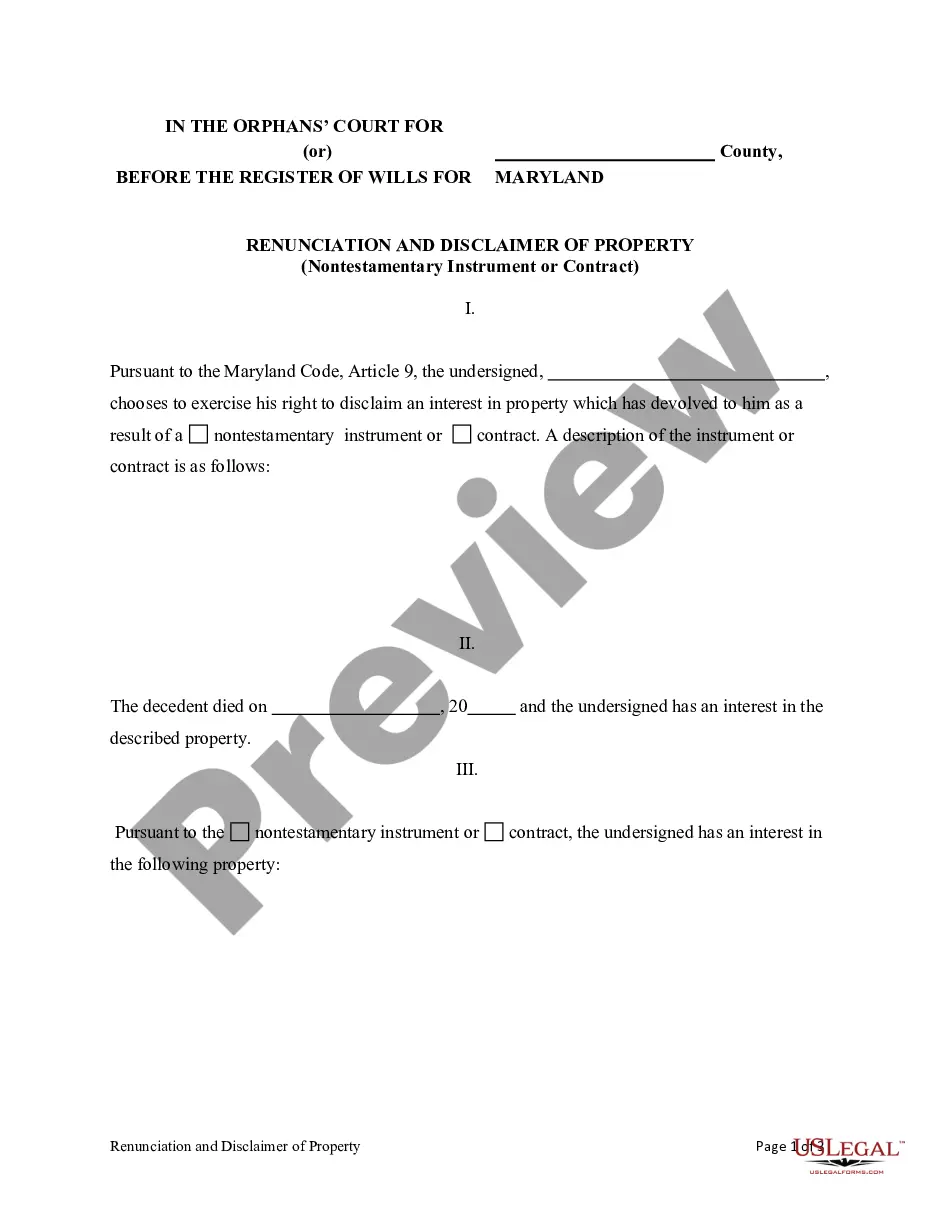

Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract

Description

How to fill out Maryland Renunciation And Disclaimer Of Property - Nontestamentary Instrument Or Contract?

If you’ve previously used our service, Log In to your account and download the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your inaugural interaction with our service, follow these straightforward steps to acquire your document.

You maintain continuous access to all documents you’ve purchased: you can find them in your profile within the My documents section whenever you wish to use them again. Utilize the US Legal Forms service to swiftly discover and save any template for your personal or professional requirements!

- Confirm you’ve found the correct document. Browse the description and use the Preview option, if available, to see if it aligns with your requirements. If it’s not suitable, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and make a payment. Enter your credit card information or utilize the PayPal option to finalize the payment.

- Acquire your Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract. Choose the file format for your document and save it to your device.

