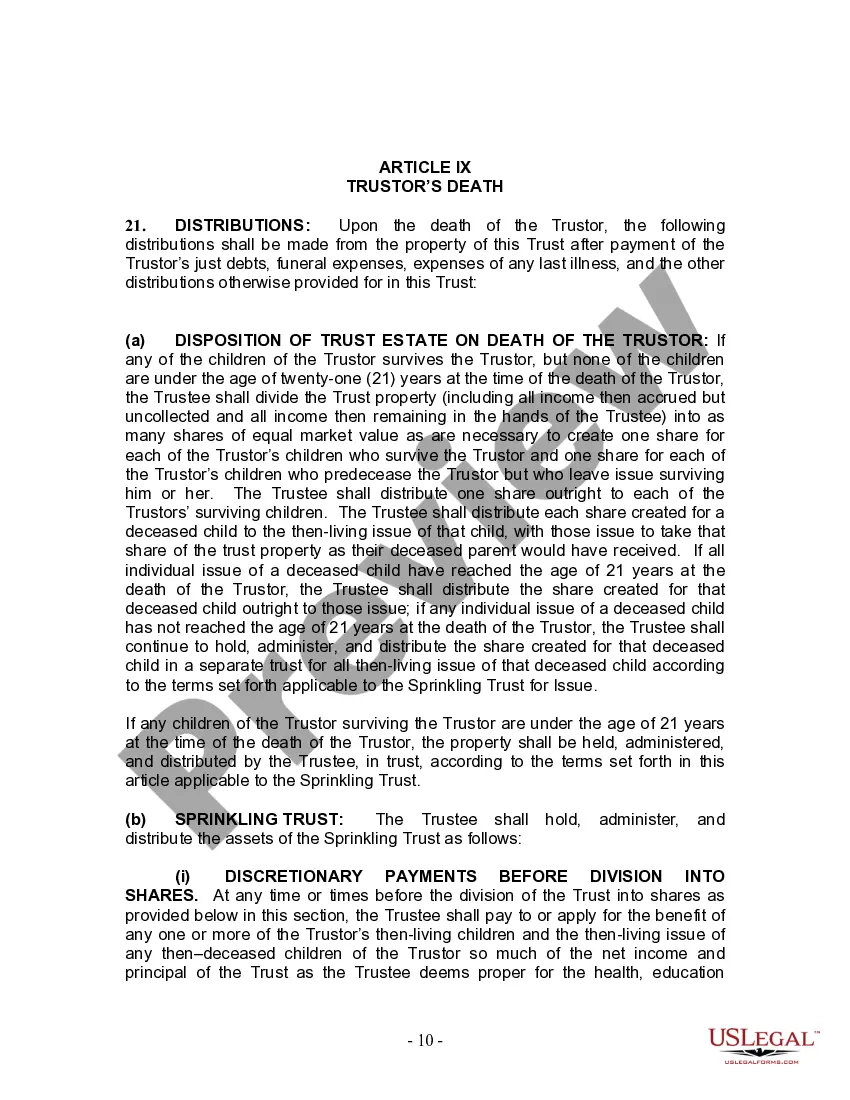

Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

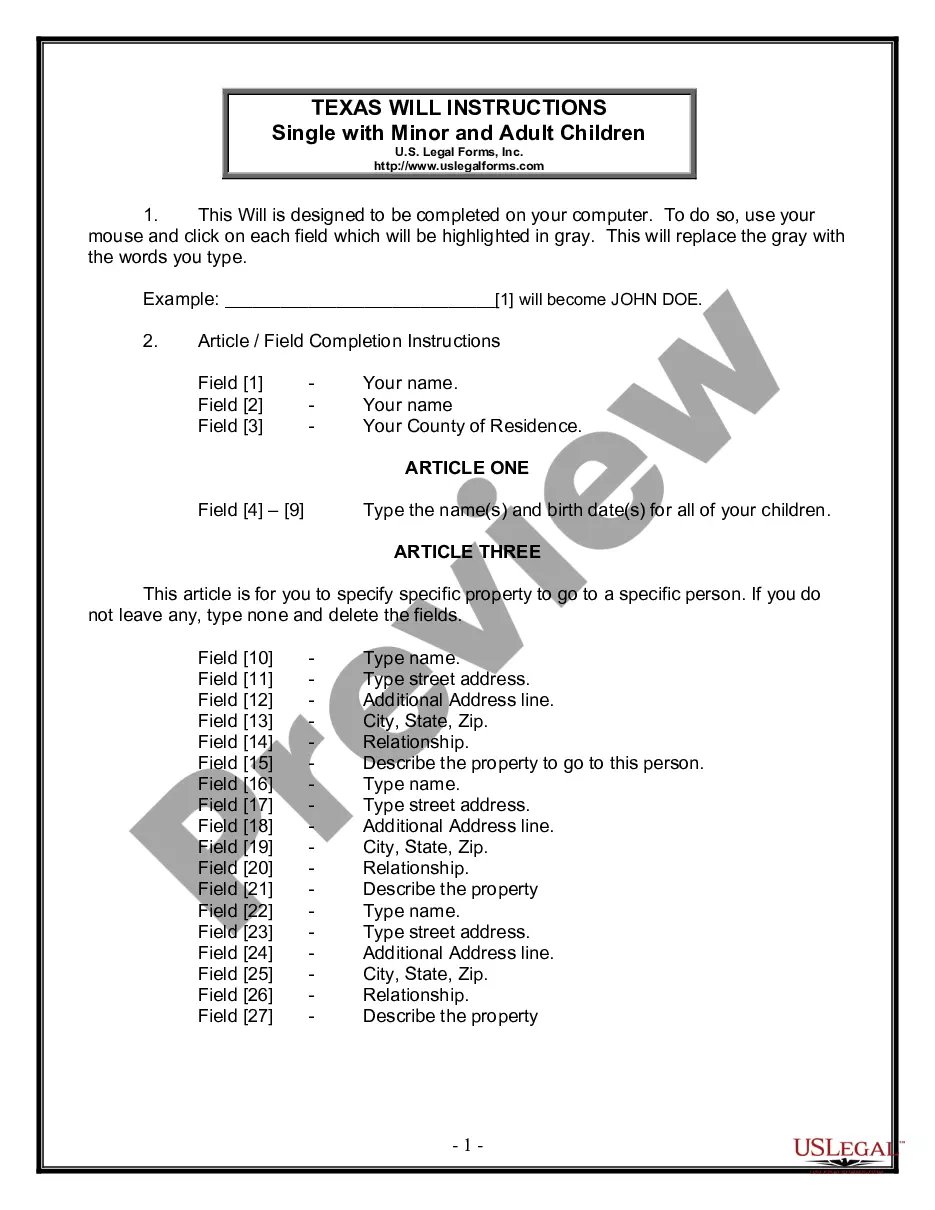

How to fill out Massachusetts Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With Children?

If you have previously utilized our service, sign in to your account and download the Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children onto your device by selecting the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment plan.

If this is your inaugural experience with our service, adhere to these straightforward steps to acquire your file.

You have ongoing access to every document you have bought: you can find it in your profile under the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Confirm you’ve located a suitable document. Review the description and utilize the Preview option, if available, to verify if it meets your needs. If it does not suit you, employ the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children. Select the file format for your document and store it on your device.

- Complete your document. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Encouraging your parents to consider a trust, like the Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, is a wise decision for many families. This arrangement can simplify the transfer of assets and help avoid probate, ensuring that their wishes are carried out efficiently. However, it’s essential that they consult with a professional to understand the benefits and responsibilities of setting up a trust.

Divorce can significantly impact a living trust, such as the Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children. Generally, assets that are held in a trust may need to be reviewed and potentially restructured. During divorce proceedings, it's crucial to ensure that your trust reflects your current intentions and does not inadvertently benefit your ex-spouse.

The disadvantage of a family trust, including the Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, often lies in the potential for family disputes. If the terms of the trust are not clear or well-communicated, it might lead to disagreements among heirs. These disputes can be emotionally taxing and could require legal intervention to resolve, which defeats the purpose of creating a trust.

A significant downfall of having a trust, like the Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, is the responsibility of ongoing management. Trusts require regular updates and maintenance to reflect changes in your life situation or family dynamics. If you overlook these responsibilities, your trust may not function as intended when it’s needed most.

