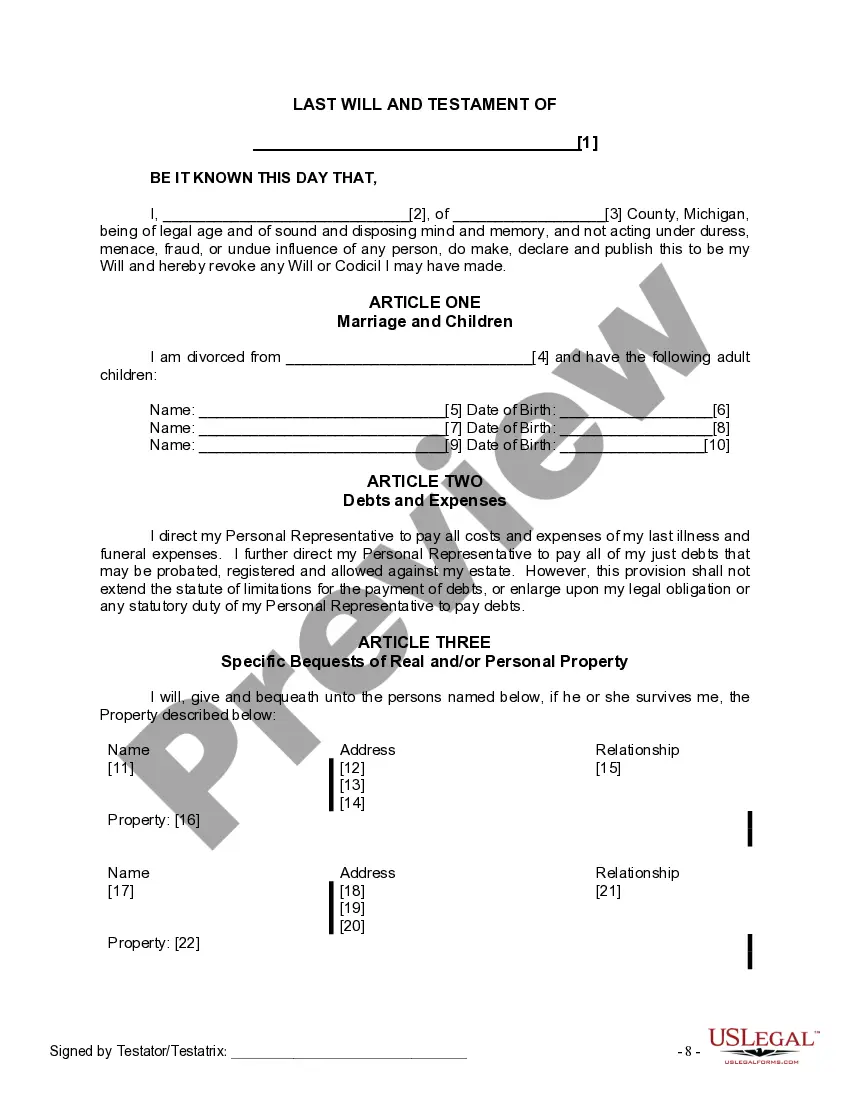

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Detroit Michigan Last Will and Testament for Divorced person not Remarried with Adult Children

