Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing

Description

How to fill out Louisiana Installment Promissory Note With No Interest Accruing?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our user-friendly platform with a vast array of documents streamlines the process of locating and acquiring nearly any document template you require.

You can save, complete, and validate the Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing in just a few minutes rather than spending hours online searching for a suitable template.

Utilizing our collection is an excellent method to enhance the security of your document submissions.

If you have not yet created an account, follow the steps outlined below.

Locate the template you need. Ensure that it is the document you were seeking: verify its name and description, and utilize the Preview option if it is present. If not, use the Search box to find the correct one.

- Our experienced legal experts routinely review all documents to verify that the templates are applicable for a specific jurisdiction and comply with current laws and regulations.

- How can you acquire the Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing? If you hold a subscription, simply Log In to your account.

- The Download button will be available on all documents you view.

- Moreover, you can access all the previously saved files in the My documents section.

Form popularity

FAQ

To set up a payment plan with the Louisiana DMV, you will need to contact them directly or visit their website for detailed instructions. Most often, the DMV will provide you with various options to help manage your fees and avoid a lump-sum payment. Utilizing a Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing can help formalize this arrangement, ensuring you stay on track with your payments.

Yes, you can set up a payment plan for Louisiana state taxes through the Louisiana Department of Revenue. This allows taxpayers to manage their tax liabilities effectively without accruing excessive penalties or interest over time. A Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing can serve as a great option to outline your agreed payment schedule in a clear manner.

In Louisiana, the validity of a promissory note generally lasts for ten years if there is no payment made or written acknowledgment of the debt. Therefore, for a Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing, it is crucial to keep track of payments or renew the note to avoid expiration. Always consider consulting a legal professional to understand your specific situation better.

In Louisiana, the legal interest rate is set at a maximum of 12% per year unless otherwise specified. This means that for a Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing, you can establish a payment agreement that is compliant with local regulations while avoiding any interest charges. It's important to reference the specific legal requirements when drafting your note to ensure it adheres to Louisiana law.

To set up a payment plan for Louisiana state taxes, you can start by visiting the Louisiana Department of Revenue’s website. They provide clear instructions on establishing a plan that fits your financial situation, often using an installment promissory note. Using a Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing can help you negotiate a manageable payment plan. This way, you can focus on meeting your obligations without incurring high-interest costs.

In the context of a Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing, installment payments do not include interest. This means you repay only the principal amount without any additional charges over time. This feature makes the repayment process simpler and more affordable for you. You can manage your finances better without the burden of accruing interest.

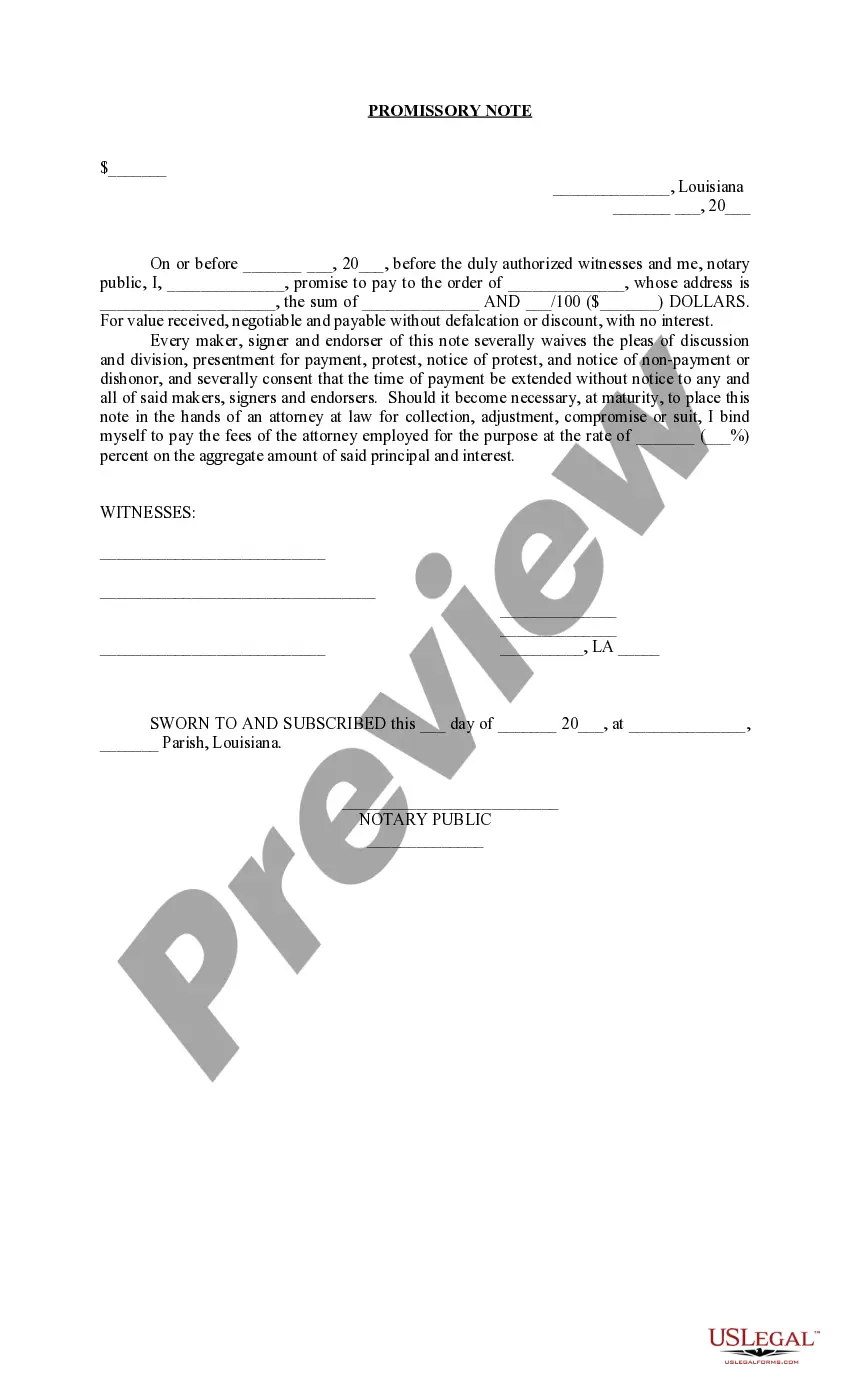

The format of a promissory note generally starts with the title, followed by the date, the borrower's and lender's information, the principal amount, interest rate, and repayment schedule. In a Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing, you should clearly state there is no interest, keeping the format clean and easy to understand. Following this format ensures both parties' responsibilities are clearly defined.

To fill out a promissory note, start with the date of the agreement, and include the names and contact information of both parties. Next, state the amount being borrowed and the agreed-upon repayment terms, indicating any lack of interest if you are using a Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing. Clear and precise language will help prevent misunderstandings.

In Louisiana, a promissory note does not need to be notarized to be legally binding, but having it notarized can provide added security. This is particularly useful for a Baton Rouge Louisiana Installment Promissory Note with No Interest Accruing, as it can help prevent disputes over the existence or terms of the note. Always consult with a legal expert if you have concerns about your specific situation.