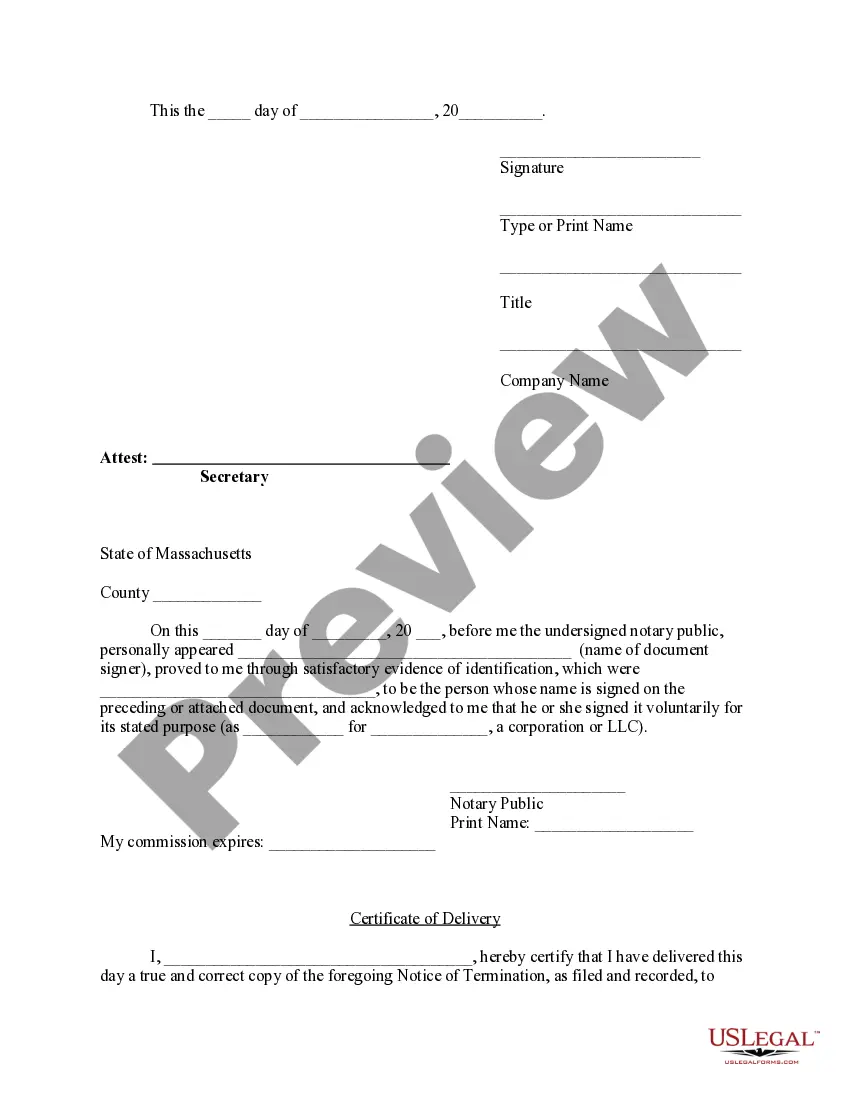

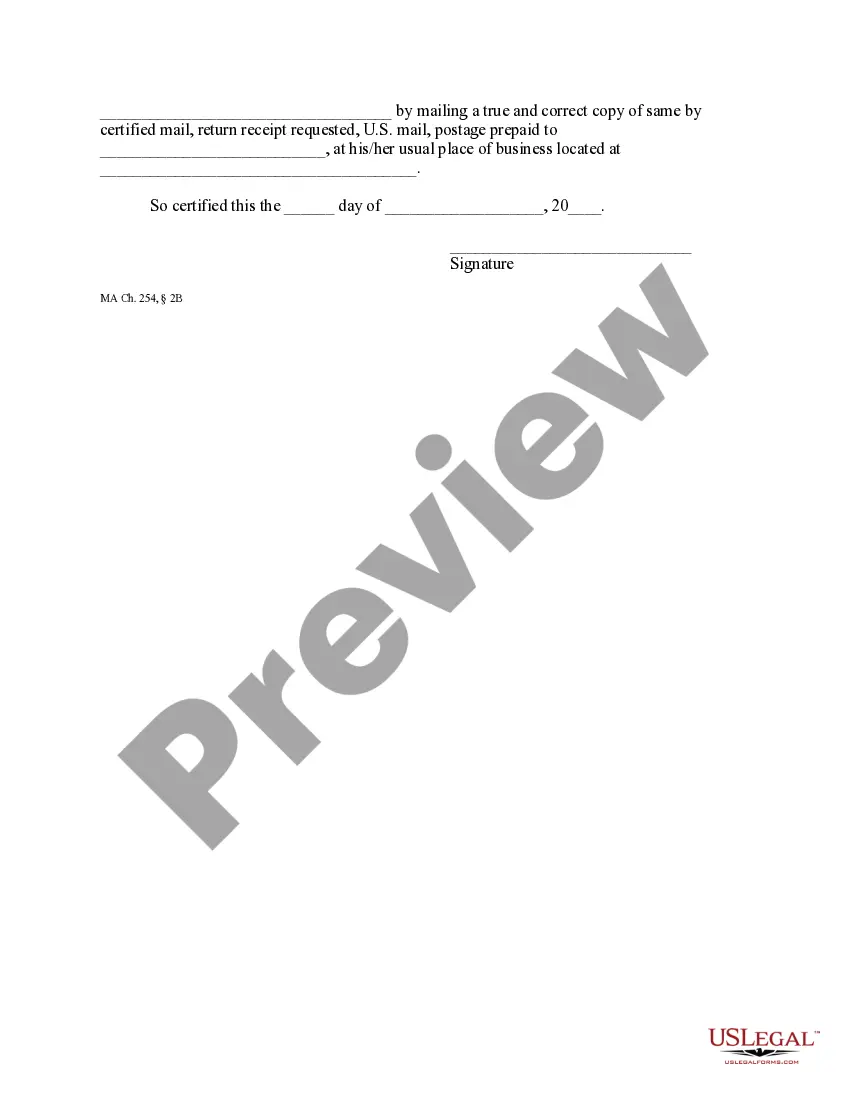

If in the event that a contract has been terminated prior to substantial completion, the owner shall provide a notice of termination by certified mail to every person who has filed or recorded a notice of contract and to the contractor. The contractor must then deliver a copy of said notice to every person who entered into a written contract directly with the contractor or who has given to the contractor written notice of identification.

Boston Massachusetts Notice of Termination by Corporation or LLC

Description

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

Do you require a trustworthy and budget-friendly provider of legal forms to obtain the Boston Massachusetts Notice of Termination by Corporation or LLC? US Legal Forms is your ideal option.

Whether you seek a straightforward agreement to establish guidelines for living with your partner or a collection of forms to advance your divorce through the judicial system, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business purposes. All templates we offer are not generic and are tailored to meet the specifications of individual states and counties.

To access the document, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates anytime from the My documents section.

Is this your first time visiting our website? No need to worry. You can set up an account in just a few minutes, but before doing that, ensure to take the following steps: Find out if the Boston Massachusetts Notice of Termination by Corporation or LLC adheres to your state and local regulations. Review the form’s description (if provided) to determine who and what the document is intended for. Restart your search if the form does not fit your particular circumstances.

Try US Legal Forms today, and say goodbye to wasting your precious time understanding legal documents online for good.