Description

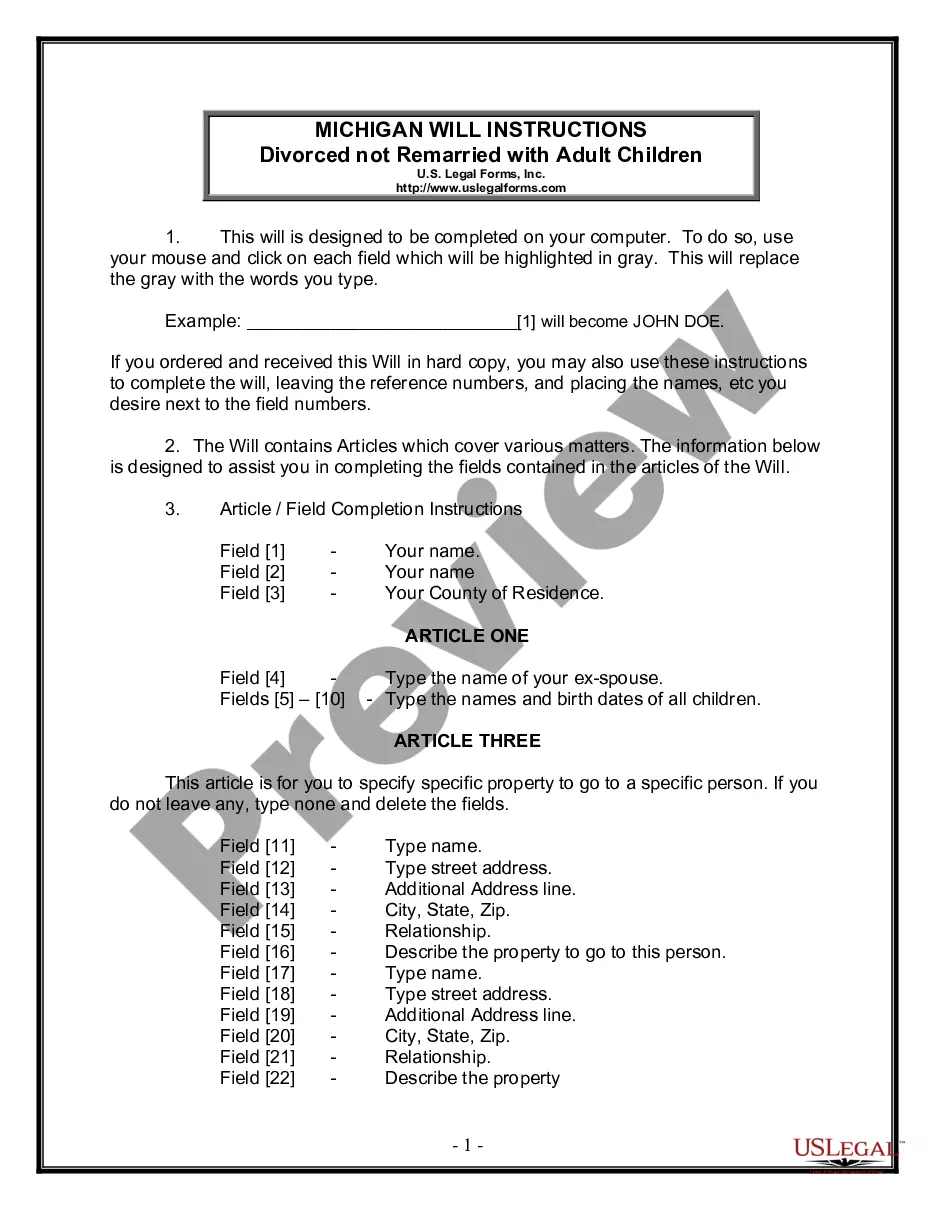

How to fill out Michigan Last Will And Testament For Divorced Person Not Remarried With Adult Children?

Are you in need of a reliable and budget-friendly provider of legal documents to acquire the Detroit Michigan Legal Last Will and Testament Form for Divorced individuals who are not Remarried and have Adult Children? US Legal Forms is the perfect answer.

Whether you require a straightforward contract to establish guidelines for living together with your partner or a set of forms to facilitate your divorce proceedings in court, we have everything you need. Our service offers over 85,000 current legal document templates for individual and business purposes. All templates available to us are not generic and are tailored to meet the specific requirements of different states and counties.

To obtain the document, you must Log In to your account, find the necessary form, and click the Download button located next to it. Please remember that you can download your previously acquired document templates at any time through the My documents section.

Is this your first visit to our platform? Don’t worry. You can create an account in just a few minutes, but first, ensure to do the following.

Now you may register for your account. Next, select a subscription plan and proceed with the payment. After the payment is processed, you can download the Detroit Michigan Legal Last Will and Testament Form for Divorced individuals who are not Remarried and have Adult Children in any of the available formats. You can revisit the website at any time and redownload the document at no extra cost.

Obtaining current legal documents has never been more straightforward. Try US Legal Forms today, and stop wasting your precious time researching legal documents online.

