Baton Rouge Louisiana Last Will and Testament, Spouse, No Children

Description

How to fill out Baton Rouge Louisiana Last Will And Testament, Spouse, No Children?

If you are looking for a applicable document, it’s hard to find a superior platform than the US Legal Forms website – one of the largest online collections.

With this collection, you can acquire thousands of form examples for business and personal uses by categories and locations, or keywords.

Utilizing our sophisticated search option, locating the most current Baton Rouge Louisiana Last Will and Testament, Spouse, No Children is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Receive the document. Choose the format and save it to your device.

- Moreover, the significance of each and every document is verified by a group of experienced attorneys who regularly assess the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Baton Rouge Louisiana Last Will and Testament, Spouse, No Children is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines below.

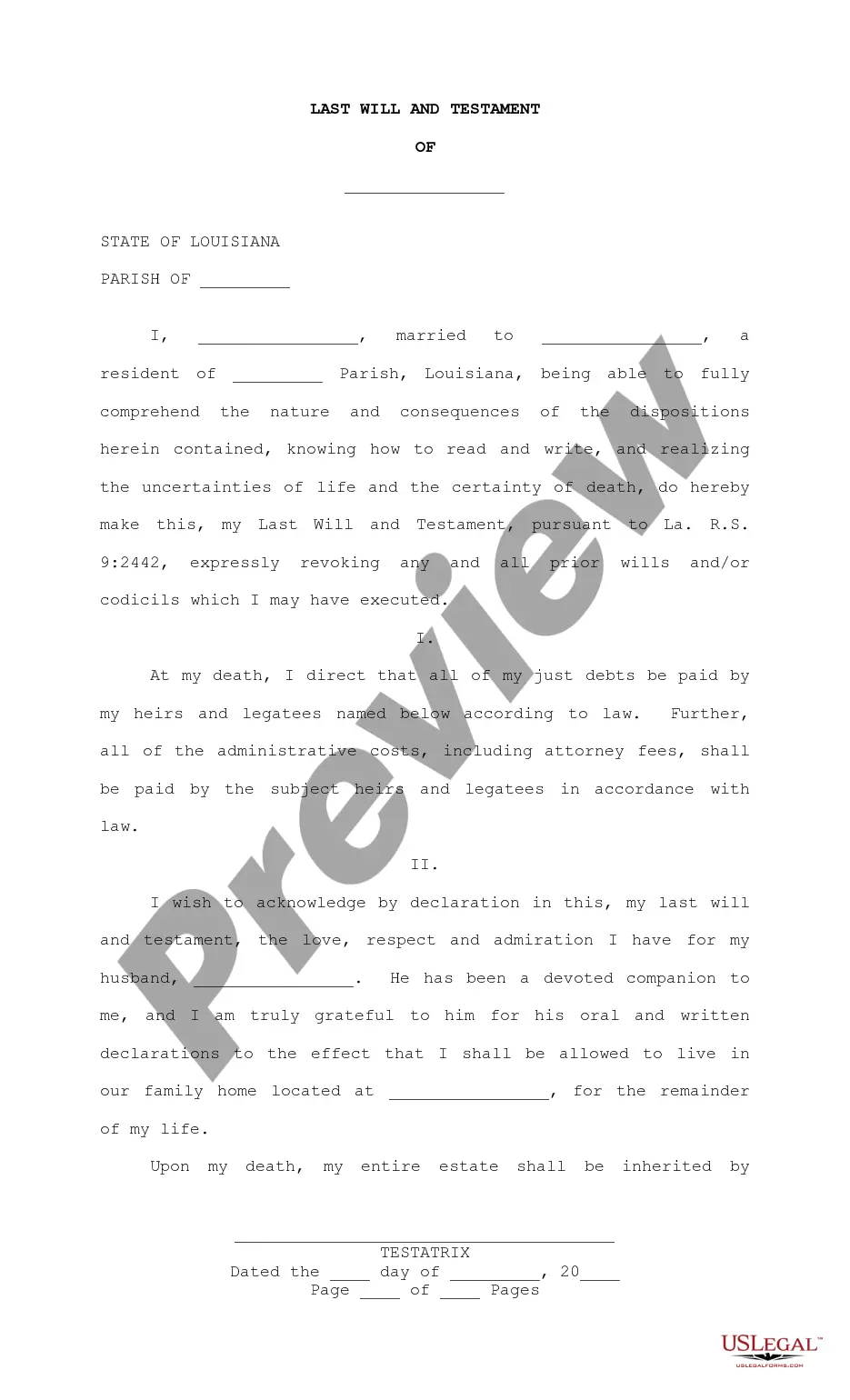

- Ensure you have accessed the form you need. Review its description and utilize the Preview feature (if available) to examine its contents. If it doesn’t meet your requirements, use the Search option at the top of the page to find the necessary document.

- Confirm your choice. Click the Buy now option. Then, select your desired pricing plan and provide information to register for an account.

Form popularity

FAQ

If there is no will, Baton Rouge Louisiana adheres to intestate succession laws to determine inheritance. This means that the estate’s assets will be distributed according to state laws, which may not align with your wishes. As a result, it is essential to create a Last Will and Testament to ensure your estate goes to your desired beneficiaries. Using platforms like uslegalforms can simplify this process and help you avoid future disputes.

In Baton Rouge Louisiana, a wife can be entitled to her husband’s inheritance, but it largely depends on the estate's structure and the existence of children. When there are no children, a wife generally inherits a major portion of her husband's estate. However, without a Last Will and Testament, complexities can arise. It's advisable to establish clear estate plans to protect your interests.

Without a will in Baton Rouge Louisiana, the state's intestacy laws govern inheritance. Typically, the spouse inherits half of the community property and shares remaining assets with children. If there are no children, the spouse may receive a larger percentage of the estate. Understanding these laws underlines the importance of creating a Last Will and Testament to clarify your intentions.

