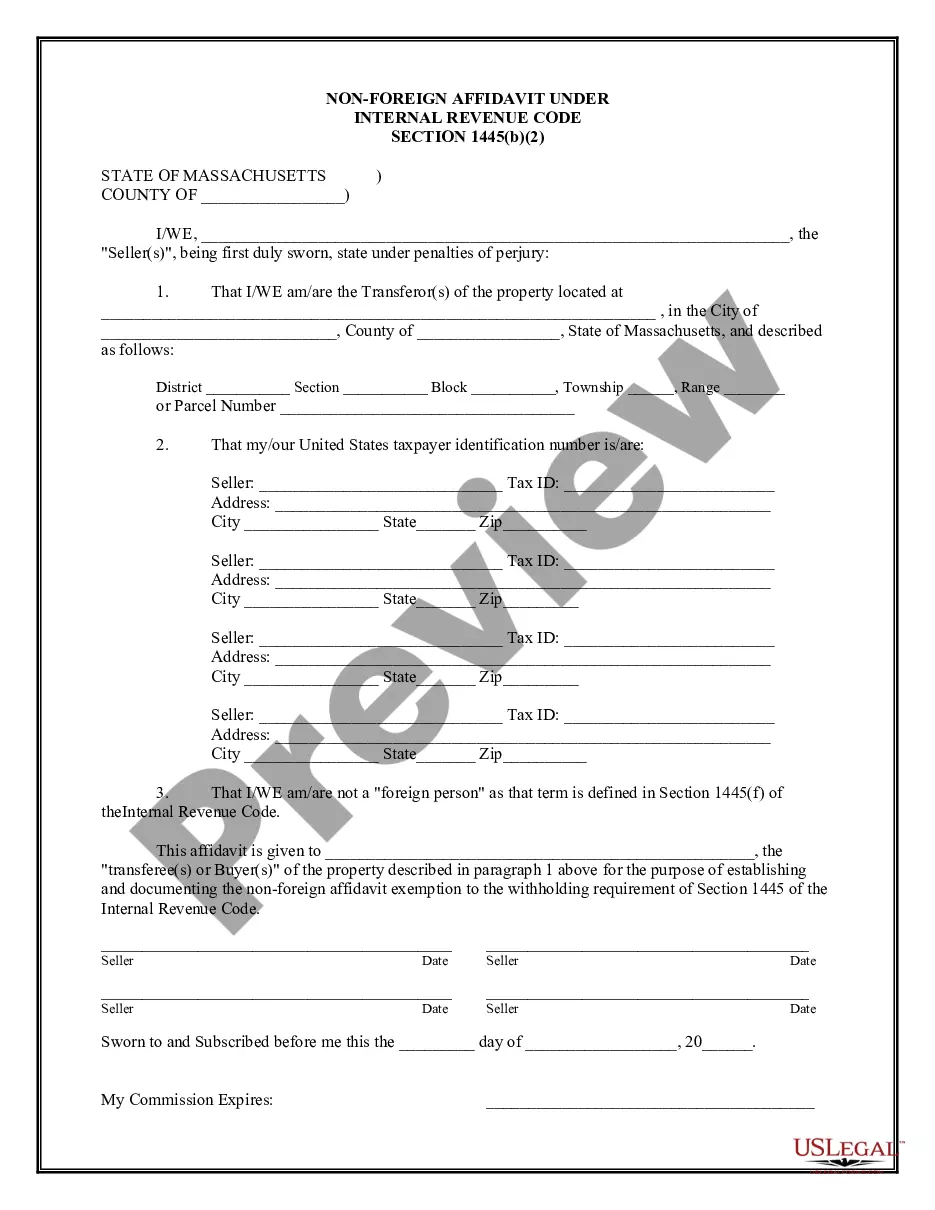

Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Massachusetts Non-Foreign Affidavit Under IRC 1445?

Acquiring validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It is an online repository of over 85,000 legal documents for both personal and business purposes and various real-world scenarios.

