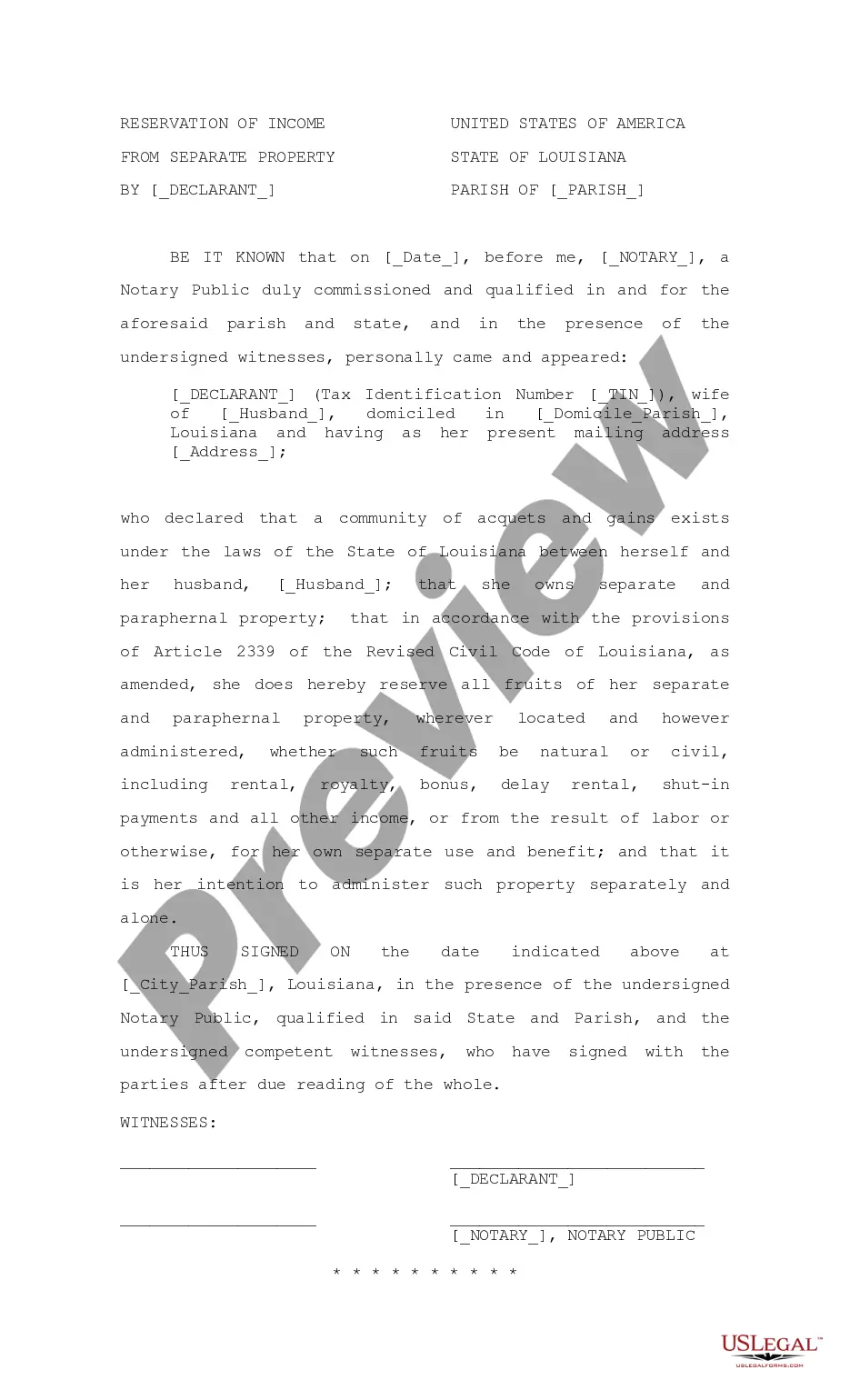

New Orleans Louisiana Reservation of Income from Separate Property

Description

How to fill out Louisiana Reservation Of Income From Separate Property?

We consistently aim to reduce or evade legal repercussions when navigating intricate legal or financial matters.

To achieve this, we engage legal services that, generally speaking, are quite expensive.

Nevertheless, not every legal situation is equally complicated. Many of them can be addressed independently.

US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Easily Log In to your account and click the Get button next to the form you require. If you happen to misplace the form, you can always re-download it from the My documents tab. The procedure is just as simple if you are not familiar with the website! You can create your account in just a few minutes.

- Our library enables you to manage your affairs autonomously without the necessity of consulting an attorney.

- We provide access to legal form templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Take advantage of US Legal Forms whenever you need to quickly and securely locate and download the New Orleans Louisiana Reservation of Income from Separate Property or any other form.

Form popularity

FAQ

If a married person dies without a will, the surviving spouse inherits a usufruct over the deceased spouse's one-half of the community property until the surviving spouse's death or remarriage.

As a general rule, the fruits of separate property, such as an inheritance, are considered community property in Louisiana.

Normally when property is purchased jointly there is a survivorship clause, meaning that on the death of one of the joint owners, their share in the property automatically passes to the survivor(s).