- Now you may register your account.

- Next, choose a subscription plan and proceed to payment.

- Once the payment is finalized, download the Boston Massachusetts Notice of Termination by Corporation or LLC in any available file type.

- You can revisit the website whenever necessary and redownload the document at no additional cost.

- Locating the latest legal forms has never been simpler.

Form popularity

FAQ

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

There is a $100 fee to file the articles of dissolution. Articles filed by mail are usually processed in 3-5 business days, filings delivered by hand usually require 1-2 business days, and faxed documents generally are processed the same day.

Corporation Filing Requirements (Includes S Corporations) You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

There is a $100 filing fee to dissolve your Massachusetts Limited Liability Company. If you file by fax, you will have to pay an additional $9 fee for expedited processing.

You can find information on any corporation or business entity in Massachusetts or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

The Massachusetts SOS (Secretary of State) allows individuals to perform entity searches via the LLC database and name reservations. If you find the entity you're looking for, you'll be able to view the following information: LLC name.

Head to the Massachusetts SOS website and type in your desired LLC name under the search of the Corporations Database.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

Corporations Division Filing Fees Domestic Profit and Professional CorporationsCertificate of Dissolution$7.00Certificate of Good Standing$12.00 (This is not a Tax Good Standing)Foreign and Foreign Professional CorporationsRegistration in Massachusetts$400.00 ($375 if filed by fax)138 more rows