargon and legal subtleties they involve.

This is where US Legal Forms steps in to assist.

Ensure that the form you have located is valid for your jurisdiction since the regulations of one state or county may not apply in another.

Review the form and read a brief description (if available) regarding the situations the document can be utilized for.

- Our platform provides an extensive repository with over 85,000 state-specific templates suitable for nearly any legal situation.

- US Legal Forms is also an excellent tool for associates or legal advisors looking to save time with our DIY forms.

- Whether you require the Minneapolis Minnesota Warranty Deed from two Individuals to LLC or any other document appropriate for your state or county, with US Legal Forms, everything is easily accessible.

- Here’s how you can quickly obtain the Minneapolis Minnesota Warranty Deed from two Individuals to LLC using our reliable platform.

- If you are already a registered user, feel free to Log In to access the relevant form.

- However, if you are new to our platform, follow these steps before acquiring the Minneapolis Minnesota Warranty Deed from two Individuals to LLC.

Form popularity

FAQ

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

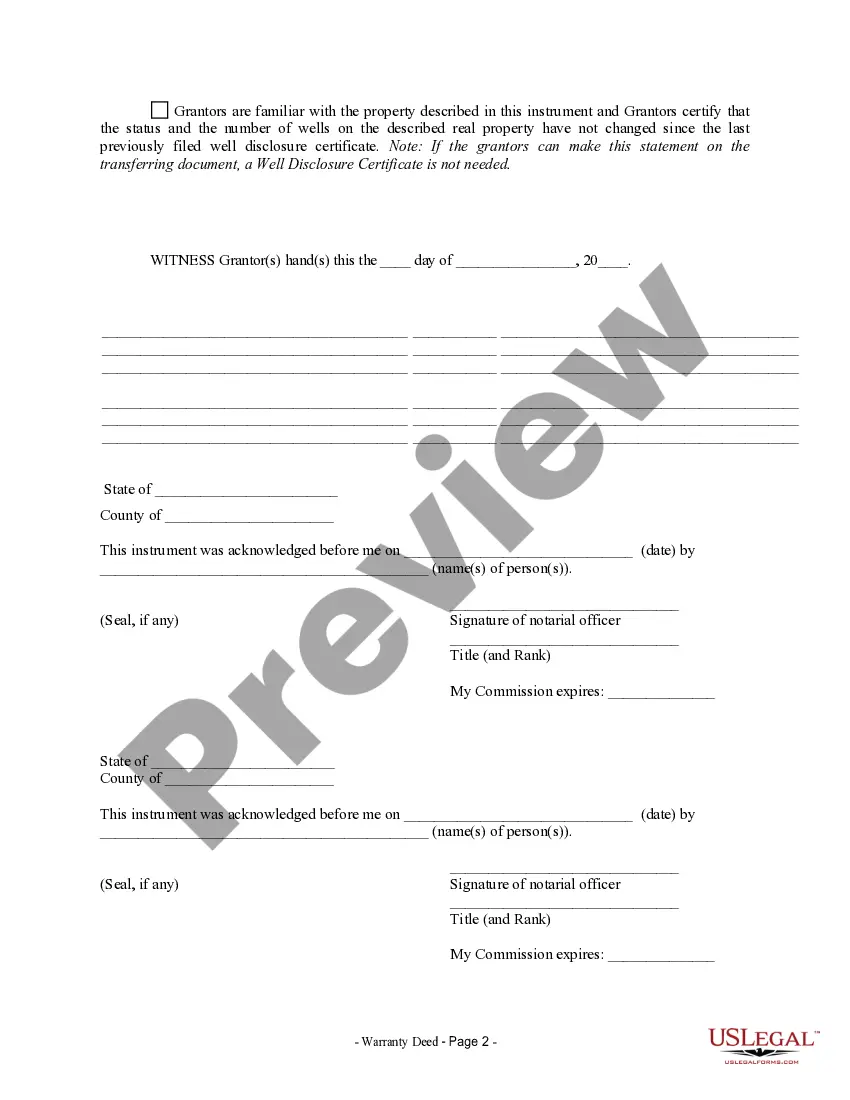

There is a $50.00 fee for filing the WDC with the county recorder. A WDC is not required if the property has no wells or if a disclosure was previously recorded for the property and the number and status of wells has not changed.

Property Transfer in Minnesota The grantor must sign the deed and have their signature notarized in order to accomplish a transfer of property. The Minnesota deed is then recorded in the county where the property is located.

Average Title transfer service fee is ?20,000 for properties within Metro Manila and ?30,000 for properties outside of Metro Manila.

Limited Warranty Deeds Conveys all right, title, and interest of the grantor in the real estate. Warrants that the grantor has not created or allowed any liens, encumbrances, or defects to attach to the real property, except as disclosed to the grantee. May or may not convey after-acquired property.

A limited warranty deed transfers legal title to real property. However, this type of deed does not promise clear title; it only guarantees the title for the period during which the grantor owned it. Despite this, it is useful in some situations. by Brette Sember, J.D. updated · 3min read.

8. Recording requirements and authorization. A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective.

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.

State deed tax (SDT) SDT is paid when recording an instrument conveying Minnesota real property. The rate is 0.0033 of the purchase price. SDT for deeds with consideration of $3,000 or less is $1.70. Hennepin County adds an additional .