All the paperwork is systematically organized by application area and jurisdiction, making the retrieval of the Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445 as straightforward as one-two-three.

Maintaining the organization of documents and adhering to legal requirements is crucial. Take advantage of the US Legal Forms library to always have essential template documents readily available for any requirements!

- Examine the Preview mode and document description. Ensure you’ve selected the appropriate one that aligns with your needs and fully complies with your local jurisdiction's regulations.

- Look for an alternative template, if necessary. If you notice any discrepancies, utilize the Search tab above to locate the correct one. If it meets your standards, proceed to the next step.

- Purchase the document. Click the Buy Now button and choose the subscription plan that suits you best. You will need to create an account to access the library's assets.

- Complete your purchase. Enter your credit card information or utilize your PayPal account to pay for the service.

- Download the Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445. Store the template on your device to continue with its completion and access it again in the My documents menu of your profile whenever you need it.

Form popularity

FAQ

Yes, a FIRPTA affidavit should be notarized to validate the claims made within the document. In the case of the Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445, having a notarized affidavit adds an extra layer of authenticity and legal security. Notarization ensures that the information is credible, protecting both the buyer and seller during the transaction.

A certificate stating that the seller is not a foreign person is essential for FIRPTA compliance. This document is part of the Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445, and it helps establish the seller's residency status. Providing this certificate can reduce potential tax withholdings, making it a vital resource for both sellers and buyers in a real estate transaction.

In the USA, an affidavit is a written statement confirmed by oath or affirmation, typically used as evidence in court. While often referred to simply as an affidavit, when discussing the Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445, it serves a particular purpose related to tax verification for real estate sellers. This document ensures compliance with federal tax laws and helps prevent unnecessary withholding.

affidavit is a specific documentation that attests to a fact without being sworn. In the context of the Cambridge Massachusetts NonForeign Affidavit Under IRC 1445, it confirms that the seller is not a foreign person. This declaration is crucial for buyers to avoid FIRPTA withholding tax obligations during real estate transactions.

Tax code 1445 refers to the section of the Internal Revenue Code that mandates withholding taxes on foreign sellers of real estate in the United States. This code aims to prevent foreign sellers from avoiding taxation on gains from U.S. real property sales. When utilizing a Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445, sellers can exempt themselves from this withholding if they provide proof of their non-foreign status. Knowledge of tax code 1445 is essential for anyone involved in real estate transactions involving foreign parties.

Section 1445 of the Internal Revenue Code outlines the regulations regarding tax withholding on the sale of U.S. real property by foreign persons. This section aims to ensure that the correct tax is collected from foreign sellers while protecting domestic buyers. To avoid delays, buyers should request a Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445. By understanding this section, buyers can navigate the closing process more effectively.

foreign affidavit serves to confirm that a seller is not a foreign person under U.S. tax law, specifically under IRC 1445. This document is essential in real estate transactions, as it protects the buyer from unwanted tax liabilities. By obtaining a Cambridge Massachusetts NonForeign Affidavit Under IRC 1445, buyers can ensure a smoother closing process. It is a vital step in confirming tax status, ultimately benefiting both parties.

Typically, the seller pays the tax under FIRPTA, which is the Foreign Investment in Real Property Tax Act. In the context of a Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445, this means that the seller must provide certification that they are not a foreign person. This affidavit helps simplify the transaction for the buyer, ensuring that no withholding will apply. Understanding this responsibility is crucial for both parties involved in the real estate transaction.

A FIRPTA certificate is typically signed by the property seller. When utilizing the Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445, the seller certifies their non-foreign status, which helps facilitate the transaction without unnecessary withholding. It is essential for all parties involved to ensure this document is correctly executed to avoid complications.

The 50% rule in FIRPTA refers to the provision that allows foreign sellers to limit withholding to 50% of the gain. For sellers utilizing the Cambridge Massachusetts Non-Foreign Affidavit Under IRC 1445, this rule can provide clarity on the tax implications. Understanding this rule can help sellers navigate their tax obligations effectively during property transactions.