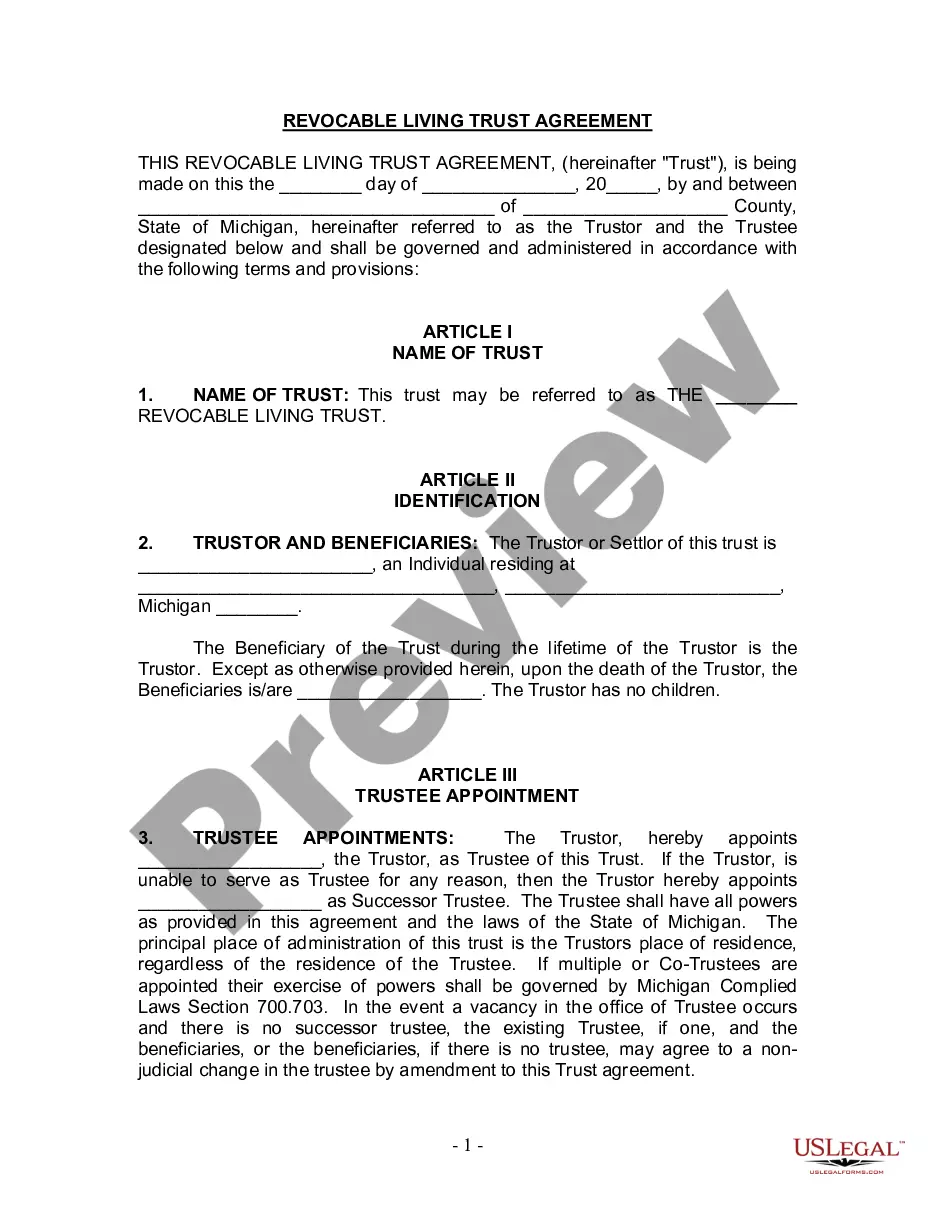

Lansing Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

How to fill out Michigan Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

If you’ve already used our service formerly, sign in to your account and obtain the Lansing Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children on your device by clicking the Download button. Confirm that your subscription is active. If it’s not, renew it following your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can find it in your profile within the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to seamlessly locate and save any template for your personal or business needs!

- Verify you’ve located a suitable document. Browse the description and utilize the Preview option, if available, to ascertain if it aligns with your needs. If it’s not suitable, use the Search tab above to find the correct one.

- Obtain the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create your account and finalize the payment. Use your credit card information or the PayPal option to complete the transaction.

- Receive your Lansing Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children. Select the file format for your document and store it on your device.

- Fill out your form. Print it out or leverage professional online editors to complete it and sign it digitally.

Form popularity

FAQ

Trusts generally do not need to be filed with the court in Michigan, which helps maintain confidentiality. This means your Lansing Michigan Living Trust for Individuals Who are Single, Divorced, or Widow (or Widower) with No Children remains a private matter. However, understanding your unique situation and potential exceptions is essential, so seek advice from a qualified attorney when needed.