- Verify that the Detroit Michigan Legal Last Will and Testament Form for Divorced individuals who are not Remarried and have Adult Children complies with the laws of your state and locality.

- Review the form’s description (if available) to understand who the document is intended for and its uses.

- Restart the search if the form does not fit your specific needs.

Form popularity

FAQ

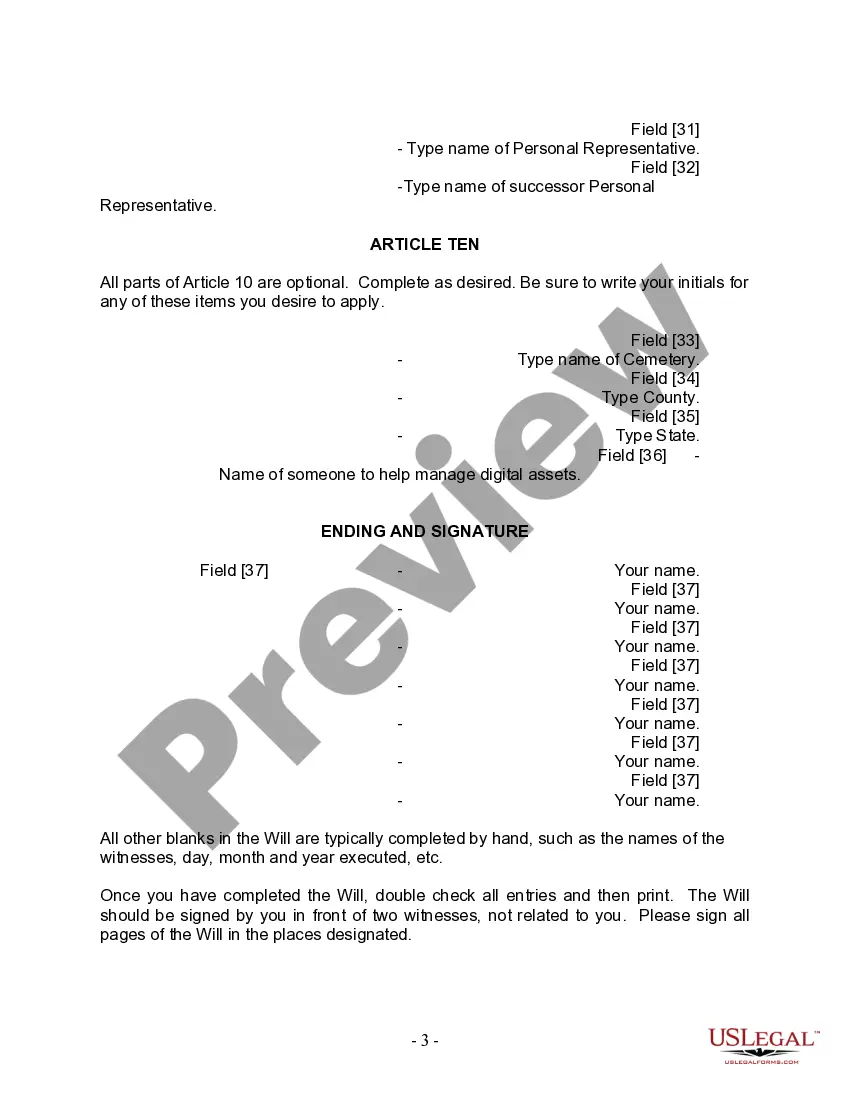

Does my will have to be notarized? No. A will does not need to be notarized. However, there must be at least two witnesses.

