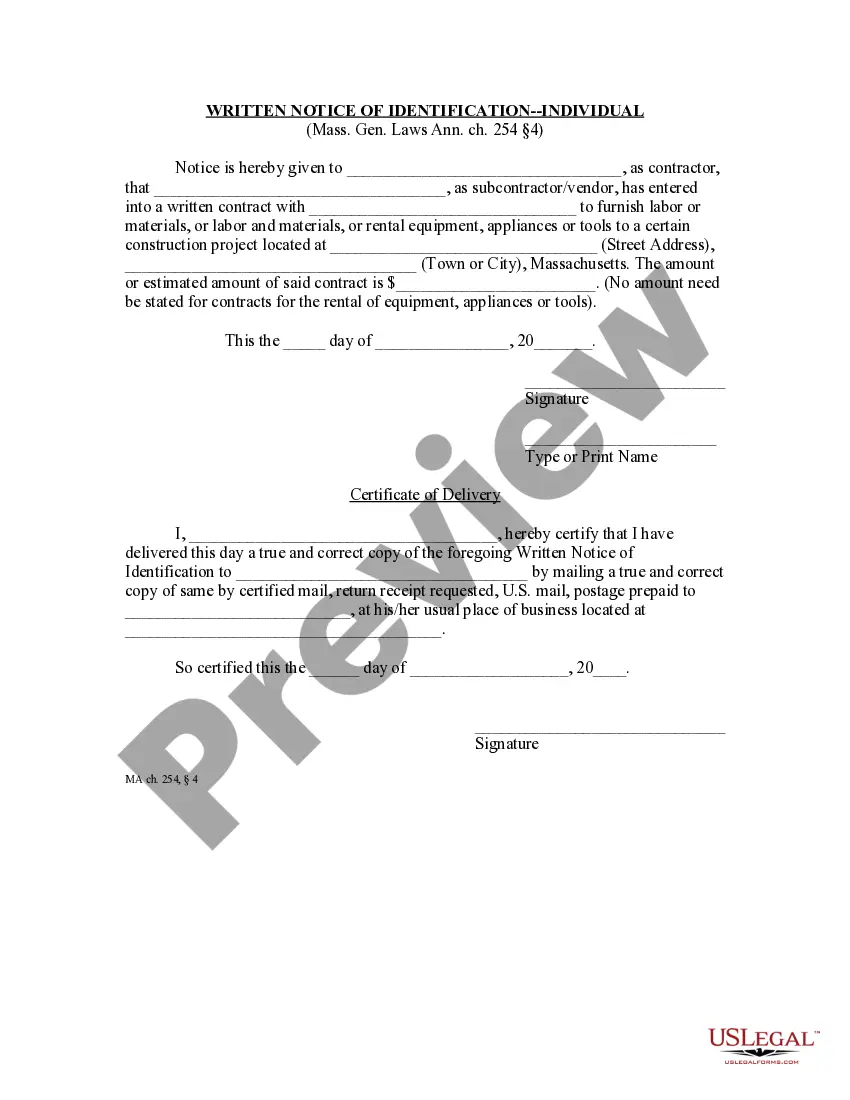

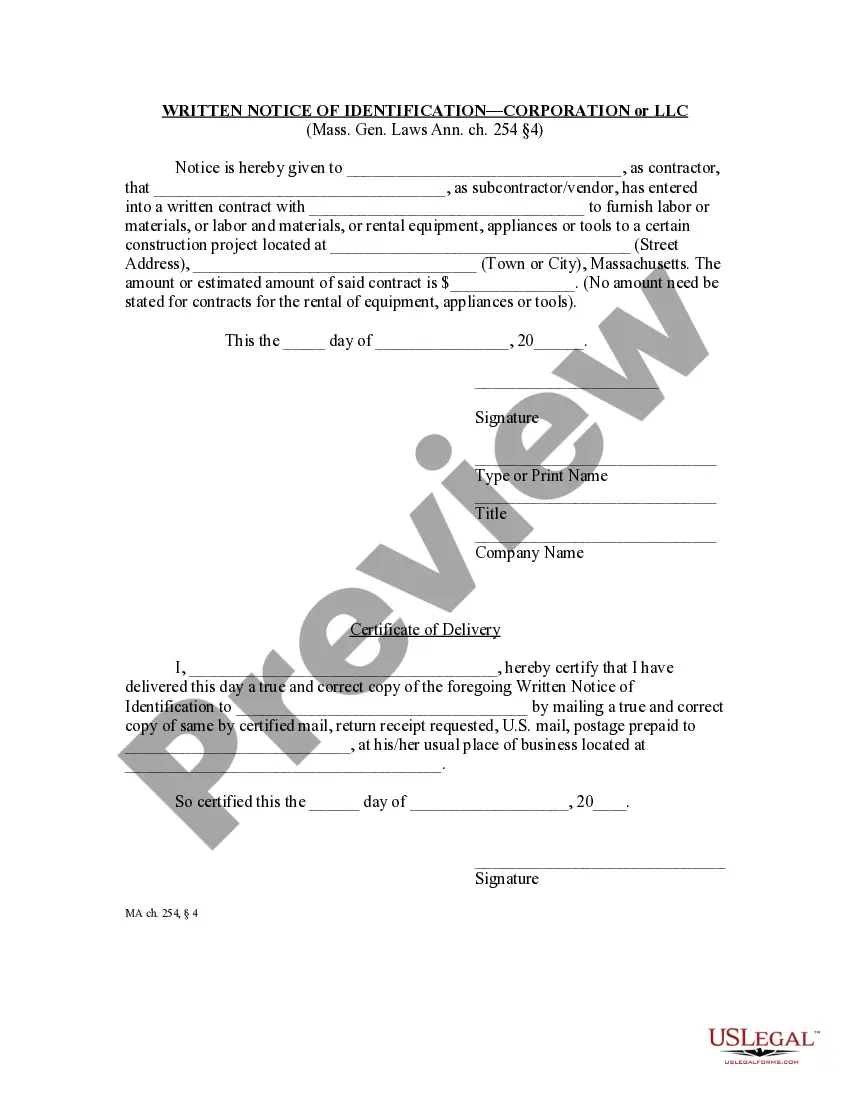

"If the person claiming a lien has no direct contractual relationship with the original contractor, except for liens for labor by persons defined in section one of this chapter, the amount of such lien shall not exceed the amount due or to become due under the subcontract between the original contractor and the subcontractor whose work includes the work of the person claiming the lien as of the date such person files his notice of contract, unless the person claiming such lien has, within thirty days of commencement of his performance, given written notice of identification by certified mail return receipt requested to the original contractor..." Mass. Gen. Laws Ann. ch. 254 §4.