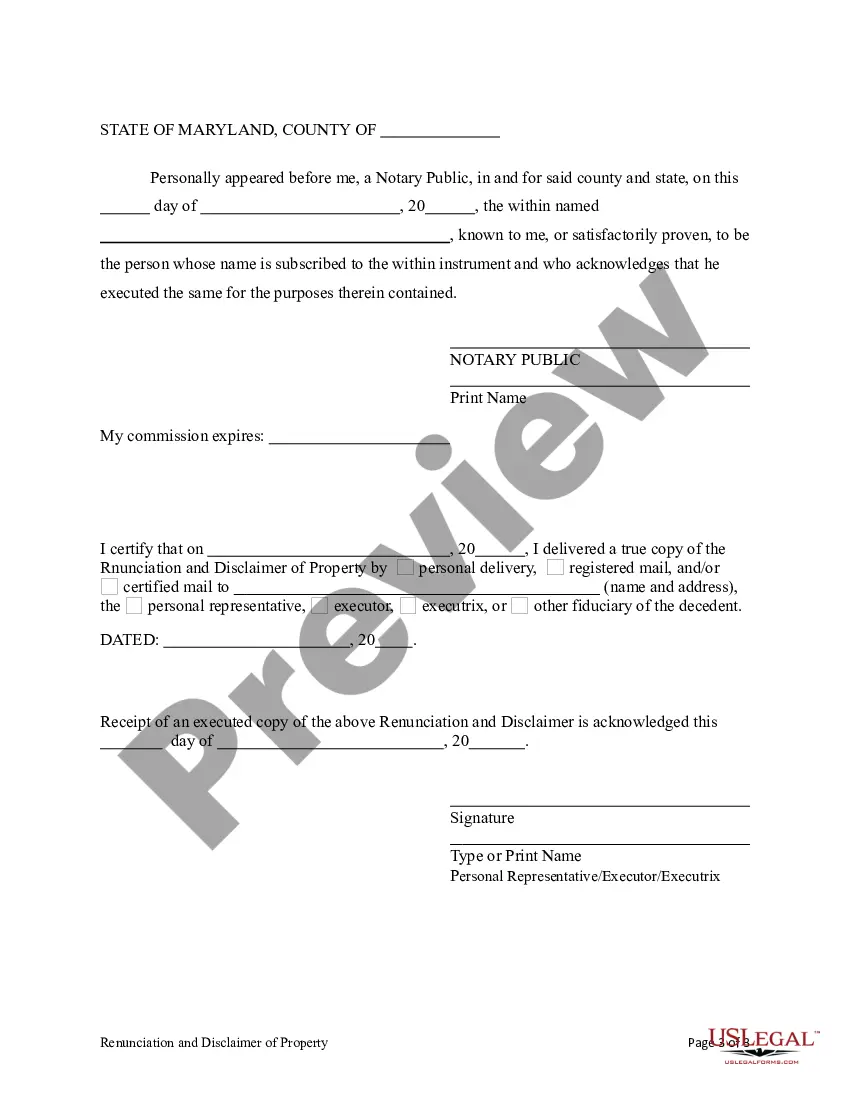

- Complete your template. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Rule 6 444 pertains to specific procedural regulations within Maryland's legal framework regarding property and estates. Understanding this rule can be crucial when engaging in the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract. This rule ensures that disclaimers abide by established legal standards, leading to valid outcomes. For assistance regarding such rules, uslegalforms provides resources and templates to help ensure compliance.

The Maryland Uniform Securities Act regulates the offer and sale of securities in the state, ensuring investor protection. While not directly related to the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract, understanding this act can be crucial for property owners with investments. Compliance with this act helps prevent fraud, promoting transparency in financial dealings. For investors wanting to navigate these regulations, resources like uslegalforms offer helpful guidance.

The Disclaimer Act in Maryland outlines the legal process for renouncing property interests. It facilitates the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract, allowing individuals to make informed choices about property rights. With this act, disclaimers can be effective if they meet specific legal requirements, creating clarity in property ownership for individuals and families. It is essential to consider legal advice when navigating this process.

The Maryland Residential Property Disclaimer Statement is a legal document used to formally renounce interest in residential property. It is part of the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract framework. This statement is particularly useful in situations where owners wish to transfer rights without complications. Consider using platforms like uslegalforms to create and file this statement accurately.

A qualified disclaimer of property allows an individual to refuse inheritance or a gift, thereby avoiding any associated taxes. In the context of the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract, this process can help in estate planning. It ensures that the property passes directly to alternative beneficiaries, often providing tax benefits and preserving the estate's value. Utilizing this disclaimer correctly can streamline estate management and planning.

