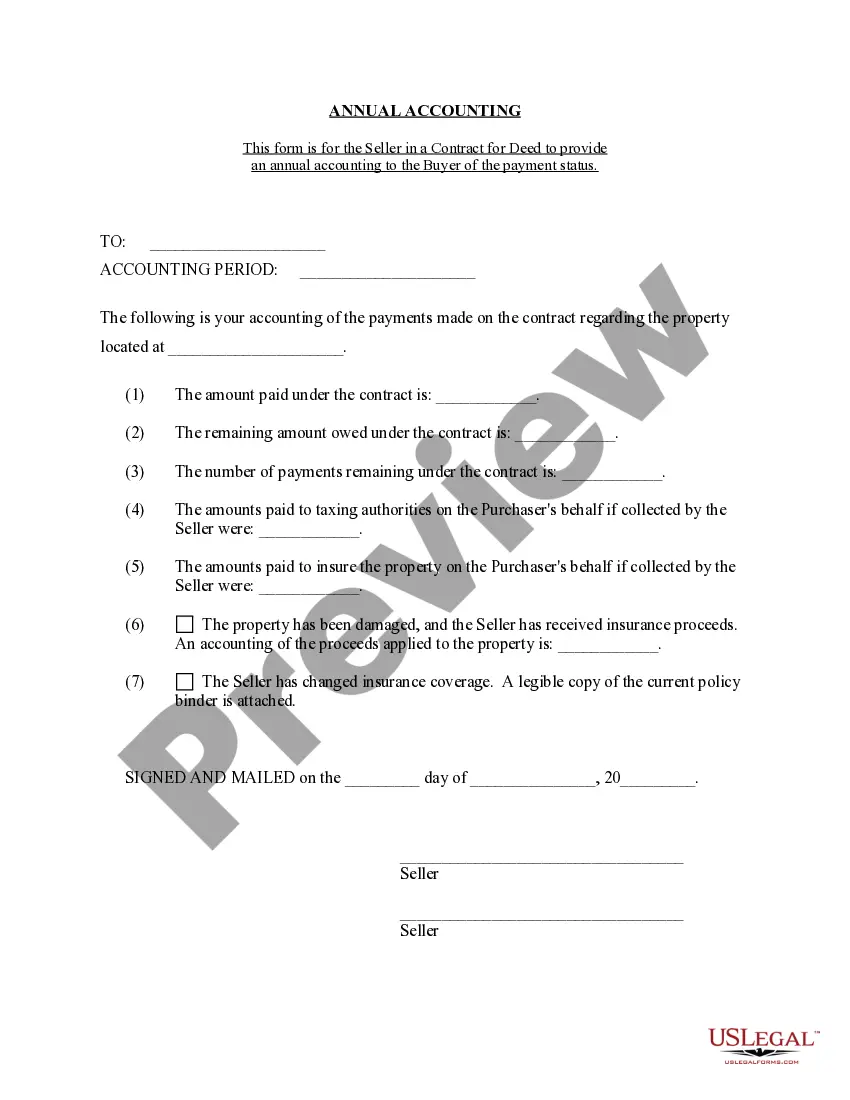

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Ann Arbor Michigan Contract for Deed Seller's Annual Accounting Statement