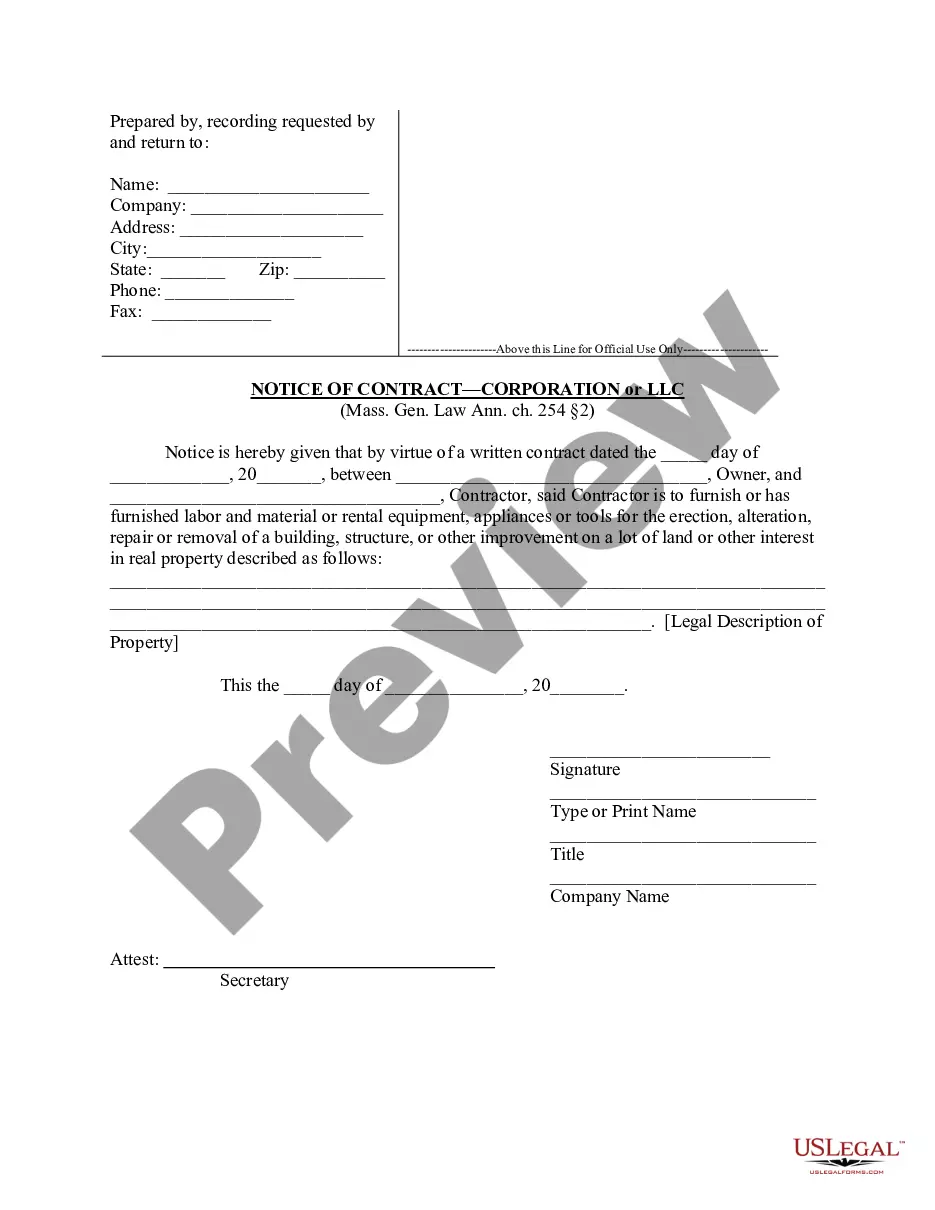

Boston Massachusetts Written Notice of Identification by Corporation or LLC

Description

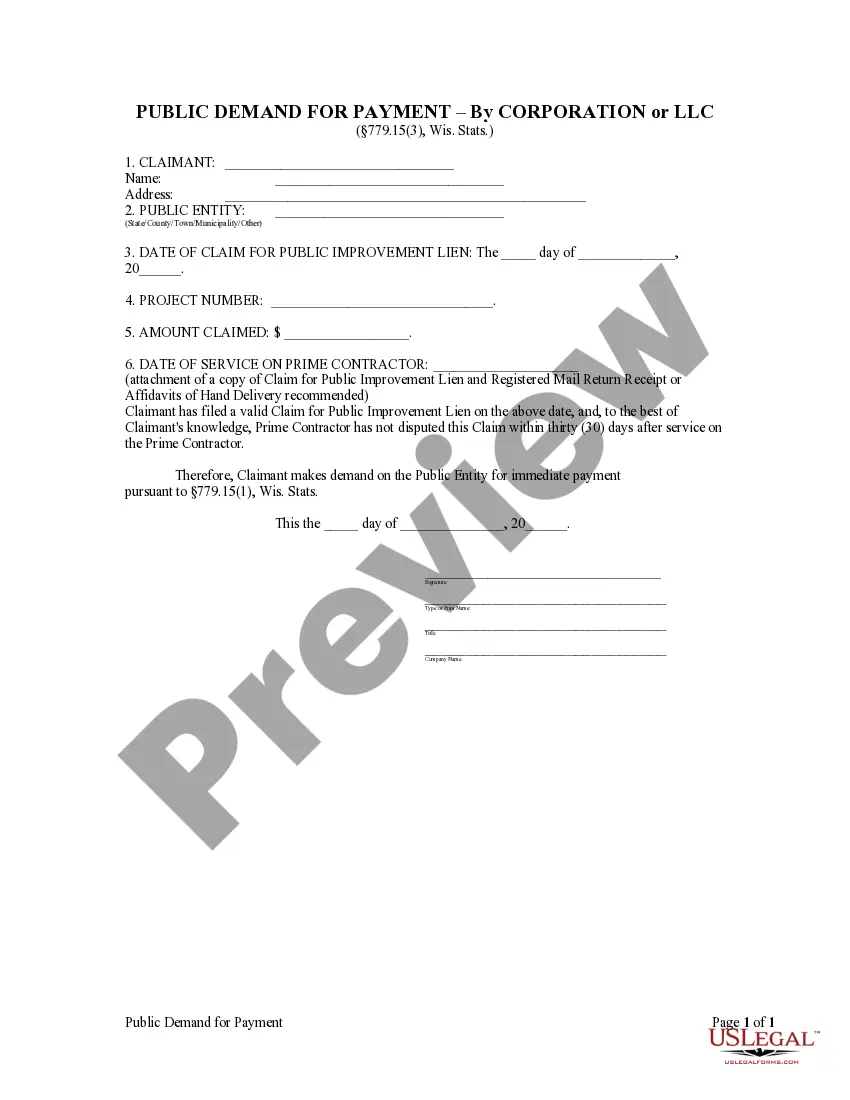

How to fill out Massachusetts Written Notice Of Identification By Corporation Or LLC?

If you are seeking a legitimate document, it’s incredibly challenging to discover a superior service compared to the US Legal Forms website – likely the most thorough collections available online.

With this collection, you can obtain a substantial amount of document examples for business and personal use by categories and locations, or keywords.

With the enhanced search functionality, locating the latest Boston Massachusetts Written Notice of Identification by Corporation or LLC is as simple as 1-2-3.

Complete the payment process. Utilize your credit card or PayPal account to finalize the registration steps.

Obtain the document. Choose the format and save it on your device. Make adjustments. Fill in, edit, print, and sign the obtained Boston Massachusetts Written Notice of Identification by Corporation or LLC.

- Moreover, the pertinence of every single document is verified by a team of skilled attorneys who consistently review the templates on our site and update them according to the newest state and county regulations.

- If you are already acquainted with our platform and possess an account, all you need to access the Boston Massachusetts Written Notice of Identification by Corporation or LLC is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first occasion, just adhere to the instructions outlined below.

- Ensure you have located the sample you require. Review its description and use the Preview option to examine its content. If it does not satisfy your needs, apply the Search box at the top of the page to find the relevant document.

- Verify your choice. Hit the Buy now button. Then, choose your desired subscription plan and submit details to create an account.