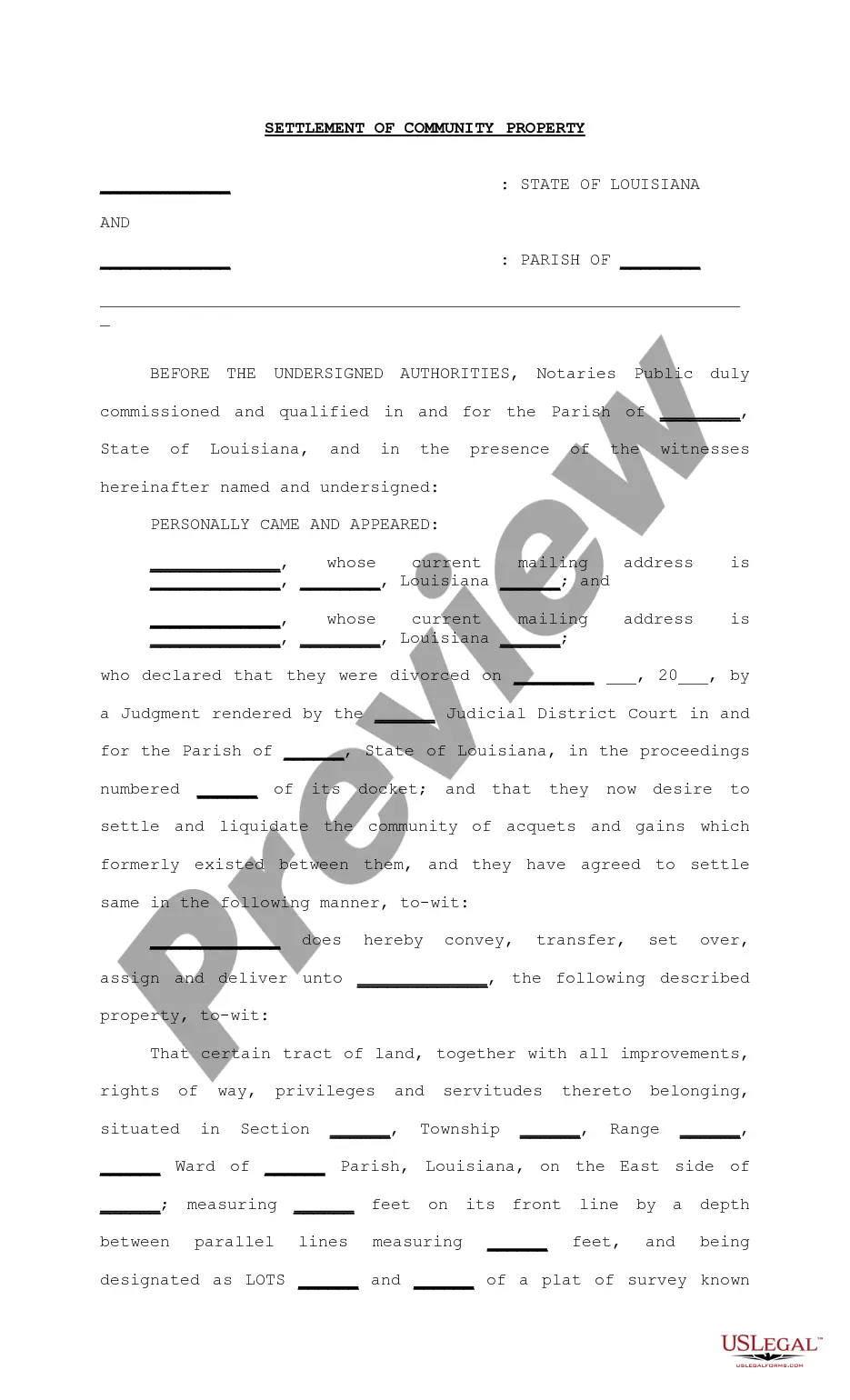

Louisiana does not recognize joint tenancy with rights of survivorship (JTWROS). Louisiana is a community property state. Often, when people decide to co-own property together, it is because they are married to each other.

Louisiana is a community property state. This means that spouses generally share equally in the assets, income and debt acquired by either spouse during the marriage. However, some income and some property may be separate income or separate property.

As a general rule, the fruits of separate property, such as an inheritance, are considered community property in Louisiana.

Spouses in Louisiana Inheritance Law Whereas spousal inheritances will typically be dictated by the presence of a child or not, Louisiana throws the parents and siblings of a decedent into the mix as well. But if no parents, children or siblings survive him or her, the whole of the estate goes to the surviving spouse.

There's a strong presumption under Louisiana law that all assets and debts a couple accumulates during marriage are community property. Separate property is property that one spouse owned alone before the marriage, acquired by gift or inheritance during the marriage, or property covered by a prenuptial agreement.

The parents will inherit the deceased person's separate property. If both parents are alive, they will inherit equally. Otherwise, the property will pass to the surviving parent. No surviving descendants, parents, siblings, descendants of siblings, or spouse.

Joint bank accounts or property held in joint tenancy with rights of survivorship will pass directly to the surviving owner without going through the court process. Accounts with payable on death clauses.