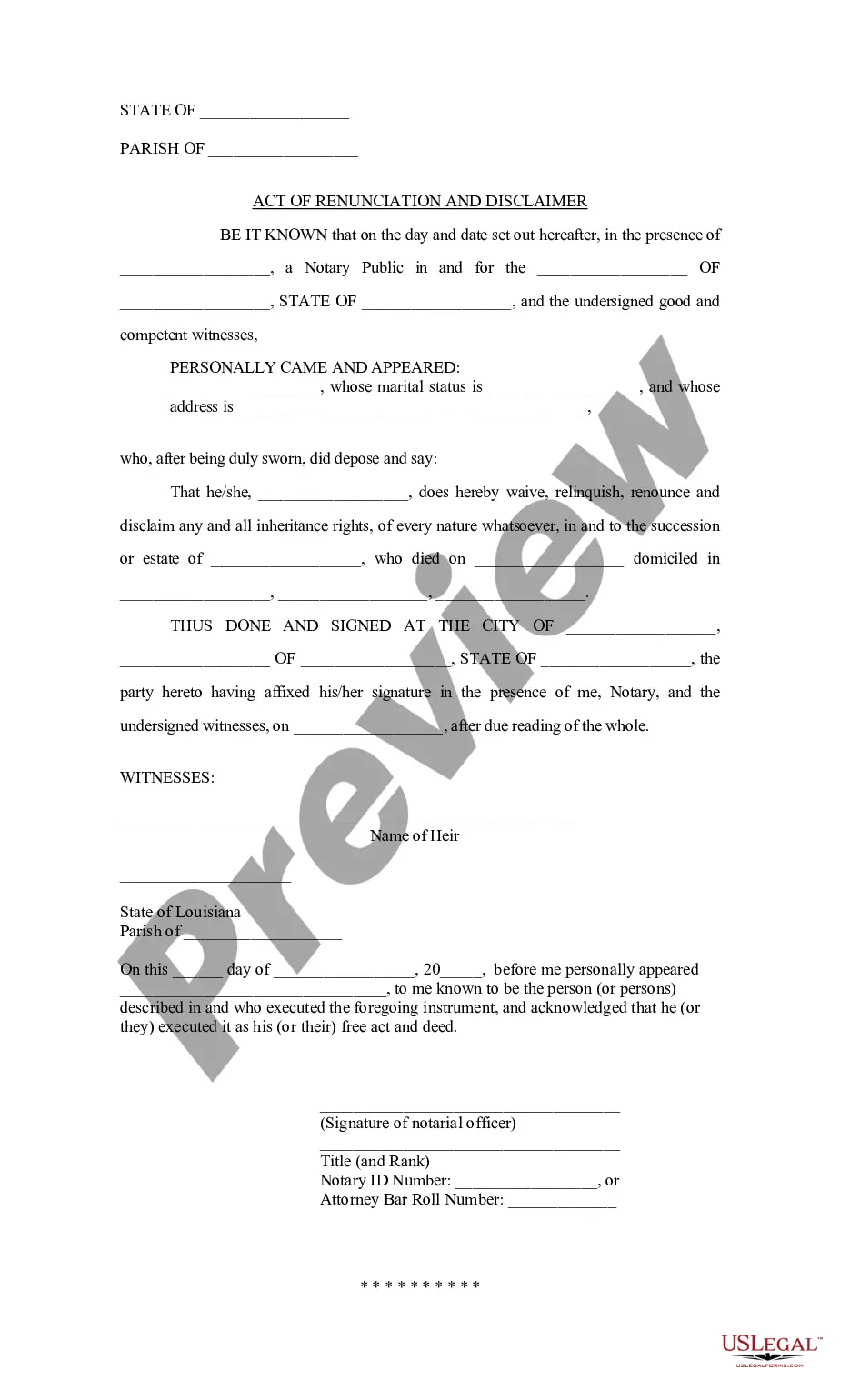

Baton Rouge Louisiana Act of Renunciation and Disclaimer

Description

How to fill out Louisiana Act Of Renunciation And Disclaimer?