Form popularity

FAQ

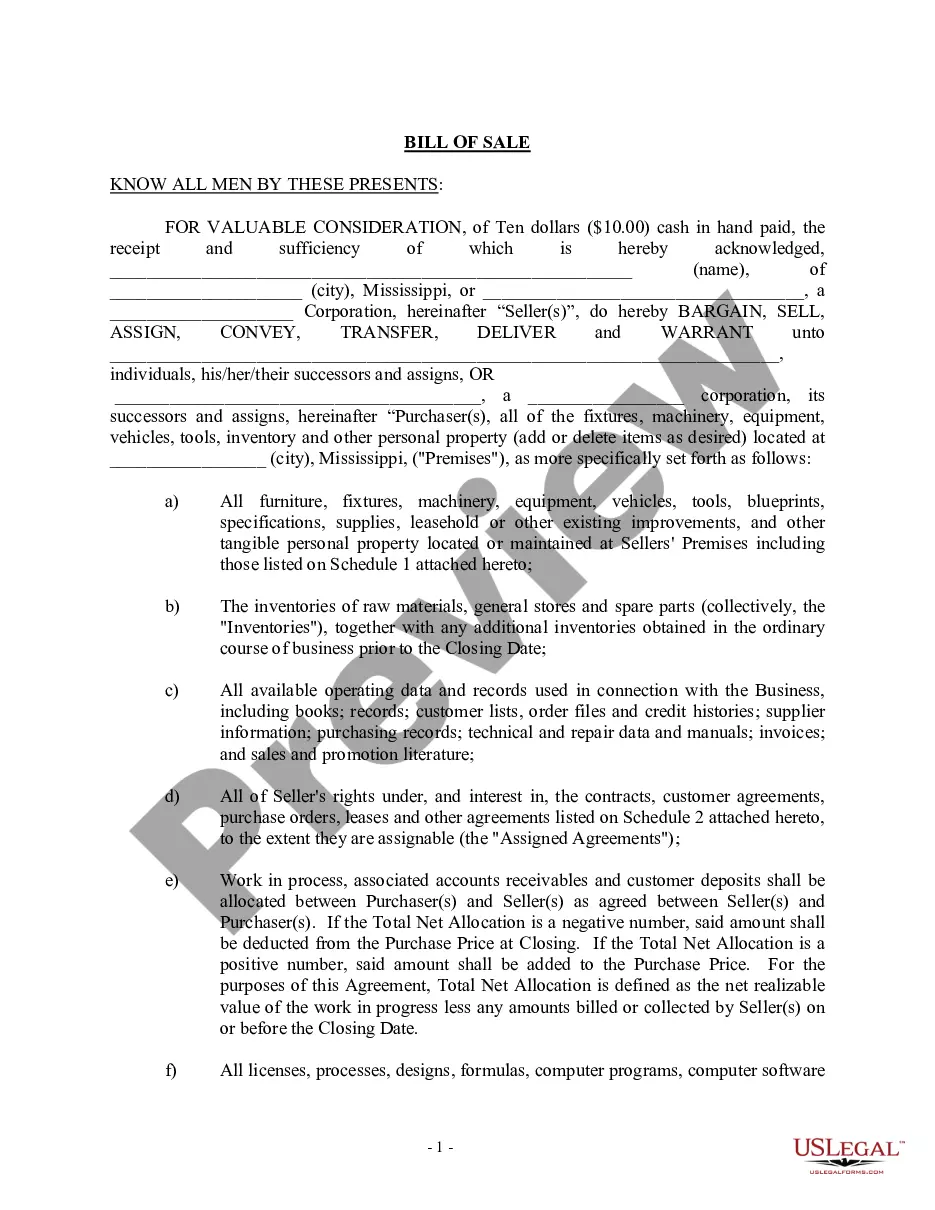

A Massachusetts corp is a legal entity that designates ownership through shareholders. To form this type of business, a corporation's shareholders will need to select an incorporator who will go through the process of creating the corporation.

A Massachusetts LLC (limited liability company) is a business type that provides limited liability and to its owners (called members) and flexible taxation and management options.

An LLC is a legal entity only and must choose to pay tax either as an S Corp, C Corp, Partnership, or Sole Proprietorship. Therefore, for tax purposes, an LLC can be an S Corp, so there is really no difference.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

Classification for Massachusetts income tax purposes An LLP or LLC will be treated as a corporation for Massachusetts income tax purposes if it is classified as such for federal tax purposes.

Head to the Massachusetts SOS website and type in your desired LLC name under the search of the Corporations Database.

You can find information on any corporation or business entity in Massachusetts or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

Corporate bylaws are legally required in Massachusetts. Massachusetts Gen L ch 156d § 2.06 (2019) requires either the incorporators or the board of directors to adopt bylaws. The board of directors typically adopt initial bylaws at the first organizational meeting.

The Massachusetts SOS (Secretary of State) allows individuals to perform entity searches via the LLC database and name reservations. If you find the entity you're looking for, you'll be able to view the following information: LLC name.