Boston Massachusetts Amendment to Living Trust

Description

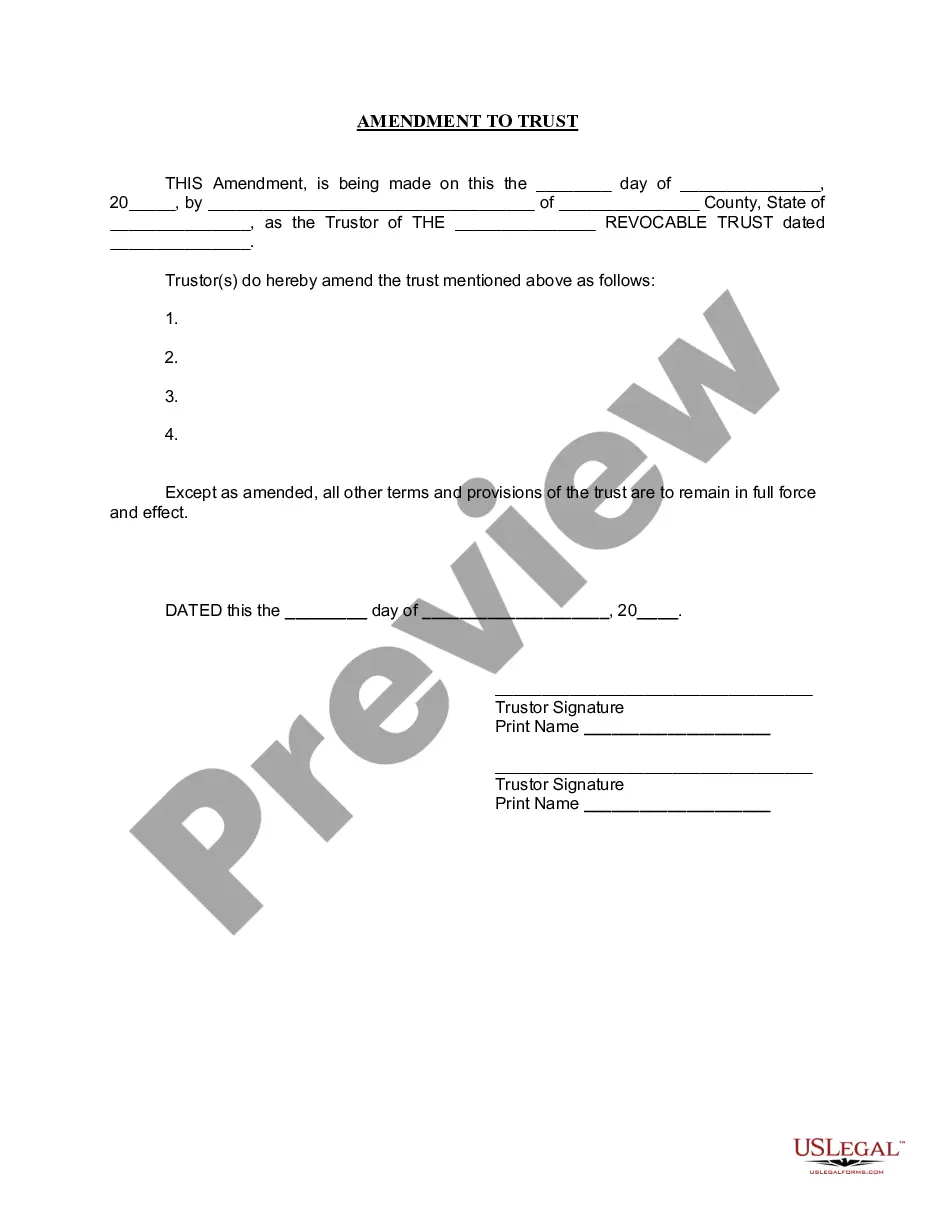

How to fill out Massachusetts Amendment To Living Trust?

We consistently endeavor to minimize or avert legal harm when engaging with intricate legal or financial issues.

To achieve this, we enroll in legal services that, generally speaking, are quite expensive.

However, not all legal challenges are equally complicated; many can be handled independently.

US Legal Forms is a digital repository of current DIY legal templates ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you lose the form, you can always download it again from the My documents tab. The procedure is equally easy if you’re new to the website! You can create your account in just a few minutes. Ensure that the Boston Massachusetts Amendment to Living Trust complies with the laws and regulations of your state and area. Additionally, it is vital to review the form’s description (if available), and if you see any inconsistencies with what you initially sought, look for an alternative form. Once you’ve confirmed that the Boston Massachusetts Amendment to Living Trust is suitable for your situation, select the subscription option and proceed with the payment. Then, you can download the form in any desired format. With over 24 years in the industry, we’ve assisted millions of people by providing customizable and current legal forms. Utilize US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your affairs without the need for legal advice.

- We offer access to legal document samples that are not always available in the public domain.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

- Take advantage of US Legal Forms whenever you require to obtain and download the Boston Massachusetts Amendment to Living Trust or any other document effortlessly and securely.

Form popularity

FAQ

Irrevocable Trusts in Massachusetts Grantors cannot dissolve or change an irrevocable trust after creating the trust. However, creators of irrevocable trusts still retain some control over their assets.