In Baton Rouge Louisiana, a spouse does not automatically inherit everything if their partner passes away without a Last Will and Testament. The distribution of assets follows intestate succession laws, which involve children or other heirs. The spouse may receive a significant share, but it may not encompass the entire estate. To secure your spouse’s interests fully, consider drafting a comprehensive will.

When a person in Baton Rouge Louisiana dies without a will, the state's intestacy laws determine how assets are distributed. Typically, the spouse inherits a portion, while the remainder goes to children or other relatives. This process highlights why having a Last Will and Testament is crucial, especially for couples with unique scenarios. Ensuring your wishes are clear can save your family from complications later.

In Baton Rouge Louisiana, laws for heirs primarily follow a system of forced heirs. If a person passes away without a Last Will and Testament, their children or descendants will inherit a portion of their estate, regardless of their marital status. The spouse may receive a share, but laws dictate the exact distribution based on the presence of children. Understanding these laws can help you plan effectively for your loved ones.

Yes, wills must be filed with the court in Louisiana after the death of the testator. This step is essential for validating the Baton Rouge Louisiana Last Will and Testament, Spouse, No Children and facilitating the probate process. If a will is not filed, heirs may face unnecessary challenges in claiming their inheritance. UsLegalForms provides useful information to help you navigate the requirements of filing a will in Louisiana.

Filing a will in Louisiana typically involves submitting your Baton Rouge Louisiana Last Will and Testament, Spouse, No Children to the local probate court. You need to provide the original document and any required information about the estate. Timing is essential, so it’s crucial to file soon after your loved one’s passing. To simplify this process, consider utilizing UsLegalForms for guidance on the necessary steps and documentation.

If a Baton Rouge Louisiana Last Will and Testament, Spouse, No Children is not filed, it may lead to complications after your death. Without filing, your wishes may not be easily known or honored by your heirs, which could result in your estate being treated as though you died intestate. This situation usually benefits state law rather than your personal preferences. It's advisable to file your will to avoid these issues and UsLegalForms can assist you in the filing process.

In Louisiana, it is not mandatory to record a will for it to be valid. However, recording a Baton Rouge Louisiana Last Will and Testament, Spouse, No Children can provide a level of protection and ensure better accessibility for your heirs. By filing with the appropriate court, you can help prevent disputes among family members regarding its validity. UsLegalForms offers resources to help you understand the process of will recording.