Ann Arbor Michigan Dissolution Package to Dissolve Limited Liability Company LLC

Description

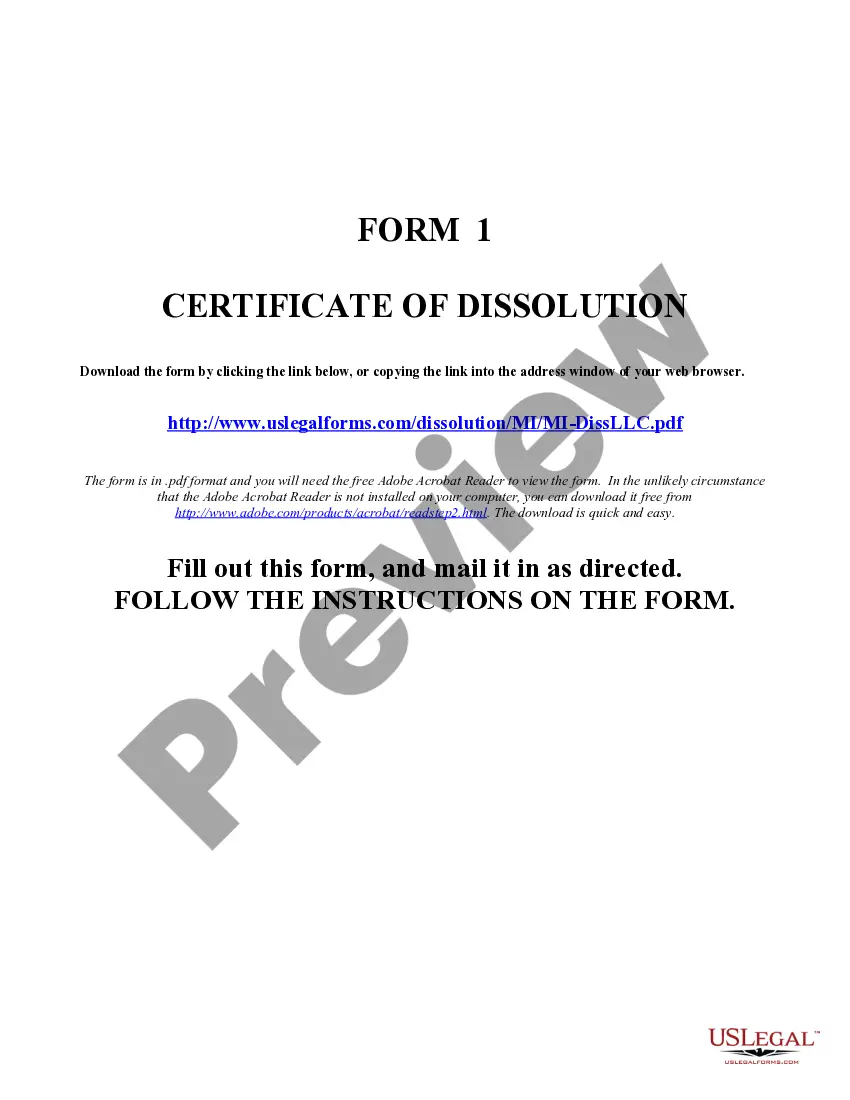

How to fill out Michigan Dissolution Package To Dissolve Limited Liability Company LLC?

We consistently aim to minimize or evade legal harm when encountering intricate legal or financial issues.

To achieve this, we seek legal services that are typically quite costly.

Nevertheless, not all legal challenges are equally intricate; many can be managed by ourselves.

US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always retrieve it again from the My documents tab.

- Our platform enables you to manage your affairs independently of a lawyer.

- We provide access to legal document templates that may not always be publicly available.

- Our templates are specific to states and regions, significantly easing the searching process.

- Utilize US Legal Forms whenever you need to locate and download the Ann Arbor Michigan Dissolution Package for Dissolving a Limited Liability Company LLC or any other document effortlessly and securely.

Form popularity

FAQ

Yes, notifying the IRS is an important step when you close your LLC. You must file a final tax return and indicate that it is a final return, ensuring that all tax obligations are settled. Using an Ann Arbor Michigan Dissolution Package to Dissolve Limited Liability Company LLC will guide you on how to properly notify the IRS and fulfill all requirements to avoid future issues.

Dissolving an LLC may seem challenging, but it doesn't have to be. As long as you follow the proper steps, such as filing the necessary forms and notifying relevant parties, you can make it manageable. An Ann Arbor Michigan Dissolution Package to Dissolve Limited Liability Company LLC can streamline this process and provide you with the reassurance you need.

