Montgomery Maryland Assignment to Living Trust: A Comprehensive Overview of the Different Types In Montgomery, Maryland, the Assignment to Living Trust is an estate planning method that allows individuals to transfer their assets to a trust during their lifetime. This detailed description will provide insight into the concept and various types of Montgomery Maryland Assignment to Living Trust, shedding light on their benefits and considerations. Living Trust Overview: A living trust, also known as an inter vivos trust, is a legal arrangement where an individual (known as the granter or settler) places their assets into a trust during their lifetime. The granter designates a trustee who manages the trust assets for the ultimate benefit of the beneficiaries. Unlike a testamentary trust, which goes into effect after the granter's death, a living trust is established and operational during the granter's lifetime. Montgomery Maryland Assignment to Living Trust Types: 1. Revocable Living Trust: The revocable living trust is the most common type of living trust assignment in Montgomery, Maryland. Herein, the granter retains the ability to modify, amend, or revoke the trust at any time. It offers flexibility and control as it allows the granter to change beneficiaries, assets, or terms as circumstances evolve. Furthermore, a revocable living trust can assist in avoiding probate, providing privacy, and facilitating seamless succession in case of incapacity. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust cannot be altered or revoked once established, except under specific circumstances and judicial approval. An irrevocable living trust offers tax benefits, asset protection, and can help qualify for Medicaid benefits. By transferring assets into an irrevocable trust, the granter effectively removes them from their estate and potentially reduces estate tax liability. 3. Testamentary Living Trust: While the primary focus of the Montgomery Maryland Assignment to Living Trust is to establish trusts during the granter's lifetime, a testamentary living trust is unique. This type of trust is created through the granter's will and only goes into effect upon their death. It allows the granter to include specific instructions regarding asset distribution, appointment of trustees, and beneficiary designations. Testamentary living trusts may help avoid probate, offer privacy, and enable asset management for minor beneficiaries or those with special needs. Considerations for Montgomery Maryland Assignment to Living Trust: 1. Asset Protection: Depending on the type of living trust, the granter can shield certain assets from potential creditors, lawsuits, or other financial risks. 2. Avoidance of Probate: The assignment to a living trust can help beneficiaries avoid probate court, saving time, costs, and offering privacy. 3. Incapacity Planning: Living trusts ensure a smooth transition of asset management if the granter becomes incapacitated, detailing the process and designated successor trustee. 4. Privacy: Unlike a will, which becomes a public document, living trusts maintain privacy by avoiding probate court and keeping sensitive information confidential. 5. Tax Planning: Irrevocable living trusts can provide estate tax and capital gains tax benefits while optimizing wealth preservation and distribution among beneficiaries. Conclusion: The Montgomery Maryland Assignment to Living Trust is an effective estate planning tool offering individuals the opportunity to ensure seamless asset management, preserve wealth, and protect their loved ones. The revocable, irrevocable, and testamentary living trust options provide flexibility and cater to various estate planning needs. With proper guidance from legal and financial professionals, individuals can make informed decisions about the most suitable type of trust assignment for their unique circumstances in Montgomery, Maryland.