One downside of placing your assets in a Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children is that it can be more complex than simply holding assets in your name. This complexity may lead to higher upfront costs for setting up the trust. Additionally, if you do not manage the trust properly over time, it could lead to complications or unintended consequences later.

The primary purpose of a living trust is to manage and distribute your assets during and after your lifetime according to your wishes. It helps avoid probate, which can be a lengthy and costly process. Moreover, it allows for a smoother transition of asset management if you become incapacitated. If you're looking into this option, a Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children can be an excellent choice to ensure your children's financial future.

One downside of a living trust is that it does not provide tax benefits in the way some other estate planning tools might. Moreover, assets placed in a living trust can still be vulnerable to creditors. It also requires proper funding to ensure it serves its intended purpose. Therefore, understanding these limitations is crucial when considering a Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children.

Placing your home in a trust can lead to added costs, such as fees for setting up and maintaining the trust. It may also limit your control over the property since the trust technically owns it. Furthermore, transferring your home to the trust involves legal paperwork, which can be a hassle. Despite these concerns, a well-structured Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children can still offer vital benefits.

Some individuals may choose not to set up a trust because they believe it adds unnecessary complexity to their estate planning. You might find that managing a trust requires ongoing attention and paperwork, which can be daunting. Additionally, certain assets may not benefit significantly from being placed in a trust. It's essential to evaluate your personal circumstances when considering a Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children.

When one spouse dies, a living trust continues to function, allowing the surviving spouse to access the assets without going through probate. The trust typically contains provisions that clarify how the assets should be managed and distributed after the loss. This offers a smooth transition during a difficult time, ensuring that your family's needs are prioritized. A Cambridge Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children can provide this level of support and clarity.