We consistently aim to mitigate or evade legal complications when managing intricate legal or financial matters.

To achieve this goal, we subscribe to legal services that are typically quite costly.

Nonetheless, not every legal issue is of equal complexity. A majority of them can be handled independently.

US Legal Forms is an online repository of current DIY legal documents covering a range of needs from wills and power of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it in the My documents section.

- Our platform empowers you to manage your own affairs without relying on attorney services.

- We provide access to legal document templates that might not always be publicly available.

- Our templates are specific to states and regions, greatly easing the search process.

- Utilize US Legal Forms when you need to find and obtain the Baton Rouge Louisiana Act of Renunciation and Disclaimer or any other document swiftly and securely.

Form popularity

FAQ

Disinheritance in Louisiana refers to legally excluding an heir from receiving a portion of an estate. This process requires specific actions, such as properly executing a will or a documented declaration of disinheritance. The Baton Rouge Louisiana Act of Renunciation and Disclaimer plays a significant role in ensuring that one's desires about estate distribution are legally binding and respected. It's crucial to understand this law as it allows individuals to manage their legacy intentionally.

Transferring property after a parent's death without a will in Louisiana involves following the intestacy laws, which dictate how property gets divided among surviving relatives. You may need to petition the court for a succession process to legally transfer the property title. The Baton Rouge Louisiana Act of Renunciation and Disclaimer can aid in clarifying who should inherit the property, ensuring that rightful heirs receive what they deserve in accordance with Louisiana law. Utilizing available resources simplifies this process.

In Louisiana, a spouse does not automatically inherit everything unless there are no children or other heirs. The inheritance system is influenced by community property laws, which may entitle a spouse to at least half of the joint property. However, the specifics can vary based on individual circumstances, such as children from previous relationships. Utilizing the Baton Rouge Louisiana Act of Renunciation and Disclaimer can help clarify any potential claims and support your planning needs.

In Louisiana, if an individual dies without a will, the state laws of intestate succession determine who inherits the property. Generally, the deceased's surviving spouse and children will have priority over inheritance rights. If there are no immediate family members, more distant relatives may inherit, based on state laws. The Baton Rouge Louisiana Act of Renunciation and Disclaimer is useful for individuals seeking to clarify their intentions regarding property distribution to ensure their wishes are honored.