Montgomery Maryland Assignment to Living Trust

Description

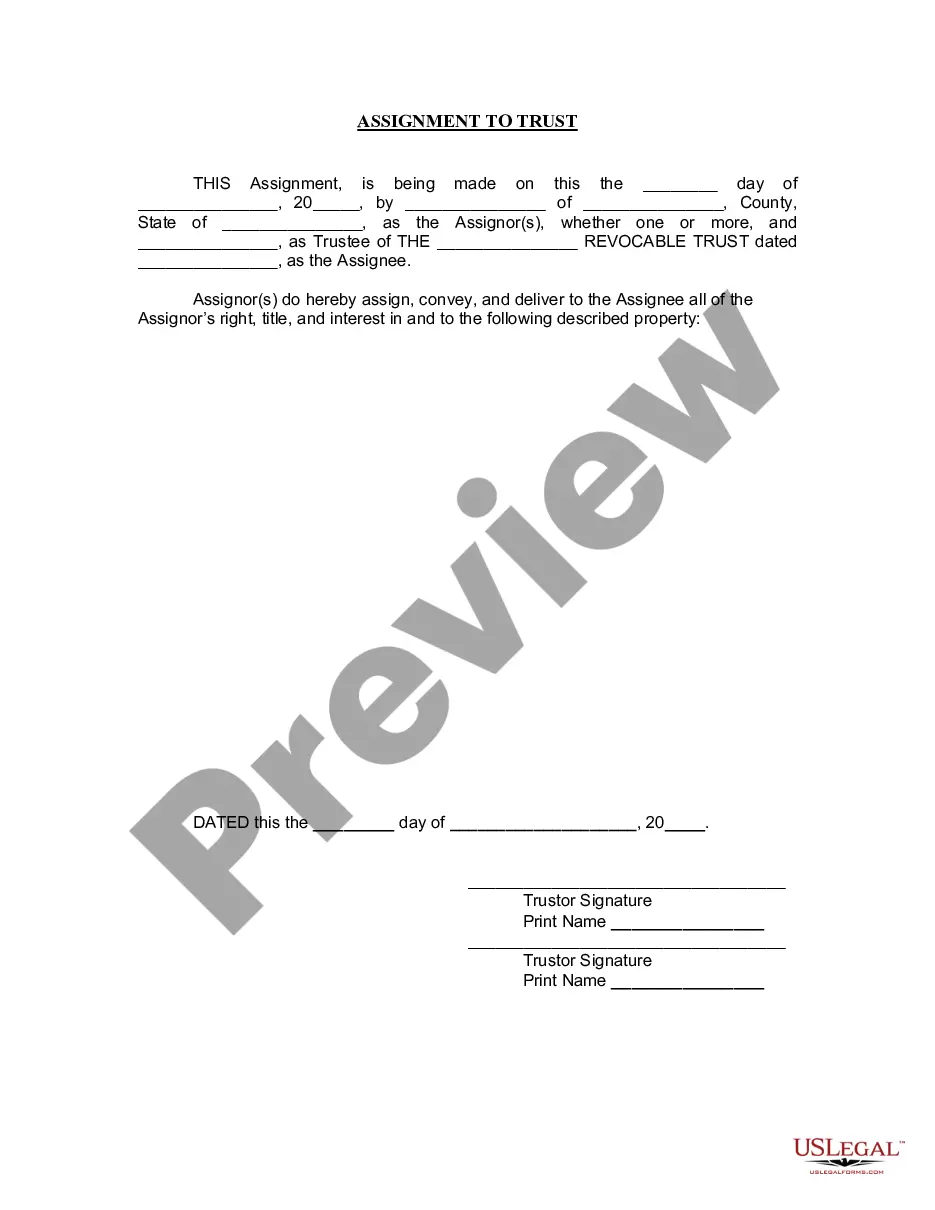

How to fill out Montgomery Maryland Assignment To Living Trust?

Are you looking for a reliable and inexpensive legal forms provider to buy the Montgomery Maryland Assignment to Living Trust? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of particular state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Montgomery Maryland Assignment to Living Trust conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is good for.

- Start the search over in case the template isn’t good for your specific situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Montgomery Maryland Assignment to Living Trust in any available file format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal papers online once and for all.

Form popularity

FAQ

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

You can add your house to your trust with a transfer deed, which is a legal document that transfers ownership of the home into the trust.

With that said, revocable trusts, irrevocable trusts, and asset protection trusts are among some of the most common types to consider. Not only that, but these trusts offer long-term benefits that can strengthen your estate plan and successfully protect your assets.

A revocable living trust (also called a ?revocable trust? or ?living trust?) is an arrangement you create to manage your assets during your lifetime and, like a will, to distribute those assets upon your death. A revocable trust can be a useful tool for managing your assets during any period of incapacity.