Description

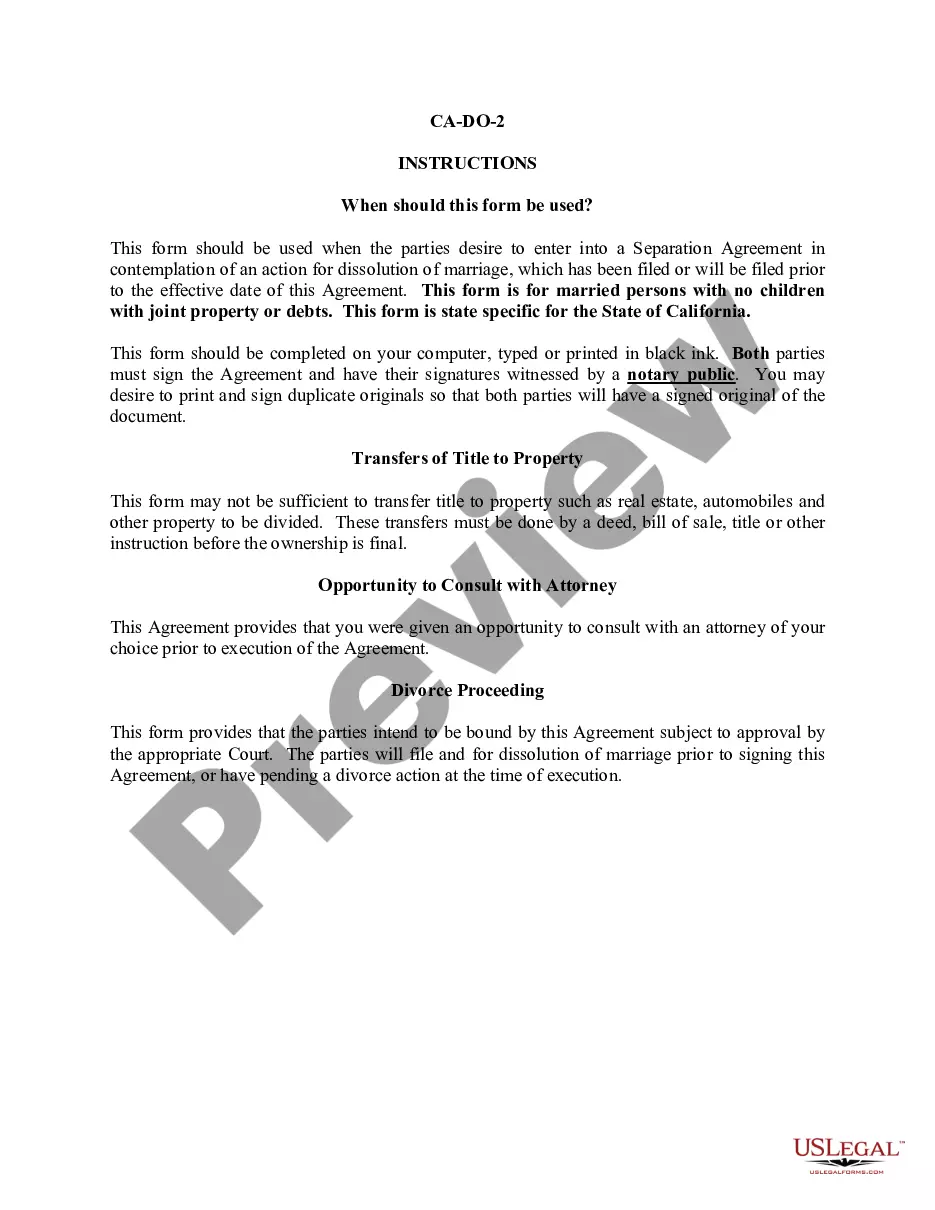

How to fill out Michigan Contract For Deed Seller's Annual Accounting Statement?

We consistently aim to minimize or evade legal repercussions when managing intricate legal or financial situations.

To achieve this, we enlist attorney services that, generally speaking, are quite costly.

However, not all legal matters possess the same level of complexity.

Many of them can be addressed independently.

Take advantage of US Legal Forms whenever you wish to locate and download the Ann Arbor Michigan Contract for Deed Seller's Annual Accounting Statement or any other form quickly and securely.

