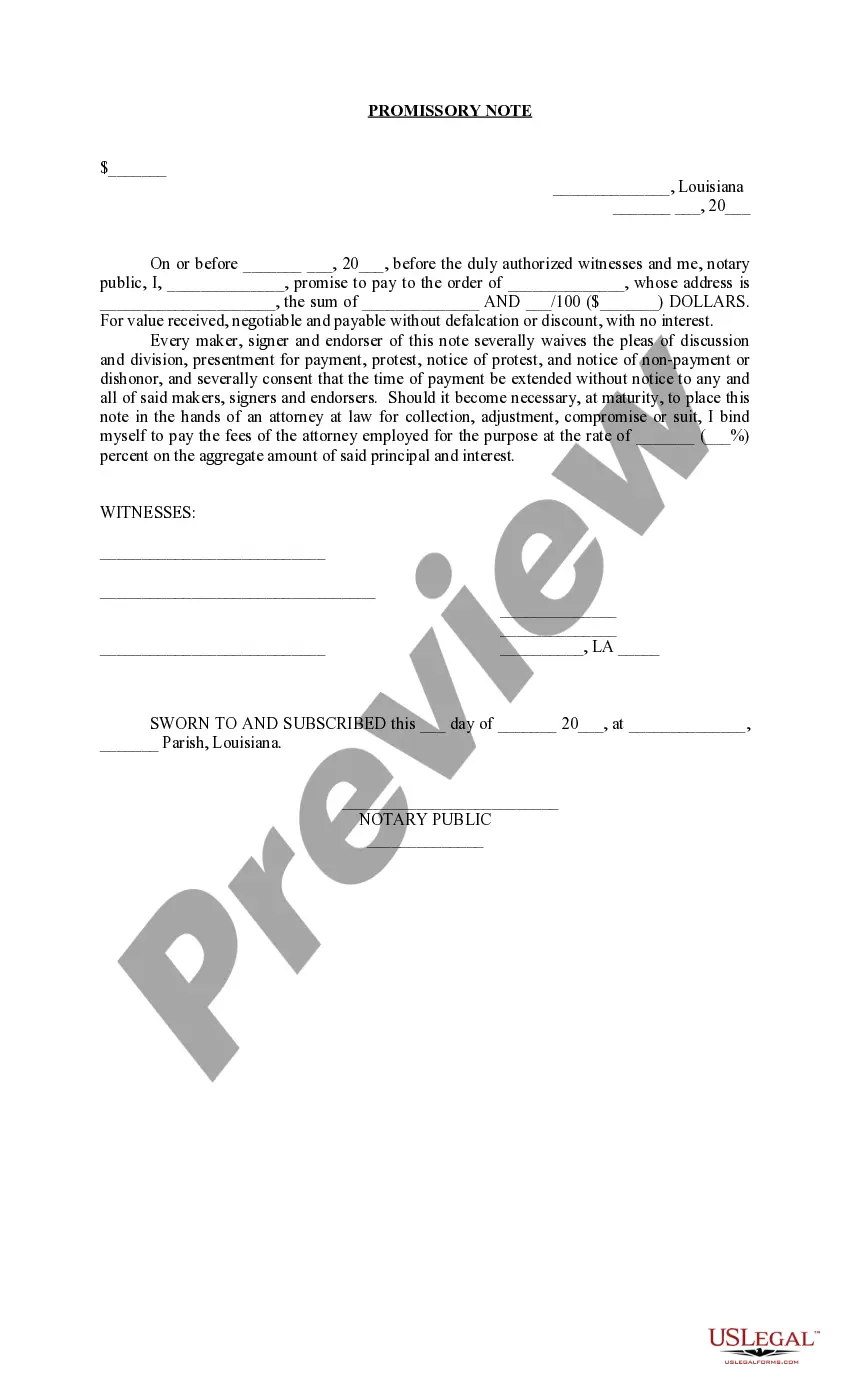

Baton Rouge Louisiana Promissory Note - Unsecured - No Interest

Description

How to fill out Louisiana Promissory Note - Unsecured - No Interest?

