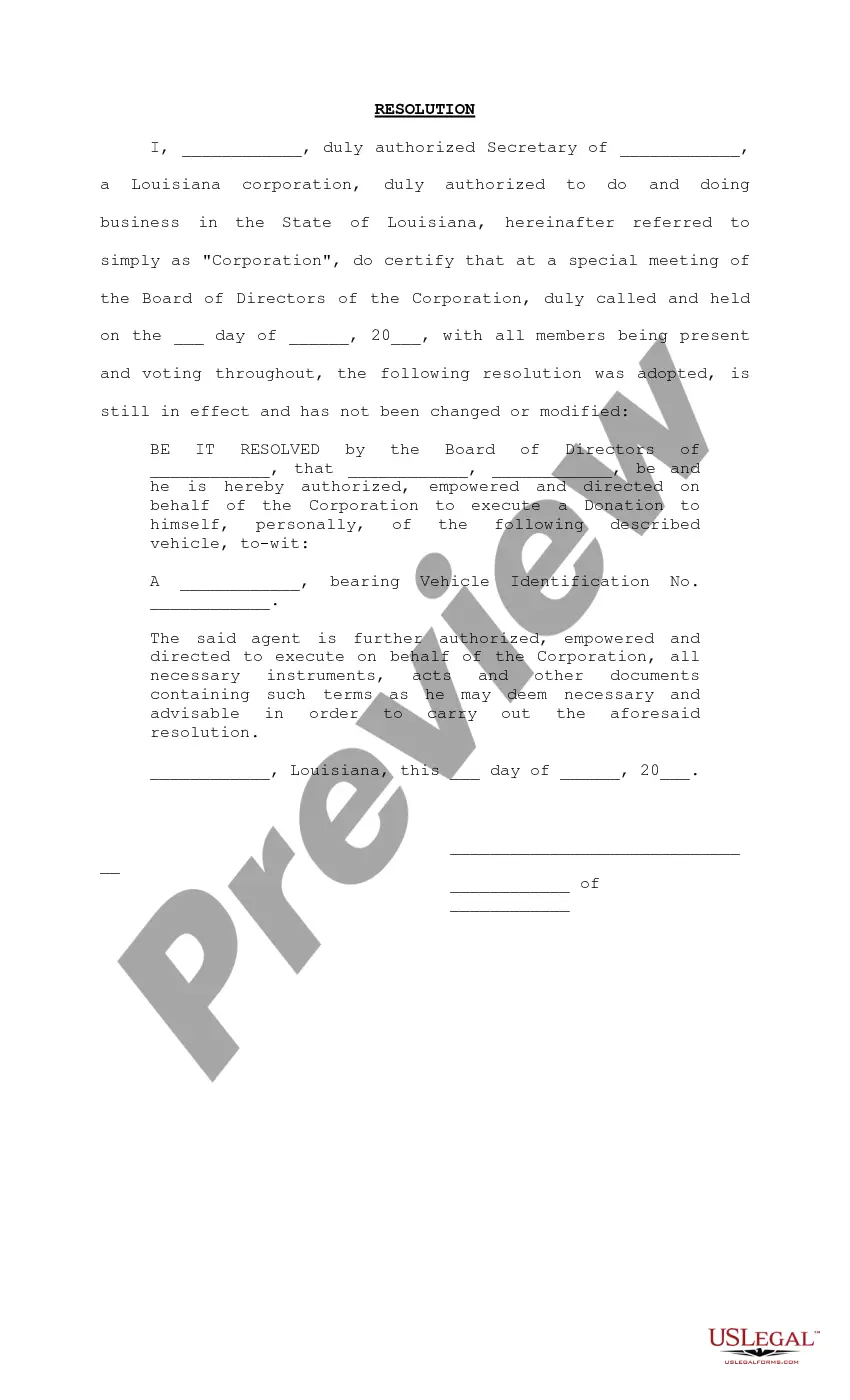

Shreveport Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer

Description

How to fill out Louisiana Resolution Authorizing Donation Of Vehicle To Corporate Officer?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our user-friendly platform featuring a vast selection of document templates simplifies the process of locating and acquiring nearly any document sample you need.

You can save, complete, and authenticate the Shreveport Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer in just a few minutes instead of spending hours online searching for an appropriate template.

Using our library is an excellent method to enhance the security of your form submission. Our skilled legal experts regularly review all documents to ensure that the templates are pertinent to a specific area and adhere to new laws and regulations.

If you haven't created an account yet, follow the instructions below.

Access the page with the required form. Confirm that it is the document you were looking for: check its title and description, and utilize the Preview option if available. Otherwise, use the Search field to find the desired form.

- How do you acquire the Shreveport Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer.

- If you already have an account, simply Log In to your account. The Download option will be available for all the samples you explore.

- Additionally, you can locate all previously saved documents in the My documents section.

Form popularity

FAQ

Simply call us toll-free at 1-866-233-8586 or fill out our online donation form. We'll schedule a date and time to get your vehicle at no cost to you, and after we've picked it up, we'll send you a tax receipt in the mail.

You must have your vehicle's title and it must be notarized in order to donate your vehicle in Pennsylvania. That means that when you sign your title, it must be done in the presence of a Notary Public.

5 Best Car Donation Charities Habitat for Humanity. Habitat for Humanity accepts donated cars, trucks, motorcycles, recreational vehicles, boats, snowmobiles, farm equipment and construction equipment.Ronald McDonald House Charities.The Salvation Army.Goodwill.Canine Companions for Independence.

Additionally, in most cases, a vehicle donation is a tax free transaction subject only to Title, Registration, and Plate fees. You provide the donor, donee, title, donee's proof of insurance, and valid identification, and we will do the rest! This includes instantly issuing a license plate to the new owner.

Contributions, including vehicle donations, may be claimed as deductions on your federal tax return, if you itemize. How much can I deduct? Once your vehicle is sold, the selling price determines the amount of your donation. If your vehicle sells for more than $500, you may deduct the full selling price.

The Commonwealth of Virginia requires that a title be signed over when you make your vehicle donation to Vehicles For Veterans. Titles should be provided at the time of vehicle pick up. If your situation is unique, please call us to see if we can work with you to complete the vehicle donation process.

Donating your car to charity can result in significant tax savings if you include it in your charitable contribution deduction. However, doing a little planning will ensure that you maximize the tax savings of your donation.

Act of Donation Forms Louisiana In other words it is the giving of something to another without receiving anything of value in return. It is purely gratuitous. A donation is made either between two living persons (known as a donation inters vivos) or a donation made after death ( known as a donation mortis causa).

Additionally, in most cases, a vehicle donation is a tax free transaction subject only to Title, Registration, and Plate fees. You provide the donor, donee, title, donee's proof of insurance, and valid identification, and we will do the rest! This includes instantly issuing a license plate to the new owner.

In order to gift a car in Louisiana, you'll generally need to transfer the title, complete an application, and notarize a report of the donation as an authentic act before the new driver can hit the road. Giving someone the freedom of their very own vehicle can certainly be a momentous and heartwarming occasion.