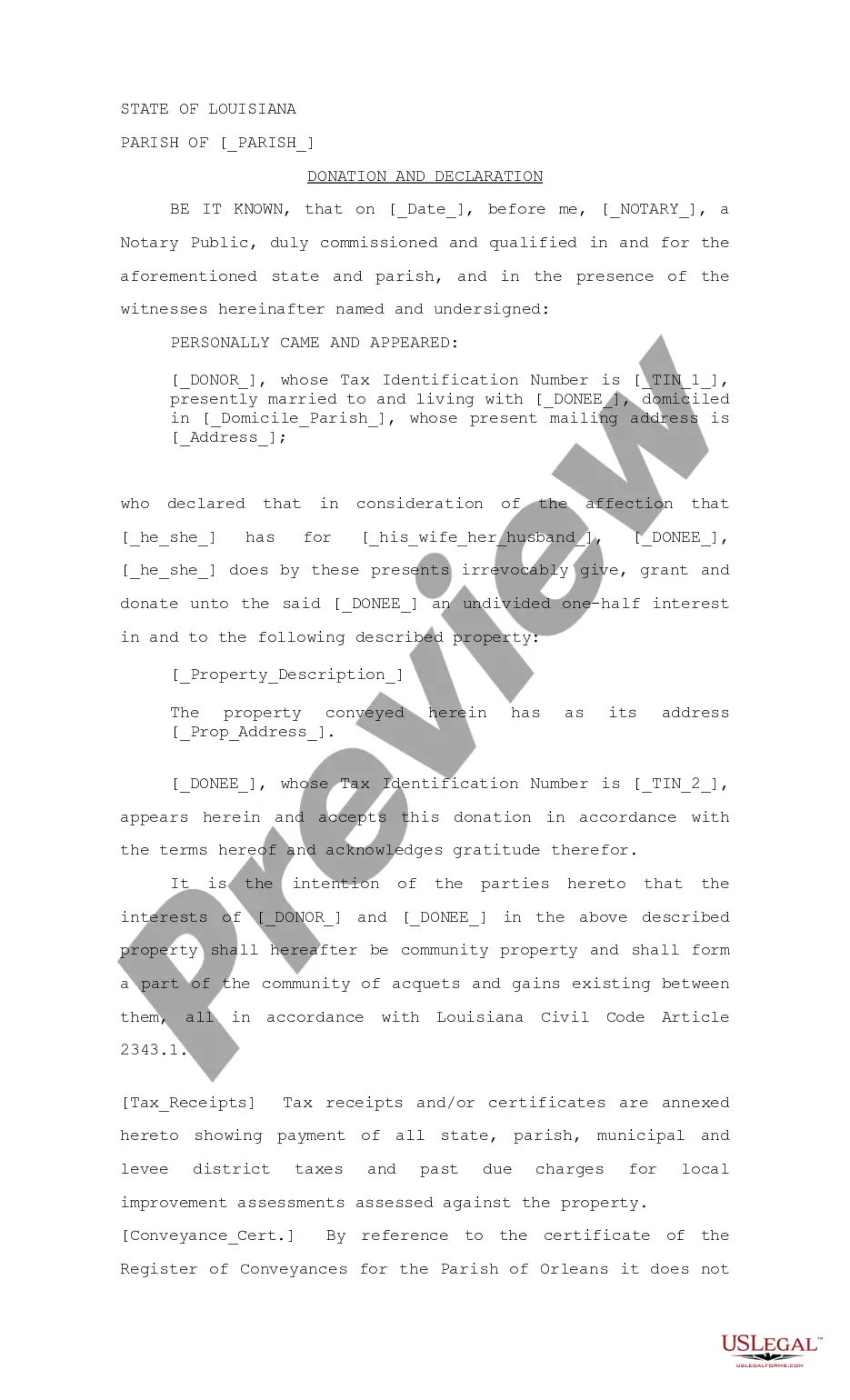

Baton Rouge Louisiana Donation and Declaration

Description

How to fill out Louisiana Donation And Declaration?