Rule 6 431 in Maryland governs the process of disclaiming property under state law. This rule outlines how a beneficiary can formalize a disclaimer and sets forth the required documentation and timing. Adhering to the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract ensures that beneficiaries comply with Rule 6 431, facilitating a smooth legal process.

A qualified disclaimer follows specific legal guidelines that allow the beneficiary to refuse property without incurring taxes or liabilities. In contrast, a non-qualified disclaimer may not meet these requirements, potentially leading to tax implications for the beneficiary. It's crucial to understand these distinctions when dealing with the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract.

A beneficiary might wish to disclaim property to avoid tax liabilities or to prevent complications in estate distribution. By doing so, the property can pass directly to subsequent beneficiaries, thereby simplifying the estate process. The Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract allows beneficiaries to make decisions that best fit their financial situations and family needs.

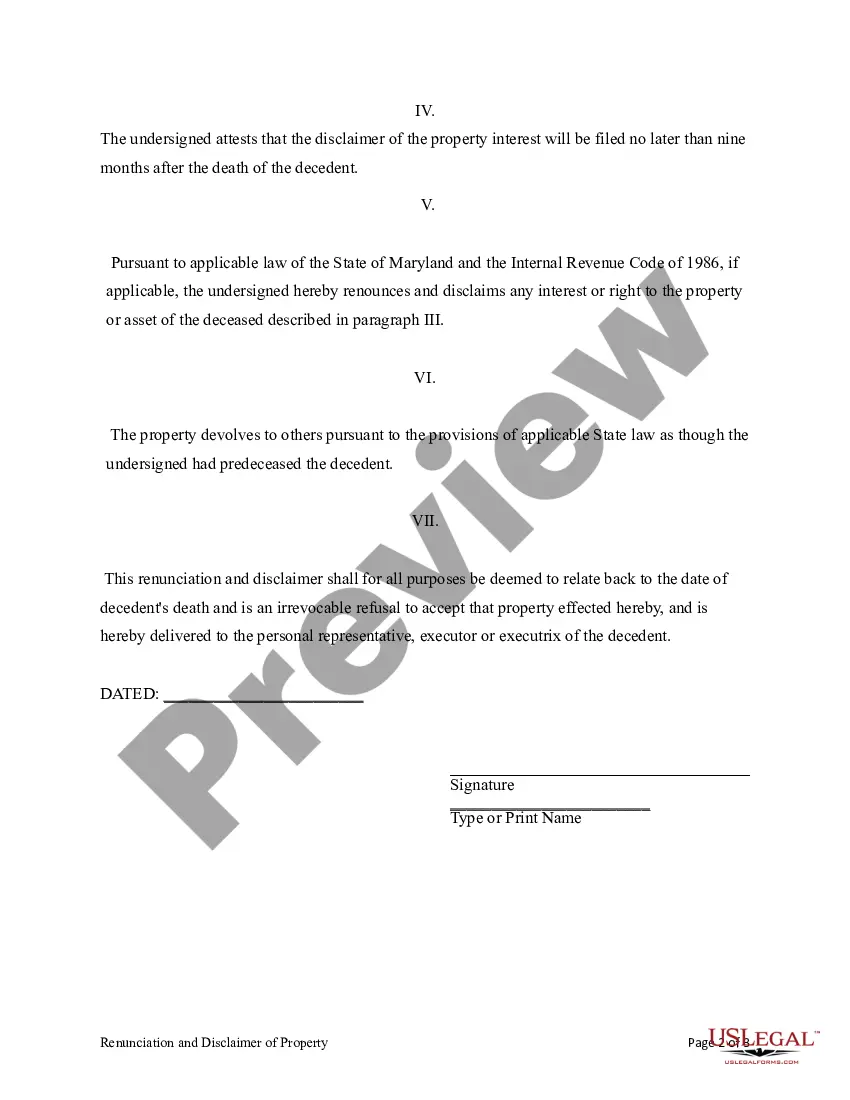

A disclaimer is considered qualified when it meets the requirements outlined in the Internal Revenue Code and state laws. To qualify, the disclaimer must be in writing, executed within nine months of the decedent's death, and the beneficiary must not accept benefits from the property. Understanding the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract is vital to ensure compliance with these regulations.

An estate disclaimer is a formal declaration in which a beneficiary chooses not to accept an inheritance. For example, if you inherit financial assets that would place you in a higher tax bracket, you might file a disclaimer to avoid that burden. Understanding the Montgomery Maryland Renunciation and Disclaimer of Property - Nontestamentary Instrument or Contract can help streamline this process.