1. General Durable Power of Attorney for Property and Finances Effective Upon Disability

2. General Durable Power of Attorney for Property and Finances Effective Immediately

3. Power of Attorney for Care and Custody of Children

4. Health Care Proxy Living Will

Grand Rapids Michigan Power of Attorney Forms Package

Description

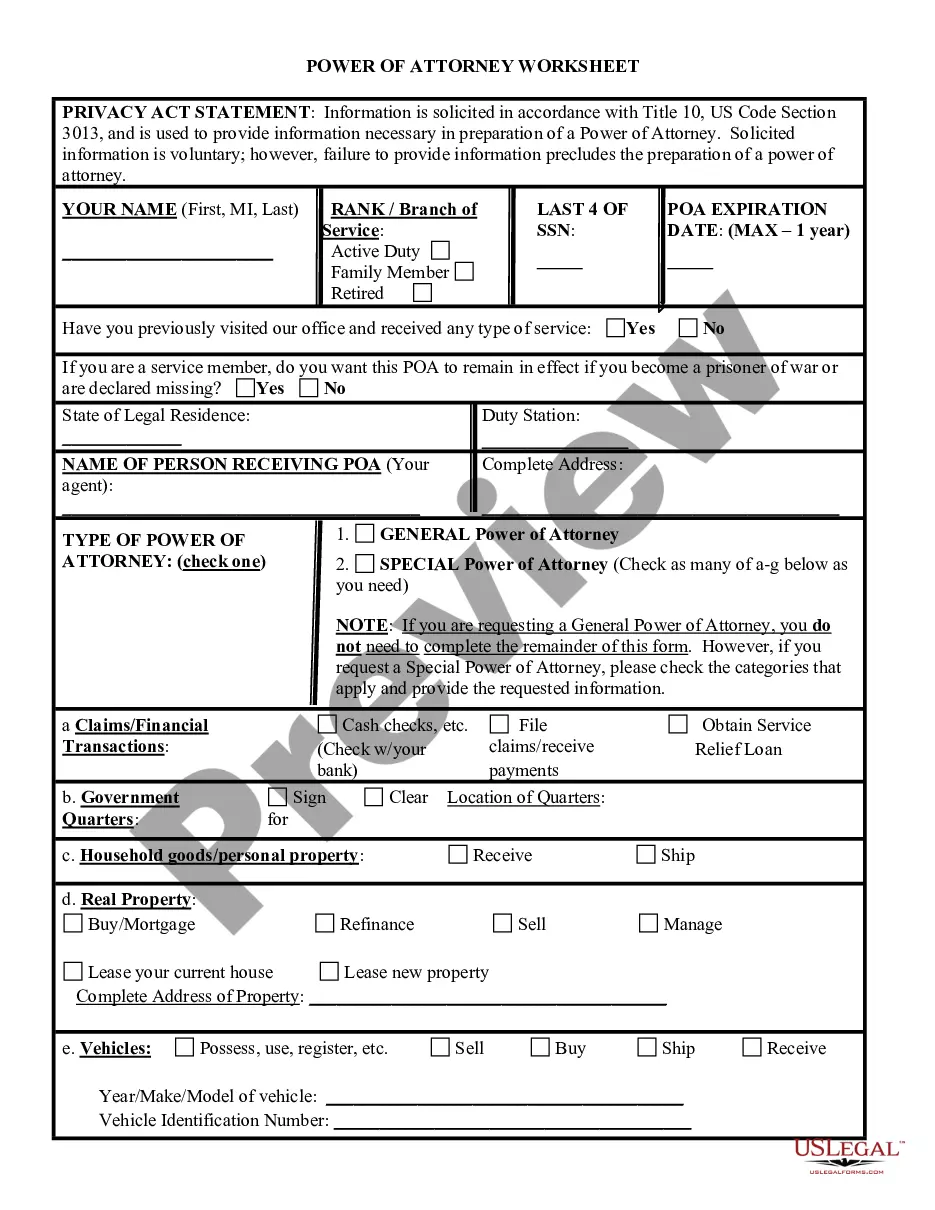

How to fill out Michigan Power Of Attorney Forms Package?