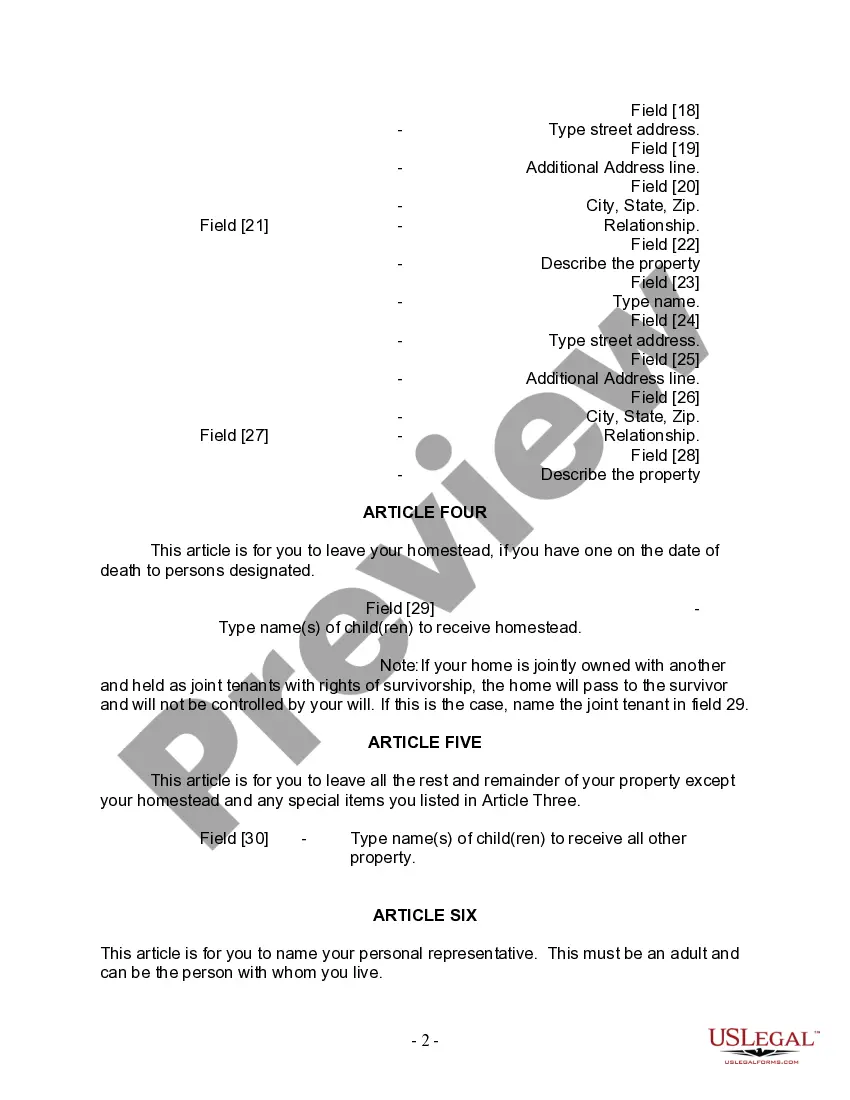

To have a Michigan statutory will, you must complete the blanks on the will form. You may do this yourself, or direct someone to do it for you. You must either sign the will or direct someone else to sign it in your name and in your presence.

A statutory will is a form. It is relatively simple to use but allows limited choice. The form is available in the Planning for Your Peace of Mind publication that is available on the Michigan Legislative website at . Advance Care Planning.

However, in the state of Michigan, you are not eligible to disinherit your spouse by omitting to provide for them in your will or by including an explicit statement in the will that your spouse is not eligible to receive anything from an estate.

The law in Michigan provides a surviving spouse in a testate proceeding (one with a will of the deceased spouse admitted to probate by the Court) with the right to elect a share of the estate of his or her spouse even if the will says the spouse is not to receive anything.

You must sign your will in front of at least two witnesses, but you can have up to three witnesses. They must be 18 or older. It is helpful if they are people you know who could be located to testify about the will if necessary. A person who will inherit from your estate after you die can still serve as a witness.

If you intend to leave most of your property to your nearest family, you can make a simple and effective will without a lawyer using the Michigan statutory will. You can use our Do-It-Yourself Will tool to prepare your will.

Spouses in Michigan Inheritance Law Unlike some states, spouses are not automatically entitled to your entire estate should you die intestate in Michigan. However, if you die with a spouse and no living parents or descendants, your spouse gets 100% of your estate.

While spouses, then children, generally take precedence in Michigan inheritance law, there are some laws of succession should you die intestate without either of those heirs. For example, if you are unmarried without children and die intestate, your parents inherit your entire estate.

And, for tax reasons, you must make your changes in writing and within two years of your loved one dying. Otherwise, if you make the changes after two years, you will not benefit from any tax advantages as outlined above.