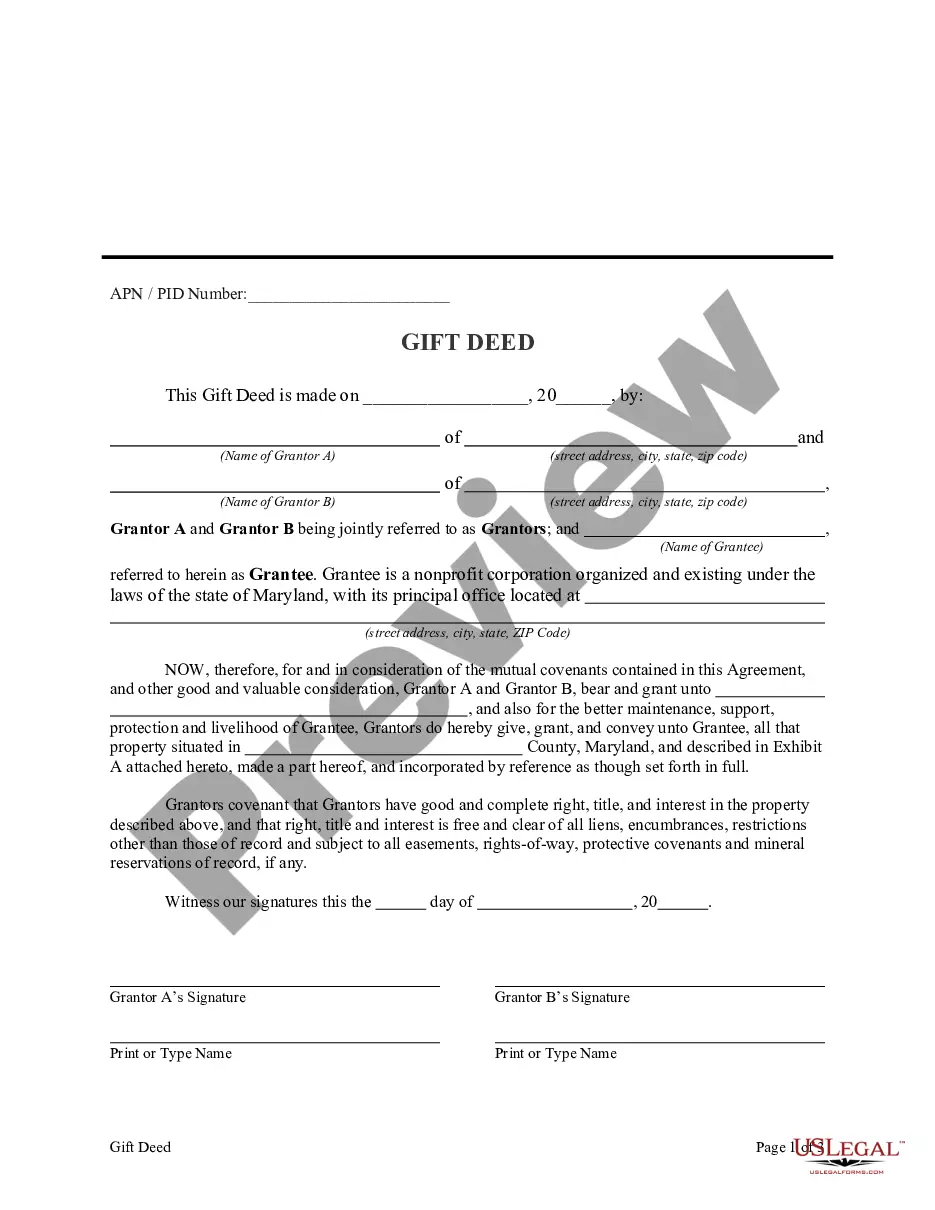

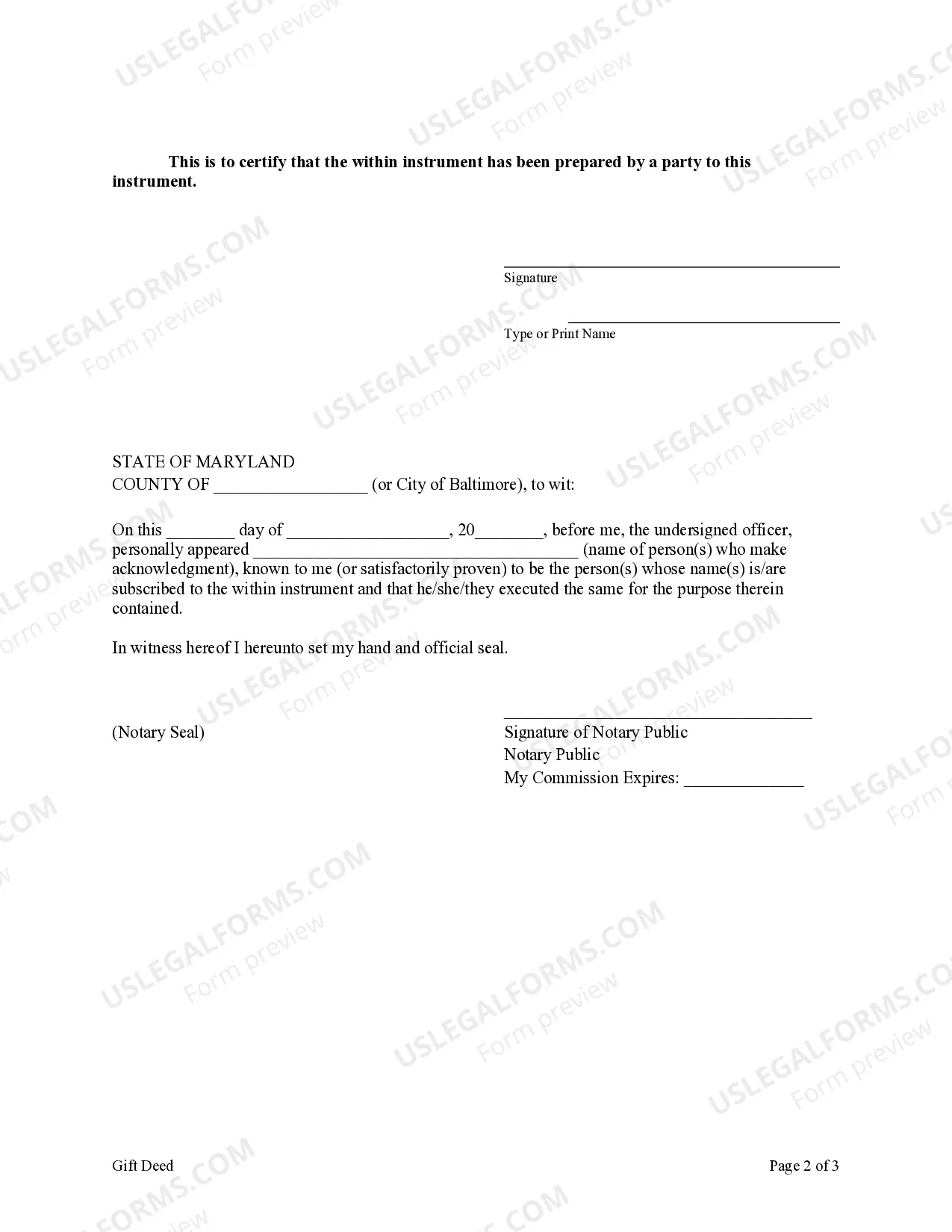

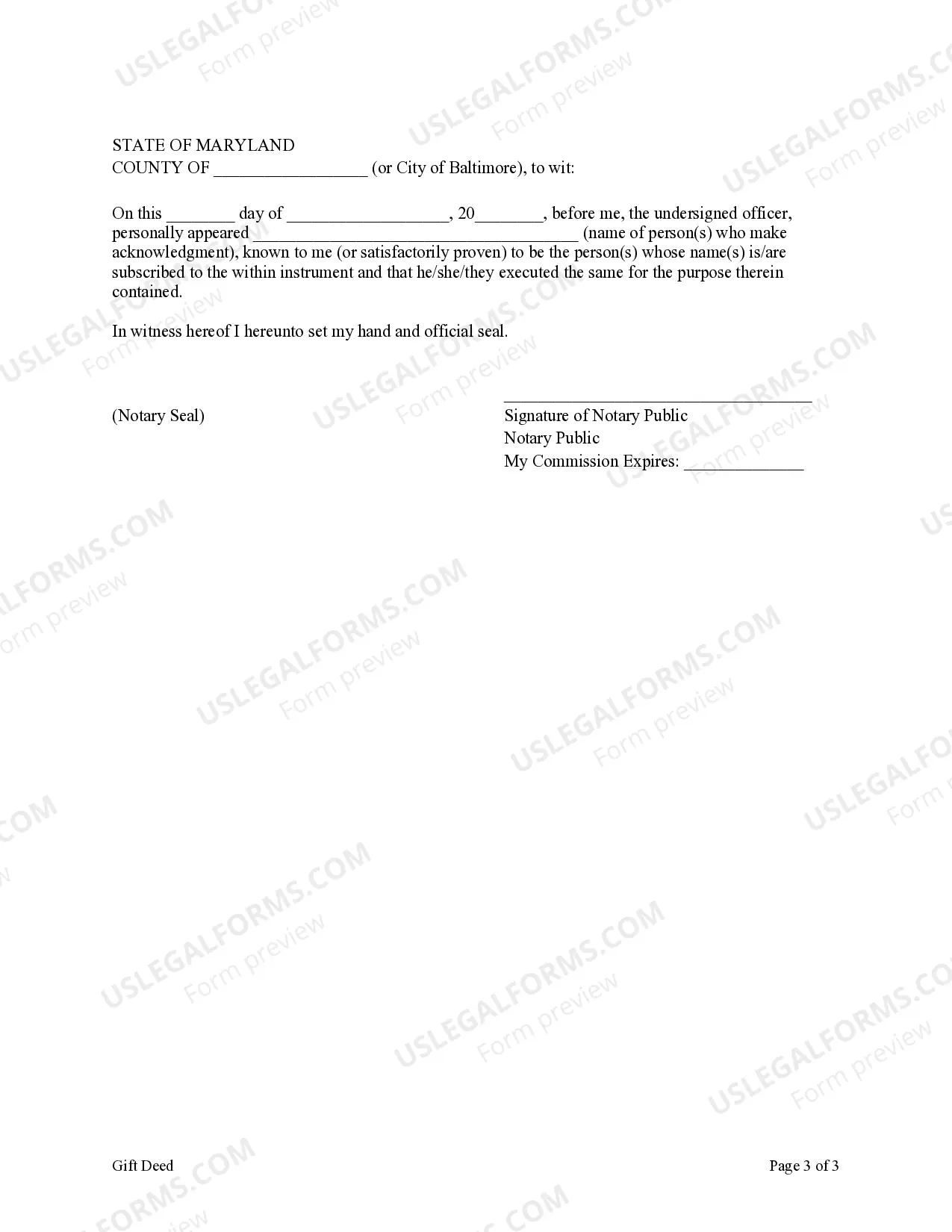

This form is a Gift Deed where the Grantors are two individuals and the Grantee is a non-profit corporation. Grantors convey the described property to the Grantee as a gift without monetary consideration. This deed complies with all state statutory laws.

Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee.

Description

How to fill out Maryland Gift Deed From Two Grantors To A Non-Profit Corporation As Grantee.?

Are you in search of a trustworthy and budget-friendly legal forms provider to purchase the Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee.

US Legal Forms is your preferred choice.

Whether you require a simple agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business purposes. All templates that we provide are tailored to meet the needs of specific states and regions.

To obtain the form, you must Log In to your account, find the necessary form, and click the Download button next to it. Please remember that you can retrieve your previously acquired form templates at any time from the My documents section.

Now, you can set up your account. Then select a subscription plan and move on to payment. After payment is completed, download the Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee in any available file format. You can revisit the website whenever needed and redownload the form without incurring additional charges.

Obtaining current legal forms has never been more straightforward. Try US Legal Forms today, and put an end to wasting your precious time searching for legal documents online.

- Are you visiting our platform for the first time? No problem.

- You can easily create an account, but first, ensure to do the following.

- Verify that the Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee conforms to your state and local laws.

- Examine the form’s description (if present) to understand who the form benefits and its intended use.