To make a living trust in Maryland, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

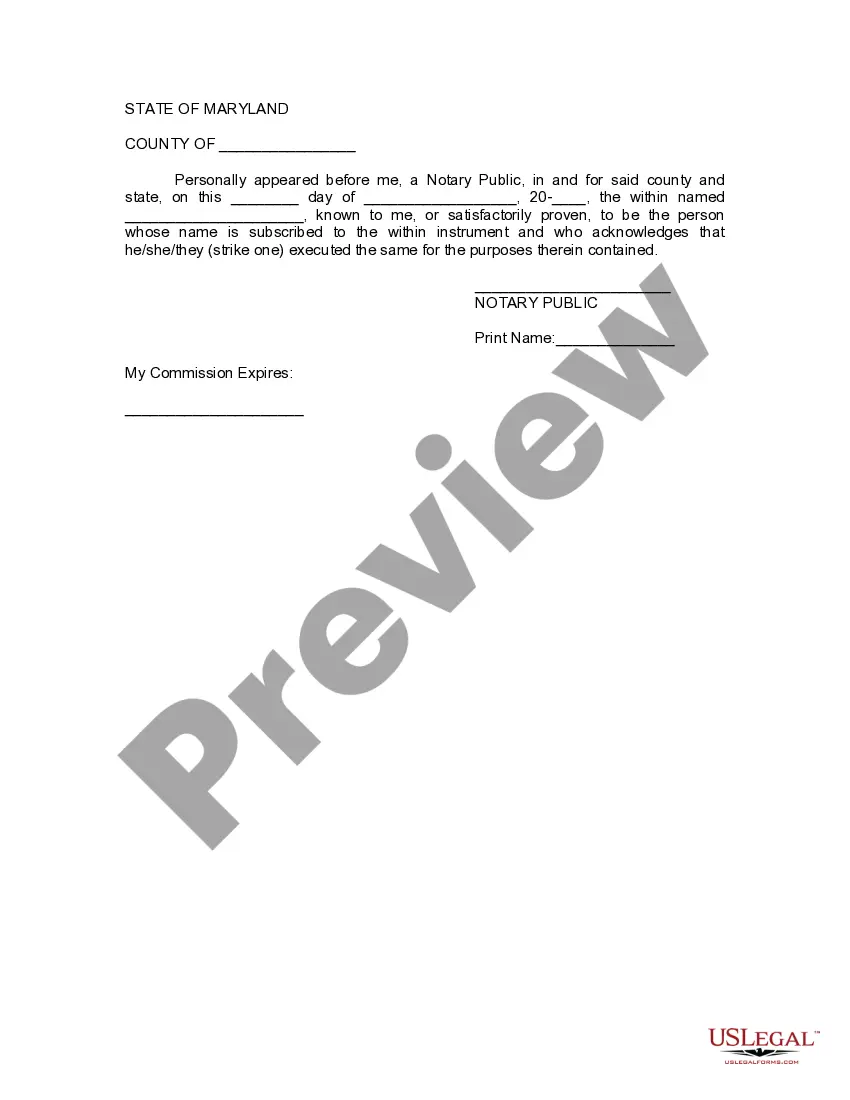

To create a living trust in Maryland you create a Declaration of Trust which is a written document. Oral trusts are valid in Maryland but are very difficult to enforce and manage. You sign the Declaration in front of a notary public. Assets are then transferred into the trust to fund the trust.

To make a living trust in Maryland, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A trust instrument is not required to be notarized in Maryland. However, it is common practice to notarize the settlor's signature and the witnesses' signatures of the trust agreement to express that the settlor: ? Intentionally created the trust.

The amount you'll spend to create a living trust in Maryland depends on the method you use to create it. If you do it yourself with the help of an online program, you'll probably spend a few hundred dollars or so. If you hire an attorney, the total cost will probably be more than $1,000.