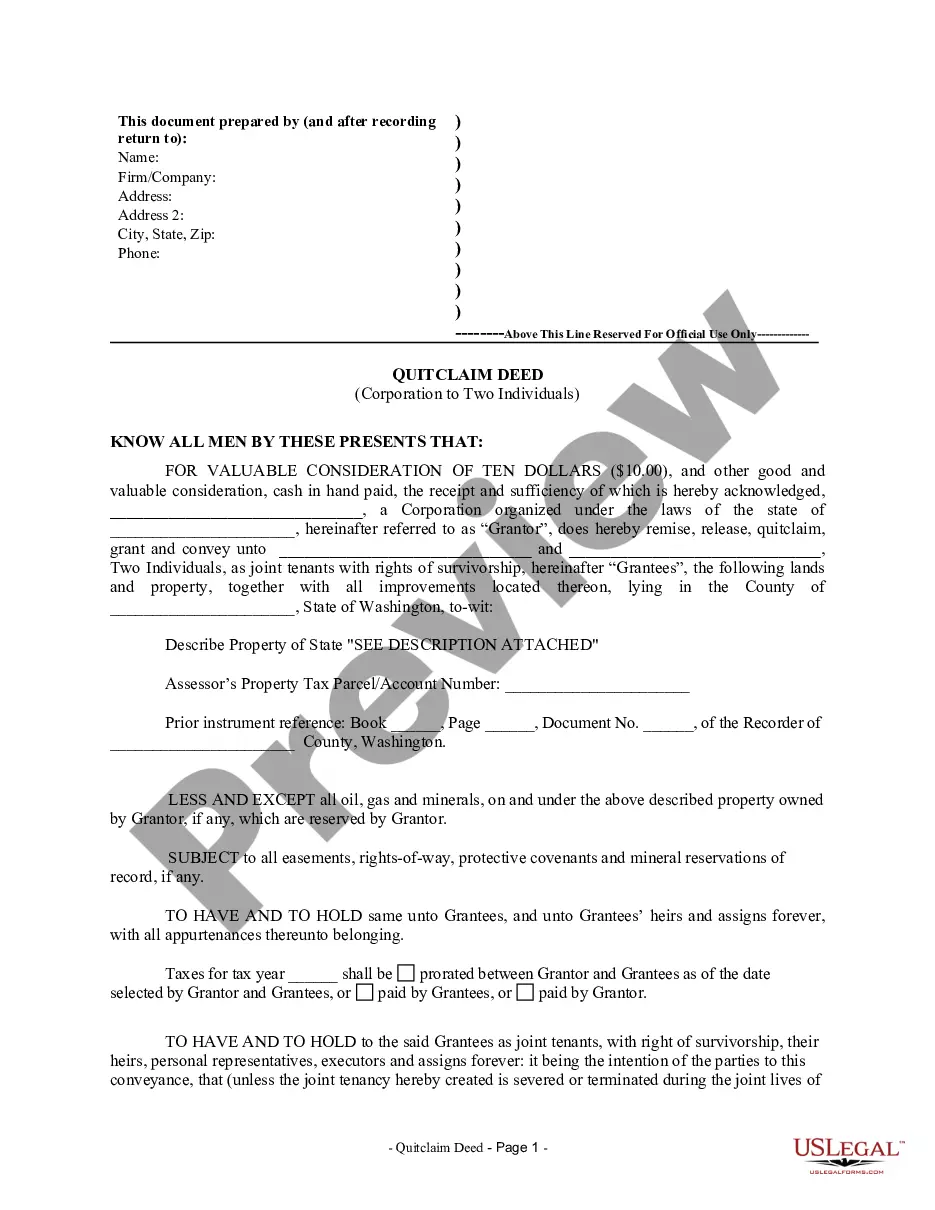

- US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to handle your concerns autonomously without resorting to a legal representative.

- We provide access to legal document templates that are not always available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Most land contracts have a forfeiture clause. A forfeiture clause usually says that if the buyer breaches the contract, the seller can keep all money paid to it. The seller can also take back possession of the home. The seller cannot forfeit the contract without a forfeiture clause.

A land contract in Michigan grants buyers an equitable title to gain immediate control over the property. However, the legal title remains with the property owner until the fulfillment of the land contract. Furthermore, the interest rates on land contracts in Michigan cannot exceed 11%.

First, a written notice of forfeiture prescribed by Michigan statute must be served on the buyer, giving him time in which to cure his breaches of the land contract. Then, if the breaches are not timely cured, the owner must seek a formal order of possession from the court.