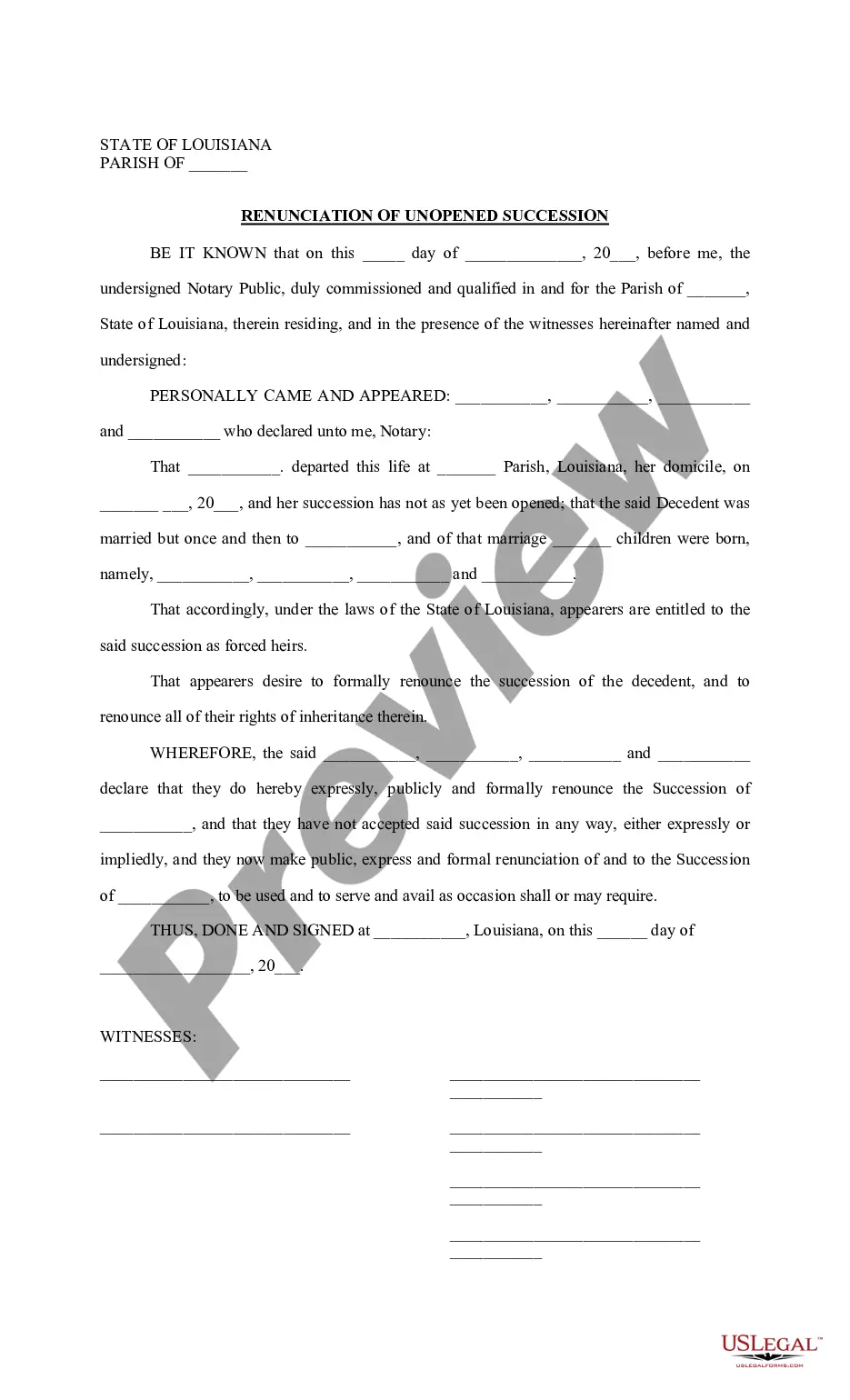

Renunciation, in a legal context, refers to the formal rejection of a right or interest in property. The Baton Rouge Louisiana Act of Renunciation and Disclaimer allows individuals to renounce their inheritance or claims to property, ensuring that those assets can be passed on according to the deceased's wishes. This process can help simplify estate matters and avoid complications in the distribution of assets. Understanding this concept can assist you in making informed decisions about your estate.

In Louisiana, when a jointly owned property experiences the death of one owner, it typically passes directly to the surviving owner, under the principle of last surviving spouse or joint tenancy. The Baton Rouge Louisiana Act of Renunciation and Disclaimer may come into play if the deceased owner wishes to renounce their interest in the property. This means the property will not form part of their estate, simplifying the transfer process. Understanding these provisions can ensure smooth management of jointly owned assets.

In Louisiana, you have a maximum of three years from the date of death to file a will with the court. However, it is advisable to file the will as soon as possible to begin the succession process without delay. If you are uncertain about the implications of the Baton Rouge Louisiana Act of Renunciation and Disclaimer, consider seeking assistance to avoid missing any important deadlines and ensure a smooth process.

Closing a succession in Louisiana typically involves filing a final accounting with the court, detailing all transactions that occurred during the administration of the estate. If you are facing challenges in this process, the Baton Rouge Louisiana Act of Renunciation and Disclaimer can serve as a helpful tool, allowing beneficiaries to disclaim their interests. Ensure that all debts and taxes are settled before you submit your final closing documents to the court to avoid future complications.

To file a succession in Louisiana, begin by gathering necessary documents, including the death certificate, will, and any relevant property titles. Next, you must submit these documents to the appropriate court, which is usually the district court in the parish where the deceased resided. In Baton Rouge, Louisiana, using the Act of Renunciation and Disclaimer can simplify the process by allowing heirs to formally relinquish their rights to an estate, helping you navigate complex succession matters.