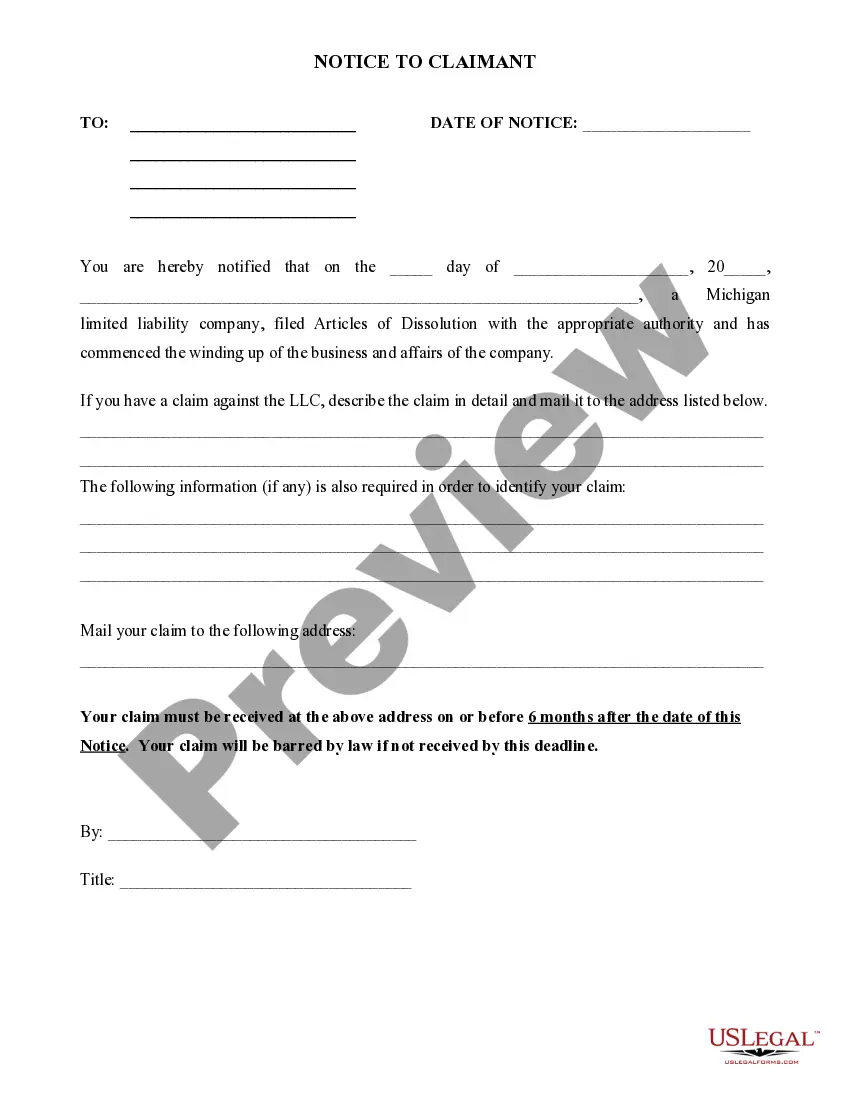

Once your LLC is dissolved, it's essential to take a few final steps. Make sure to notify creditors, close any business accounts, and distribute any remaining assets among members. To simplify this process, consider the Ann Arbor Michigan Dissolution Package to Dissolve Limited Liability Company LLC, which outlines key steps for a smooth transition.

Dissolving an LLC can have tax consequences, as you may need to file a final tax return with the IRS and settle any outstanding taxes. It's crucial to report any gains or losses during dissolution. By using an Ann Arbor Michigan Dissolution Package to Dissolve Limited Liability Company LLC, you can get help navigating these tax implications to avoid any surprises.

To dissolve your LLC in Michigan, you need to file Articles of Dissolution with the Michigan Department of Licensing and Regulatory Affairs. This document formally ends your LLC's existence and must be submitted along with any required fees. Utilize an Ann Arbor Michigan Dissolution Package to Dissolve Limited Liability Company LLC for guidance and to make this process smoother.

Before you dissolve your LLC, it's important to review your operating agreement and understand the necessary steps. Ensure that you have settled any outstanding debts and notified all members. Additionally, consider using the Ann Arbor Michigan Dissolution Package to Dissolve Limited Liability Company LLC, which provides a structured process for completing your dissolution effectively.

How do you dissolve a Wyoming Limited Liability Company? To dissolve your Wyoming LLC, you must submit in duplicate the completed Limited Liability Company Articles of Dissolution form to the Secretary of State by mail or in person, along with the filing fee.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Nevada requires an articles of dissolution form be filed with the Secretary of State by mail, fax or email. This form is available online, along with instructions. There is a fee for filing and it is usually processed within 5 business days. Expedited processing is available for an additional fee.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.