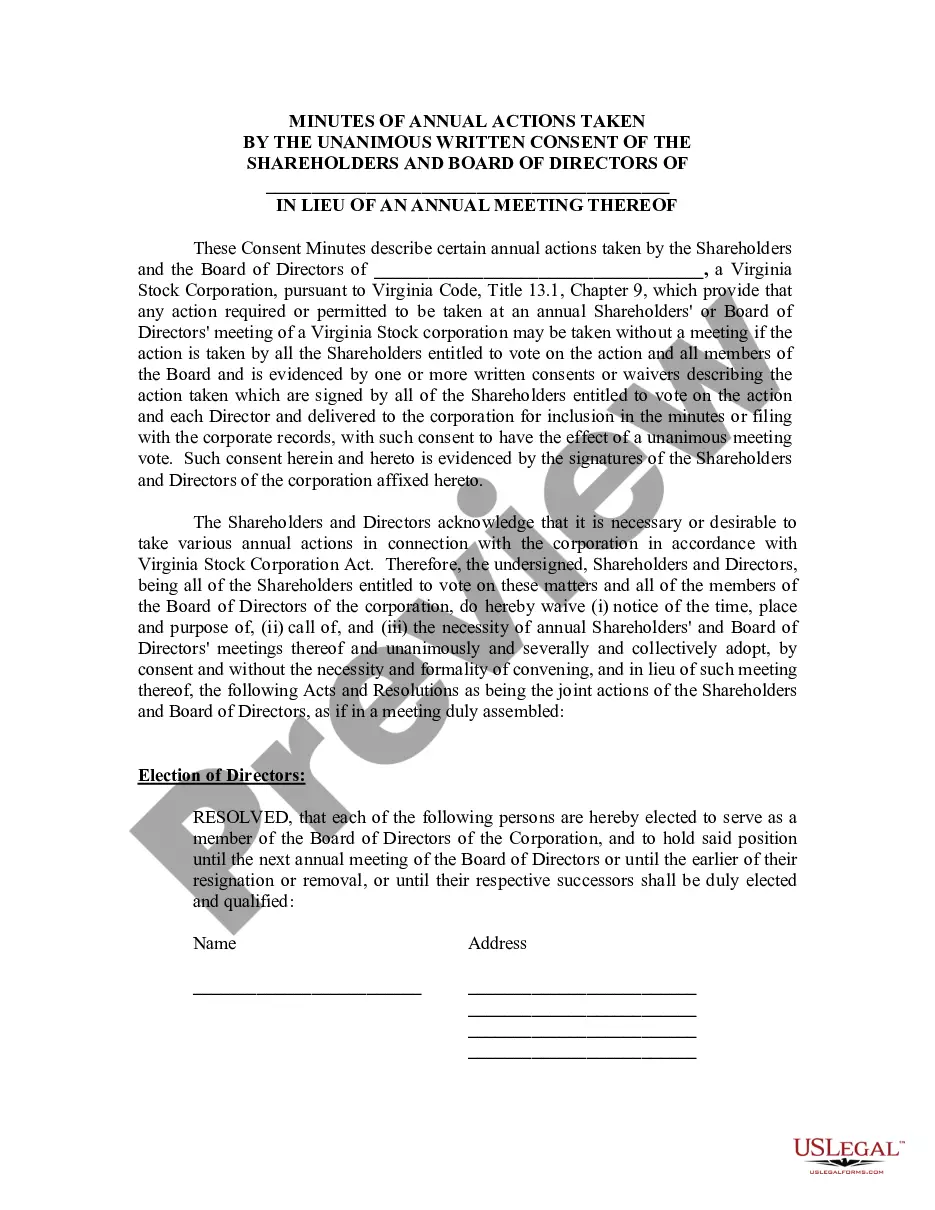

Baton Rouge Louisiana Partnership Agreement between Two Partners

Description

How to fill out Louisiana Partnership Agreement Between Two Partners?

Irrespective of one's social or occupational standing, completing law-related paperwork is a regrettable requirement in today’s workplace.

Frequently, it’s nearly unfeasible for an individual lacking legal education to produce these types of documents from the ground up, primarily due to the intricate jargon and legal subtleties they incorporate.

This is where US Legal Forms can be a game changer.

Ensure the template you have located is relevant to your area because the laws of one state or county may not apply to another.