Do you require a reliable and cost-effective provider of legal documents to purchase the Baton Rouge Louisiana Promissory Note - Unsecured - No Interest? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for cohabitating with your partner or a collection of paperwork to facilitate your divorce proceedings in court, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business purposes. All templates we present aren’t one-size-fits-all and are tailored to meet the specifications of specific states and regions.

To acquire the form, you must Log In to your account, find the desired form, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased document templates at any time from the My documents section.

Is this your first time visiting our site? No problem. You can create an account with great ease, but before that, ensure you carry out the following.

Now you can establish your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Baton Rouge Louisiana Promissory Note - Unsecured - No Interest in any available format. You can revisit the website at any moment and redownload the form at no additional cost.

Acquiring updated legal documents has never been simpler. Try US Legal Forms today, and stop wasting your valuable time sifting through legal forms online for good.

- Verify if the Baton Rouge Louisiana Promissory Note - Unsecured - No Interest aligns with the regulations of your state and local area.

- Review the form’s specifications (if provided) to understand who and what the form is meant for.

- Restart your search if the form does not fit your legal situation.

Form popularity

FAQ

Requirements for a promissory note in Louisiana include clear terms of repayment, a specific amount, and the signatures of both parties. A Baton Rouge Louisiana Promissory Note - Unsecured - No Interest must also address what happens in case of default. Utilizing a platform like US Legal Forms can simplify the creation of your note, ensuring all legal criteria are met.

In Louisiana, a promissory note does not necessarily need to be notarized to be enforceable. However, having a notarized document can provide additional legal protection. If you opt for a Baton Rouge Louisiana Promissory Note - Unsecured - No Interest, considering notarization may enhance the credibility of the agreement.

The 90-day rule in Louisiana refers to how certain obligations, including promissory notes, must be honored within a specific timeframe. If you are using a Baton Rouge Louisiana Promissory Note - Unsecured - No Interest, be aware that failure to comply can lead to legal challenges. Knowing this rule helps ensure you keep good faith with your lender.

For a promissory note to be valid, it must involve a clear agreement between the lender and borrower. In Baton Rouge Louisiana Promissory Note - Unsecured - No Interest, the document should specify the payment terms and any applicable conditions for modifications. A well-defined note helps avoid misunderstandings in the borrowing process.

A promissory note must include key details such as the amount borrowed, the repayment terms, and the interest rate, if applicable. In a Baton Rouge Louisiana Promissory Note - Unsecured - No Interest, it’s crucial to clearly outline the repayment schedule. This ensures both parties have a mutual understanding of their obligations.

Yes, promissory notes can be unsecured. In the case of a Baton Rouge Louisiana Promissory Note - Unsecured - No Interest, the borrower is not required to provide collateral. This means that the lender relies on the borrower's promise to repay rather than a particular asset.

In Louisiana, the statute of limitations for a written contract, including promissory notes, is generally ten years. This means that individuals or entities have a decade to enforce the terms of the agreement. For those holding a Baton Rouge Louisiana promissory note - unsecured - no interest, this extended period provides ample time to address any issues regarding the contract. Being aware of these legal timelines is vital for your financial planning.

A debt becomes uncollectible in Louisiana when the statute of limitations expires, which is typically five years for a promissory note. Therefore, after this period, you cannot legally pursue the debt without facing potential dismissal in court. If you have a Baton Rouge Louisiana promissory note - unsecured - no interest, it is essential to resolve any outstanding debts before this timeline lapses. Staying informed can facilitate timely actions on your part.

The statute of limitations for enforcing a promissory note in Louisiana is generally five years. This means that if you need to take legal action regarding a Baton Rouge Louisiana promissory note - unsecured - no interest, you must initiate that action within this five-year period. Failing to do so could result in losing your right to collect the debt. Awareness of this timeline can be helpful for both lenders and borrowers.

In Louisiana, the validity of a promissory note typically lasts for up to ten years if there is no specific end date mentioned. This timeframe aligns with the general civil code pertaining to personal obligations. If you have a Baton Rouge Louisiana promissory note - unsecured - no interest, knowing this duration is crucial for any parties involved in the agreement. Ensure that you keep track of the timeline for your records.