New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Louisiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

No matter your social or professional standing, completing law-related paperwork is a regrettable requirement in today’s society.

Frequently, it’s nearly impossible for someone lacking any legal knowledge to create this type of documentation from scratch, primarily due to the complex terminology and legal nuances involved.

This is where US Legal Forms steps in to assist.

Ensure that the template you’ve selected is applicable to your location, as regulations from one state or area may not apply to another.

Review the document and read any available brief description of the scenarios for which the form is applicable.

- Our platform provides an extensive collection of over 85,000 state-specific documents that are suitable for virtually any legal situation.

- US Legal Forms is also an excellent resource for associates or legal representatives aiming to save time by using our DIY forms.

- Whether you seek the New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors or any other valid paperwork for your state or region, US Legal Forms has it available.

- Here’s how to quickly access the New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors using our dependable platform.

- If you are an existing subscriber, simply Log In to your account to acquire the required form.

- However, if you are new to our library, be sure to follow these steps before obtaining the New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors.

Form popularity

FAQ

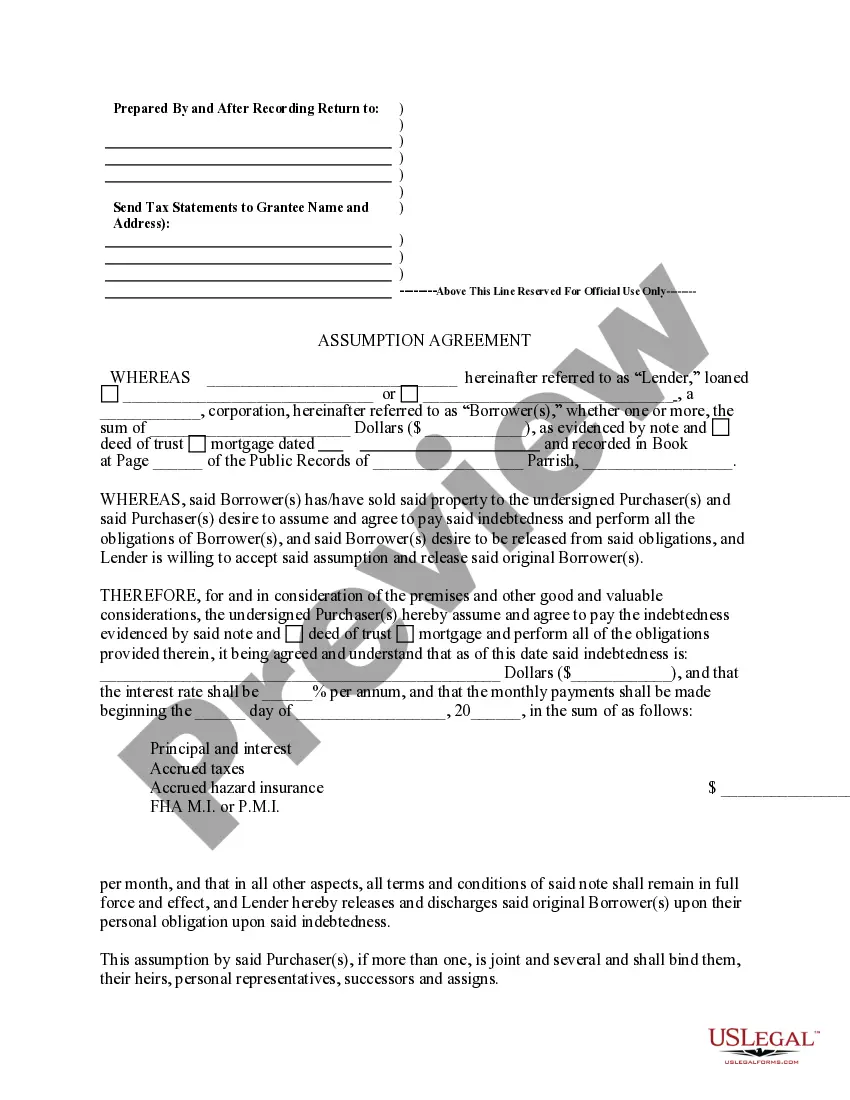

An assumption agreement for a mortgage is a legal document that details the transfer of mortgage responsibility from one party to another. In essence, it outlines the terms under which the buyer will assume the seller's mortgage. The New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors provides clarity about the rights, obligations, and release of the original mortgagors. It ensures that all parties involved are protected and aware of their responsibilities under the new agreement.

The process of assuming a mortgage begins with the buyer and seller agreeing to the assumption. The buyer must then submit a formal request to the lender, often accompanied by a credit application. Upon lender approval, the New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors is executed, allowing the buyer to take over the mortgage. Completing this transaction requires attention to detail and may benefit from legal assistance to ensure all terms are met.

The purpose of the New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors is to allow a buyer to take over the seller's mortgage. This agreement helps to simplify the transfer of property by ensuring that all parties understand their rights and responsibilities. It can also protect the seller from potential liability associated with the mortgage after the sale. Overall, it facilitates a smoother transition in ownership.

To assume a mortgage in New Orleans, Louisiana, you generally need the lender's approval. You'll also need to complete the New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors, which documents the transfer of responsibility from the original borrower to you. Additionally, financial qualifications such as credit checks or income verification might be required to ensure you can meet the mortgage obligations. Using a service like uslegalforms can streamline this process and provide you with the necessary documents.

When assuming a mortgage, specific documents are typically required to facilitate the process. You will need the original mortgage contract, identification, and possibly financial documents to show your ability to fulfill the financial obligation. Additionally, a New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors will be essential for formalizing the transfer of responsibility.

To take over a mortgage from a family member, you should first consult the lender about their policies on mortgage assumptions. This often involves completing a New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors to legally transfer the mortgage obligations to you. Ensuring that all relevant paperwork is in order makes this transition smoother and protects all parties involved.

Assuming someone's mortgage can vary in difficulty based on the lender's requirements and the mortgage type. Generally, if the lender allows for the assumption, the process is straightforward but may require legal documentation. A New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors can simplify this process, helping you confidently navigate the required steps.

Assuming a mortgage from a family member involves clear steps. Start by reaching out to the lender to express your intention to assume the mortgage. You will likely need to fill out a New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors to finalize the agreement, ensuring that all necessary documentation is properly submitted.

To assume a mortgage from a family member after their death, you usually need to follow specific legal protocols. Typically, you must first contact the lender to inform them of the situation and request the assumption of the mortgage. After this, you may require a New Orleans Louisiana Assumption Agreement of Mortgage and Release of Original Mortgagors to formalize the transfer and ensure all parties are protected.