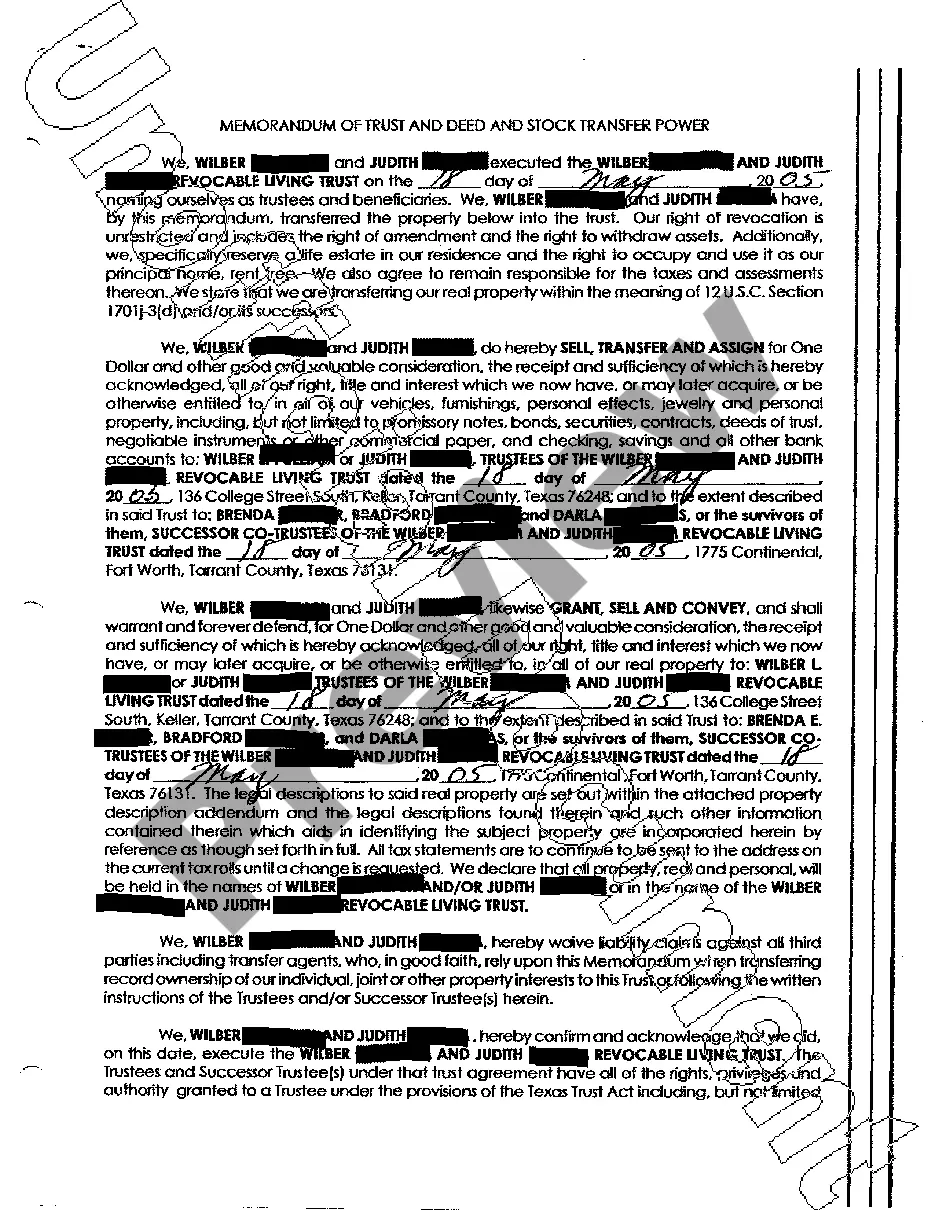

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Boston Massachusetts Notice of Assignment to Living Trust is a legal document that is used to transfer ownership of assets or property into a living trust. This notice serves as a formal notification to relevant parties about the assignment of these assets to the trust, which is an important step in the estate planning process. The notice provides information about the trust, the assets being assigned, and any other relevant details that need to be acknowledged. The purpose of the Boston Massachusetts Notice of Assignment to Living Trust is to ensure that the transfer of assets to a living trust is properly documented and legally recognized. By assigning assets to a living trust, individuals can avoid probate and maintain control over their assets during their lifetime. This process enables the seamless transfer of assets to designated beneficiaries upon the individual's death, as dictated by the terms of the trust. There may be different types of Boston Massachusetts Notice of Assignment to Living Trust, depending on the specific nature of the assets being assigned. For example, there may be notices related to real estate, financial accounts, investments, intellectual property, or personal property. Each type of notice will provide specific details about the asset being assigned, along with any necessary supporting documents or information. To execute a Boston Massachusetts Notice of Assignment to Living Trust, certain steps need to be followed. Firstly, the individual creating the trust should consult an attorney or legal professional to ensure that the trust is appropriately drafted and legally valid. Once the trust is established, the notice can be prepared and signed by the assignor, the person transferring the assets, and often require witnesses or notarization to affirm its authenticity. It is recommended to file the Boston Massachusetts Notice of Assignment to Living Trust with the appropriate authorities, such as the Registry of Deeds or relevant financial institutions, to ensure the transfer is recorded and recognized. Moreover, it is important to communicate the notice to all involved parties, such as beneficiaries, co-owners, or relevant professionals like accountants or financial advisors, to ensure a smooth transition of assets and to avoid any potential disputes. In summary, the Boston Massachusetts Notice of Assignment to Living Trust is a critical legal document used to transfer ownership of assets into a living trust. Its purpose is to confirm the assignment of assets to the trust and provide necessary information to all parties involved. By properly executing this notice, individuals can ensure their wishes for asset distribution are maintained and avoid potential complications during probate.