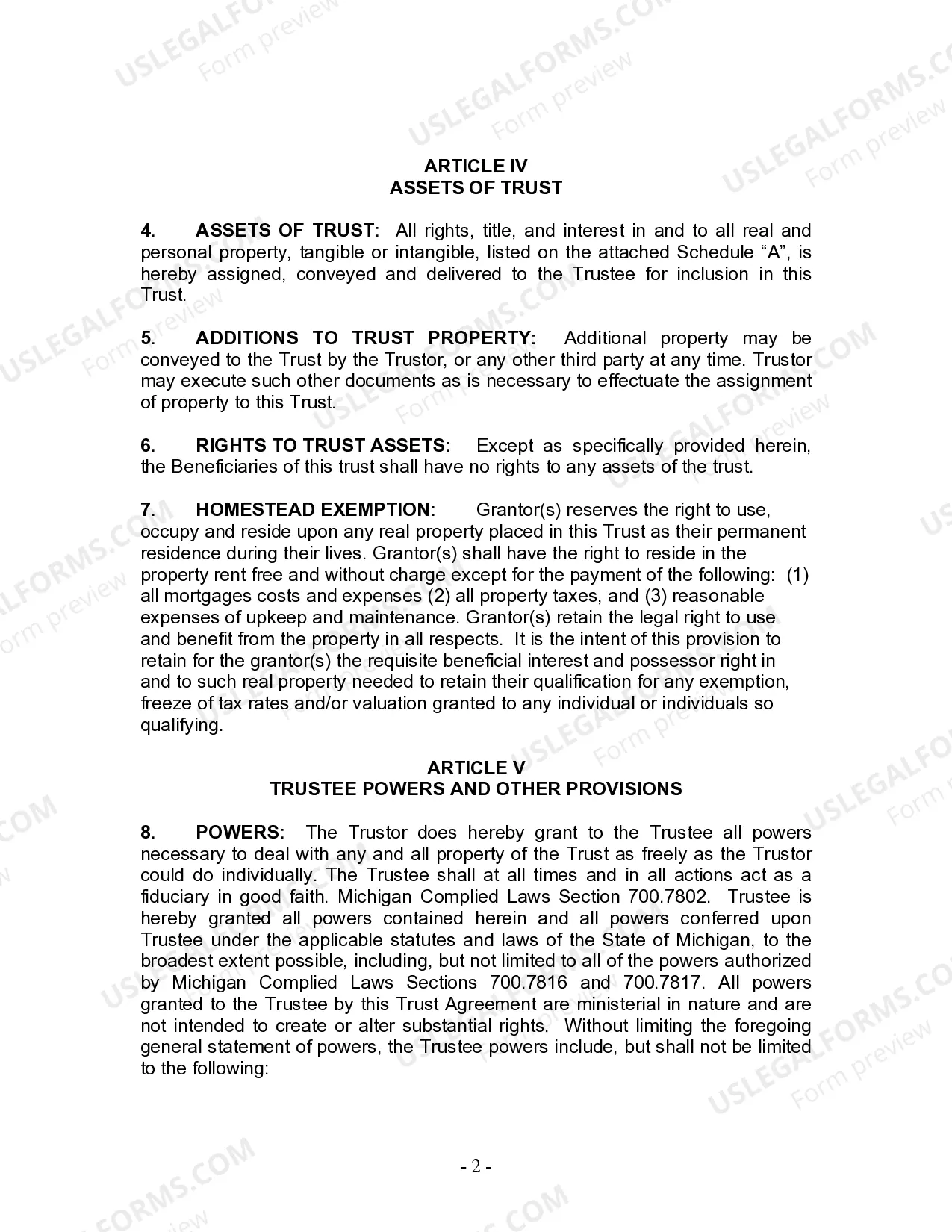

To be valid in Michigan, a trust must be established with a settlor’s clear intent, have a designated trustee, and define the beneficiaries appropriately. Creating a Lansing Michigan Living Trust for Individuals Who are Single, Divorced, or Widow (or Widower) with No Children involves ensuring these elements are correctly outlined. Consulting with a legal professional or using platforms like U.S. Legal Forms can help ensure validity.

If you have a living trust and one spouse passes away, the trust typically continues to operate seamlessly. The surviving spouse often retains access to the assets and management of the Lansing Michigan Living Trust for Individuals Who are Single, Divorced, or Widow (or Widower) with No Children. It's important for both parties to understand the terms of the trust to ensure a smooth transition.

While you do not file a living trust in Michigan, you do need to create the document, have it signed, and possibly notarized. A Lansing Michigan Living Trust for Individuals Who are Single, Divorced, or Widow (or Widower) with No Children includes specific instructions for managing your assets. Consider using U.S. Legal Forms to guide you through the creation process with ease.

No, Michigan trusts typically do not need to be filed with the court. This non-filing requirement keeps the details of your Lansing Michigan Living Trust for Individuals Who are Single, Divorced, or Widow (or Widower) with No Children private. However, certain situations may require court involvement, so it's wise to consult with a legal expert to understand your specific circumstances.

In Michigan, you do not have to record a living trust, such as a Lansing Michigan Living Trust for Individuals Who are Single, Divorced, or Widow (or Widower) with No Children. However, you should keep the trust document in a safe location and inform trusted persons about its existence. This ensures that your wishes are honored and easily accessible when needed.

One of the biggest mistakes individuals make when setting up a trust fund is failing to clearly define their intentions or update the trust as life circumstances change. For those considering a Lansing Michigan Living Trust for Individuals Who are Single, Divorced or Widow (or Widower) with No Children, it’s essential to keep the trust document current. This ensures that it aligns with your current wishes and avoids complications for intended beneficiaries.

To create a Lansing Michigan Living Trust for Individuals Who are Single, Divorced or Widow (or Widower) with No Children, you need to identify the assets you wish to place in the trust. You should also decide on a trustee, who will be responsible for managing these assets. It's important to consult with a legal expert to ensure that your trust meets all state requirements and reflects your intentions clearly.

A widow's trust is designed to provide financial security for a surviving spouse in the event of the other spouse’s passing. This type of trust can be especially beneficial for individuals creating a Lansing Michigan Living Trust for Individuals Who are Single, Divorced or Widow (or Widower) with No Children. It helps manage the deceased's assets, ensuring that they are used to support the surviving spouse's needs while also protecting the estate from potential creditors.

To establish a Lansing Michigan Living Trust for Individuals Who are Single, Divorced or Widow (or Widower) with No Children, you must be at least 18 years old. The trust document must be in writing, and you need to have the mental capacity to understand the agreement. Additionally, you should specify the assets to be held in trust and name a trustee to manage those assets in accordance with your wishes.