With the adoption of Probate Code Section 15401, that changed, and the law provided two distinct ways in which to revoke a California Trust: (1) revoke using the manner provided in the Trust instrument, or (2) revoke by any writing (other than a Will) signed by the Settlor and delivered to the trustee during the

A living trust in Massachusetts is created by the grantor, the person putting things into trust. As the grantor you must choose a trustee who is charged with managing the trust for your benefit while you are alive and distributing your assets to your beneficiaries after your death.

As legal owner of the real estate, the nominee trust instrument or a certificate that sets forth information about the trust must be recorded with the registry of deeds.

Fortunately, California law allows for the amendment, modification or termination of an otherwise irrevocable trust--under the proper circumstances and using the proper procedures.

Phone Main number Call Supreme Judicial Court, Main number at (617) 557-1000. Clerks' Offices Emergency Number Call Supreme Judicial Court, Clerks' Offices Emergency Number at (857) 275-8036. Clerk's Office for the Commonwealth Call Supreme Judicial Court, Clerk's Office for the Commonwealth at (617) 557-1020.

Amending a Living Trust in California Nearly all trust documents can be amended. However, some are easier to amend than others. In the case of a revocable living trust, amendments usually take on the form of additional documents written after the original trust document has been signed and notarized.

A trustee is required to send a copy of the Trust and its amendments, if there are any amendments, to the beneficiaries of the Trust and heirs of the settlor (i.e., the person who created the Trust), within 60 days of a written request.

In Massachusetts, there is statutory authority for amending Irrevocable Trusts (Massachusetts General Law Chapter 203E § 411). If the Donor and all the beneficiaries agree, they may petition the Probate Court for permission to amend an Irrevocable Trust.

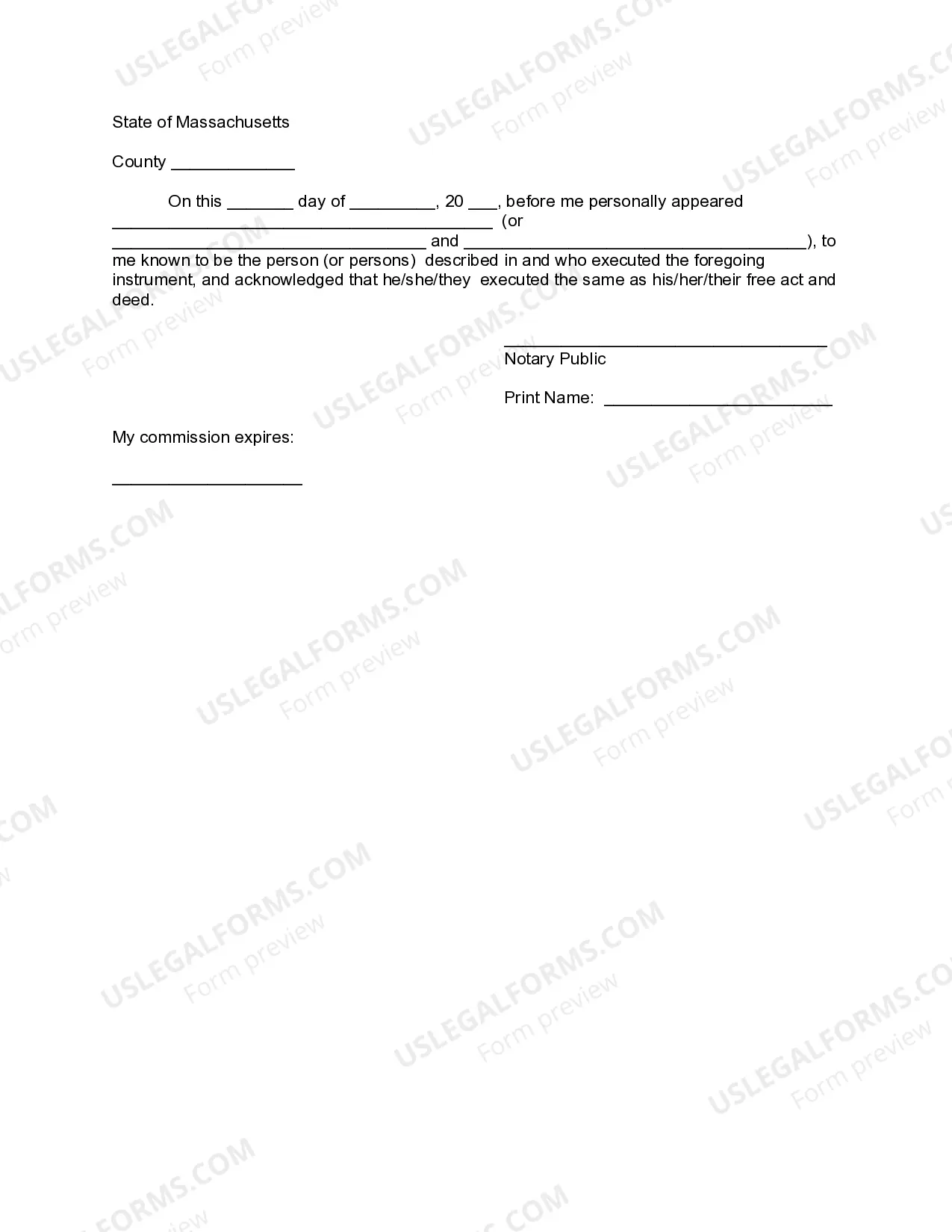

In Massachusetts, a will is only valid if it is a written document, signed by the person who created it, and signed by two witnesses. A trust is valid when written, signed in front of a notary public, and when the property has been transferred to your name as trustee.