Locating authentic templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It’s an internet resource of over 85,000 legal documents for both personal and professional requirements and any real-world situations.

All the paperwork is properly categorized by usage area and jurisdiction, making the search for the Grand Rapids Michigan Power of Attorney Forms Package as quick and straightforward as ABC.

Maintaining documentation orderly and in compliance with legal standards is critically important. Leverage the US Legal Forms library to have crucial document templates readily available for any needs at your fingertips!

- Verify the Preview mode and form description.

- Ensure you’ve selected the correct template that fits your requirements and aligns with your local jurisdiction standards.

- Search for another document, if necessary.

- If you spot any discrepancies, use the Search tab above to locate the appropriate one.

- Once it meets your needs, advance to the subsequent step.

Form popularity

FAQ

A Michigan tax POA form, or Power of Attorney form, allows you to grant authority to someone else to act on your behalf regarding tax matters. This is particularly useful for dealing with the Michigan Department of Treasury. By filling out this form, you can ensure that your designated agent can access your tax information and submit necessary documents. Consider using a Grand Rapids Michigan Power of Attorney Forms Package to make the process simpler and more effective.

You can fax Michigan Form 151 to the number indicated on the form's instructions. Ensure that you have the correct fax number to avoid any submission issues. By faxing, you can often receive quicker confirmation of receipt, which is essential for timely tax processing. Utilizing the Grand Rapids Michigan Power of Attorney Forms Package can also empower someone else to handle faxing on your behalf.

In Michigan, there are several types of power of attorney, including durable, springing, and limited power of attorney. Durable power of attorney remains effective even if you become incapacitated, while springing power of attorney only takes effect under specific conditions. Limited power of attorney allows you to specify particular actions your agent can take. For any of these options, consider obtaining a Grand Rapids Michigan Power of Attorney Forms Package for streamlined documentation.

You should send your Michigan tax form to the address listed in the form's instructions. Each form may have a different mailing address, so it is essential to follow this guidance carefully. To avoid delays in processing, ensure that your form is complete and properly signed. Use the Grand Rapids Michigan Power of Attorney Forms Package if you wish to authorize someone to submit tax forms for you.

If you need to speak with a live person at the Michigan Department of Treasury, call their customer service number during business hours. When you reach the automated system, follow the prompts to connect with a representative. They can provide guidance on your specific inquiries. Additionally, the Grand Rapids Michigan Power of Attorney Forms Package can assist you with authorizing someone to handle these matters on your behalf.

To mail your Michigan Form 163, you should refer to the specific address outlined in the form instructions. Make sure to include any required documents and send it to the address listed, whether it is for the Grand Rapids area or elsewhere in Michigan. Proper mailing ensures that your form is processed appropriately. For convenience, using a Grand Rapids Michigan Power of Attorney Forms Package can help manage your filing responsibilities effectively.

You can send your amended Michigan tax return to the Michigan Department of Treasury. If you are mailing your return, be sure to use the correct address found on the instructions provided with the form. It is vital to send it to the right location to ensure processing. For any tax-related matters, including amendments, consider utilizing the Grand Rapids Michigan Power of Attorney Forms Package to simplify communications with tax authorities.

In Michigan, if you earn income in a city that imposes a city tax, you must file a city tax return. Grand Rapids requires residents and non-residents who earn local income to comply with this rule. Understanding your tax responsibilities can be challenging, but resources like the Grand Rapids Michigan Power of Attorney Forms Package can simplify your documentation process, ensuring you stay compliant while managing your affairs.

Grand Rapids tax is determined by your income level and other factors, with a current city tax rate that typically falls around 1.3%. It is essential to review your financial situation to ensure compliance with local tax laws. This information helps you better prepare for your tax obligations, and managing your affairs becomes easier when you complete necessary documents like the Grand Rapids Michigan Power of Attorney Forms Package.

As a resident of Michigan, you generally need to file a state tax return if your income exceeds certain thresholds. This requirement holds whether you earn income in or out of state. By staying informed about state tax regulations, you can better manage your financial responsibilities. If you are also handling a power of attorney, consider integrating it with the Grand Rapids Michigan Power of Attorney Forms Package for a streamlined approach.