- Restart your search if the form does not suit your legal requirements.

Form popularity

FAQ

While a gift deed can be beneficial, it does come with disadvantages. When you utilize a Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee, you permanently relinquish ownership and any control over the property. Additionally, there may be gift tax implications or risks regarding the property’s future liabilities. Therefore, it’s essential to carefully consider your options and consult with a legal professional.

To add someone to a deed in Maryland, you typically need to execute a new deed that formally includes both parties’ names. This process is similar to creating a Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee, ensuring the proper documentation is filed with the local land records. It’s advisable to consult an attorney to guide you through the necessary legal steps and ensure compliance with Maryland laws.

Once a gift deed is executed, the property legally belongs to the recipient. In situations involving a Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee, the non-profit organization becomes the rightful owner. It’s important to understand that the original owners relinquish legal rights upon completion of the deed. This transfer solidifies the non-profit’s claim to the property.

The choice between a gift deed and a sale deed often depends on your goals. A Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee allows for the transfer of property without financial exchange, offering tax advantages. In contrast, a sale deed involves monetary transactions. Thus, if you're looking to donate property for charitable purposes, a gift deed might be the better option.

Gifting a house can be an excellent option, especially when considering a Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee. This process can help reduce estate tax liabilities for the grantors while providing a valuable asset to a non-profit. However, it's essential to weigh the potential financial implications and ensure that the recipient aligns with your intentions. Consulting a legal expert can provide clarity on this matter.

To gift property in Maryland, you will need to create a legally binding deed that clearly states your intentions. This process involves filling out a Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee, including all required details, and having it properly signed and witnessed. Using resources like uslegalforms can streamline this process and help you navigate the necessary steps effectively.

A deed can be written by the property owner, an attorney, or a legal service platform. While you may choose to draft it yourself, having a legal professional or using a credible service can increase accuracy. For a Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee, utilizing uslegalforms can be especially beneficial for ensuring compliance with local regulations.

A gift deed provides immediate legal transfer of property, unlike a will, which only takes effect after death. This can simplify the process for your heirs and avoid probate complications. However, a gift deed may have tax implications that a will does not, so it’s important to evaluate these factors, especially when considering a Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee.

In Maryland, anyone can prepare a deed, but it is often advisable to have it drafted by a qualified professional. This includes attorneys who specialize in real estate or property law. Using a platform like uslegalforms can also assist you in preparing your Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee effectively and accurately.

A deed does not have to be prepared by a lawyer, but hiring one can offer significant advantages. Legal expertise can ensure that your Montgomery Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee adheres to all relevant laws and regulations. Using accurate legal language can help protect your interests and prevent issues later on.