If you've previously made use of our service, Log In to your account and retrieve the Baton Rouge Louisiana Donation and Declaration on your device by selecting the Download button. Ensure your subscription is active. If not, renew it based on your payment arrangement.

If this marks your initial encounter with our service, follow these straightforward steps to obtain your document.

You have ongoing access to all documents you have purchased: you can locate them in your profile under the My documents section whenever you need to access them again. Utilize the US Legal Forms service for a convenient way to discover and store any template for your personal or professional requirements!

- Confirm you've located an appropriate document. Review the description and utilize the Preview option, if available, to verify if it aligns with your needs. If it doesn't suit you, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Baton Rouge Louisiana Donation and Declaration. Choose the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Form 540 in Louisiana is a declaration form used for state tax filings, specifically for claiming various credits and deductions. It is often associated with personal income returns. Familiarizing yourself with Form 540 can help ensure that you are accurately reporting your income and claiming any eligible benefits. Resources available on US Legal Forms can assist you in completing this form correctly.

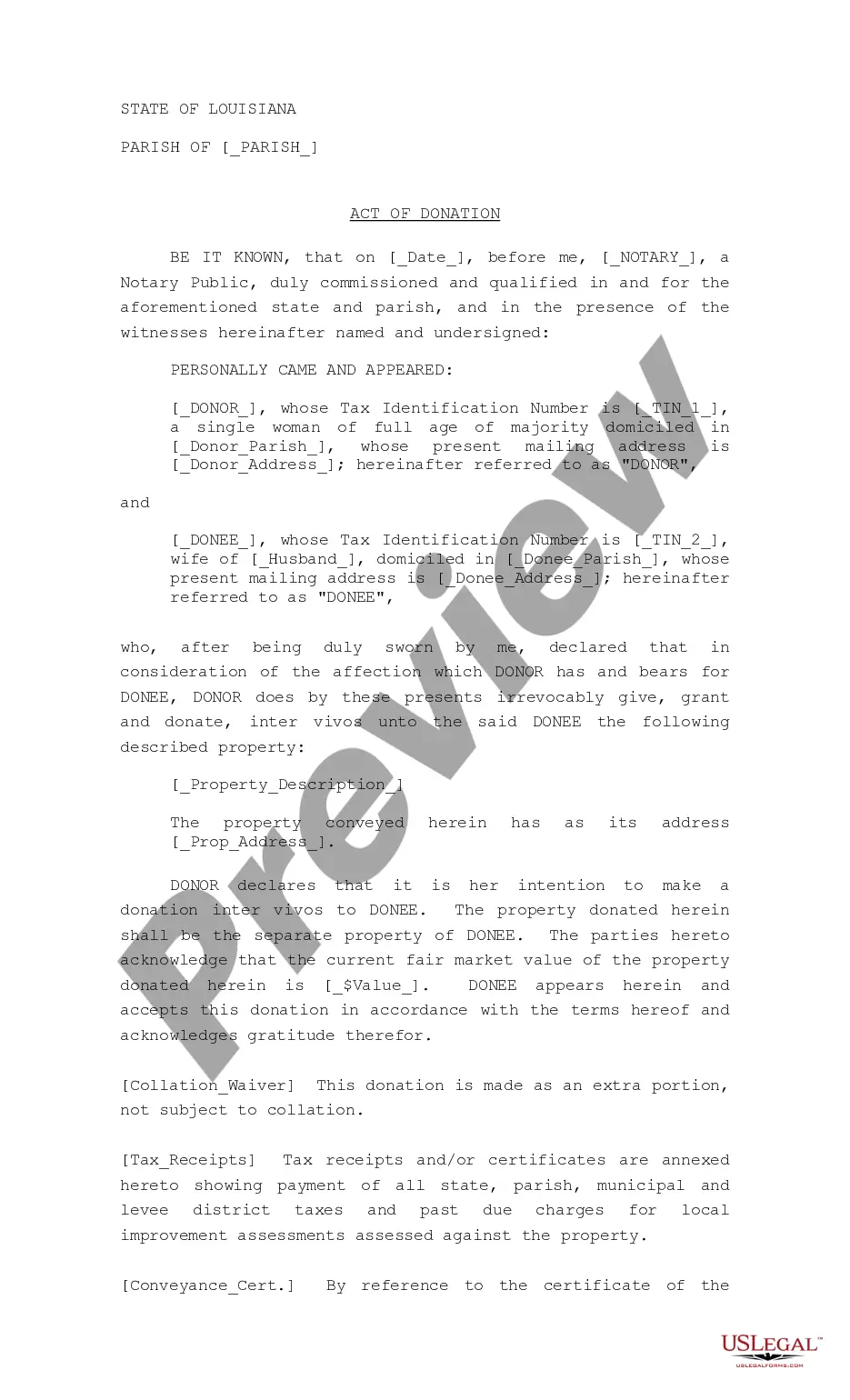

An act of donation in Louisiana property is a legal document that transfers ownership of a property from one person to another without payment. This type of act is significant in estate planning and can also serve tax planning purposes. By executing an act of donation, you allow the recipient to enjoy the benefits of ownership immediately. For those navigating this process, US Legal Forms provides resources tailored to Baton Rouge Louisiana Donation and Declaration.

Yes, if you're an independent contractor or entity making payments to others, you need to file Form 1099 with the state of Louisiana. This requirement helps the state track income for tax purposes. Always ensure that you maintain accurate records of the payments made, as this will simplify the filing process. The US Legal Forms platform can help you prepare the necessary forms efficiently.