Review the document and examine a brief summary (if available) of the situations for which the document may be utilized.

- Our platform provides an extensive repository with over 85,000 ready-to-use state-specific forms that cater to virtually any legal scenario.

- US Legal Forms also serves as a valuable resource for associates or legal advisors who wish to save time using our DIY papers.

- No matter if you need the Baton Rouge Louisiana Partnership Agreement between Two Partners or any other documentation that fits your jurisdiction, with US Legal Forms, everything is readily accessible.

- Here’s how you can swiftly acquire the Baton Rouge Louisiana Partnership Agreement between Two Partners using our trustworthy platform.

- If you are already a registered user, feel free to Log In to your account to download the relevant form.

- However, if you are new to our library, make sure to follow these instructions before downloading the Baton Rouge Louisiana Partnership Agreement between Two Partners.

Form popularity

FAQ

A partnership agreement between partners is a document that lays out the terms and conditions of the business relationship. In Baton Rouge, this agreement includes aspects such as profit sharing, decision-making processes, and procedures for resolving disputes. Creating a detailed Baton Rouge Louisiana Partnership Agreement between Two Partners is essential for establishing expectations and responsibilities. Platforms like USLegalForms can assist you in developing a robust agreement that meets all legal requirements.

The rule of partnership essentially refers to the responsibilities and rights each partner holds within the business relationship. In Baton Rouge, partners are jointly responsible for the partnership's debts and obligations, meaning each partner contributes to both profits and losses. Having a clear Baton Rouge Louisiana Partnership Agreement between Two Partners is vital for outlining these rules and ensuring all parties understand their roles. This clarity can significantly reduce potential conflicts.

To write a solid agreement between two partners in Baton Rouge, start by clearly defining the partnership's purpose and vision. Next, outline terms such as ownership shares, profit distribution, roles, and responsibilities of each partner. Incorporating a well-structured Baton Rouge Louisiana Partnership Agreement between Two Partners is crucial as it provides a legal framework to address conflicts. You can use online platforms like USLegalForms to draft a comprehensive agreement tailored to your needs.

In Baton Rouge, Louisiana, a partnership does not have a formal filing requirement with the state. However, partners may choose to register a trade name if they operate under a name different from their own. It's also advisable to create a Baton Rouge Louisiana Partnership Agreement between Two Partners to outline the roles, responsibilities, and profits shared. This agreement helps prevent disputes and ensures clarity among partners.

To form a partnership in Louisiana, you need to create a detailed Baton Rouge Louisiana Partnership Agreement between Two Partners. This agreement should specify the roles and contributions of each partner, as well as guidelines for managing the partnership. After completing the agreement, register your partnership with the state and secure any required licenses to begin your business operations.

Partnerships in Louisiana do not file a separate tax return for the entity itself. Instead, each partner files their share of partnership income on their individual tax returns. For partners in a Baton Rouge Louisiana Partnership Agreement between Two Partners, it is important to keep accurate records for personal tax filings and to ensure compliance with state tax laws.

A domestic partnership in Louisiana is a legal or personal relationship between individuals who live together and share a domestic life but are not married. This relationship can be relevant for those entering into a Baton Rouge Louisiana Partnership Agreement between Two Partners, as personal circumstances may affect business partnerships. Understanding the implications of domestic partnerships is crucial for legal and tax considerations.

Certain types of income are exempt from Louisiana income tax, including Social Security benefits, certain retirement pensions, and some capital gains from the sale of property. This exemption can be particularly advantageous for partners in a Baton Rouge Louisiana Partnership Agreement between Two Partners, allowing them to maximize their income. Always consult a tax professional to understand your specific situation.

In Louisiana, individuals, businesses, and partnerships are required to file a tax return if they earn income that exceeds a certain threshold. This includes partners in a Baton Rouge Louisiana Partnership Agreement between Two Partners, as their distributive share of partnership income is subject to tax. It’s crucial to check current regulations to ensure compliance with all tax obligations.

Forming a partnership in Louisiana involves selecting a business name and drafting a Baton Rouge Louisiana Partnership Agreement between Two Partners. This agreement should detail the roles, responsibilities, and contributions of each partner, as well as the profit-sharing arrangement. After finalizing the agreement, you may need to register your partnership with the state and obtain any necessary licenses.