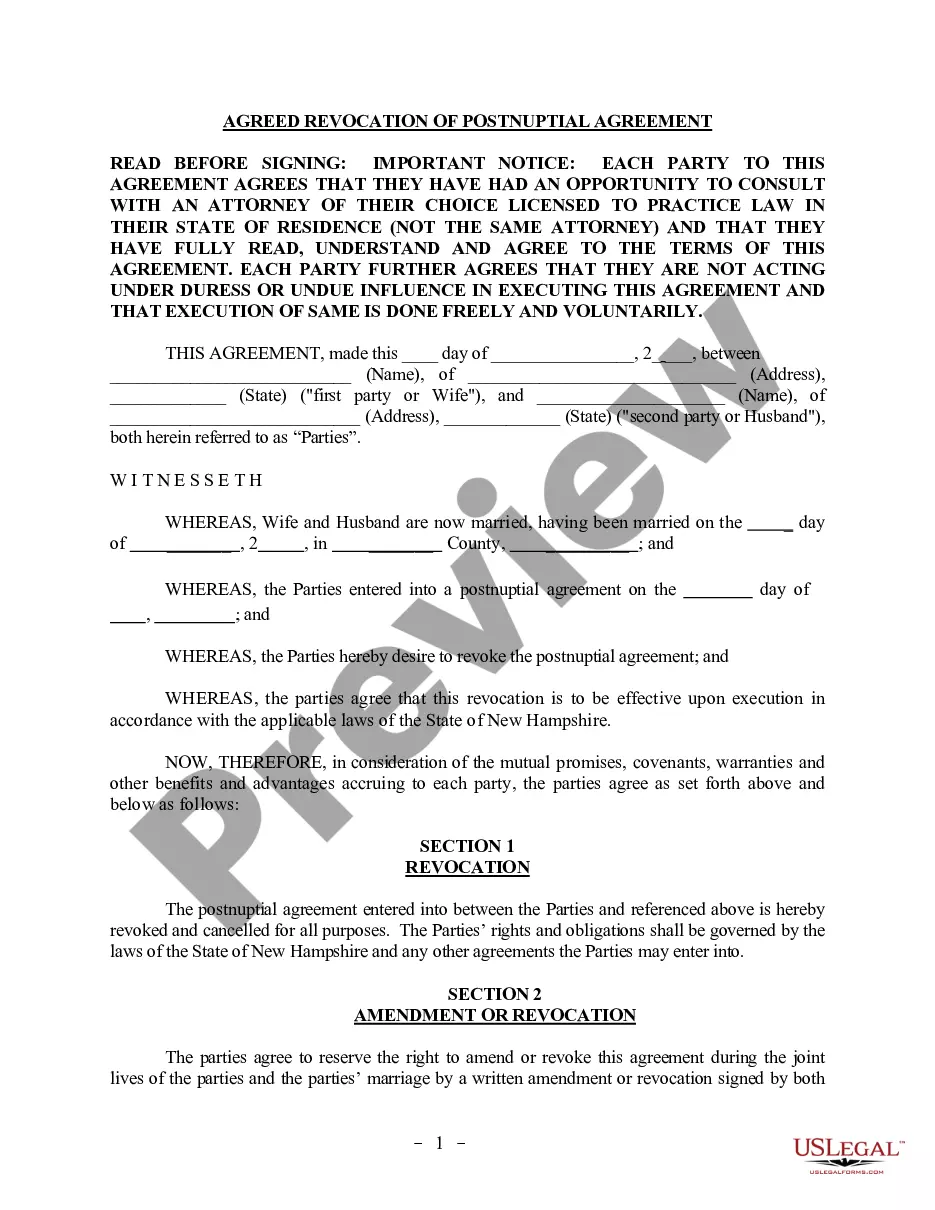

In Baton Rouge, Louisiana, separate property primarily includes assets owned individually before marriage, gifts received directly by one spouse, and inheritances. These assets remain distinct under the Baton Rouge Louisiana Act of Renunciation and Disclaimer, safeguarding them during legal proceedings. Understanding what constitutes separate property allows individuals to better manage and protect their assets.