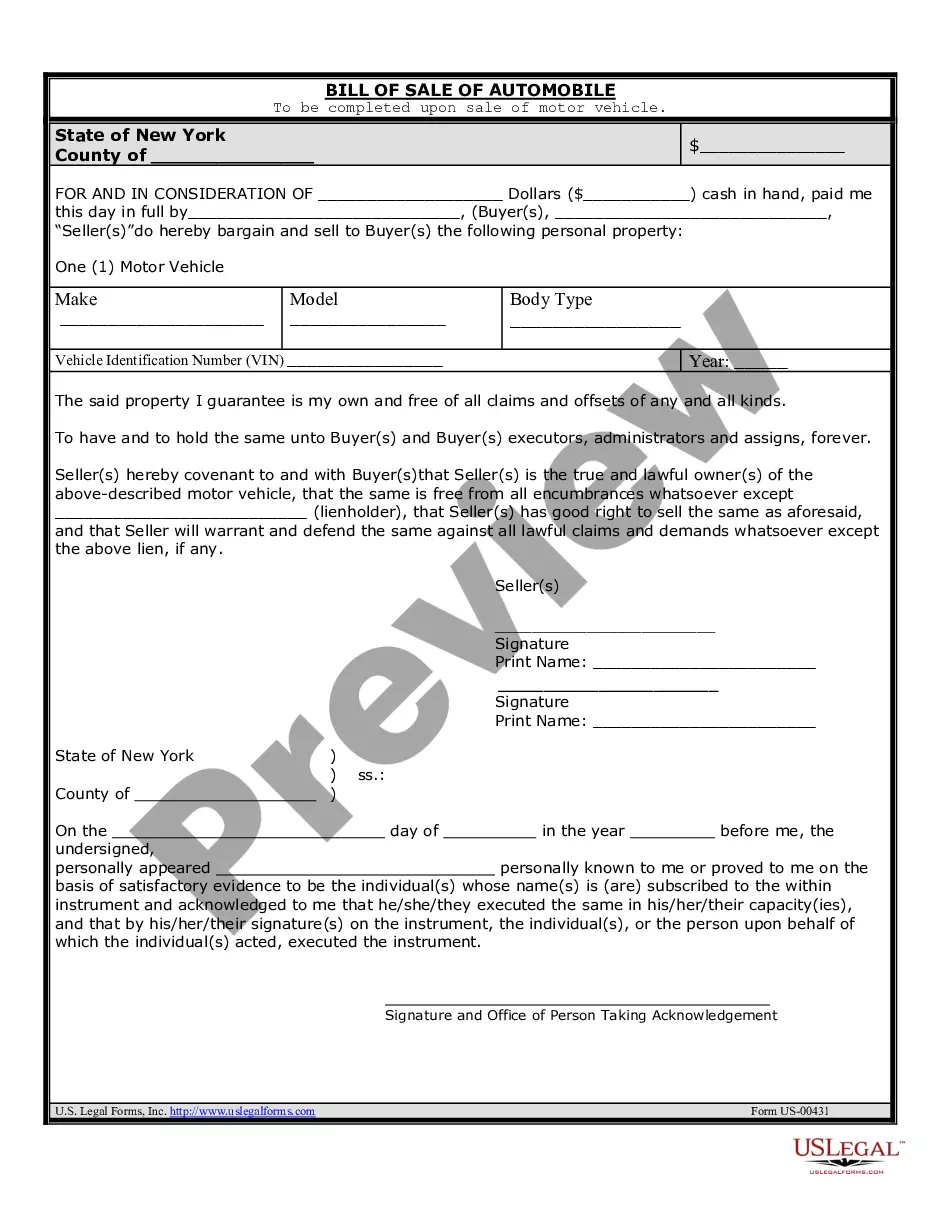

If the buyer passes away before the contract has been fulfilled, the beneficiaries will make the final decision, but the financial situation of the estate and priority within probate court may prevent the buyers from being able to uphold the contract.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.

The land contract purchaser takes possession of the real estate and agrees to make installment payments of principal and interest, typically on a monthly basis, until the contract is paid in full or balloons. During the term of the contract, the purchaser has ?equitable title? to the property.

Does a Land Contract Have to be Recorded in Michigan? A land contract is not legally required to be recorded in Michigan. However, both the buyer and the seller may wish to record the contract to protect their interests in the property.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.