To make a donation request in Baton Rouge, Louisiana, it's important to clearly outline the specific item or property you wish to donate and to whom. You can draft a formal letter or use flexible templates available on platforms like US Legal Forms. Ensure that your request expresses gratitude and explains the purpose of the donation. A thoughtful request can significantly enhance the likelihood of approval.

Yes, if you are a resident of Baton Rouge, Louisiana, and earn income, you typically need to file state taxes. The amount and type of income may affect your filing requirement. Even if your income falls below a certain threshold, it may still be beneficial to file for potential refunds. Make sure to check the guidelines specific to Louisiana to understand your obligations regarding state taxes.

To complete an act of donation in Louisiana, you need to prepare a written document that clearly states your intent to donate the property. This document should include a description of the property and the recipient's details. Additionally, it's essential to have the act notarized, as this step is crucial for validating the donation. You can streamline this process by utilizing the US Legal Forms platform, which offers templates tailored to Baton Rouge Louisiana Donation and Declaration.

Yes, you can donate a house to a family member in Louisiana. This process typically requires drafting a donation deed that specifies the details of the transfer. By understanding the Baton Rouge Louisiana Donation and Declaration framework, you can manage the complexities of this gift and ensure all legal obligations are fulfilled.

To donate clothes in Louisiana, you can find local charities or organizations that accept clothing donations. Many community centers, shelters, and thrift stores appreciate clothing contributions. Exploring Baton Rouge Louisiana Donation and Declaration resources will guide you in choosing the best method for your charitable contributions.

A donation deed in Louisiana is a legal document that formalizes a transfer of property from one person to another as a gift. This deed must meet certain requirements, including clear descriptions of the property and the intent of the donor. By utilizing the Baton Rouge Louisiana Donation and Declaration guidelines, you can streamline your process and ensure all legal criteria are met.

An act of donation in Louisiana involves drafting a formal document that outlines the specifics of the donation. The giver, known as the donor, must intend to make the gift without receiving anything in return. In the context of Baton Rouge Louisiana Donation and Declaration, using a platform like US Legal Forms can help ensure that the documentation is accurate and legally binding.