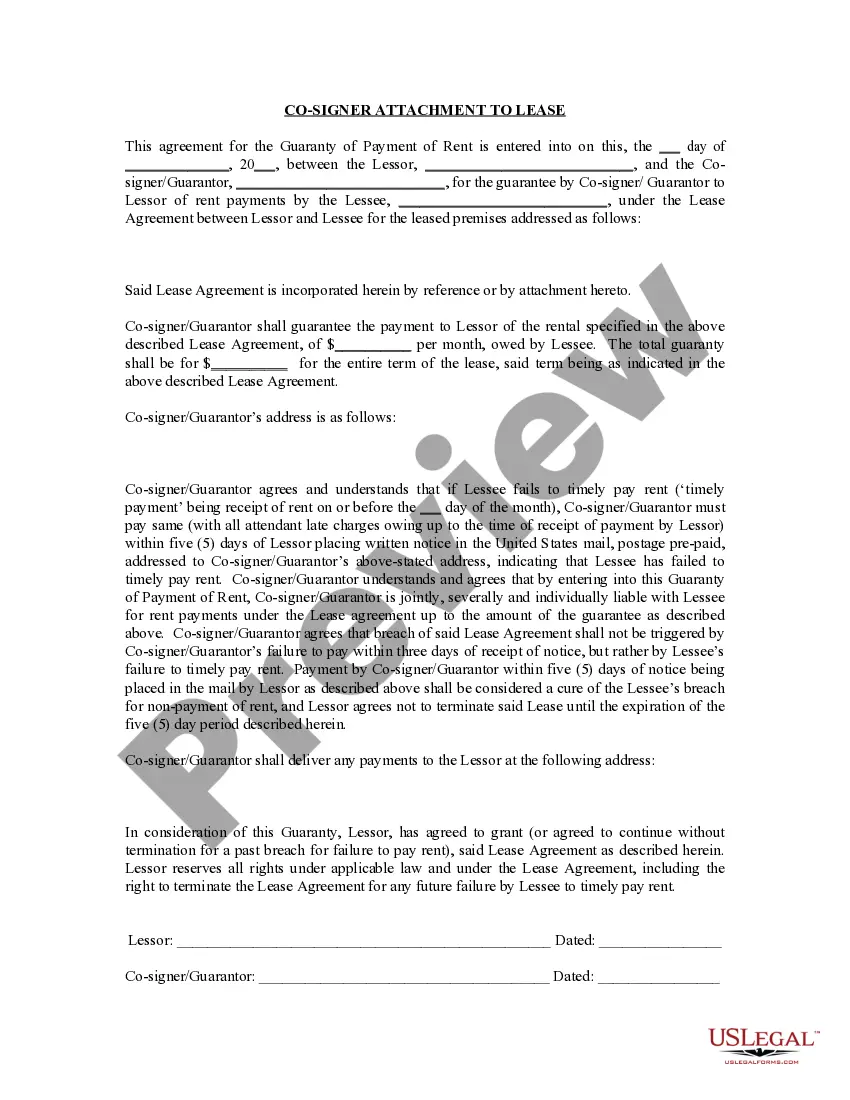

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Boston Massachusetts Guaranty Attachment to Lease for Guarantor or Cosigner

Description

How to fill out Massachusetts Guaranty Attachment To Lease For Guarantor Or Cosigner?

Finding authenticated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements as well as various real-world scenarios.

All the documents are appropriately organized by area of application and jurisdictional regions, making it as straightforward as ABC to find the Boston Massachusetts Guaranty Attachment to Lease for Guarantor or Cosigner.

Downloading the Boston Massachusetts Guaranty Attachment to Lease for Guarantor or Cosigner. Store the template on your device to complete it, and access it anytime from the My documents menu in your profile.

- Review the Preview mode and form description.

- Ensure you’ve selected the right one that aligns with your needs and completely meets your local jurisdiction requirements.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the accurate one. If it aligns with your needs, proceed to the next step.

- Complete the purchase.

- Click on the Buy Now button and select the subscription plan you wish to choose. You need to create an account to gain access to the library’s resources.

Form popularity

FAQ

When you cosign on a lease, you're making a legal promise to uphold the terms of the lease and to pay rent if the lessee does not. As a cosigner, your credit could be affected whether or not the person you're cosigning with pays their rent. This uncertainty makes cosigning for an apartment risky.

signer is equally liable for a loan, while a guarantor becomes responsible for a loan if the borrower cannot pay it. While the terms may seem interchangeable if you're just hearing them for the first time, there is a distinct difference in responsibilities between the two.

A cosigner has more financial responsibility than a guarantor since the cosigner is responsible for rent on day one. The guarantor only steps in if a renter can't make payments. Plus, if a cosigner is a roommate, he or she has to pick up the slack if the other roommates can't make rent.

Possible disadvantages of cosigning a loan It could limit your borrowing power. Potential creditors decide whether or not to lend you money by looking at your existing debt-to-income ratio.It could lower your credit scores.It could damage your relationship with the borrower.

Under the Landlord and Tenant (Convenants) Act 1995 (LTCA 1995), a lease cannot be assigned by a tenant to that tenant's guarantor, even if the guarantor agrees.

If you do miss rent payments, not only may your guarantor be asked to remit those payments, but their credit score may take a devastating hit depending on how behind you are. You will most likely be hearing from a disgruntled guarantor if their credit takes a dive because of your financial mismanagement.

When you cosign a lease, you are agreeing to become 100 percent responsible for that lease. In other words, if your friend decides to skip town in their brand-new car and simultaneously stop paying their $300/month car lease payments, it's on you to foot the bill.

Cosigners have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the property occupant is unable to make the rental payment.

However, a landlord has the right to request a rent guarantor whenever they think there is a risk their new tenant might not pay their rent as and when they should.

Cosigners have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the property occupant is unable to make the rental payment.