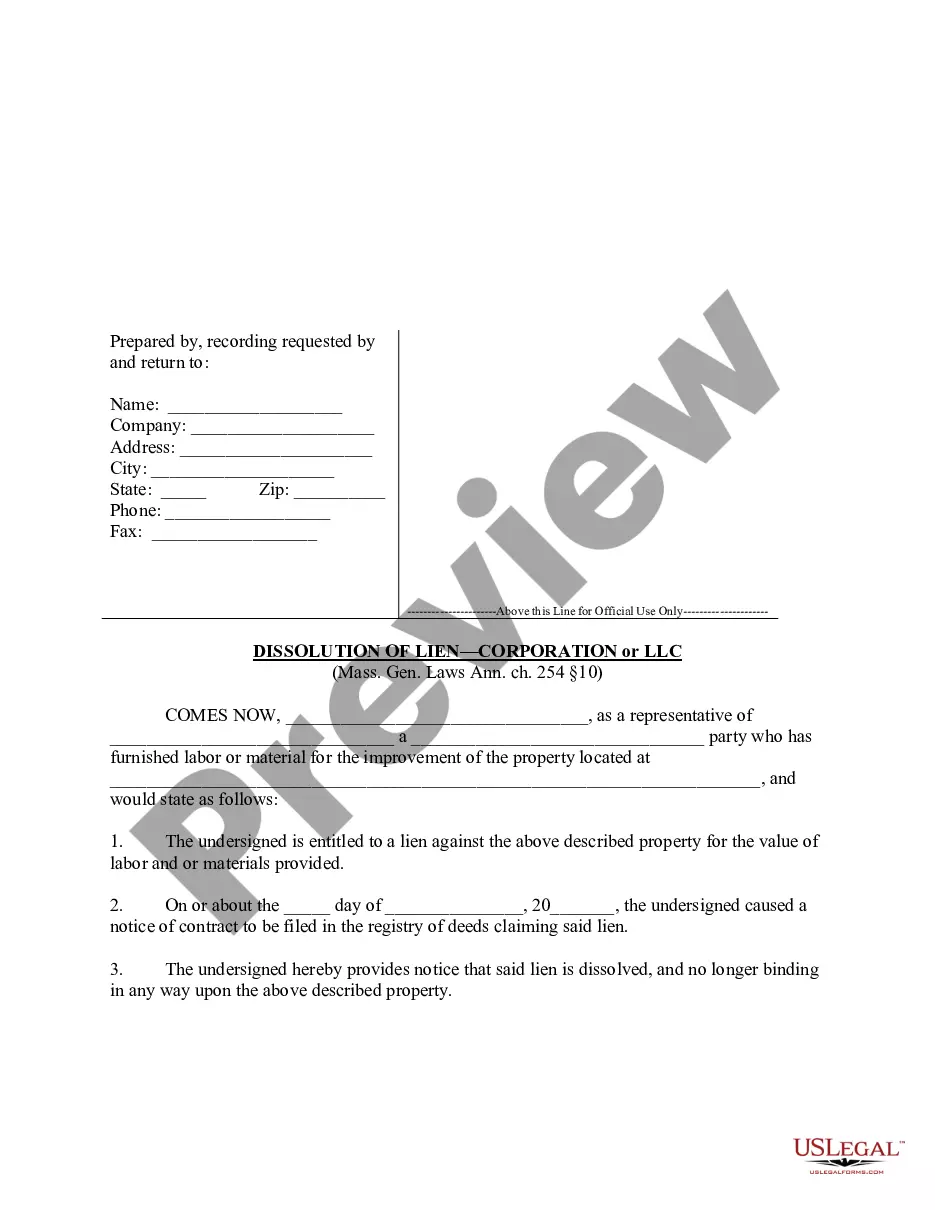

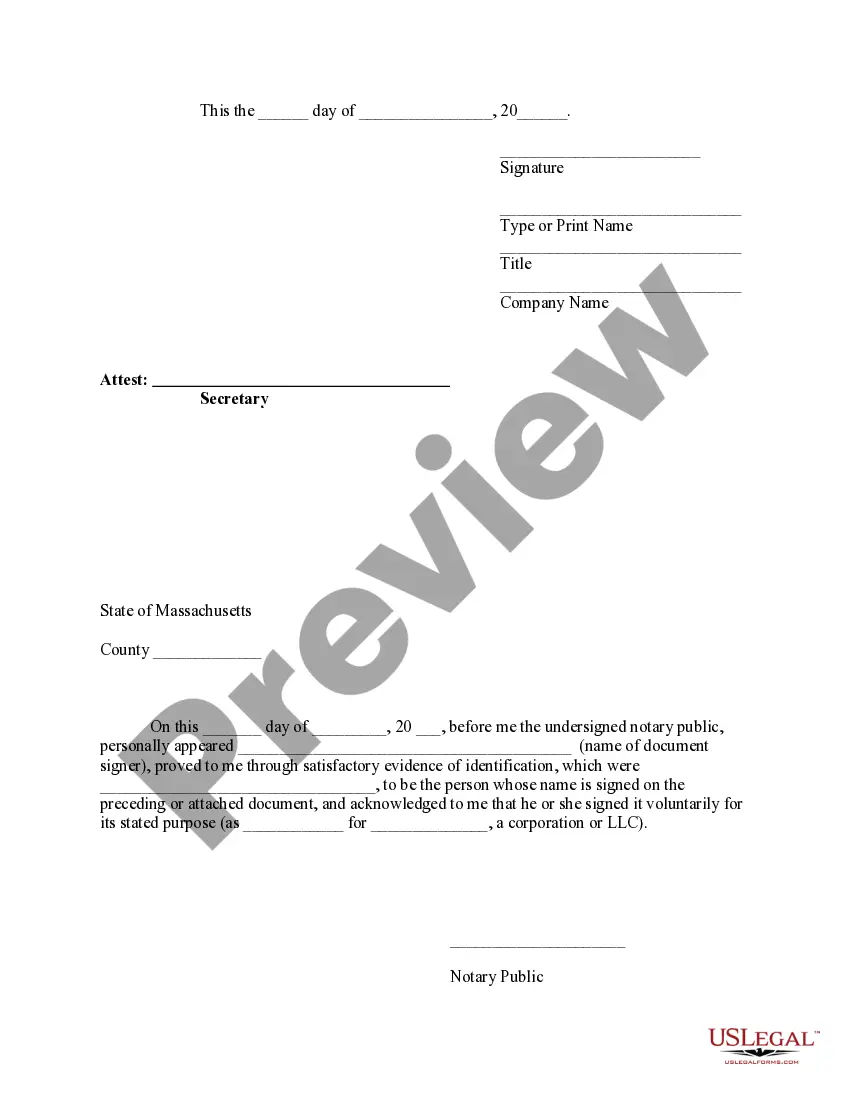

"The lien of any person may, so far as his interest is concerned, be dissolved by a notice signed by him, stating that his lien is dissolved, filed in the registry of deeds where the notice of the contract is filed under which contract the lien is claimed." Mass. Gen. Laws Ann. ch. 254 ?§10.

Boston Massachusetts Dissolution of Lien by Corporation or LLC

Description

How to fill out Massachusetts Dissolution Of Lien By Corporation Or LLC?

Regardless of one's societal or occupational standing, finalizing legal documents is an unfortunate requisite in the modern world.

Often, it is nearly impossible for an individual without any legal expertise to create such paperwork from scratch, chiefly because of the intricate language and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Ensure that the form you have selected is tailored to your area, as the laws of one state or region do not apply to another.

Preview the document and check a brief overview (if available) of the situations in which the form can be utilized.

- Our platform provides an extensive library with over 85,000 ready-to-use state-specific forms suitable for nearly every legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to enhance their efficiency with our DIY forms.

- Whether you require the Boston Massachusetts Dissolution of Lien by Corporation or LLC, or any other document suitable for your state or region, US Legal Forms offers everything at your fingertips.

- Here’s how to acquire the Boston Massachusetts Dissolution of Lien by Corporation or LLC in moments using our reliable platform.

- If you are already a customer, simply Log In to your account to retrieve the necessary form.

- However, if you are new to our platform, make sure to follow these steps before securing the Boston Massachusetts Dissolution of Lien by Corporation or LLC.

Form popularity

FAQ

Corporation Filing Requirements (Includes S Corporations) You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

If a corporation has failed to comply with the provisions of the General Laws requiring the filing of annual reports with the Division or tax returns with the Commissioner of Revenue or the payment of any taxes under M.G.L.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

Dissolution. The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.

A corporate dissolution may be ordered by the Court of Common Pleas to protect shareholders' investments. This may happen when three conditions exist: The directors of the company have engaged in illegal or fraudulent activities. Assets of the company have been spent unwisely or otherwise wasted.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

Involuntary dissolution is a judicial process where the court separates the warring partners by forcing a sale of ownership from one to the other, or by forcing a sale of the entire business. You use this process when all else has failed for a dispute between owners of a corporation or an LLC in California.

Steps to dissolve, surrender, or cancel a California business entity File all delinquent tax returns and pay all tax balances, including any penalties, fees, and interest. File the final/current year tax return.Cease doing or transacting business in California after the final taxable year.

A corporation may also be dissolved upon finding by a final judgment that the corporation was created for the purpose of committing, concealing, or aiding the commission of securities violations, smuggling, tax evasion, money laundering, or graft and corrupt practices; committed or aided in such acts, and its

Corporations Division Filing Fees Domestic Profit and Professional CorporationsCertificate of Dissolution$7.00Certificate of Good Standing$12.00 (This is not a Tax Good Standing)Foreign and Foreign Professional CorporationsRegistration in Massachusetts$400.00 ($375 if filed by fax)138 more rows